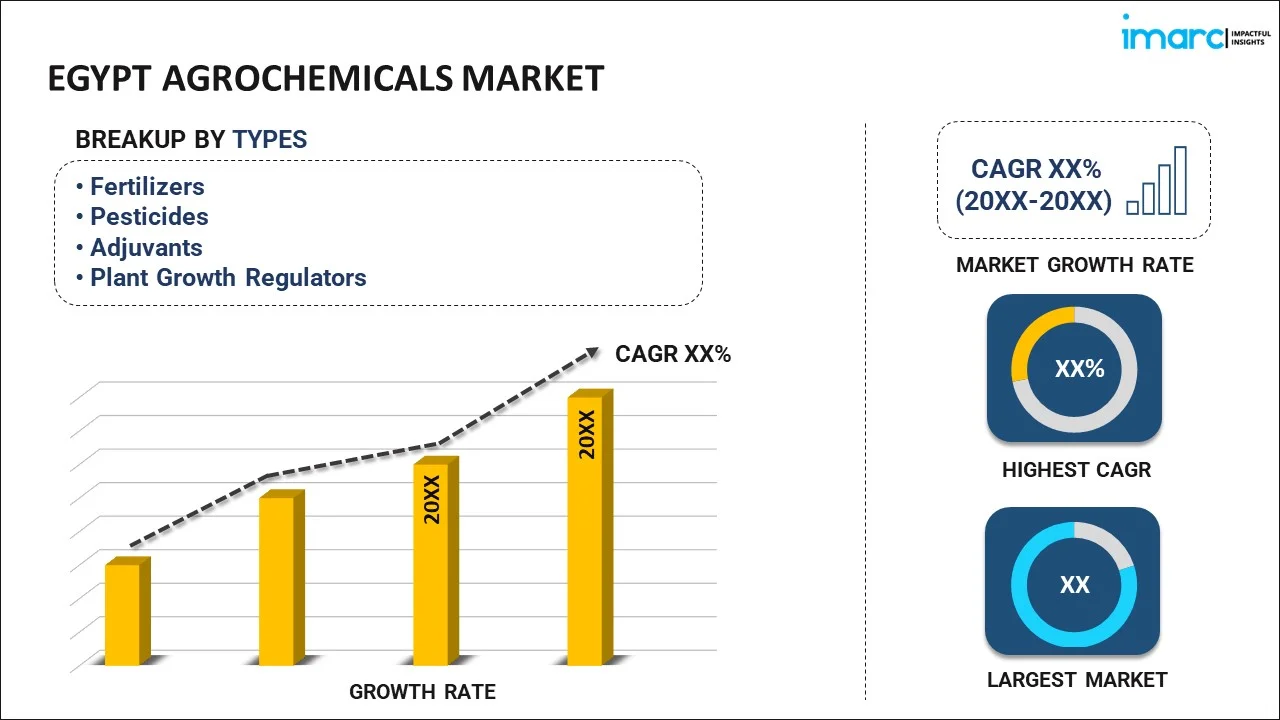

Egypt Agrochemicals Market Report by Type (Fertilizers, Pesticides, Adjuvants, Plant Growth Regulators), Application (Cereals, Oilseeds, Fruits and Vegetables, and Others), and Region 2026-2034

Egypt Agrochemicals Market Overview:

The Egypt agrochemicals market size reached USD 1,091.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,643.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.42% during 2026-2034. The increasing agricultural productivity needs, government initiatives to boost crop yields, rising awareness of modern farming techniques, the growing demand for higher food production among consumers, and expanding export opportunities are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,091.2 Million |

|

Market Forecast in 2034

|

USD 1,643.6 Million |

| Market Growth Rate 2026-2034 | 4.42% |

Access the full market insights report Request Sample

Egypt Agrochemicals Market Trends:

Increasing Agricultural Productivity Needs

The rising need to enhance agricultural productivity, along with the growing population is acting as a major growth-inducing factor. This drives the widespread adoption of agrochemicals such as fertilizers and pesticides to improve crop yields and protect against pests and diseases. According to the data from Crop Trust, Egypt has a population base of nearly 90 million inhabitants. The per capita food consumption is 3,160 calories a day and ranks within the top quarter in the world. With increasing demands and a population growth rate of 2%, Egypt must work towards a food-secure world. Mostly desert, the Nile Delta hosts most of the agricultural land and only 2.8% of the country’s territory is arable. Egypt’s main agricultural products are wheat, beans, and fruits. The agriculture and food sector in Egypt accounts for 15-20% of the GDP. It employs nearly one-third of the country’s working population. Further, it makes up 15-20% of exports and imports. Notable imports are wheat, maize, and soybeans. Wheat imports amount to up to 9,800,006 tons and nearly USD 3.2 billion in value. While Egypt’s agricultural sector accounts for such a large part of its GDP and workforce, Egypt remains interdependent when it comes to crop diversity. 91-99% of the food energy consumed in Egypt comes from crops that are not native to the region.

