Edge Computing Market Report by Component (Hardware, Software, Services), Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), Vertical (Manufacturing, Energy and Utilities, Government and Defense, BFSI, Telecommunications, Media and Entertainment, Retail and Consumer Goods, Transportation and Logistics, Healthcare and Life Sciences, and Others), and Region 2025-2033

Edge Computing Market Overview:

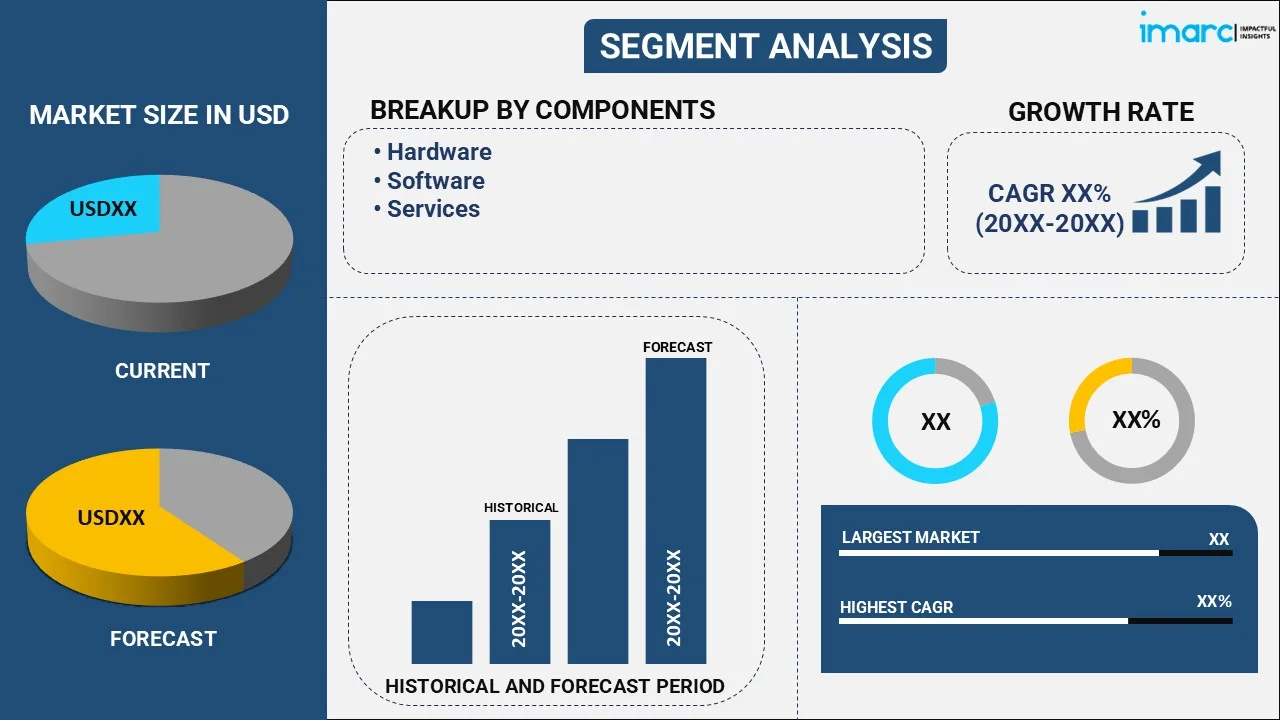

The global edge computing market size reached USD 18.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 114.4 Billion by 2033, exhibiting a growth rate (CAGR) of 22.40% during 2025-2033. The increasing demand for low-latency computing, the rising utilization of advanced technologies, the growing use of data-intensive applications in numerous end-use industries, and the escalating concerns regarding security and compliance risks associated with storing sensitive data in centralized data centers are some of the factors propelling the market.

Key Insights:

- In terms of region, North America held the leading position in revenue in 2024.

- Hardware accounted for the highest market share by component.

- Large enterprises represented the dominant organization size segment.

- Energy and utilities emerged as the top-performing vertical.

