Egypt Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Structure, Fuel Type, Application, Distribution Channel, and Region, 2025-2033

Egypt Kitchen Appliances Market Overview:

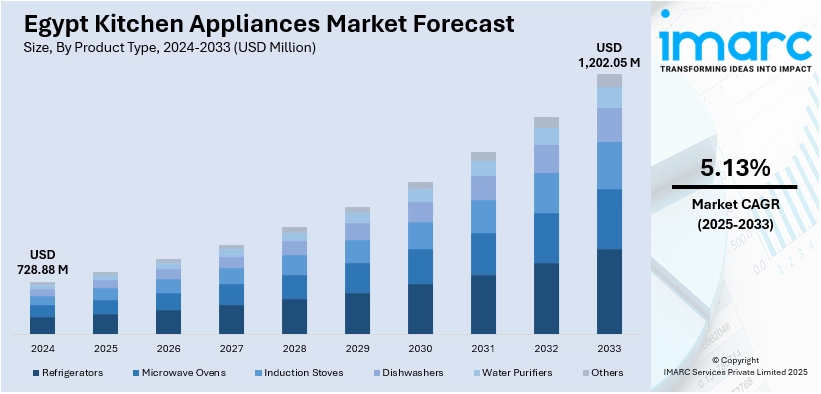

The Egypt kitchen appliances market size reached USD 728.88 Million in 2024. Looking forward, the market is expected to reach USD 1,202.05 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The market is witnessing steady growth, driven by urbanization, changing lifestyles, and increasing demand for modern, energy-efficient appliances. Rising consumer preference for smart and multifunctional devices, coupled with growing middle-class income, is shaping product adoption. The shift toward online retail also supports expansion in the Egypt kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 728.88 Million |

| Market Forecast in 2033 | USD 1,202.05 Million |

| Market Growth Rate 2025-2033 | 5.13% |

Egypt Kitchen Appliances Market Trends:

Growth in Local Production and Brand Expansion

Egyptian manufacturers are ramping up domestic production of kitchen appliances, supported by favorable industrial policies and reduced import dependencies. Local brands are investing in manufacturing facilities, creating employment, and improving after-sales service, which resonates well with nationalistic consumer preferences. This shift enables faster product rollouts, affordable pricing, and easier adaptation to local needs, such as voltage stabilizers and dust-resistant designs suited to Egypt’s infrastructure and climate. Furthermore, collaborations between local OEMs and international brands bring global quality standards with localized features. This rising presence of domestic players has intensified competition, pushed innovation, and increased product availability across both urban and regional areas. As consumers seek affordability without compromising quality, local manufacturing is becoming a cornerstone of Egypt kitchen appliances market growth.

To get more information on this market, Request Sample

Expansion of Hospitality and Foodservice Sectors

Egypt’s expanding tourism industry and growing prominence of cafés, restaurants, and food delivery services are fueling demand for commercial-grade kitchen appliances. Hotels, resorts, and fast-casual establishments require heavy-duty equipment like industrial mixers, ovens, hoods, and dishwashers. The revival of travel post-pandemic has further accelerated upgrades and new installations. These commercial purchases generate spillover benefits into residential markets, as consumers often seek restaurant-inspired gadgets. Urban renovation and upscale dining trends support a steady flow of orders to local distributors and retailers. Additionally, foodservice investments bring training programs and service infrastructure that elevate consumer expectations, driving demand for premium kitchen appliances at home. This hospitality-driven ripple effect remains a key market driver in Egypt.

Financing Options and Credit Accessibility

The rising availability of consumer financing programs is making premium kitchen appliances more affordable in Egypt. Several banks and retailers now offer interest-free installments spanning multiple months, making features like built-in ovens, induction cooktops, and smart refrigerators more accessible to middle-income households. This shift enables buyers to manage cash flow while upgrading homes without lump-sum expenses. Moreover, credit schemes tied to e-commerce platforms and digital wallets simplify purchasing processes. Bundled offers with warranties and maintenance services further enhance perceived value. These financing tools reduce cost barriers and encourage consumers to consider higher-tier or larger appliances they previously overlooked. As credit models become more widespread, they play an increasingly influential role in driving market growth.

Egypt Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, structure, fuel type, application, and distribution channel.

Product Type Insights:

- Refrigerators

- Microwave Ovens

- Induction Stoves

- Dishwashers

- Water Purifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes refrigerators, microwave ovens, induction stoves, dishwashers, water purifiers, and others.

Structure Insights:

- Built-In

- Free Stand

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes built-in and free stand.

Fuel Type Insights:

- Cooking Gas

- Electricity

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes cooking gas, electricity, and others.

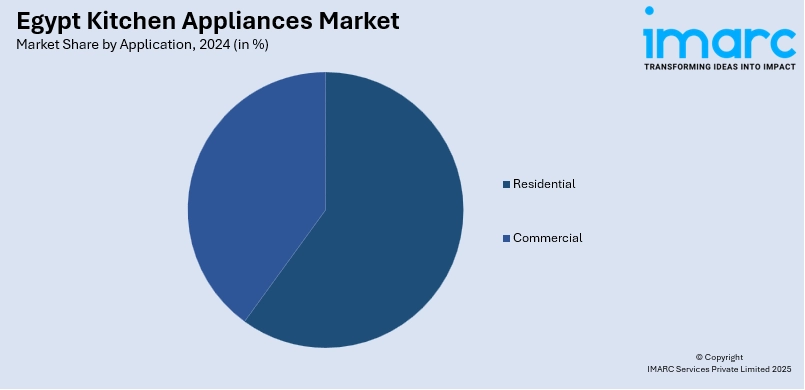

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, departmental stores, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Kitchen Appliances Market News:

- In September 2024, LG Egypt introduced its Built-In kitchen range to the Egyptian market for the first time, marking a significant milestone in its product lineup. These newly launched appliances, including the Built-In Oven, Cooktop, and Hood, boast contemporary aesthetics and cutting-edge technology designed to elevate everyday living. The sleek designs are complemented by innovative features that reflect LG’s global philosophy, “Life’s Good,” by enhancing convenience, functionality, and comfort within the modern home. This launch aligns with the company’s continued commitment to delivering state-of-the-art home appliance solutions tailored to the evolving needs of Egyptian consumers. Through this new offering, LG aims to set a new standard in kitchen innovation and lifestyle improvement in the region.

Egypt Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Refrigerators, Microwave Ovens, Induction Stoves, Dishwashers, Water Purifiers, Others |

| Structures Covered | Built-In, Free Stand |

| Fuel Types Covered | Cooking Gas, Electricity, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Departmental Stores, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt kitchen appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt kitchen appliances market on the basis of product type?

- What is the breakup of the Egypt kitchen appliances market on the basis of structure?

- What is the breakup of the Egypt kitchen appliances market on the basis of fuel type?

- What is the breakup of the Egypt kitchen appliances market on the basis of application?

- What is the breakup of the Egypt kitchen appliances market on the basis of distribution channel?

- What is the breakup of the Egypt kitchen appliances market on the basis of region?

- What are the various stages in the value chain of the Egypt kitchen appliances market?

- What are the key driving factors and challenges in the Egypt kitchen appliances market?

- What is the structure of the Egypt kitchen appliances market and who are the key players?

- What is the degree of competition in the Egypt kitchen appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)