Egypt Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

Egypt Air Freight Market Overview:

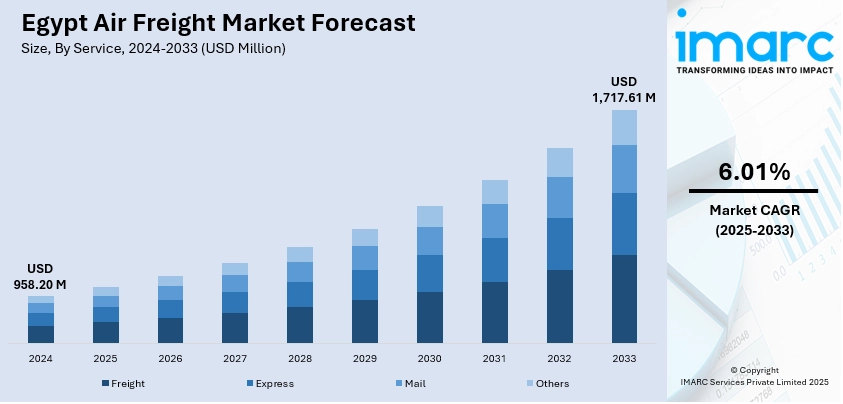

The Egypt air freight market size reached USD 958.20 Million in 2024. The market is projected to reach USD 1,717.61 Million by 2033, exhibiting a growth rate (CAGR) of 6.01% during 2025-2033. The market is driven by rapid infrastructure expansion, such as Cairo International airport upgrades and new Ras El Hekma development, alongside rising e-commerce and tourism. Technological integration, including AI and cold-chain systems, and streamlined customs processes foster efficiency and reliability, strengthening the Egypt air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 958.20 Million |

| Market Forecast in 2033 | USD 1,717.61 Million |

| Market Growth Rate 2025-2033 | 6.01% |

Egypt Air Freight Market Trends:

Infrastructure Expansion Fueling Capacity Growth

Egypt's air freight capacity is expanding significantly due to major aviation infrastructure projects. Upgrades at Cairo International—including expanded cargo terminals—combined with new airports like Ras El Hekma, enhance national connectivity and freight throughput. These investments directly respond to growing e-commerce demand and tourism, enabling faster, higher-volume cargo movement. With EgyptAir converting aircraft into freighters and modernizing fleets, the country aims to become a regional air cargo hub. Improvements in ground handling, warehousing, and logistics corridors further support this transformation. Collectively, these developments are accelerating Egypt air freight market growth, positioning the sector for sustained capacity and economic resurgence. For instance, in June 2025, EGYPTAIR ordered six more Airbus A350-900 aircraft, bringing its total to 16, to meet rising long-haul travel demand and modernize its fleet. The airline aims to expand its network and support sustainable aviation with fuel-efficient planes. The A350s will enhance Egypt’s air transport capabilities and international reach.

To get more information on this market, Request Sample

Regulatory Reforms and Trade Facilitation

Egypt is advancing customs system reforms to enhance trade competitiveness and curb smuggling. In March 2025, Prime Minister Mostafa Madbouly led a high-level meeting outlining facilitation and regulatory measures, including instalment-based customs duties, pre-clearance, digital payments, and expanded logistics services. The reforms aim to streamline clearance, reduce smuggling, and modernize processes through digitization. Key initiatives include updating customs tariffs, expanding warehouse licensing, and increasing participation in the Authorised Economic Operator programme. The digital transformation also improves exporter-importer registration via Egypt’s online portal.

Egypt Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

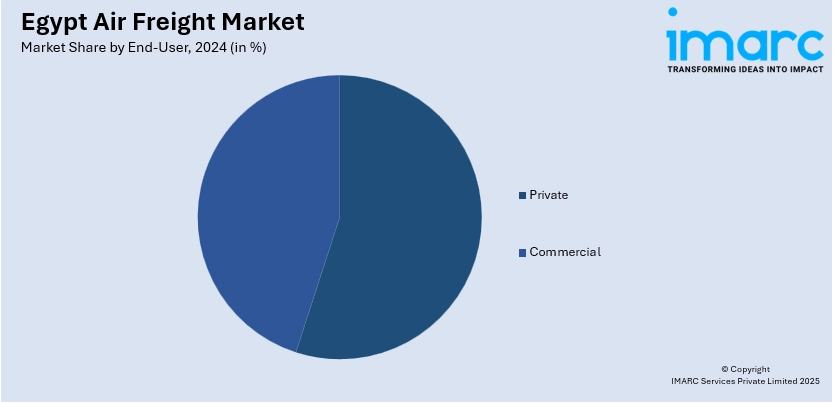

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private and commercial.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Air Freight Market News:

- In October 2024, Egyptair Cargo signed a long-term agreement with Unilode Aviation Solutions for full-service ULD (Unit Load Device) management. This partnership strengthens Unilode’s presence in Africa and adds Egyptair Cargo to its global ULD pool of over 170,000 units. The deal supports Egyptair Cargo’s expansion and operational efficiency through digitalised ULD tracking, a global network, and sustainability-focused solutions.

Egypt Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt air freight market on the basis of service?

- What is the breakup of the Egypt air freight market on the basis of destinations?

- What is the breakup of the Egypt air freight market on the basis of end-user?

- What is the breakup of the Egypt air freight market on the basis of region?

- What are the various stages in the value chain of the Egypt air freight market?

- What are the key driving factors and challenges in the Egypt air freight?

- What is the structure of the Egypt air freight market and who are the key players?

- What is the degree of competition in the Egypt air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)