Egypt Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Egypt Diaper Market Overview:

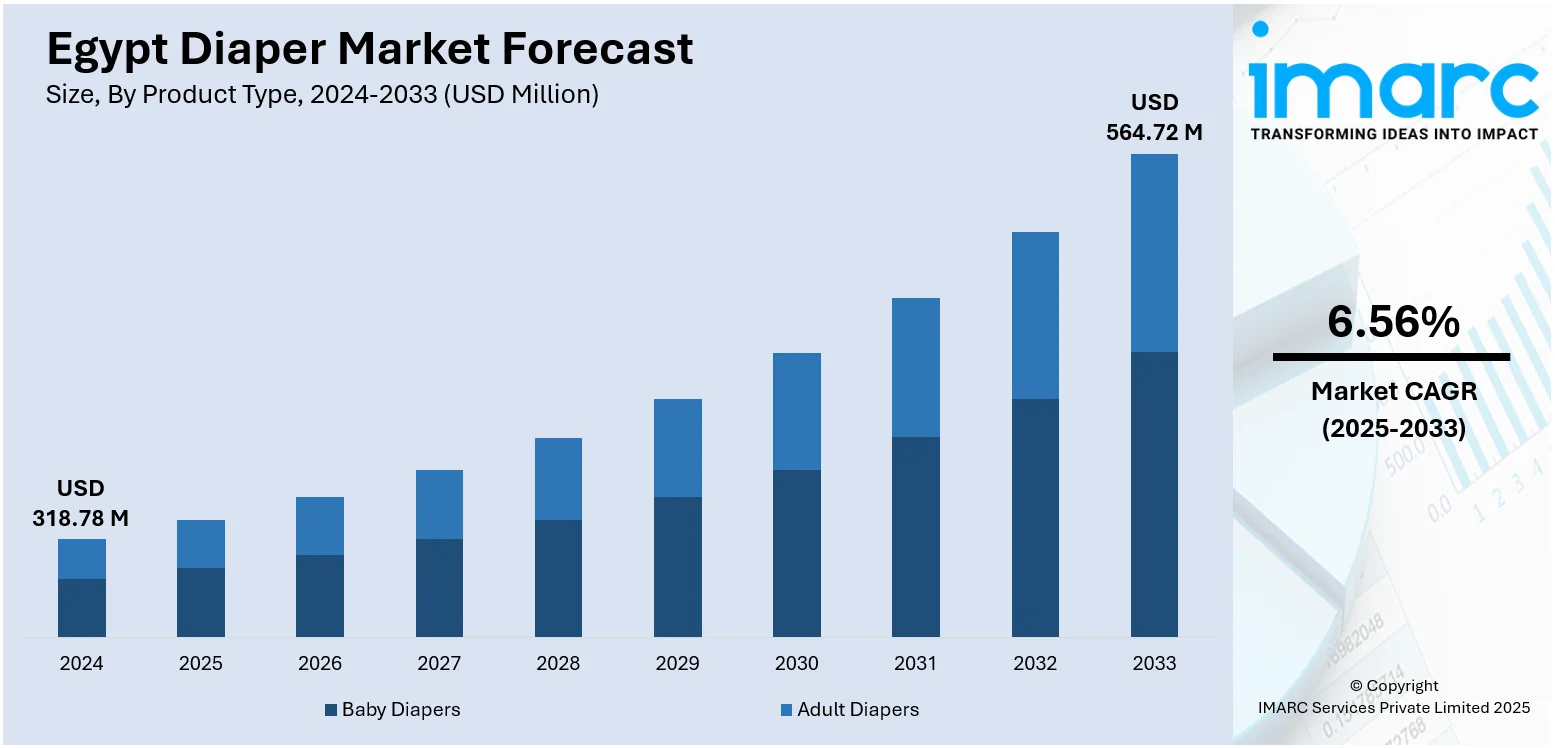

The Egypt diaper market size reached USD 318.78 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 564.72 Million by 2033, exhibiting a growth rate (CAGR) of 6.56% during 2025-2033. The market is driven by rising urbanization and improving household incomes, leading parents to prefer convenient, disposable diaper options over traditional methods. Growing knowledge of baby health and hygiene promotes demand for premium, skin-friendly, and cutting-edge goods like hypoallergenic or eco-friendly diapers. Additionally, the need for time-saving baby care solutions has increased due to the growing number of working women. Expanding e-commerce platforms also make diaper shopping more accessible, boosting online sales and broadening Egypt diaper market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 318.78 Million |

| Market Forecast in 2033 | USD 564.72 Million |

| Market Growth Rate 2025-2033 | 6.56% |

Egypt Diaper Market Trends:

Rising Incomes & Urbanization

As more Egyptians move to urban centers and family incomes rise, lifestyles are rapidly changing. Parents in urban areas are increasingly turning to modern childcare solutions, with disposable diapers becoming a key component of this shift. Urban living comes with a faster pace of life, where convenience and ease of use are valued more than ever. Disposable diapers offer the comfort of quick disposal, reducing laundry loads and saving time for busy parents. Furthermore, as consumers become more brand-conscious, the desire for trusted, high-quality diaper brands is also growing. Families are willing to invest in products that offer enhanced comfort, hygiene, and skin protection for their babies. This overall improvement in economic conditions and urban exposure is steadily driving the Egypt diaper market growth for disposable diapers across Egypt’s growing cities and towns.

