Egypt Cement Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Egypt Cement Market Overview:

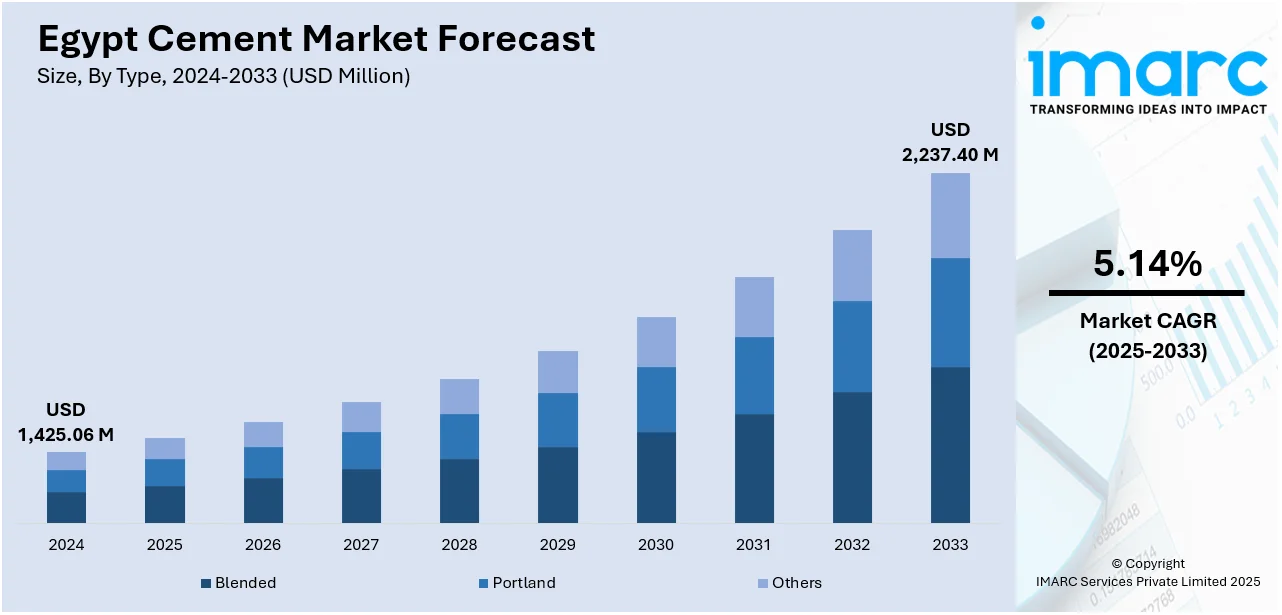

The Egypt cement market size reached USD 1,425.06 Million in 2024. The market is projected to reach USD 2,237.40 Million by 2033, exhibiting a growth rate (CAGR) of 5.14% during 2025-2033. Strong government urban development and infrastructure projects such as new cities and transportation systems drive the market and underpin domestic demand. Additionally, the growing demand for exports is another significant driver, bolstered by competitiveness-enhancing industrial policies in regional markets. Further, the industry is welcoming sustainability and technological advancement, with companies implementing substitute fuels, power-saving devices, and computer-based solutions to enhance efficiency and comply with environmental regulations thus boosting the Egypt cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,425.06 Million |

| Market Forecast in 2033 | USD 2,237.40 Million |

| Market Growth Rate 2025-2033 | 5.14% |

Egypt Cement Market Trends:

Export Growth & Industrial Policy Support

Rising demand for exports of cements has become a vital Egypt cement market trend, complementing its strong domestic production base. With an estimated 50 million tons of cement produced year in 2023, Egypt ranks 11th in the world and can effectively supply both domestic and foreign markets. Government policies actively encourage producers to expand exports through logistical support, trade facilitation, and fixed energy pricing, helping maintain competitive costs. Egypt’s strategic location enables smooth access to African, Middle Eastern, and Mediterranean markets, positioning the country as a regional cement hub. Export-focused strategies also help producers diversify revenue streams, reducing reliance on domestic demand while enhancing market resilience. By supporting manufacturing efficiency improvements and removing trade barriers, Egypt’s industrial policy aligns with global demand trends, ensuring its cement sector capitalizes on growing regional construction and infrastructure development opportunities.

To get more information on this market, Request Sample

Government Infrastructure & Urban Development

Egypt’s cement market is strongly driven by large-scale government infrastructure and urban development initiatives. The country’s leadership is investing heavily in road networks, bridges, public transport systems, and new cities, with a special focus on developing the New Administrative Capital and other major urban centers. These projects require vast amounts of cement for both commercial and residential construction, creating steady demand in the domestic market. In addition, government housing schemes aim to address population growth and urbanization, fueling further cement consumption. This commitment to infrastructure modernization supports long-term stability for the industry by ensuring ongoing projects across different regions. As the government prioritizes industrial zones, transportation hubs, and affordable housing, the cement sector remains a crucial supplier, reinforcing its role in Egypt’s national development strategy.

