Egypt E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2026-2034

Egypt E-Invoicing Market Summary:

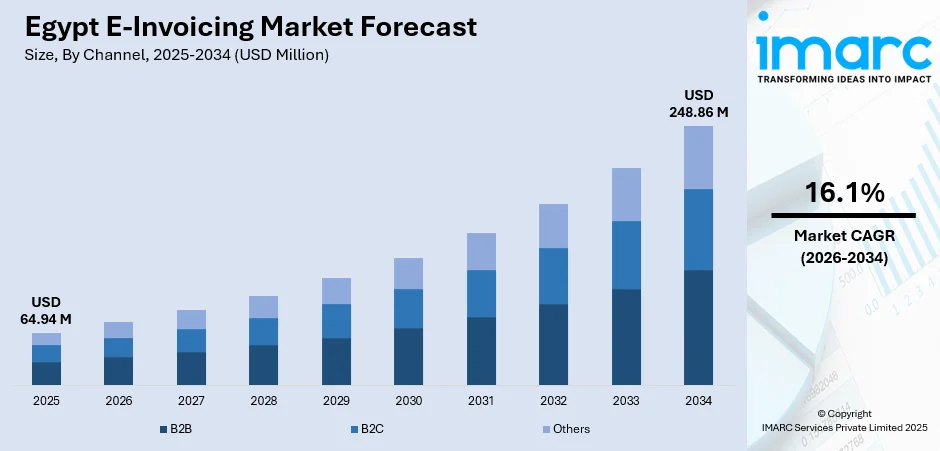

The Egypt e-invoicing market size was valued at USD 64.94 Million in 2025 and is projected to reach USD 248.86 Million by 2034, growing at a compound annual growth rate of 16.1% during 2026-2034.

The Egypt e-invoicing market is experiencing robust expansion, driven by comprehensive government mandates. The Egyptian Tax Authority's phased implementation approach has created structured compliance timelines, while Egypt Vision 2030 and the Digital Egypt initiative have established supportive policy frameworks that encourage adoption of automated financial systems. Rising cloud computing infrastructure investments and integration of artificial intelligence (AI) in invoice processing are propelling sustained demand for e-invoicing solutions.

Key Takeaways and Insights:

- By Channel: B2B dominates the market with a share of 66% in 2025, driven by mandatory e-invoicing compliance requirements for all VAT-registered companies conducting inter-business transactions, supported by the Egyptian Tax Authority's regulatory enforcement ensuring real-time invoice validation and tax transparency across commercial operations.

- By Deployment Type: Cloud-based leads the market with a share of 75% in 2025, owing to its scalability, reduced upfront infrastructure costs, seamless integration with existing enterprise resource planning systems, and enhanced accessibility for businesses managing distributed operations across multiple Egyptian governorates.

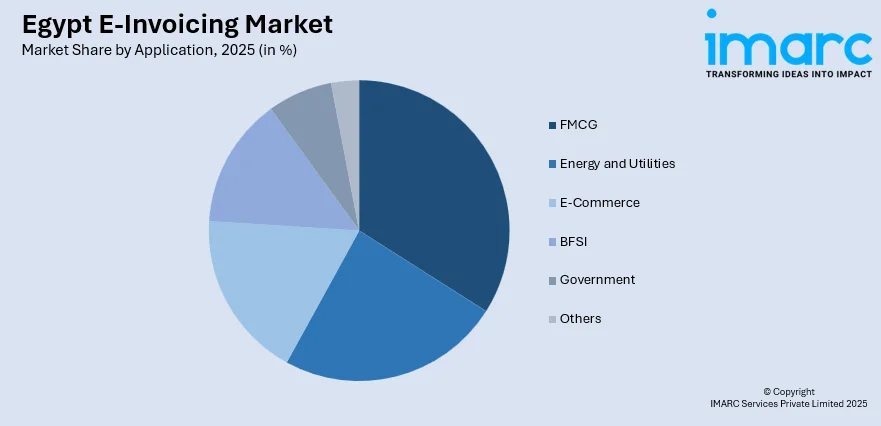

- By Application: FMCG represents the largest segment with a market share of 20% in 2025. This dominance is driven by the sector's high transaction volumes, complex supply chain networks spanning multiple distribution tiers, and strong regulatory pressure on consumer goods companies to maintain transparent financial documentation for tax compliance.

