e-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region 2025-2033

e-KYC Market Size and Share:

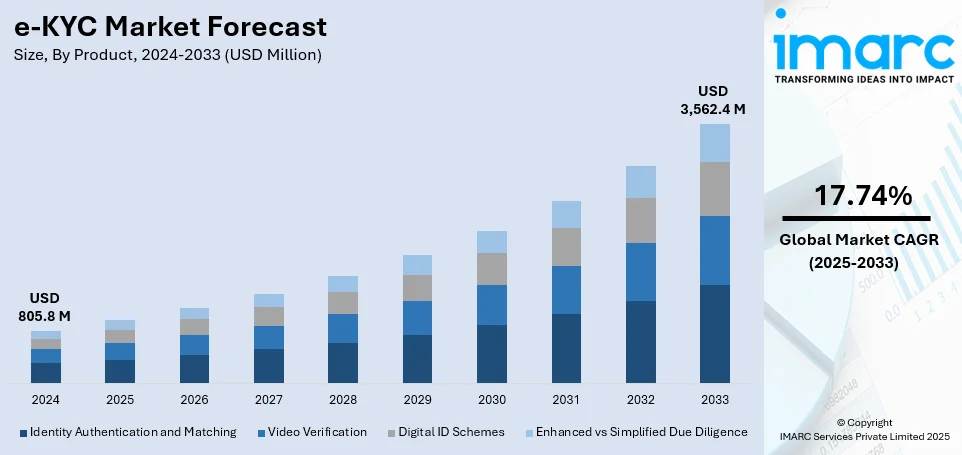

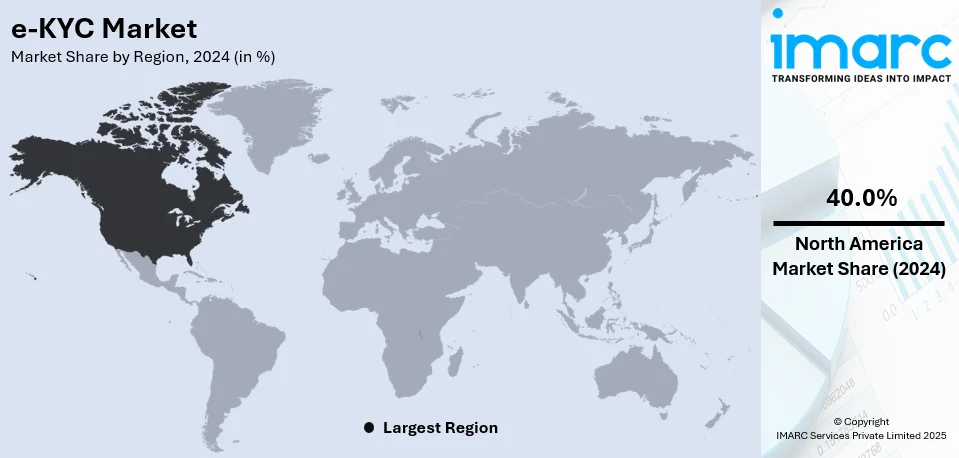

The global e-KYC market size was valued at USD 805.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,562.4 Million by 2033, exhibiting a CAGR of 17.74% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024. The market is growing significantly due to the escalating need for digital, safe identity authentication solutions. In addition, the automation and technological advancements, regulatory adherence requirements, and a surge in fintech and digital banking solutions, upgrading consumer onboarding and minimizing fraud risk is further increasing the e-KYC market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 805.8 Million |

|

Market Forecast in 2033

|

USD 3,562.4 Million |

| Market Growth Rate (2025-2033) | 17.74% |

The global e-KYC market demand is increased by the intensification of digital transformation in various industries, demand for smooth, seamless, and secure identity verification processes, and strict regulatory compliance against fraud in financial operations and laundering of money. The rise in online banking, digital payments, and adoption of fintech has further increased the demand for efficient automatic KYC procedures. Besides, the accuracy and security are improved by the advancement of AI, Blockchain, and Biometric Authentication in e-KYC solutions that minimize the identity theft. Increasing compliance worldwide with governments also undertaken AML and CFT toward higher demand in the marketplace. The post-pandemic increase in adoption of remote onboarding has raised the pressure on digital identity verification across the banking, telecom, and e-commerce sectors. According to the IMARC Group, the global e-commerce market size has reached USD 26.8 Trillion in 2024.

