Eastern Europe Online Pharmacy Market Size, Share, Trends and Forecast by Type, Platform, End Use, Application, and Country, 2025-2033

Eastern Europe Online Pharmacy Market Size and Share:

The Eastern Europe online pharmacy market size was valued at USD 7.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.9 Billion by 2033, exhibiting a CAGR of 13.2% during 2025-2033. Rising internet use, digital pharmacies, convenience, discounts, e-prescriptions, and busy urban lifestyles are some of the factors contributing to Eastern Europe online pharmacy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.2 Billion |

| Market Forecast in 2033 | USD 24.9 Billion |

| Market Growth Rate (2025-2033) | 13.2% |

Rising internet penetration and widespread smartphone use are making it easier for people in Eastern Europe to order medicines online. Many brick-and-mortar pharmacies are launching digital platforms to stay competitive, offering doorstep delivery and discounts that appeal to price-conscious buyers. Consumers also trust online pharmacies more now due to better regulations and secure payment gateways. Growing awareness about self-care, over-the-counter products, and wellness supplements adds to demand. Busy lifestyles and the need for discreet purchases of personal care or sensitive products encourage people to choose online services. E-prescriptions and teleconsultations are being adopted widely, helping expand digital access to healthcare. Countries like Poland, Romania, and Hungary are leading this shift as urban populations seek convenience and affordability. Partnerships between pharmacies and tech companies also help deliver a smoother buying experience, strengthening the Eastern Europe online pharmacy market growth.

To get more information on this market, Request Sample

Digital health services are pushing online pharmacies deeper into Eastern Europe. Affordable weight loss treatments and broader teleconsultation access attract more users. Companies aim to combine virtual care with quick delivery, tapping into growing interest in digital wellness solutions and expanding reach across new urban and rural markets. For instance, in June 2025, Hims & Hers acquired European telehealth firm Zava, expanding into the UK, Germany, France, and Ireland. The deal adds 1.3 Million European users. With lower-priced weight loss drugs and rising interest in Eastern Europe, Hims aims to boost GLP-1 sales and grow its regional footprint.

Eastern Europe Online Pharmacy Market Trends:

Rising Online Medicine Sales

More people in Eastern Europe are turning to online channels to buy everyday health products and prescription medicines, highlighting clear Eastern Europe online pharmacy market trends. In Poland, the sharp increase in internet retailers, now at about 250,000, shows how digital buying habits are catching on. Shoppers want quicker delivery, discreet packaging, and competitive pricing. Local pharmacies are investing in secure online payment systems and easy-to-use mobile apps to keep pace. Younger buyers, used to fast e-commerce for other goods, expect the same for health needs. Cross-border buying within the region is also picking up speed as trust in online sellers grows. This shift points to strong digital demand for convenient access to medicine and wellness products across urban and rural parts of Eastern Europe. For example, in 2023, Poland’s e-commerce market grew significantly, reaching about 250,000 online businesses, reflecting rapid tech adoption and shifting consumer habits, and establishing Poland as a key Eastern European retail hub.

AI Boosting Digital Medicine

AI is becoming a major force behind new ways to buy and manage medicine online shaping the Eastern Europe online pharmacy market outlook. In Hungary, strong growth in AI spending shows how health tech is changing fast. Digital pharmacies are starting to use smart systems for personalized offers, automated prescription checks, and safer online payments. Machine learning helps predict demand for specific drugs, cutting wait times and keeping shelves stocked. Better data tools also help pharmacies guide customers toward the right products. This rapid uptake of AI makes online medicine shopping quicker and more accurate. As funding for AI keeps climbing, expect more local companies to add advanced features that make health services more efficient and easier to access for people across the region. According to the International Trade Administration, Hungary’s artificial intelligence market is forecasted to hit USD 350.20 Million in 2024 and grow at an annual rate of 28.48%, reaching USD 1,575.00 Million by 2030.

Startup Surge Reshaping Online Pharmacies

New ventures keep shaking up how people get medicine online in Eastern Europe. Small companies are stepping in with ideas to make deliveries faster, payment safer, and advice more accessible. Many focus on easy-to-use apps and simple prescription services to meet changing buyer habits. Some have secured outside backing and early-stage investment, encouraging more founders to join in. New players appear every year, keeping the market lively and pushing older pharmacies to improve digital tools and expand delivery options. These businesses aim to make health products reachable for both cities and smaller towns, with quick orders and trusted guidance. As per the Eastern Europe online pharmacy market forecast, this steady flow of fresh companies helps build a more convenient way for people to manage everyday health needs online. As of April 2025, Eastern Europe counts 162 pharmacy startups, including names like Dr.Max Group, Zhivika, Magazintrav, Dr. Max lekarna, and Invaru. Eight have received funding so far, with nine reaching Series A or beyond. Over the last decade, the region has seen an average of four new pharmacy ventures launched each year.

