Egypt Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033

Egypt Footwear Market Overview:

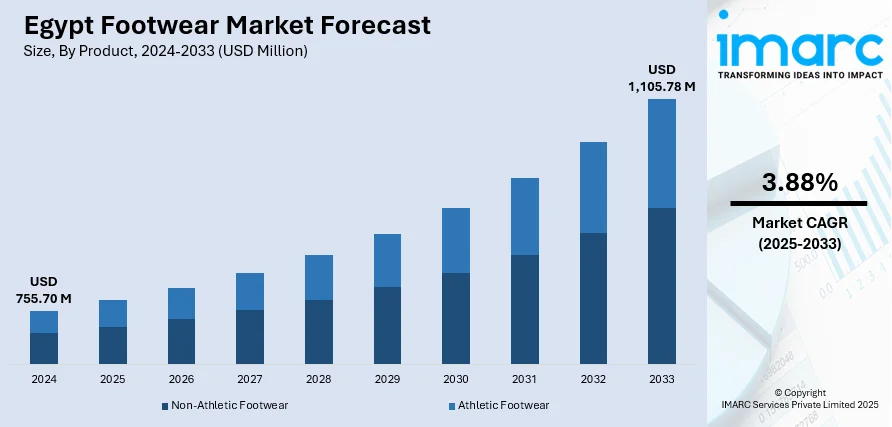

The Egypt footwear market size reached USD 755.70 Million in 2024. The market is projected to reach USD 1,105.78 Million by 2033, exhibiting a growth rate (CAGR) of 3.88% during 2025-2033. The market is experiencing consistent growth driven by urbanization growth, rising consumer expenditure, and changing fashion trends. Growth in production capacity and the evolution of varied distribution channels, such as the internet, are improving product availability and accessibility. Furthermore, increased demand for low-cost and high-quality footwear is propelling the diversification of the market. These combined factors project a promising future for the industry, further consolidating the country’s strategic role in the footwear industry and further expanding the Egypt footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 755.70 Million |

| Market Forecast in 2033 | USD 1,105.78 Million |

| Market Growth Rate 2025-2033 | 3.88% |

Egypt Footwear Market Trends:

Sustainable Footwear Materials Gain Traction

As consumer demand intensifies for environmentally friendly products, Egyptian manufacturers are adopting greener processes, including water-efficient dyeing techniques and waste-reducing manufacturing systems. These approaches help reduce the environmental impact while maintaining the durability and quality expected by modern consumers. Additionally, the government’s support for sustainability in manufacturing through tax incentives and green certifications encourages more businesses to follow suit. Efforts to reduce carbon footprints have led some factories to install solar-powered energy systems, further solidifying Egypt’s commitment to sustainable industrial practices. In June 2024, the UNIDO‑supported Green Innovation & Circularity Expo in Luxor showcased over 90 MSMEs from across Upper Egypt presenting climate‑friendly leather, footwear and bio‑based solutions, marking a growing ecosystem around circular‑economy manufacturing in the country. As awareness grows, many domestic consumers and international buyers now prefer shoes made from biodegradable or ethically sourced materials. This strategic realignment is driving new business opportunities and export potential, further supporting growth. The industry’s response to environmental concerns is setting new benchmarks, showcasing one of the defining features of Egypt footwear market trends.

To get more information on this market, Request Sample

E-Commerce Expansion Drives Market Reach

Footwear brands are rapidly adapting by launching mobile-first websites, AI-driven size recommendation tools, and personalized user interfaces that streamline the shopping experience. Payment platforms supporting local currencies and digital wallets are also improving checkout accessibility. Notably, platforms integrating augmented reality (AR) are enabling virtual try-ons, enhancing online customer satisfaction. Meanwhile, delivery ecosystems are evolving with real-time order tracking and same-day shipping capabilities in major cities like Cairo and Alexandria. E-commerce is helping retailers reach underserved regions, significantly improving inclusivity and market penetration. By reducing overhead costs compared to physical stores, online retail is unlocking scalability for small and medium enterprises. This digital acceleration highlights a key aspect of market, offering enhanced consumer access and contributing directly to Egypt footwear market growth through innovation-led retail strategies.