The United States stands out as a key market disruptor, due to increased digital banking, strict regulatory norms, and concern for financial frauds. A recent increase in the number of fintech companies, digital wallets, and online payment platforms have led to increasing the demand for smoother and safer processes of identification verification. This drives the financial institution to adopt sophisticated e-KYC solutions, compelled by regulatory compliance and the need for compliance with BSA, AML laws, and Know Your Customer (KYC) guidelines set forth by the Financial Crimes Enforcement Network, or FinCEN. Additionally, it incorporates advancements in AI, biometrics, and blockchain technology for more accuracy and security, further minimizing fraud risks. Further boosts in market growth across banking, insurance, and telecom sectors has been accelerated with the demand of remote onboarding due to COVID-19 pandemic.

e-KYC Market Trends:

Increasing adoption of digital onboarding solutions

The e-KYC market is experiencing a substantial trend towards the rapid adoption of digital onboarding solutions, primarily propelled by the escalating demand for safe and seamless customer identification systems. Reports indicate that around 91% of clients view security and fraud protection as essential when choosing a digital banking platform. Government organizations, financial firms, and telecom companies are utilizing e-KYC platforms to upgrade verification procedures of customers, reduce manual errors, and minimize paperwork. Moreover, this significant inclination towards digital onboarding improves customer experience while guaranteeing adherence with regulatory policies. This trend is further fueled by continuous fintech advancements, adoption of digital wallets, and advent of remote banking systems, all of which demand secure and effective identity authentication processes for both consumer retention and acquisition, driving a positive e-KYC market outlook. For instance, in September 2024, MidWestOne Bank adopted the digital onboarding solution, provided by Temenos, a bank and financial services software company, to improve its customer retention and acquisition through digital platforms.

Rapid integration of machine learning and artificial intelligence

Machine learning (ML) and artificial intelligence (AI) are rapidly becoming an integral part of the global e-KYC market, reshaping identity verification systems. Such advanced technologies significantly improve the speed as well as precision of customer verification system by automating processes such as fraud tracing, document assessment, and facial recognition. Moreover, AI-driven e-KYC solutions can identify dubious patterns and anomalies, lowering the risk of both fraud and identity theft. In addition, ML algorithms are actively enhancing the verification methods with time, guaranteeing more resilient adherence with transitioning regulatory protocols. Furthermore, this technological incorporation is essential for managing large-scale data effectively and minimizing the operational costs of verification processes, ultimately boosting the e-KYC demand. For instance, in April 2024, PayToMe.co launched its advanced KYC and AI technologies in collaboration with ShipToBox, an e-commerce company. This new technology will improve transaction security as well as KYC verification of customers on the e-commerce platform.

Increasing emphasis on regulatory adherence

Regulatory policies and the heightening emphasis on data security as well as adherence are significantly increasing the e-KYC market growth. Financial regulatory organizations and government agencies around the globe are implementing stringent anti-money laundering (AML) and KYC policies, prompting various institutions to adopt resilient e-KYC systems. Moreover, the increasing prevalence as well as awareness regarding security breaches and data privacy has fueled the demand for solutions that can assure customer verification while securing sensitive data. In addition, this trend is particularly prevalent in sectors such as financial services, banking, and insurance, where the demand for complaint, safe systems is requisite, and the regulatory inspection is customary. Consequently, such strict regulations and implementation policies significantly increase the e-KYC market revenue. As per industry reports, organizations with a negligible adherence exhibit an average data breach cost of USD 5.05 million, that is 12.5% more than the average breach cost.

e-KYC Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global e-KYC market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, deployment mode, and end user.

Analysis by Product:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

Identity authentication and matching stand as the largest component in 2024. According to the e-KYC market forecast, identity authentication and matching is anticipated to sustain its dominance as it is a critical process that ensures accurate verification of users' identities. This step involves cross-referencing customer information with official databases to confirm authenticity and prevent fraud. Moreover, advanced technologies like biometric recognition, facial matching, and document validation are widely used to streamline and enhance the accuracy of the process. In addition, identity authentication is essential in regulatory compliance, helping businesses meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

On-premises lead the market in 2024. As per the e-KYC market research report, on-premises remain a prominent model in the e-KYC market, offering organizations greater control over their data and security infrastructure. This deployment mode is preferred by institutions that prioritize stringent data privacy standards and require compliance with regional regulations. Moreover, on-premises solutions provide direct access to sensitive customer information, enabling customization and enhanced protection. Furthermore, despite the rise of cloud-based solutions, many financial and government entities continue to opt for on-premises models to meet their specific security needs.

