Egypt EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

Egypt EdTech Market Overview:

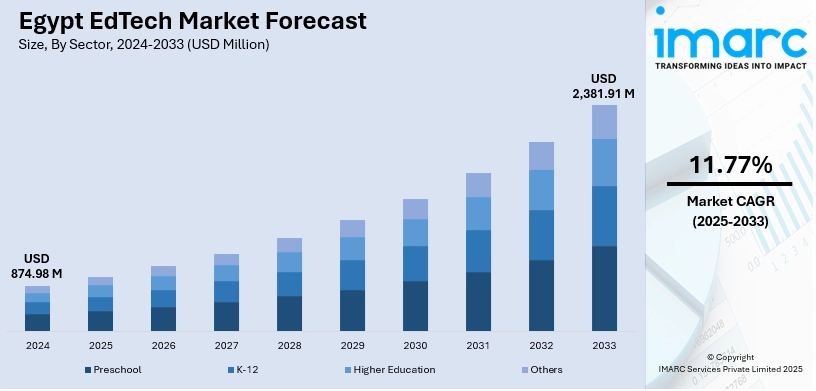

The Egypt EdTech market size reached USD 874.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,381.91 Million by 2033, exhibiting a growth rate (CAGR) of 11.77% during 2025-2033. Population growth, government investment in digital education, rising smartphone use, poor teacher-student ratios, demand for affordable private tutoring, and expanding internet access are some of the factors contributing to Egypt EdTech market share. Local platforms, foreign partnerships, and AI integration in K–12 and higher education also support rapid development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 874.98 Million |

| Market Forecast in 2033 | USD 2,381.91 Million |

| Market Growth Rate 2025-2033 | 11.77% |

Egypt EdTech Market Trends:

Focus on Mental Health and Character Development in Youth Learning

In Egypt, there’s growing attention on educational tools that support children’s emotional and personal development. Programs that combine mental health guidance with learning are gaining traction, especially among younger age groups. These approaches go beyond test scores, centering on psychological resilience, empathy, and self-awareness. More partnerships are forming between educational platforms and schools to deliver such support in classrooms, starting as early as age three. Private investors from the Gulf are backing these ideas, seeing long-term value in shaping balanced, mentally healthy individuals through early intervention. This shift reflects changing priorities in education, where well-being and personal growth are increasingly viewed as essential components of a child’s learning experience. These factors are intensifying the Egypt EdTech market growth. For example, in September 2024 , Egyptian EdTech startup Farid secured USD 250,000 in pre-seed funding from Saudi investor Amal bint Abdulaziz Al-Ajlan. Founded in 2024 by Mahmoud Hussein, Farid partners with schools across Egypt and focuses on character education and mental health support for children aged 3–18. The startup applies modern methods to boost personal and psychological growth, aiming to improve youth well-being through innovative educational programs.

To get more information on this market, Request Sample

Major Acquisition Highlighting Growing Role in Regional Learning Platforms

In Egypt, there’s growing attention on educational tools that support children’s emotional and personal development. Programs that combine mental health guidance with learning are gaining traction, especially among younger age groups. These approaches go beyond test scores, centering on psychological resilience, empathy, and self-awareness. More partnerships are forming between educational platforms and schools to deliver such support in classrooms, starting as early as age three. Private investors from the Gulf are backing these ideas, seeing long-term value in shaping balanced, mentally healthy individuals through early intervention. This shift reflects changing priorities in education, where well-being and personal growth are increasingly viewed as essential components of a child’s learning experience. For instance, in January 2024, Egyptian EdTech company Orcas Tutoring was fully acquired by Baims, a Middle Eastern platform, marking a major exit in Egypt’s startup space. The deal accompanied a USD 11 Million funding round involving investors like Algebra Ventures and Access Bridge Ventures. Orcas’ integration strengthens Baims’ tutoring capabilities, while the launch of a new AI-based test prep tool aims to expand reach across the GCC, spotlighting Egypt’s growing role in regional EdTech.

Egypt EdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

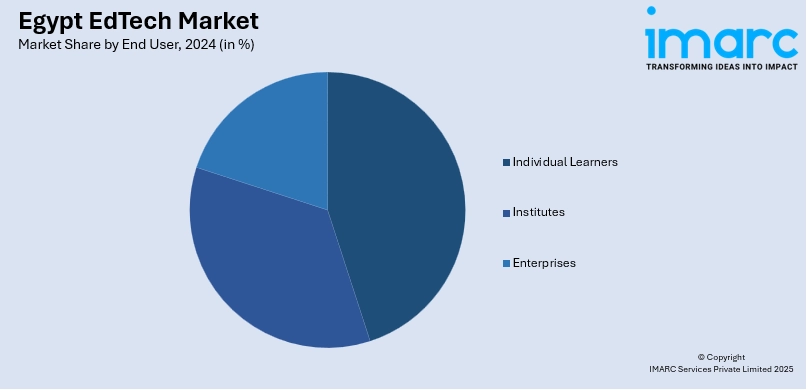

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt EdTech Market News:

- In February 2025 , EdVentures and the Mastercard Foundation accelerated Egypt’s EdTech sector through their joint Fellowship program. Ten months in, participating startups have grown their reach by 147,200 learners, marking a 30% rise. The initiative focuses on scaling educational technology and supporting startup innovation, aiming to expand digital access to quality education across the country through targeted entrepreneurship development and practical implementation support.

Egypt EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt EdTech market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt EdTech market on the basis of sector?

- What is the breakup of the Egypt EdTech market on the basis of type?

- What is the breakup of the Egypt EdTech market on the basis of deployment mode?

- What is the breakup of the Egypt EdTech market on the basis of end user?

- What is the breakup of the Egypt EdTech market on the basis of region?

- What are the various stages in the value chain of the Egypt EdTech market?

- What are the key driving factors and challenges in the Egypt EdTech market?

- What is the structure of the Egypt EdTech market and who are the key players?

- What is the degree of competition in the Egypt EdTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt EdTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt EdTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt EdTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)