Market Size and Forecast:

- Market Size in 2024: USD 18.3 Billion

- Projected Market Size in 2033: USD 114.4 Billion

- CAGR (2025–2033): 22.40%

- Largest Market in 2024: North America

Edge computing represents a distributed computing framework designed to bring computational tasks and data storage closer to their point of use, often situated at the network edge. The overarching objective is to curtail latency, optimize bandwidth usage, and enhance response times, enabling swift and near real-time data processing and analysis. The distinctive attributes of edge computing encompass on-site data processing, a network of distributed computing nodes, integration with cloud resources, and the utilization of sensors and edge devices. This approach facilitates immediate data handling, filtering, local analysis, storage, and caching, creating a robust platform for executing applications at the network periphery. It proves particularly effective for scenarios necessitating rapid low-latency processing, including domains like autonomous vehicles, industrial automation, and virtual reality. Edge computing's merits encompass diminished latency and network congestion, heightened security and privacy safeguards, augmented efficiency and dependability, and data transfer and cloud infrastructure cost savings. Given the escalating number of internet-connected devices demanding real-time processing capabilities, edge computing trends are rapidly reshaping enterprise strategies around distributed computing.

To get more information on this market, Request Sample

The edge computing market size 2025 is projected to reflect the accelerating deployment of distributed infrastructure, fueled by rising demand across telecom, manufacturing, and healthcare sectors, aiming to enable real-time services at scale. The global edge computing market size 2025 is majorly driven by the growing demand for low-latency computing, facilitating real-time decision-making and enhancing performance. This rise can be attributed to the rapid adoption of cutting-edge technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and the rapid expansion of high-speed 5G internet connectivity. Simultaneously, the remarkable increase in data-intensive applications across diverse industries such as healthcare, finance, and retail is propelling market growth. Organizations generating vast amounts of data worldwide are inclined to minimize processing times, further driving market expansion. The rising adoption of cloud computing among businesses has amplified the need for seamless integration between cloud infrastructure and edge computing, particularly to establish hybrid cloud environments. Another driving force stems from concerns about security and compliance risks linked to centralized data centers, pushing organizations towards decentralized solutions. The market's momentum is bolstered by the imperative to reduce data transfer and storage costs while optimizing cloud resources efficiently, adding to the overall edge computing market growth.

Edge Computing Market Trends/Drivers:

Increasing Digital Transformation Initiatives

The increasing digital transformation initiatives are stimulating the market. As businesses across industries strive to modernize their operations and harness the potential of advanced technologies, edge computing emerges as a crucial enabler. The transition to digitized processes, data-driven decision-making, and the proliferation of Internet of Things (IoT) devices necessitates efficient and swift data processing. Edge computing's ability to handle data closer to its source aligns perfectly with the requirements of a digitally transformed ecosystem. Its adoption empowers organizations to seamlessly manage and analyze data in real time, improving operational efficiency and enhancing customer experiences. As more companies recognize the advantages of edge computing in supporting their digital transformation journeys, the demand for edge computing infrastructure continues to grow across industry verticals.

Rise of Industry 4.0

The rise of Industry 4.0 is catalyzing the market. This industrial revolution, characterized by the fusion of digital technologies, automation, and data exchange, reshapes manufacturing and operations. Integrating smart devices, IoT, big data analytics, and artificial intelligence enhances efficiency, productivity, and connectivity. As organizations embrace Industry 4.0 principles, the demand for edge computing is rising. Edge computing's ability to process data at or near its source aligns seamlessly with the real-time requirements of Industry 4.0. It empowers factories and production facilities to analyze data locally, reducing latency and enabling timely decision-making. In the context of Industry 4.0, AI edge computing market growth is accelerating as smart factories increasingly rely on edge devices to deliver faster insights and improved automation. It enables organizations to extract actionable insights at the edge, optimizing processes and enabling predictive maintenance. Therefore, the rise of Industry 4.0 is propelling the adoption of edge computing as businesses seek to unlock the full potential of this industrial revolution.

Growing Research and Development (R&D) Efforts

The escalating emphasis on research and development (R&D) activities is bolstering the market. Organizations and institutions are increasingly investing resources into exploring new technologies, refining existing processes, and developing novel solutions to address complex challenges. This heightened focus on R&D directly impacts the edge computing market forecast by fostering advancements and improvements in edge-related technologies. The continuous exploration and refinement of edge computing capabilities lead to the creation of more efficient hardware, enhanced software frameworks, and optimized data processing methodologies. These developments cater to the evolving demands of businesses seeking agile and responsive data processing solutions. The synergy between growing R&D efforts and edge computing extends beyond technology itself. It also encompasses creating specialized applications, tools, and strategies that leverage edge computing's strengths. As R&D efforts drive the evolution of edge computing, its adoption becomes more viable, efficient, and aligned with the diverse needs of industries.