- Key Players: The Egypt e-invoicing market exhibits moderate competitive intensity, with global enterprise software providers competing alongside regional technology integrators offering localized compliance solutions tailored to Egyptian Tax Authority specifications and Arabic language requirements.

To get more information on this market Request Sample

The Egypt e-invoicing market is undergoing transformative growth as regulatory mandates converge with broader digital transformation objectives outlined in Egypt Vision 2030. Egypt launched its biggest Data and Cloud Computing Center (P1) in April 2024 on the Ain Sokhna highway, creating an innovative center for extensive data analysis and artificial intelligence in Egypt and North Africa. This infrastructure investment reflects the government's commitment to data localization and digital sovereignty, creating robust foundations for electronic transaction processing. Enterprises across sectors are increasingly recognizing e-invoicing as an operational efficiency enabler rather than merely a compliance requirement. The market benefits from Egypt's strategic position connecting Africa, Europe, and the Middle East, attracting multinational companies that require standardized digital invoicing capabilities across their regional operations.

Egypt E-Invoicing Market Trends:

Accelerated Government Mandate Expansion

The Egyptian Tax Authority continues to expand electronic invoicing requirements through successive implementation waves targeting progressively smaller enterprises. Effective from January 15, 2025, the ETA mandates that taxpayers mentioned on its official website must provide e-receipts for products and services sold to final consumers. This regulatory progression under Resolution No. 455/2024 represents the sixth sub-phase of the second stage of e-receipt system deployment, demonstrating Egypt's systematic approach to achieving comprehensive digital tax documentation across all business segments.

Cloud-Native Invoice Processing Adoption

Egyptian enterprises are increasingly migrating from on-premises invoicing systems to cloud-based platforms offering enhanced flexibility and reduced maintenance overhead. At the Huawei Cloud Summit 2024 in Cairo, Huawei revealed plans to invest USD 300 Million over five years to establish the new Egypt Region, allocating funds for more than 200 cloud services, such as AI platforms, data platforms, and development platforms. This substantial foreign investment signals growing confidence in Egypt's cloud infrastructure maturity and its capacity to support mission-critical financial applications including e-invoicing.

AI Integration in Invoice Automation

AI integration is driving the market growth by automating invoice creation, validation, and error detection, reducing manual work and improving accuracy. In September 2025, Amr Talaat, the Minister of Communications and Information Technology in Egypt, announced bold initiatives to raise the contribution of AI to the country's GDP to 7.7% by the year 2030. Intelligent systems can auto-extract data, classify transactions, and flag inconsistencies in real time. This speeds up processing, lowers compliance risks, and minimizes fraud. Businesses benefit from faster approvals and fewer disputes. AI also enables predictive analytics for cash flow forecasting and tax reporting.

Market Outlook 2026-2034:

The market growth will be underpinned by continued regulatory enforcement, expansion of digital payment infrastructure, and increasing integration of e-invoicing capabilities within enterprise resource planning systems. The market generated a revenue of USD 64.94 Million in 2025 and is projected to reach a revenue of USD 248.86 Million by 2034, growing at a compound annual growth rate of 16.1% from 2026-2034. The government's commitment to transforming Egypt into a regional digital hub, combined with private sector investments in cloud computing infrastructure, will create favorable conditions for market advancement. Small and medium enterprises (SMEs), representing the next compliance wave, will drive volume growth, as they continue to adopt standardized e-invoicing solutions to meet tax authority requirements while gaining operational efficiencies.

Egypt E-Invoicing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Channel | B2B | 66% |

| Deployment Type | Cloud-based | 75% |

| Application | FMCG | 20% |

Channel Insights:

- B2B

- B2C

- Others

B2B dominates with a market share of 66% of the total Egypt e-invoicing market in 2025.

The B2B e-invoicing segment's market leadership reflects Egypt's regulatory framework prioritizing inter-business transaction transparency as the foundation of tax compliance modernization. Starting from 1 July 2023, Egyptian taxpayers would no longer be able to use paper VAT invoices for VAT deductions due to the gradual implementation of required e-invoices and e-receipts. This policy enforcement eliminated paper-based invoice acceptance for tax deductions, compelling all businesses engaged in B2B transactions to adopt electronic invoicing systems certified by the Egyptian Tax Authority.

The segment's dominance is further reinforced by the structural characteristics of Egypt's commercial ecosystem, where formal business relationships require documented transaction records for banking, financing, and regulatory reporting purposes. Multinational corporations operating in Egypt have implemented integrated e-invoicing solutions that connect their Egyptian operations with regional headquarters, driving standardization and efficiency improvements across cross-border supply chains.