Government Initiatives and Support

The Egyptian government is implementing various initiatives and providing subsidies to promote modern farming practices and improve crop yields. These measures encourage farmers to use agrochemicals, boosting market growth. According to the USAID, USAID helps Egypt increase its agricultural productivity and raise farmers’ incomes. Through $1.4 billion in investments in the agriculture sector in Egypt since 1978, USAID provided technical assistance to more than 500,000 smallholder farmers, enabled farmers to purchase land, improved farm management techniques and access to financial services, and liberalized agricultural markets. Through Feed the Future, the U.S. Government’s global hunger and food security initiative, USAID’s approach encourages free-market competition and helps match farmers with local and international buyers to meet market needs and consumer demands. Since the late 1990s, Egypt has increased agricultural export revenue by 1,500 percent with USAID support.

Egypt Agrochemicals Market News:

- In May 2024, the Government of Egypt initiated the first phase of a sprawling agricultural development project, The Future of Egypt, aiming to improve Egypt's food security and reduce its reliance on imports. The Future of Egypt project seeks to reclaim about 1.8 million hectares of land by 2030, in addition to modernizing irrigation systems and increasing agricultural production.

- In February 2024, Entlaq, a Cairo-based entrepreneurship think tank, forged a strategic alliance with the agritech start-up Ninjacart. The alliance will focus on identifying and supporting promising farm-to-fork agri start-ups in Egypt, providing them with Ninjacart’s cutting-edge tech platform, supply chain management solutions, and specialized advisory services.

Egypt Agrochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Fertilizers

- Pesticides

- Adjuvants

- Plant Growth Regulators

The report has provided a detailed breakup and analysis of the market based on the type. This includes fertilizers, pesticides, adjuvants, and plant growth regulators.

Application Insights:

- Cereals

- Oilseeds

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cereals, oilseeds, fruits and vegetables, and others.

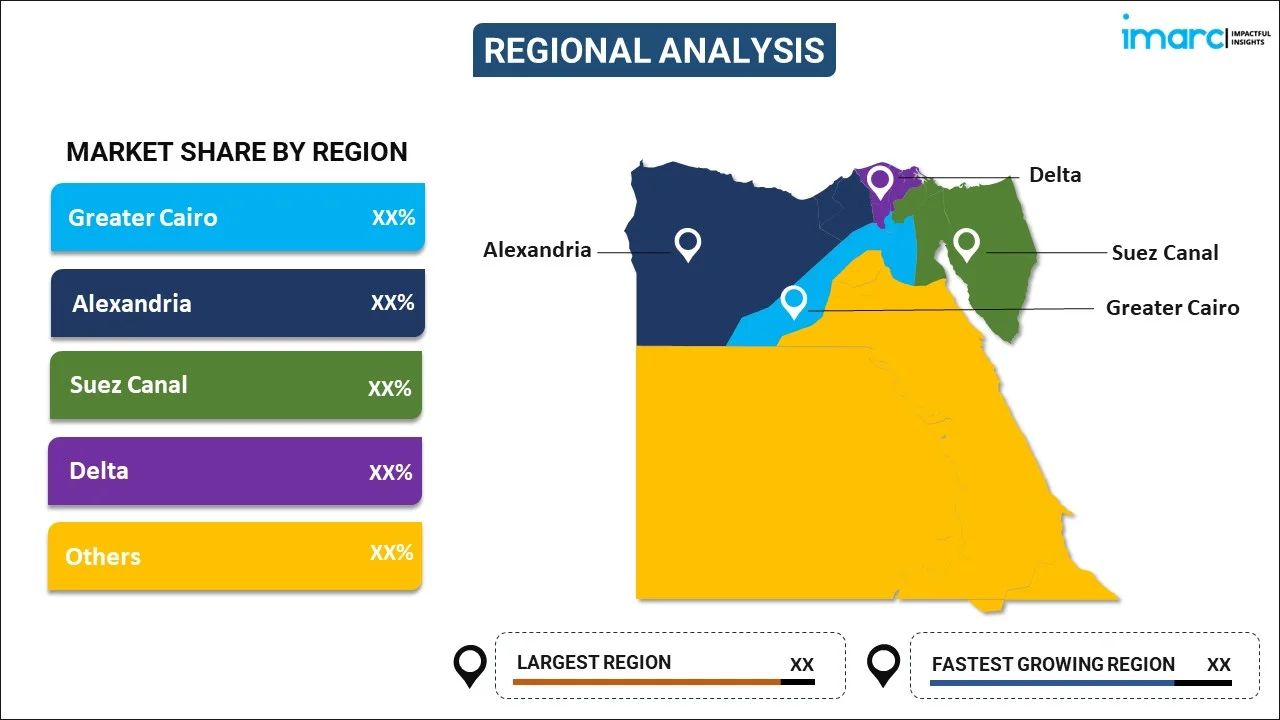

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Agrochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fertilizers, Pesticides, Adjuvants, Plant Growth Regulators |

| Applications Covered | Cereals, Oilseeds, Fruits and Vegetables, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt agrochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt agrochemicals market on the basis of type?

- What is the breakup of the Egypt agrochemicals market on the basis of application?

- What are the various stages in the value chain of the Egypt agrochemicals market?

- What are the key driving factors and challenges in the Egypt agrochemicals?

- What is the structure of the Egypt agrochemicals market and who are the key players?

- What is the degree of competition in the Egypt agrochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt agrochemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt agrochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt agrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)