Egypt Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

Egypt Gaming Market Overview:

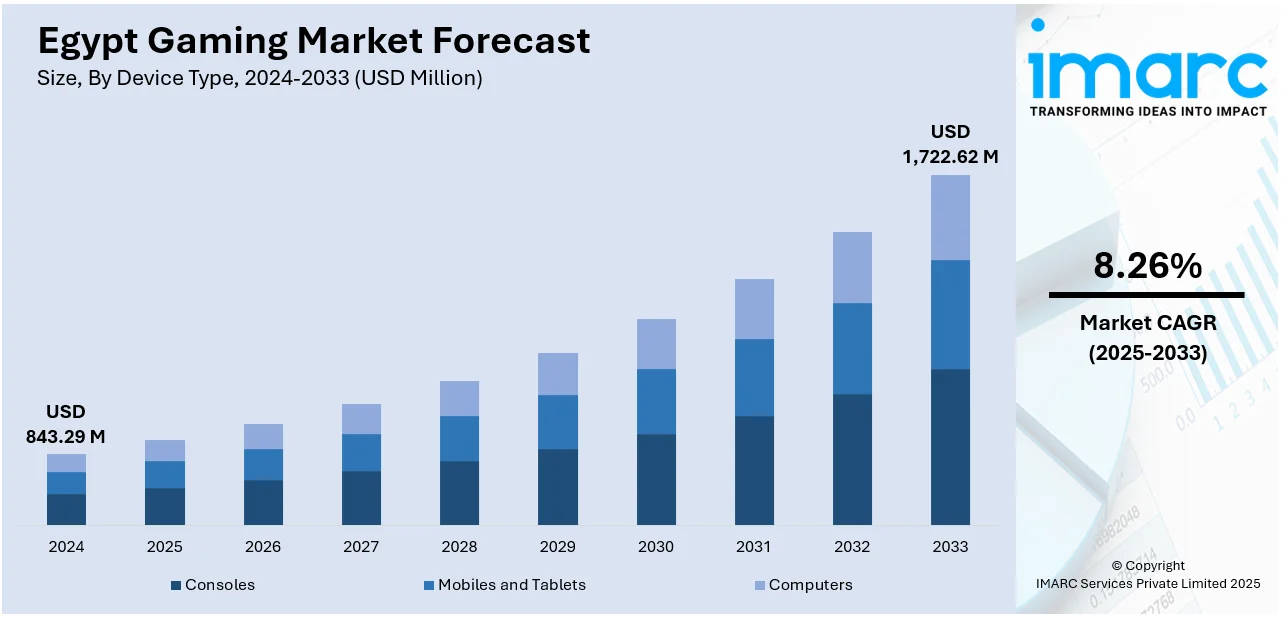

The Egypt gaming market size reached USD 843.29 Million in 2024. Looking forward, the market is projected to reach USD 1,722.62 Million by 2033, exhibiting a growth rate (CAGR) of 8.26% during 2025-2033. The market is driven by Egypt’s young population, expanding internet access, and growing digital literacy supporting increased gaming participation. Development of local studios and culturally relevant Arabic-language content is strengthening regional engagement. Additionally, the emergence of esports infrastructure and increasing sponsorship opportunities are further augmenting the Egypt gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 843.29 Million |

| Market Forecast in 2033 | USD 1,722.62 Million |

| Market Growth Rate 2025-2033 | 8.26% |

Egypt Gaming Market Trends:

Rising Youth Population and Growing Digital Engagement

Egypt’s large and youthful population forms the foundation for the country’s expanding gaming industry. With over half the population under the age of 30, there is strong demand for digital entertainment platforms, including online and mobile games. Egypt’s gaming market is projected to generate USD 2.13 Billion in revenue in 2025, with an expected annual growth rate (CAGR 2025–2030) of 8.04%, reaching USD 3.14 Billion by 2030. By 2030, Egypt is anticipated to have 28.9 million users, with user penetration rising from 20.2% in 2025 to 23.1%, supported by an average revenue per user (ARPU) of USD 852.44. This can be attributed to the increased smartphone penetration and affordable internet access, that have accelerated gaming adoption across urban and rural regions alike. Social gaming and multiplayer platforms are particularly popular, fostering community-driven engagement through competitive play and shared online spaces. Additionally, Egypt’s digital literacy programs and education initiatives have improved technology access for younger demographics. Social media influencers and local streamers play a vital role in promoting new games, often driving viral adoption through platforms such as YouTube and TikTok. Government investment in ICT infrastructure further complements these trends by strengthening broadband coverage and data speeds. Cairo and Alexandria are emerging as focal points for technology entrepreneurship, attracting local developers aiming to serve Arabic-speaking gamers. This convergence of demographic advantage, digital connectivity, and cultural engagement is fueling Egypt gaming market growth, positioning the country as a rising force in the regional interactive entertainment landscape.