Deployment Type Insights:

- Cloud-based

- On-premises

Cloud-based leads with a share of 75% of the total Egypt e-invoicing market in 2025.

Cloud-based e-invoicing solutions have achieved market leadership by offering Egyptian enterprises cost-effective compliance pathways that eliminate substantial upfront infrastructure investments. In April 2025, Egypt's Suez Canal Economic Zone initiated digital one-stop-shop services for investors, created in collaboration with the European Bank for Reconstruction and Development and Egypt's Ministry of International Cooperation, aiming to digitize and simplify 80 essential services in the next two years. This government-led digitalization initiative exemplifies the broader shift towards cloud-based service delivery models that enable rapid deployment and scalable operations.

The deployment model's popularity among Egyptian businesses reflects practical considerations, including reduced IT maintenance requirements, automatic software updates ensuring ongoing regulatory compliance, and enhanced disaster recovery capabilities. The concentration of cloud infrastructure in major urban centers ensures reliable connectivity for cloud-based e-invoicing users while enabling service providers to offer localized support and Arabic language interfaces tailored to Egyptian business requirements.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

FMCG exhibit a clear dominance with a 20% share of the total Egypt e-invoicing market in 2025.

The FMCG sector's e-invoicing leadership stems from its inherently high transaction volumes and complex distribution networks spanning manufacturers, wholesalers, distributors, and retail outlets across Egyptian governorates. As per industry reports, Morocco and Egypt had the highest levels of traditional trade, at 79% and 73%, respectively, which provide a strong foundation for eB2B expansion as more small retailers are embracing digital tools. This extensive traditional trade network generates substantial invoicing requirements that electronic systems can address more efficiently than manual processing methods.

FMCG companies face particular pressure to maintain transparent supply chain documentation due to value-added tax implications across multiple distribution tiers and the sector's susceptibility to informal trade practices. Leading FMCG enterprises are leveraging e-invoicing implementations as platforms for broader digital transformation initiatives, integrating electronic invoice data with inventory management, demand forecasting, and financial planning systems to achieve comprehensive operational visibility.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Greater Cairo holds prominence due to high business concentration and strong digital infrastructure. Corporate headquarters, financial institutions, and service companies here adopt e-invoicing early to improve compliance, automation, and reporting efficiency.

Alexandria’s growing commercial and industrial base is driving the demand for digital invoicing. Port-related businesses, manufacturers, and traders adopt e-invoicing to streamline billing processes, improve record accuracy, and support faster transaction cycles.

The Suez Canal region relies on e-invoicing for logistics, shipping, and export operations. High transaction volumes encourage digital documentation to improve transparency, track shipments, and maintain regulatory compliance efficiently.

The Delta region is adopting e-invoicing through agricultural, wholesale, and small manufacturing businesses. Digital invoicing improves financial visibility, reduces paperwork, and supports tax reporting for growing local enterprises.

Market Dynamics:

Growth Drivers:

Why is the Egypt E-Invoicing Market Growing?

Expansion of E-Commerce Portals

The rapid growth of e-commerce channels is significantly fueling the market expansion by increasing the volume of digital transactions across retail and B2B trade. As per IMARC Group, the Egypt e-commerce market size reached USD 93.7 Million in 2024.Online platforms require fast, accurate, and automated invoice generation to manage high order volumes and reduce manual errors. E-invoicing improves transaction tracking, return handling, and compliance with tax requirements. As online sellers expand, they prefer integrated invoicing systems that connect payments, orders, and inventory in real time. Digital invoices also improve customer experience through instant billing and transparency. Logistics companies benefit from faster documentation, reducing delays in shipping and delivery verification. With mobile commerce and online marketplaces expanding nationwide, businesses are adopting e-invoicing to handle scale efficiently. This rising dependence on digital sales channels makes e-invoicing a core operational necessity rather than just a compliance tool.