Eastern Europe Online Pharmacy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Eastern Europe online pharmacy market, along with forecasts at the regional, and country levels from 2025-2033. The market has been categorized based on type, platform, end use, and application.

Analysis by Type:

- Over the Counter (OTC)

- Prescription

Over the counter stood as the largest type in 2024. People in Eastern Europe increasingly rely on digital platforms to buy basic medicines, vitamins, and wellness items that don’t require a prescription. Many consumers prefer to manage minor health issues themselves, and online pharmacies make this easy with home delivery, discreet packaging, and clear product information. Urban areas, busy lifestyles, and better internet access have made this segment even stronger. Seasonal illnesses, rising health awareness, and cost savings also push more people to choose over the counter products online instead of visiting a local pharmacy. Discounts and loyalty offers encourage repeat purchases. This trend shows how the over the counter segment shapes the future of how people in this region buy everyday healthcare products.

Analysis by Platform:

- Mobile

- Desktop

Mobile stand as the largest platform in 2024 due to rising smartphone penetration and better internet access across urban and rural areas. People prefer mobile apps owing to the ease of browsing, ordering, and tracking medicines anytime. Demand has grown due to busy lifestyles and longer working hours, which push consumers to skip physical visits and order through apps instead. Mobile payments are more trusted now owing to secure gateways and improved digital literacy. Pharmacies invest in mobile-friendly platforms due to high user engagement and repeat orders. Growth is also driven by promotional offers and discounts sent directly to users’ phones. Rural users benefit too, due to doorstep delivery where local pharmacies may be limited. All this has strengthened the market’s mobile-first shift, making it the main driver in Eastern Europe.

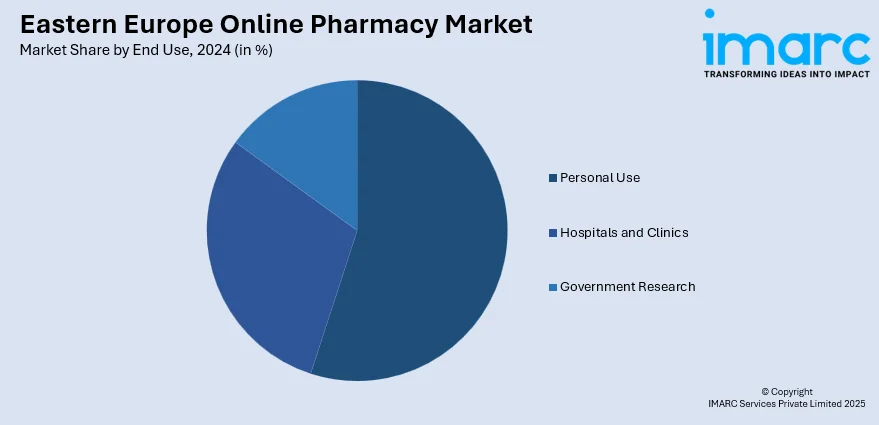

Analysis by End Use:

- Hospitals and Clinics

- Personal Use

- Government Research

Personal use led the market in 2024, owing to growing awareness about self-care and preventive health. People choose to buy medicines for personal use owing to convenience and privacy, especially for chronic conditions or sensitive treatments. Rising disposable income has boosted spending on wellness and daily health needs due to changing lifestyles and busier schedules. Personal use orders have increased owing to easy access to over-the-counter drugs, supplements, and personal care products online. Many prefer home delivery due to time saved compared to visiting crowded pharmacies. Better mobile apps and websites have helped customers compare prices and read reviews before purchase, owing to greater digital trust. Demand is also rising due to an aging population managing long-term conditions at home. All these factors make personal use a major market driver.

Analysis by Application:

- Medicines

- Personal Care

- Devices and Surgical

- Others

Medicines led the market in 2024 because of the steady demand for prescription and over-the-counter drugs. People prefer ordering medicines online owing to time savings and easy doorstep delivery, which is helpful for chronic conditions needing regular refills. Demand has grown due to rising health issues linked to changing lifestyles and aging populations. Customers choose online platforms owing to the wider availability of branded and generic medicines compared to local stores. Trust in digital prescriptions has increased due to secure payment options and verified sellers. Many rely on online pharmacies due to discounts and bulk purchase deals, which help reduce treatment costs. Remote and rural users benefit too, owing to limited access to physical pharmacies nearby. All these reasons have made medicines the leading segment driving market growth in Eastern Europe.