Surge in Demand for Real-Time Application Performance

As more industries adopt smart systems, i.e., autonomous vehicles, industrial automation, and remote healthcare, expectations for ultra-fast data processing have climbed. Traditional cloud models often struggle with latency. Edge computing offers a fix by bringing data processing closer to the user or device, reducing delays significantly. This is driving its uptake across sectors where milliseconds matter. The shift isn’t limited to large enterprises; even startups in gaming, retail, and AR/VR are prioritizing low-latency solutions to deliver better user experiences. With AI models increasingly running on edge devices, the need for real-time performance continues to push edge adoption into mainstream IT strategies. This demand is also boosting interest in purpose-built edge computer hardware designed to support real-time inference and local analytics.

5G Expansion Accelerating Edge Deployment

5G is making edge computing far more practical. Its ability to support high-speed, high-volume data traffic at low latency has created the right conditions for edge infrastructure to thrive. As telecom operators roll out 5G more widely, edge computing is gaining momentum in areas like smart cities, connected factories, and immersive mobile experiences. The improved bandwidth and reduced network delays help edge servers handle complex workloads in near real time. Businesses are responding by building smaller, distributed data centers near end users to match the capabilities 5G enables, leading to faster processing, better scalability, and more responsive services. Notably, the edge computing market in APAC is accelerating quickly due to strong government support, dense urban populations, and aggressive 5G deployments in countries like China, South Korea, and Japan.

Finally, as vendors scale deployments and enterprises pursue more distributed architectures, edge computing market share is expected to rise across sectors. Continued investment in edge-based solutions, alongside maturing use cases, will likely define the next phase of intelligent computing.

Edge Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global edge computing market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on component, organization size and vertical.

Breakup by Component:

- Hardware

- Software

- Services

Hardware dominates the market

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services. According to the report, hardware represented the largest segment.

As organizations increasingly adopt edge computing solutions, a growing demand for specialized hardware that can efficiently process and manage data at the network edge is growing. The unique requirements of edge computing, such as low-latency processing and real-time analytics, drive the development of hardware components tailored to these demands.

Hardware innovations in edge computing encompass a spectrum of devices, including edge servers, gateways, sensors, and edge devices equipped with optimized processors and memory. These hardware components are designed to handle data processing closer to the source, reducing latency and enhancing overall system performance.

Moreover, hardware evolution in the edge computing sector contributes to edge deployments' scalability, reliability, and cost-efficiency. As more industries recognize the advantages of edge computing in enhancing data processing efficiency, the hardware segment continues to drive innovation, expanding the market's capabilities and appeal.

Breakup by Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Large enterprises dominate the market

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises (SMEs) and large enterprises. According to the report, large enterprises represented the largest segment.

Large enterprises play a significant role in propelling the market. With their extensive resources and complex operational requirements, these enterprises are increasingly adopting edge computing solutions to optimize data processing and enhance operational efficiency. The scalability and customization potential of edge computing aligns well with the diverse needs of large organizations.

Large enterprises benefit from edge computing's ability to process and analyze data closer to the source, enabling quicker decision-making and reducing latency. This capability is especially critical for industries with massive data volumes requiring real-time insights, such as manufacturing, logistics, and healthcare.

As large enterprises embrace edge computing to gain a competitive edge, the demand for tailored solutions, robust infrastructure, and seamless integration rises. Their influence drives technological advancements, encourages innovation, and fosters collaborations within the edge computing ecosystem, shaping and expanding the market landscape.

Breakup by Vertical:

- Manufacturing

- Energy and Utilities

- Government and Defense

- BFSI

- Telecommunications

- Media and Entertainment

- Retail and Consumer Goods

- Transportation and Logistics

- Healthcare and Life Sciences

- Others

Energy and utilities dominate the market

The report has provided a detailed breakup and analysis of the market based on vertical. This includes manufacturing, energy and utilities, government and defense, BFSI, telecommunications, media and entertainment, retail and consumer goods, transportation and logistics, healthcare and life sciences, and others. According to the report, energy and utilities represented the largest segment.

The energy and utilities sector is pivotal in bolstering the market. As this industry undergoes a digital transformation, the integration of advanced technologies like the Internet of Things (IoT) and real-time data analytics becomes crucial. Edge computing's capability to process data at the point of generation aligns perfectly with the energy and utilities sector's need for rapid decision-making and efficient operations.

In this sector, edge computing enables real-time monitoring of energy distribution, predictive maintenance of equipment, and optimization of power generation and consumption. By reducing latency and enhancing data processing efficiency, edge computing empowers energy and utility companies to respond promptly to fluctuations in demand, mitigate potential disruptions, and improve overall system reliability.