To get more information on this market, Request Sample

Growth of Working Women & E-commerce Access

With more Egyptian women actively joining the workforce, the demand for practical and time-saving baby care solutions like disposable diapers has surged. Disposable diapers are favored over conventional cloth alternatives owing to the working parents, particularly moms, value items that provide convenience and lessen domestic tasks. At the same time, the rise of e-commerce platforms has simplified the shopping experience, allowing parents to purchase diapers online with ease, access promotions, and even subscribe for regular deliveries. This shift in consumer behavior aligns with the strategies of major diaper producers like Hayat Egypt, which holds about 20% of the national market as of July 2023–24. One of the major companies in the nation, Hayat Egypt, is ideally positioned to satisfy the rising demand by providing dependable, high-quality products that satisfy the demands of busy, tech-savvy, and convenience-focused Egyptian families through both online and physical retail channels.

Increased Hygiene Awareness & Product Innovation

Another notable Egypt diaper market trend is the rising educational levels of Egyptian parents. Increased exposure to media, parenting blogs, and health care tips has informed parents about the need to keep babies dry, comfortable, and irritation-free. Consequently, increased demand for diapers with increased absorbency, breathability, and skin protection is on the horizon. Brands are also innovating by incorporating organic materials, fragrance-free ranges, and environmentally friendly alternatives that are attractive to health-oriented and environmentally conscious families. Parents nowadays not only want functionality but also value-added benefits such as softness, rash prevention, and safe ingredients. This new tide of product innovation promises a greater range of options in the marketplace, responding to the changing tastes of today's Egyptian caregivers who value their child's comfort and well-being more than mere affordability.

Egypt Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diapers

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diapers

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diaper, training diaper, cloth diaper, swim pants, and biodegradable diaper) and adult diaper (pad type, flat type, and pant type).

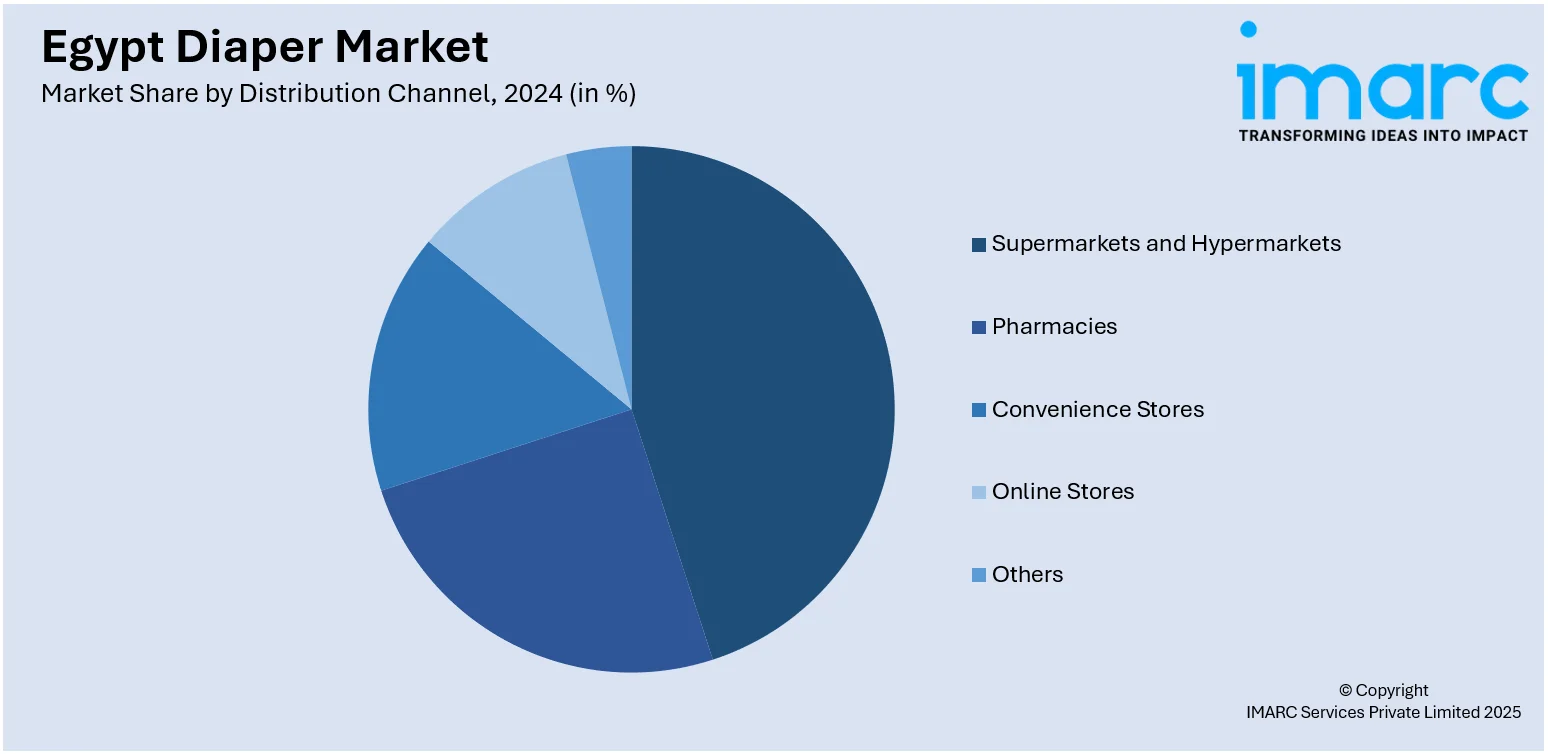

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt diaper market on the basis of product type?

- What is the breakup of the Egypt diaper market on the basis of distribution channel?

- What is the breakup of the Egypt diaper market on the basis of region?

- What are the various stages in the value chain of the Egypt diaper market?

- What are the key driving factors and challenges in the Egypt diaper market?

- What is the structure of the Egypt diaper market and who are the key players?

- What is the degree of competition in the Egypt diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)