Country Analysis:

- Russia

- Poland

- Czech Republic

- Romania

- Hungary

- Others

In 2024, Russia showed steady growth in the Eastern Europe online pharmacy market due to a large urban population, wider internet reach, and higher trust in online payments, with many choosing home delivery where local pharmacies are limited. Poland is growing owing to strong digital infrastructure, the introduction of e-prescriptions, and a young, tech-aware population that prefers competitive prices, quick delivery, and the ease of comparing products online. The Czech Republic is developing due to high digital literacy, secure transactions, and better awareness of the benefits of buying medicines online. People there prefer online orders owing to time savings, privacy, and attractive discounts or loyalty deals that traditional stores may not match. Together, these countries contribute to market expansion due to changing consumer habits and greater comfort with digital healthcare solutions.

Competitive Landscape:

The Eastern Europe online pharmacy market is seeing fast growth due to rising internet use, wider smartphone access, and a push for digital health solutions. Companies are focusing on expanding their platforms, launching new services, and partnering with local health networks. Cross-border agreements help reach more customers and improve logistics. Governments in some countries support e-prescriptions and digital healthcare rules, encouraging smoother online transactions. Investments in tech like AI chat support and secure digital payment systems are also common. Partnerships and acquisitions help companies strengthen their presence and diversify offerings. Overall, forming partnerships and expanding service portfolios are the most common moves right now, as firms compete to stay relevant and build trust with more people shopping for medicines online.

The report provides a comprehensive analysis of the competitive landscape in the Eastern Europe online pharmacy market with detailed profiles of all major companies, including:

- Apotheka SIA

- AZETA Sia

- EXTRAPHARMA online pharmacy

- Lékárna WPK sro

- Medikaments.lv

- 1MG Technologies Pvt. Ltd

- Pelion SA

- Webaptieka

- Zur Rose Group AG.

Latest News and Developments:

- June 2025: Glasgow-based Simple Online Healthcare launched in Denmark after tripling annual revenue to GBP 66 Million. Celebrating its 10th anniversary, the digital clinic group now operates in the UK, Germany, Australia, and Denmark, with plans to expand further and strengthen its leadership in the booming online pharmacy market.

- April 2025: Dr. Max partnered with VusionGroup to digitalize 1,000 pharmacies across six European countries by 2026. Using VusionCloud and electronic shelf labels, the upgrade will boost operational efficiency, automate pricing, and free pharmacists to focus on personalized care, strengthening Dr. Max’s leadership in digital pharmacy services.

- November 2024: Two Dutch online pharmacies, Apomeds and Easymeds, joined the European Association of E-pharmacies (EAEP), raising its membership to 38 across 20 European markets. Apomeds expands its cross-border services to Sweden, Denmark, Germany, Switzerland, and Portugal, strengthening digital healthcare in Eastern Europe. Both focus on trusted prescription services and will boost EAEP’s reach in digital pharmaceutical care and e-prescription adoption.

Eastern Europe Online Pharmacy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Over the Counter (OTC), Prescription |

| Platforms Covered | Mobile, Desktop |

| End Uses Covered | Hospitals and Clinics, Personal Use, Government Research |

| Applications Covered | Medicines, Personal Care, Devices and Surgical, Others |

| Countries Covered | Russia, Poland, Czech Republic, Romania, Hungary, Others |

| Companies Covered | Apotheka SIA, AZETA Sia, EXTRAPHARMA online pharmacy, Lékárna WPK sro, Medikaments.lv, 1MG Technologies Pvt. Ltd, Pelion SA, Webaptieka and Zur Rose Group AG |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Eastern Europe online pharmacy market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Eastern Europe online pharmacy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Eastern Europe online pharmacy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online pharmacy market in Eastern Europe was valued at USD 7.2 Billion in 2024.

The Eastern Europe online pharmacy market is projected to exhibit a CAGR of 13.2% during 2025-2033, reaching a value of USD 24.9 Billion by 2033.

The Eastern Europe online pharmacy market is expanding due to increased smartphone and internet usage, the shift of traditional pharmacies to online platforms, consumer preference for convenient and discounted services, and the adoption of technologies like AI and e-prescriptions. These factors collectively drive the market's growth.

Based on type, over the counter (OTC) accounted for the largest share of the market in 2024 by offering hassle-free access to everyday medicines and health products, meeting rising demand for convenient self-care purchases online.

Some of the major players in the Eastern Europe online pharmacy market include Apotheka SIA, AZETA Sia, EXTRAPHARMA online pharmacy, Lékárna WPK sro, Medikaments.lv, 1MG Technologies Pvt. Ltd, Pelion SA, Webaptieka, Zur Rose Group AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)