National Digital Transformation Initiatives

Government-led digital transformation initiatives, combined with rising internet penetration, are accelerating the adoption of e-invoicing in Egypt by promoting paperless operations and financial transparency. The count of internet users rose significantly to 96.3 Million in January 2025, an increase from 82.01 Million in 2024, boosting the internet penetration rate from 72.2% to 81.9%. Public programs encourage businesses to modernize accounting systems and adopt standardized digital procedures. Integration of e-invoicing with tax platforms simplifies reporting and improves audit efficiency. Digital identity systems, cashless payment programs, and cloud services make adoption easier for businesses of all sizes. Government awareness campaigns also highlight benefits, such as cost savings and efficiency gains. As more public services are moving online, private companies are following suit to remain compliant and competitive. These initiatives reduce administrative burden and strengthen trust in digital systems. By aligning technology with regulation, national digitization efforts are making e-invoicing central to Egypt’s evolving business environment.

Cloud Computing Infrastructure Expansion

Substantial investments in cloud computing infrastructure by both government entities and private sector technology providers are enabling scalable e-invoicing service delivery models accessible to enterprises of all sizes. The Egypt data center market size was valued at USD 223.2 Million in 2024 and is expected to reach USD 484.78 Million by 2033, exhibiting a CAGR of 8.26%. This infrastructure expansion addresses previous concerns regarding data sovereignty and service reliability that had inhibited cloud-based e-invoicing adoption. The availability of local cloud hosting options enables enterprises to meet data residency regulations while taking advantage of the scalability, flexibility, and cost advantages inherent in cloud-based service delivery models that reduce barriers for SME adoption.

Market Restraints:

What Challenges is the Egypt E-Invoicing Market Facing?

Limited SME Awareness and Technical Capacity

Many SMEs lack understanding of system benefits, legal requirements, and implementation processes, creating resistance to change. Technical skill gaps make integration with accounting software difficult, increasing reliance on external consultants and raising costs. Smaller firms may also lack IT infrastructure and cybersecurity readiness, causing hesitation.

Infrastructure Gaps in Peripheral Regions

Internet connectivity limitations and unreliable electricity supply in certain Egyptian governorates create practical barriers to e-invoicing implementation for enterprises operating outside major urban centers. These infrastructure challenges particularly affect agricultural and manufacturing operations in Delta and Upper Egypt regions where traditional trade practices remain prevalent, requiring investments in connectivity expansion and offline-capable solution architectures.

Technical Integration Complexity

Integrating e-invoicing capabilities with legacy enterprise resource planning systems and accounting software presents substantial technical challenges for Egyptian enterprises, particularly those utilizing older or customized business applications. The requirement for digital signatures, unique invoice identifiers, and real-time submission to Egyptian Tax Authority platforms demands specialized technical expertise that may be scarce or expensive, particularly for mid-sized enterprises seeking compliance without major system overhauls.

Competitive Landscape:

The Egypt e-invoicing market features a diverse competitive environment, comprising global enterprise software providers, regional technology integrators, and specialized compliance solution developers. Market participants differentiate through technical capabilities, local support infrastructure, integration flexibility, and pricing models adapted to varying enterprise sizes. Global software companies leverage established enterprise relationships to cross-sell e-invoicing modules as extensions to existing enterprise resource planning (ERP) implementations, while regional providers compete through localized service delivery, Arabic language interfaces, and deep understanding of Egyptian Tax Authority requirements. The market increasingly rewards providers capable of offering comprehensive solutions encompassing invoice generation, digital signature management, archiving compliance, and analytics capabilities within unified platforms.

Recent Developments:

- In January 2025, the Egyptian Tax Authority revealed the sixth wave of taxpayers required to generate e-receipts for B2C transactions as per Resolution No. 455/2024, starting January 15, 2025. This expansion signified ongoing advancement towards complete electronic receipt availability in consumer-oriented businesses.

Egypt E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Egypt e-invoicing market size was valued at USD 64.94 Million in 2025.

The Egypt e-invoicing market is expected to grow at a compound annual growth rate of 16.1% from 2026-2034 to reach USD 248.86 Million by 2034.

B2B dominates the market with 66% share, driven by expanding commercial ecosystem and mandatory e-invoicing compliance requirements for all VAT-registered companies conducting inter-business transactions.

Key factors driving the Egypt e-invoicing market include comprehensive regulatory mandates from the Egyptian Tax Authority, national digital transformation initiatives under Egypt Vision 2030, expanding cloud computing infrastructure, and increasing enterprise awareness of operational efficiency benefits.

Major challenges include limited SME awareness and technical capacity, infrastructure gaps in peripheral regions affecting connectivity reliability, technical integration complexity with legacy systems, cost concerns among smaller enterprises, and the need for sustained technical support and training resources.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)