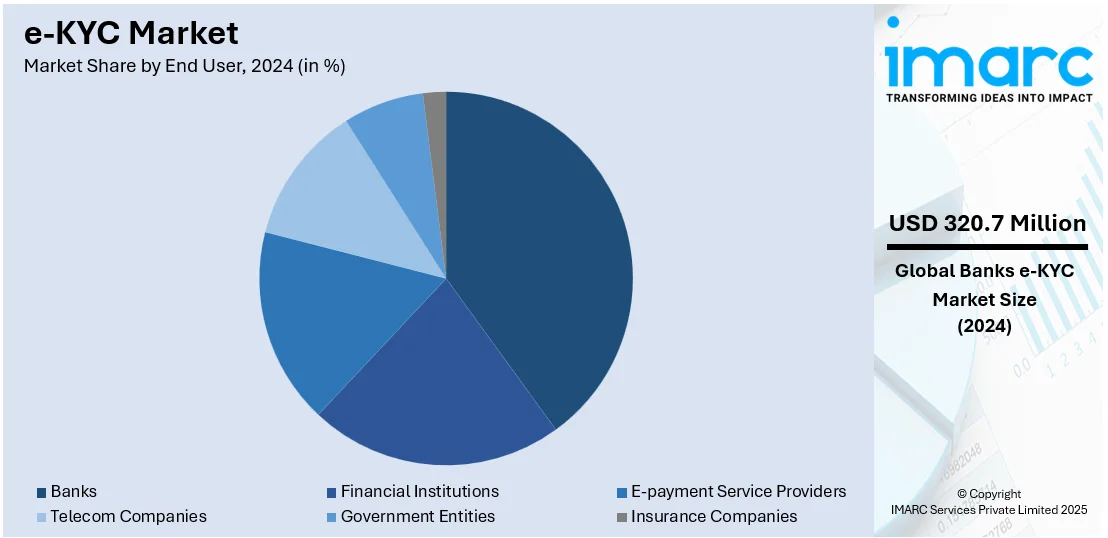

Analysis by End User:

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

Banks lead the market in 2024, driven by the need for secure, streamlined customer onboarding and compliance with stringent financial regulations. Since banks are the primary users of e-KYC solutions, they heavily rely on automated identity verification technologies to prevent fraud, ensure compliance with anti-money laundering (AML) laws, and enhance operational efficiency. In addition, with the growing adoption of digital banking and remote services, banks continue to lead the demand for reliable and secure e-KYC systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%, majorly due to resilient regulatory protocols, a highly upgraded financial industry, and bolstered adoption of digital technologies. The rising incidents of data breach and identity theft is also driving the region’s emphasis on advanced identity authentication solution. As per industry reports, in 2023, more than 3200 data breaches were recorded in the United States. Moreover, the presence of major fintech firms and financial organizations has fueled the requirement for safe and robust digital onboarding solutions. In addition, stringent adherence standards, coupled with technological advancements is further strengthening North America’s position as a dominant region in the global e-KYC market.

Key Regional Takeaways:

United States e-KYC Market Analysis

The e-KYC market in the United States is being driven by the increasing adoption of digital transformation across financial institutions, telecommunications, and government sectors. The surge in online banking, fintech innovations, and the proliferation of digital wallets demand seamless and secure customer onboarding solutions. In 2023, 72% of adults in the US used online banking, as per reports. In line with this, regulatory frameworks, including mandates from the Financial Crimes Enforcement Network (FinCEN) and the Patriot Act, are emphasizing stricter compliance with Know Your Customer (KYC) norms, accelerating e-KYC adoption. Furthermore, the rise in identity theft and fraud has created a pressing need for advanced verification technologies that incorporate biometrics, artificial intelligence, and blockchain. Moreover, biometrics, such as facial recognition, fingerprint scanning, and voice analysis, offer unique and non-replicable identifiers, significantly reducing the risk of identity fraud. These technologies enable real-time and seamless authentication, making it harder for fraudsters to impersonate genuine users. AI enhances the detection of fraudulent activities by analyzing vast datasets, identifying suspicious patterns, and predicting risks with high accuracy. Blockchain technology offers a tamper-proof and decentralized system to store and share identity information. Furthermore, the U.S. market is also supported by robust investments in cybersecurity and data privacy infrastructure, as consumer trust in secure digital platforms grows. The competitive landscape, driven by innovative startups and collaborations between technology providers and financial institutions, is fostering the rapid integration of e-KYC solutions across diverse sectors.