Furthermore, the energy and utilities sector's edge computing investment drives hardware, software, and analytics innovation tailored to its specific needs. As the industry embraces edge solutions, it shapes the market, fosters technology advancements, and sets a precedent for other sectors seeking to harness the benefits of edge computing.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

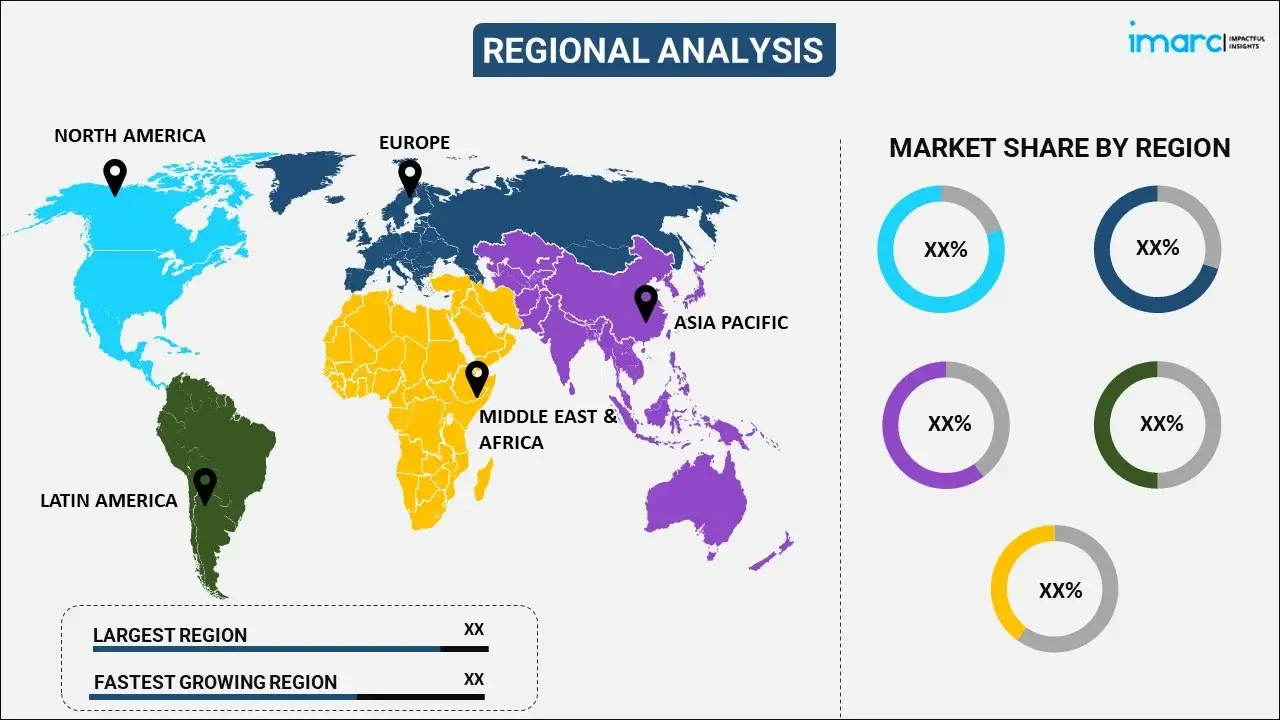

North America exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for edge computing.

As a hub for technological innovation and digital transformation, North America is rapidly adopting edge computing solutions across various industries. The region's advanced IT infrastructure, increasing deployment of IoT devices, and emphasis on real-time data analytics contribute to the rise in demand for edge computing.

In North America, edge computing is leveraged to enhance the manufacturing, healthcare, finance, and transportation sectors. Its ability to process data at the edge aligns with the region's emphasis on minimizing latency and optimizing decision-making processes.

Numerous key players, startups, and research institutions further foster the market. As the region pioneers the integration of edge computing into diverse sectors, it sets trends, encourages innovation, and significantly shapes the global edge computing market landscape.

Edge Computing Market Leaders:

Top companies actively strengthen market growth through strategic initiatives and innovative solutions. These industry leaders are consistently investing in research and development, driving the evolution of edge computing technologies and applications. They are pivotal in shaping industry standards and best practices, ensuring scalability, security, and efficiency of edge computing implementations. Furthermore, these companies are fostering collaborations with technology partners, cloud providers, and businesses across various sectors. By offering comprehensive solutions that integrate edge computing with cloud resources, they enable the creation of hybrid environments that cater to diverse operational needs. Top companies also lead in the development of specialized hardware and software, addressing the unique requirements of data processing at the edge. Their thought leadership, active participation in industry events, and educational initiatives contribute to increasing awareness and understanding of edge computing's benefits.