Sustainability, Innovation & Market Competition

Sustainability and innovation are transforming Egypt’s cement industry as producers adopt cleaner technologies to address environmental concerns and meet global standards. Companies are implementing energy-efficient systems, alternative fuels, and low-carbon cement formulations to reduce emissions. One notable example is the Assiut facility in Cemex Egypt, which uses cutting-edge decarbonization technology to reduce CO2 emissions by about 290,000 tonnes per year and turn about 500,000 tonnes of municipal trash into energy. These efforts reflect the industry’s shift towards greener operations, helping firm’s lower costs, optimize processes, and enhance product quality amid rising domestic competition. Digital tools, smart monitoring, and automation are further improving efficiency and sustainability across the sector. Together, these measures position Egypt’s cement industry as a forward-looking player that aligns with global environmental trends while remaining competitive in both local and international markets, thus contributing to the Egypt cement market growth.

Egypt Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

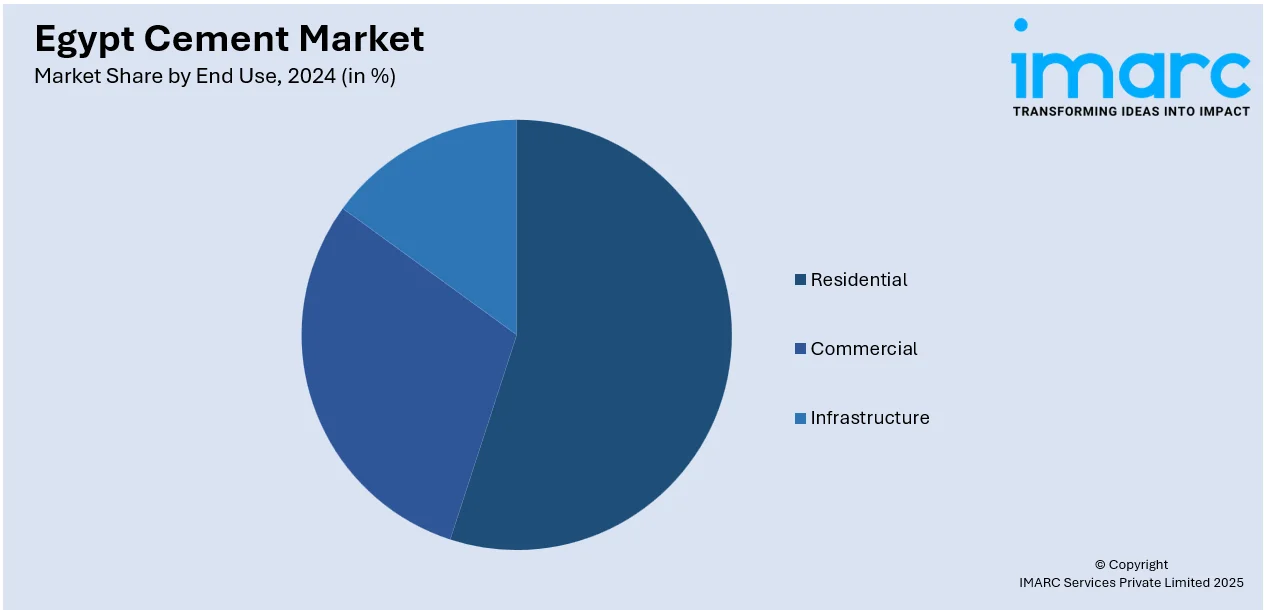

End Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Cement Market News:

-

In August 2024, Cementir Holding N.V. declared that, for about EUR 30 million, its subsidiary, Aalborg Portland Holding A/S, had purchased an extra 25.4% of Sinai White Portland Cement Co. from Vicat Group's Sinai Cement Company. This increases Cementir’s indirect ownership in SWCC to 96.5%. The move reinforces Cementir’s strategic focus on the white cement sector in Egypt, where SWCC operates one of the Mediterranean’s largest white cement plants.

Egypt Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt cement market on the basis of type?

- What is the breakup of the Egypt cement market on the basis of end use?

- What is the breakup of the Egypt cement market on the basis of region?

- What are the various stages in the value chain of the Egypt cement market?

- What are the key driving factors and challenges in the Egypt cement market?

- What is the structure of the Egypt cement market and who are the key players?

- What is the degree of competition in the Egypt cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)