To get more information on this market, Request Sample

E-Sports Momentum and Competitive Gaming Opportunities

Egypt’s esports sector is experiencing rapid development, driven by growing interest among youth and increasing support from private sector sponsors. Titles such as PUBG Mobile, FIFA, and League of Legends dominate local tournaments, both at amateur and semi-professional levels. Dedicated esports venues in Cairo are emerging, complemented by gaming cafes and internet hubs that serve as informal training grounds for competitive players. Sponsorship deals with telecommunications providers, electronics brands, and financial services companies are raising prize pools and professionalizing tournament structures. Additionally, Egyptian esports players and teams have gained recognition in regional competitions, enhancing the country’s profile on the broader MENA esports stage. This rise in esports participation aligns with broader growth across Egypt’s digital gaming sector, particularly in mobile and download gaming segments. Egypt’s gaming industry generated USD 738.4 Million from mobile games in 2024, positioning mobile as the country’s leading gaming segment. Download games followed with USD 183.1 Million in revenue, reflecting growing demand for digital downloads in the Egyptian gaming ecosystem. This can be attributed to the expanding digital entertainment landscape that is actively supporting the esports ecosystem by increasing player bases, commercial interest, and mainstream cultural relevance. Educational initiatives are emerging to integrate esports management and broadcasting into academic curricula, fostering future professional opportunities beyond playing. The government has also expressed interest in formalizing esports regulations and event hosting standards, encouraging foreign investment in the sector. Media partnerships with regional broadcasters are helping bring competitive gaming content to mainstream audiences. As Egypt’s esports infrastructure continues to evolve, it is positioning the country as a potential leader in the Arabic-speaking competitive gaming market.

Egypt Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

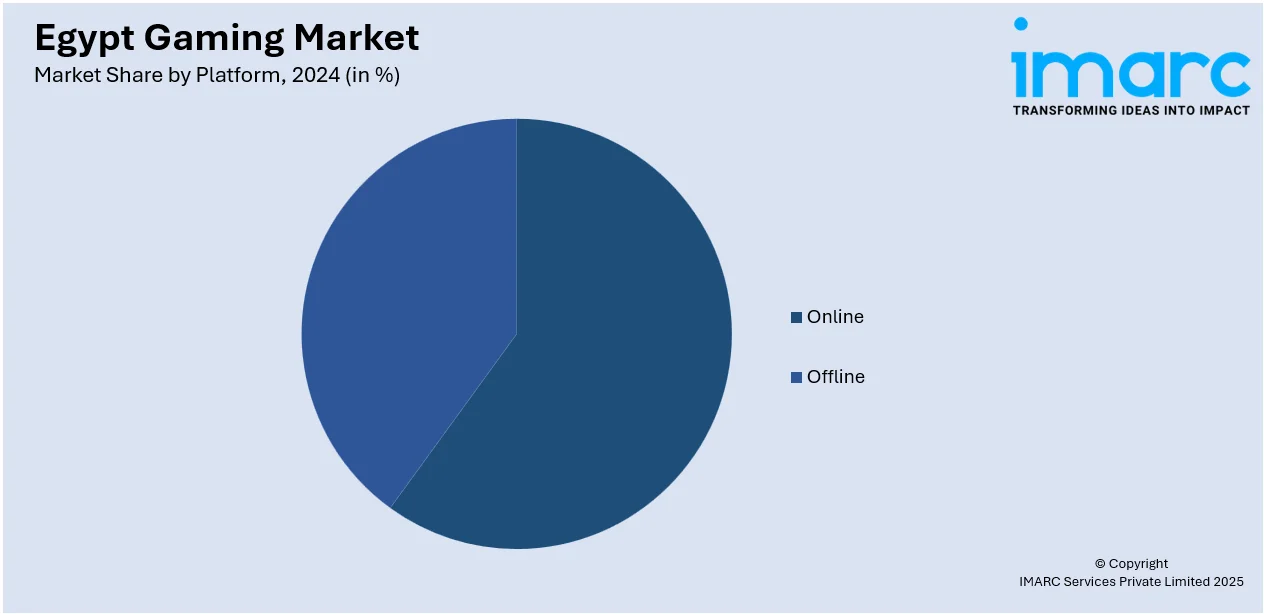

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Gaming Market News:

- On January 29, 2025, Vodafone Egypt announced an exclusive partnership with Yango Play, an all-in-one entertainment super app offering movies, music, series, and interactive games to users across Egypt and the MENA region. This collaboration will provide Vodafone Egypt customers with privileged access to Yango Play’s vast library of Arabic and international content, including exclusive releases and gaming services.

- On December 16, 2024, GAMERGY Egypt hosted a press conference unveiling details of its inaugural edition, scheduled from January 30 to February 1, 2025, at Alburouj New Heliopolis, under the auspices of Egypt’s Ministry of Youth and Sports and the Egyptian Esports Federation. The event will feature six gaming zones, international teams, cosplay competitions, and over EGP 2 Million (approximately USD 64,800) in cash prizes, establishing Egypt as a regional esports hub.

Egypt Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt gaming market on the basis of device type?

- What is the breakup of the Egypt gaming market on the basis of platform?

- What is the breakup of the Egypt gaming market on the basis of revenue type?

- What is the breakup of the Egypt gaming market on the basis of type?

- What is the breakup of the Egypt gaming market on the basis of age group?

- What is the breakup of the Egypt gaming market on the basis of region?

- What are the various stages in the value chain of the Egypt gaming market?

- What are the key driving factors and challenges in the Egypt gaming market?

- What is the structure of the Egypt gaming market and who are the key players?

- What is the degree of competition in the Egypt gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)