The report has provided a comprehensive analysis of the competitive landscape in the edge computing market. Detailed profiles of all major companies have also been provided.

- ABB Ltd.

- Amazon Web Services (AWS), Inc.

- Cisco Systems Inc.

- Digi International Inc.

- General Electric Company

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- SAP SE

- Siemens AG

Recent Developments:

- In January 2025, ZEDEDA reported a sharp rise in 2024, doubling revenue and edge nodes under management. The growth reflects rising enterprise demand for scalable edge computing across energy, transportation, manufacturing, retail, and agriculture. CEO Said Ouissal highlighted the shift from pilots to full-scale deployment as the market matures. ZEDEDA’s platform continues to gain momentum as organizations seek robust solutions for managing distributed edge infrastructure in real-world environments.

- In June 2024, at NVIDIA GTC Paris, AAEON showcased its latest edge AI solutions powered by NVIDIA Jetson modules. A live demo with Isarsoft highlighted the BOXER-8653AI system, analyzing crowd density and foot traffic for smart city applications. AAEON also unveiled the NV8600-Nano AI Developer Kit, featuring the Jetson Orin Nano with Super Mode. These advances reinforce edge computing’s role in real-time video analytics and urban infrastructure intelligence.

- In July 2023, ABB and Microsoft joined forces in a collaborative effort to introduce generative AI to industrial applications. ABB and Microsoft collaborate to integrate generative AI functionalities into industrial digital solutions to elevate operational standards toward safety, intelligence, and sustainability.

- In July 2023, Amazon Web Services (AWS) announced a pioneering service called AWS HealthScribe, harnessing the power of generative AI. This innovative offering is designed to automate the creation of clinical documentation.

- In August 2023, Cisco Systems Inc. introduced automated ransomware recovery. Cisco's Extended Detection and Response (XDR) introduces groundbreaking features enabling organizations to rebound from ransomware attacks autonomously. This innovative capability empowers businesses to automatically recover from such incidents, marking a significant advancement in cybersecurity technology.

Edge Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Verticals Covered | Manufacturing, Energy and Utilities, Government and Defense, BFSI, Telecommunications, Media and Entertainment, Retail and Consumer Goods, Transportation and Logistics, Healthcare and Life Sciences, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Amazon Web Services (AWS), Inc., Cisco Systems Inc., Digi International Inc., General Electric Company, Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., IBM Corporation, Intel Corporation, Microsoft Corporation, SAP SE, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the edge computing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global edge computing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the edge computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The edge computing market was valued at USD 18.3 Billion in 2024.

The edge computing market is projected to exhibit a CAGR of 22.40% during 2025-2033, reaching a value of USD 114.4 Billion by 2033.

The edge computing market is driven by low-latency demands, growth in IoT devices, real-time data processing needs, 5G rollout, data privacy concerns, reduced cloud dependence, cost savings on bandwidth, AI at the edge, smart infrastructure, and industry-specific applications like autonomous vehicles and industrial automation.

The sudden outbreak of the COVID-19 pandemic has led to the growing utilization of edge computing solutions to minimize the amount of long-distance communication between the client and the server for an improved process efficiency, during the remote working scenario.

Based on the component, the global edge computing market can be categorized into hardware, software, and services. Currently, hardware exhibits clear dominance In the market.

Based on the organization size, the global edge computing market has been segmented into Small and Medium-sized Enterprises (SMEs) and large enterprises. Among these, large enterprises currently hold the largest market share.

Based on the vertical, the global edge computing market can be bifurcated into manufacturing, energy and utilities, government and defense, BFSI, telecommunications, media and entertainment, retail and consumer goods, transportation and logistics, healthcare and life sciences, and others. Currently, the energy and utilities sector accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

North America dominated the edge computing market in 2024 due to strong investment in 5G, widespread cloud adoption, established data center infrastructure, and early deployment of IoT solutions across multiple industries.

Some of the major players in the edge computing market include ABB Ltd., Amazon Web Services (AWS), Inc., Cisco Systems Inc., Digi International Inc., General Electric Company, Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., IBM Corporation, Intel Corporation, Microsoft Corporation, SAP SE, Siemens AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)