Asia Pacific e-KYC Market Analysis

The Asia Pacific e-KYC market is fueled by the region’s rapid digitalization and the growing penetration of smartphones and internet services. As per the Press Information Bureau (PIB), it is expected that by 2030, more than 40% of India's population will live in urban areas. In addition, government initiatives, such as India’s Aadhaar-based e-KYC, Thailand’s National Digital ID project, and Malaysia’s e-KYC guidelines, are major drivers that are propelling the market growth. These initiatives aim to improve financial inclusion by simplifying onboarding for unbanked and underbanked populations. Fintech growth is another significant contributor, with increased adoption of e-wallets, peer-to-peer lending platforms, and cryptocurrency exchanges requiring efficient customer verification processes. Apart from this, the high incidence of financial fraud and money laundering activities is prompting regulators to impose stricter KYC compliance standards, boosting the demand for advanced e-KYC technologies. In line with this, cross-border trade and remittance activities in this diverse and densely populated region further underscore the necessity for secure and scalable verification systems. Additionally, the rise of regional tech companies offering AI-driven e-KYC platforms is also playing a pivotal role in the market’s expansion. Regional companies are also more agile in adapting to local regulatory changes and integrating country-specific compliance requirements into their solutions. This flexibility allows them to collaborate effectively with banks, fintech firms, and governments, ensuring widespread adoption of e-KYC systems.

Europe e-KYC Market Analysis

The e-KYC market in Europe is primarily propelled by stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) and the Anti-Money Laundering Directives (AMLD). These laws necessitate secure, efficient, and privacy-compliant identity verification processes for financial institutions, online platforms, and telecommunication companies. Increasing awareness of digital fraud and identity theft is encouraging businesses in the region to adopt robust e-KYC solutions powered by artificial intelligence, machine learning, and blockchain. Digital banking and neobanking trends are rapidly gaining traction across the region, requiring efficient onboarding and fraud detection capabilities. Europe’s diverse financial ecosystem, including fintech startups, insurance providers, and cross-border payment platforms, further stimulates the demand for scalable e-KYC technologies. As per reports, the UK maintained its leading position in the European FinTech sector, securing 40% of the top 10 deals in Q2. In line with this, collaboration between governments and private sector players to develop secure digital ID systems, such as the European e-ID initiative, also contributes to the market growth. These partnerships streamline regulatory compliance, improve interoperability, and foster innovation in e-KYC technologies, driving adoption across sectors such as finance, e-commerce, and public services. Furthermore, rising preferences for seamless online services is driving innovation in verification technologies across sectors.

Latin America e-KYC Market Analysis

The region’s growing efforts to enhance financial inclusion and mitigate financial fraud is impelling the market growth. With a significant unbanked population, governments and financial institutions are adopting digital onboarding solutions to simplify access to banking services. Rising smartphone and internet penetration supports the adoption of e-KYC platforms, particularly in rural and underserved areas. As per reports, the share of smartphones users is 66.6% in Brazil. Regulatory advancements, such as Brazil’s PIX payment system and Mexico’s Fintech Law, are fostering the adoption of standardized KYC processes. Besides this, the growth of fintech ecosystems, including digital wallets and lending platforms, also fuels the need for secure identity verification technologies. Additionally, the increasing threat of identity theft and fraudulent activities is driving investments in AI-powered and biometric e-KYC solutions across various sectors.

