Egypt ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Egypt ATM Market Overview:

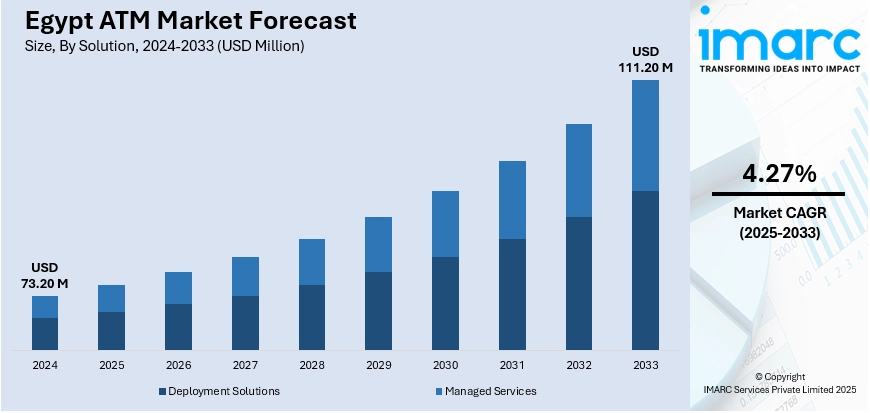

The Egypt ATM market size reached USD 73.20 Million in 2024. The market is projected to reach USD 111.20 Million by 2033, exhibiting a growth rate (CAGR) of 4.27% during 2025-2033. The market is expanding due to the rising adoption of digital banking and Sharia-compliant financial services. Concurrent with this, an increased focus on cashless transactions and inclusive banking solutions continues to support Egypt ATM market share across urban and underserved regions, driving infrastructure upgrades and service diversification.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.20 Million |

| Market Forecast in 2033 | USD 111.20 Million |

| Market Growth Rate 2025-2033 | 4.27% |

Egypt ATM Market Trends:

Digital Transformation Fueling ATM Innovation

Egypt's ATM market is also undergoing a major transformation, prompted by the broader trend towards digital financial services. With mobile banking applications and internet-enabled platforms becoming increasingly accessible, consumer behavior is gradually shifting away from cash-based transactions. Not only are people's interactions with banks changing, but even the infrastructure banks invest in is being modernized. In September 2024, the Central Bank of Egypt licensed the operation of the country's first digital bank, marking a significant milestone for the nation's financial sector. The move is anticipated to accelerate financial inclusion by extending services to underserved communities through digital platforms, thereby reducing the need for physical branches and ATMs. As electronic banking becomes increasingly popular, demand for traditional ATM services may decrease, prompting banks to reassess their ATM distribution strategies. Rather than expanding ATM networks, institutions could focus on retrofitting existing machines with intelligent features or integrating them into digital ecosystems. This shift mirrors a general global trend toward cashless economies, with convenience, speed, and ease of access being emphasized. Egypt's digital banking drive is set to transform the ATM industry by minimizing the dependence on physical infrastructure and promoting innovation in self-service banking technology.

To get more information on this market, Request Sample

Islamic Finance Widening ATM Outreach

The expansion of Sharia-compliant banking is a significant driver in Egypt ATM market growth. With the increased popularity of Islamic finance, banks are modifying their offerings to address the concerns of a wider customer base seeking ethical and interest-free financial products. This change not only affects product offerings but also how banking services are provided throughout the country. In September 2024, the Kuwait Finance House (KFH) finalized the transformation of Ahli United Bank – Egypt into entirely Sharia-compliant operations. The strategic initiative should help boost the uptake of digital banking and ATM services tailored to Islamic finance values. Unlike traditional banking, Sharia-compliant organizations tend to emphasize transparency and inclusivity, hence the need for increased investments in ATM infrastructure to promote access to finance. With an increasing number of customers turning to Islamic banking, there will be a greater demand for ATMs that provide services in line with these ideals, particularly in areas where branch penetration is weak. The trend implies a twofold effect: while digital banking continues to grow, the ATM market can also expand to meet the unique requirements of Islamic finance users. The combination of ethical banking with the latest technology is set to enhance Egypt's financial system and diversify ATM services.

Egypt ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

The report has provided a detailed breakup and analysis of the market based on the screen size. This includes 15" and below and above 15".

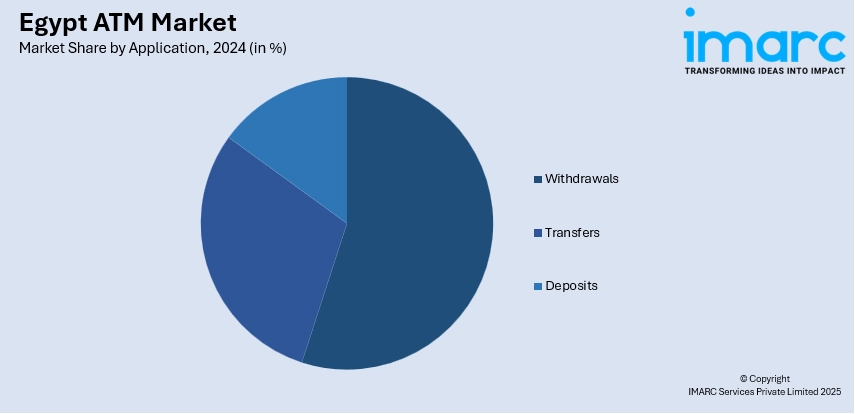

Application Insights:

- Withdrawals

- Transfers

- Deposits

The report has provided a detailed breakup and analysis of the market based on the application. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt ATM Market News:

- February 2025: Egypt launched its first ATM manufacturing plant in partnership with GRG Banking and IST. This move aimed to reduce reliance on imports, enhance local production, and strengthen Egypt’s position as a regional ATM technology hub, boosting market growth and financial inclusion.

- September 2024: Kuwait Finance House (KFH) completed the conversion of Ahli United Bank – Egypt to Sharia-compliant banking. This move is expected to boost the adoption of digital banking and ATM services aligned with Islamic finance, expanding Egypt's ATM market share and promoting cashless transactions.

Egypt ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt ATM market on the basis of solution?

- What is the breakup of the Egypt ATM market on the basis of screen size?

- What is the breakup of the Egypt ATM market on the basis of application?

- What is the breakup of the Egypt ATM market on the basis of ATM type?

- What is the breakup of the Egypt ATM market on the basis of region?

- What are the various stages in the value chain of the Egypt ATM market?

- What are the key driving factors and challenges in the Egypt ATM market?

- What is the structure of the Egypt ATM market and who are the key players?

- What is the degree of competition in the Egypt ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt ATM market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)