Technological Advancements Enhance Manufacturing Efficiency

These tools help companies reduce production time and material waste, making operations more sustainable. Automation in stitching, cutting, and sole attachment has increased output consistency and enabled mass customization, allowing producers to meet niche market demands. Furthermore, cloud-based inventory systems and IoT-connected machinery are streamlining supply chain coordination and quality control. In May 2024, the Egyptian startup Garment IO deployed its smart terminal and cloud analytics across several garment factories in Cairo and Alexandria, helping managers spot bottlenecks in real time and boost productivity—illustrating the powerful impact of IoT-based digitalization. Such enhancements are not only improving efficiency but also helping Egyptian manufacturers remain competitive in global markets. Educational institutions are also offering technical training programs in digital manufacturing, ensuring a future-ready workforce. These comprehensive improvements reflect an industry moving confidently toward innovation-led growth. As advanced tools redefine production standards, they signal a key development supporting footwear market and building momentum behind the market through smarter, faster, and more agile manufacturing processes.

Egypt Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end-user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others.

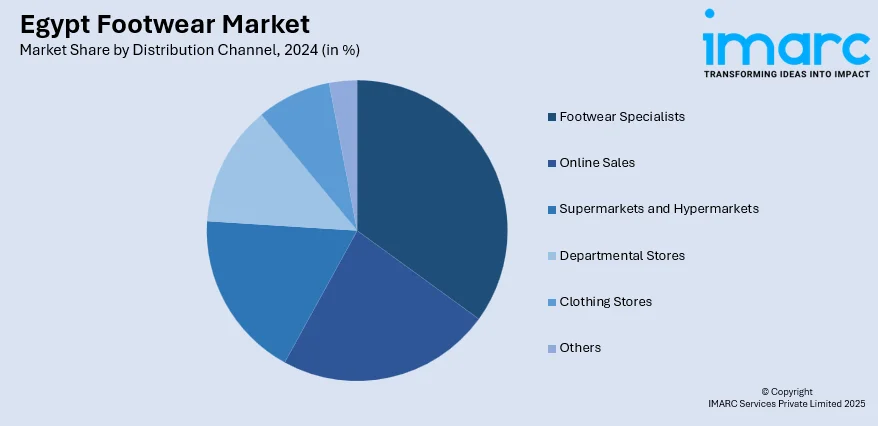

Distribution Channel Insights:

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, online sales, supermarkets and hypermarkets, departmental stores, clothing stores, and others.

Pricing Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes premium and mass.

End-User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes men, women, and kids.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Footwear Market News:

- March 2025: Turkish company Bonysocks announced a $50 million investment to establish a state-of-the-art sock manufacturing facility in Egypt. Supported by government incentives, the project aims to cater to major export markets, including global retailers like H&M and LC Waikiki. The factory will also adopt green energy practices, aligning with sustainable manufacturing goals. This initiative highlights Egypt’s growing appeal as a textile and apparel hub, while promoting eco-friendly production and boosting the country’s export potential in the global market.

Egypt Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End-Users Covered | Men, Women, Kids |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt footwear market on the basis of product?

- What is the breakup of the Egypt footwear market on the basis of material?

- What is the breakup of the Egypt footwear market on the basis of distribution channel?

- What is the breakup of the Egypt footwear market on the basis of pricing?

- What is the breakup of the Egypt footwear market on the basis of end-user?

- What is the breakup of the Egypt footwear market on the basis of region?

- What are the various stages in the value chain of the Egypt footwear market?

- What are the key driving factors and challenges in the Egypt footwear?

- What is the structure of the Egypt footwear market and who are the key players?

- What is the degree of competition in the Egypt footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)