Middle East and Africa e-KYC Market Analysis

The e-KYC market in the Middle East and Africa is impelled by digital transformation efforts aimed at improving financial access and combating money laundering. In addition, governments and financial institutions are implementing e-KYC systems to enhance transparency and reduce onboarding complexities. In the Gulf Cooperation Council (GCC) countries, initiatives like the UAE’s SmartPass and Saudi Arabia’s Vision 2030 encourage digital identity adoption. The region’s growing fintech sector, along with expanding mobile banking services, supports e-KYC implementation. In Africa, initiatives to promote financial inclusion and reduce fraud, such as Nigeria’s Bank Verification Number (BVN) system, are significant drivers. The rising mobile internet usage and an increasing focus on digital payments across the region further contribute to the demand for efficient and secure e-KYC technologies. According to reports, there were 36.31 Million internet users in Saudi Arabia in January 2023.

Competitive Landscape:

Key players in the e-KYC space focus on innovation through technological advancement, strategic partnerships, and compliance-focused solutions. Companies like Jumio, Onfido, and IDnow are making heavy use of AI-driven identity verification, biometric authentication, and machine learning to enhance security and accuracy. Major financial institutions and fintech firms are joining the integration chain of blockchain-based KYC solutions to enhance data security and streamline onboarding. Mastercard and Equifax are leading efforts to help banks and regulatory bodies build scalable, compliant frameworks for digital identity verification. Newer entrants to the sector are RegTech firms that introduce new tools into their portfolios with real-time risk assessments and customer due diligence processes that can automate many steps involved.

The report provides a comprehensive analysis of the competitive landscape in the e-KYC market with detailed profiles of all major companies, including:

- 63 Moons Technologies Limited

- Acuant Inc.

- Financial Software & Systems Pvt. Ltd.

- GB Group plc

- GIEOM Business Solutions Pvt. Ltd.

- Jumio

- Onfido

- Panamax Inc.

- Tata Consultancy Services Limited

- Trulioo

- Trust Stamp

- Wipro Limited.

Latest News and Developments:

- January 2025: India Post launched an Aadhaar-based electronic Know Your Customer (eKYC) system for opening Post Office Savings Accounts, a major leap in India's digital identity infrastructure. This will now enable the use of digital verification for opening accounts at Departmental Post Office counters, taking forward the expanding biometric authentication capabilities of UIDAI.

- November 2024: Brankas announced the integration of ADVANCE.AI's eKYC technology and API suite into its open banking compliance solution. Banks mandated to comply with open banking regulations like BI-SNAP in Indonesia can now utilize a unified platform for all their compliance requirements.

- September 2024: Finacus Solutions, a technology company specializing in banking, and pi-labs.ai, a deep fake detection startup based on AI, has announced a tie-up that marked a step in the e-KYC landscape. The collaboration brought to the forefront a deepfake-proof eKYC solution for fortifying identity verification processes with rising deep fake fraud in the financial sector.

- September 2024: HDB Financial Services, the top non-banking financial firm, is the first organization to utilize the e-KYC Setu System of the National Payments Corporation of India. This advanced system has been created through a partnership between NPCI and the Unique Identification Authority of India (UIDAI) to facilitate account opening with a quicker, easier, and more secure approach to accessing banking services.

e-KYC Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence |

| Deployment Modes Covered | Cloud-based, On-Premises |

| End Users Covered | Banks, Financial Institutions, E-Payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 63 Moons Technologies Limited, Acuant Inc., Financial Software & Systems Pvt. Ltd., GB Group plc, GIEOM Business Solutions Pvt. Ltd., Jumio, Onfido, Panamax Inc., Tata Consultancy Services Limited, Trulioo, Trust Stamp, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the e-KYC market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global e-KYC market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-KYC market was valued at USD 805.8 Million in 2024.

The e-KYC market is projected to exhibit a CAGR of 17.74% during 2025-2033, reaching a value of USD 3,562.4 Million by 2033.

The e-KYC market is driven by increasing digital banking adoption, stringent regulatory compliance (AML, CFT, and KYC norms), advancements in AI and biometrics, rising financial fraud concerns, and the growing demand for seamless, remote identity verification across industries.

North America dominates the market due to its stringent regulatory environment, high adoption of digital banking and fintech solutions, advanced AI-driven identity verification technologies, and the rising need for fraud prevention and compliance with AML and KYC regulations.

Some of the major players in the e-KYC market include 63 Moons Technologies Limited, Acuant Inc., Financial Software & Systems Pvt. Ltd., GB Group plc, GIEOM Business Solutions Pvt. Ltd., Jumio, Onfido, Panamax Inc., Tata Consultancy Services Limited, Trulioo, Trust Stamp, and Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)