Egypt Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Egypt Logistics Market Overview:

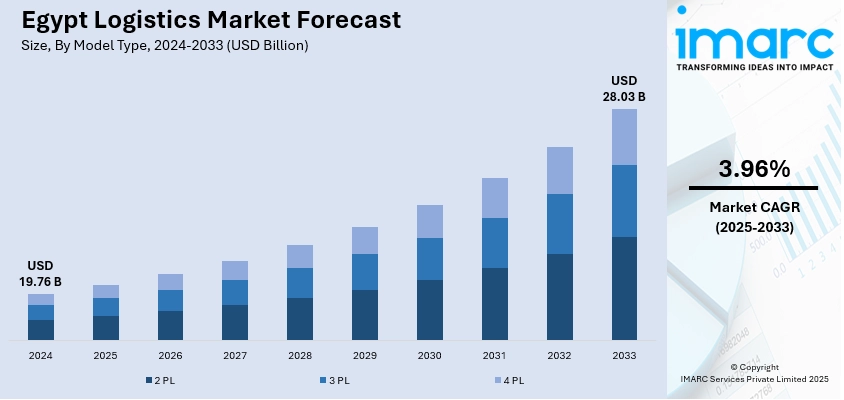

The Egypt logistics market size reached USD 19.76 Billion in 2024. The market is projected to reach USD 28.03 Billion by 2033, exhibiting a growth rate (CAGR) of 3.96% during 2025-2033. At present, the government is prioritizing the construction of new roads, the expansion of highways, and the enhancement of rail networks to boost transportation effectiveness. Besides this, retailers are collaborating with shipping firms to guarantee customer satisfaction and seamless delivery experiences. This is fueling the Egypt logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.76 Billion |

| Market Forecast in 2033 | USD 28.03 Billion |

| Market Growth Rate 2025-2033 | 3.96% |

Egypt Logistics Market Trends:

Rising infrastructure investments

Increasing infrastructure investments are positively influencing the market in Egypt. The government is focusing on building new roads, expanding highways, and upgrading rail networks to improve transportation efficiency. These projects reduce delays, lower fuel costs, and help goods move faster across the country. Airport expansions are also supporting quicker air cargo handling. Industrial zones and logistics parks are being developed to support warehousing services. These areas continue to attract both local and foreign companies looking to grow in Egypt. Improved infrastructure is encouraging businesses to wager on supply chain operations, driving the demand for logistics services. Better connectivity between production sites, ports, and user markets makes the logistics process smoother and more cost-effective. Apart from this, infrastructure development is creating jobs and helping logistics companies broaden fleets, technology, and service offerings. Overall, consistent expenditure on construction projects is strengthening the foundation of Egypt’s logistics sector and aiding it to become more competitive, reliable, and enticing for long-term economic growth. As per the IMARC Group, the Egypt construction market size is estimated to exhibit a growth rate (CAGR) of 8.27% during 2025-2033.

To get more information on this market, Request Sample

Expansion of e-commerce portals

The broadening of e-commerce portals is fueling the Egypt logistics market growth. According to industry reports, the e-commerce market in Egypt produced revenue of USD 1,485 Million in 2024, demonstrating a growth rate of 20-25%. As more people are shopping online, especially through mobile phones, logistics companies are being encouraged to improve speed, accuracy, and coverage. This is leading to higher volumes of small and frequent shipments, motivating companies to invest in better technology, inventory systems, and last-mile delivery networks. Warehousing services are broadening to support online retailers, with many setting up fulfillment centers near major cities. Local and regional delivery networks are expanding to meet rising customer expectations for same-day or next-day delivery. Increasing adoption of e-commerce sites is also creating opportunities for small logistics startups and digital platforms that manage orders and track shipments in real-time. Cash-on-delivery services remain popular, requiring strong payment and returns systems. As online shopping is spreading to rural areas, logistics providers are extending their reach to less connected regions. Retailers are partnering with logistics companies to ensure customer satisfaction and smooth delivery experiences. The thriving e-commerce sector is not only increasing shipping volumes but also transforming how logistics operations work. Overall, the rise of e-commerce is helping to modernize Egypt’s logistics market, making it more flexible, efficient, and customer-focused.

Egypt Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

A detailed breakup and analysis of the market based on the model type have also been provided in the report. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, seaways, railways, and airways.

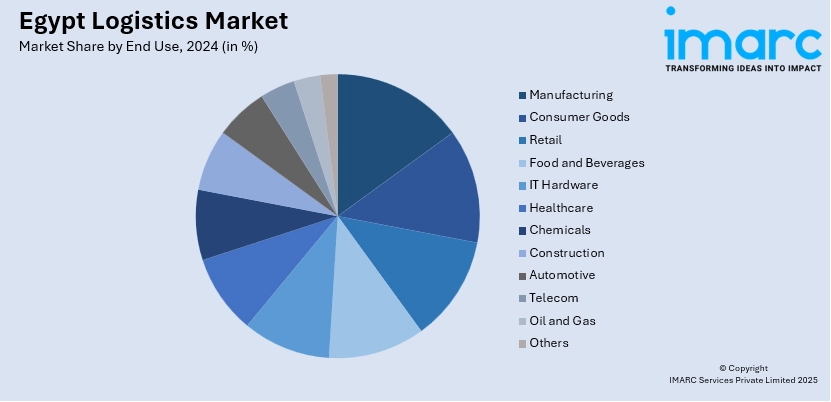

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Logistics Market News:

- In May 2025, Egypt's Suez Canal Economic Zone completed a 50-year concession deal with the Abu Dhabi Ports Group from the United Arab Emirates to create a 20-square km logistics and industrial zone to the east of Port Said in Egypt. AD Ports designated USD 120 Million for the first phase, which encompassed development and feasibility studies for a 2.8 square kilometer area, set to be finalized within three years. The contract marked the most recent in a succession of investments by AD Ports in the country’s logistics and maritime infrastructure.

- In March 2025, Egypt's Prime Minister Moustafa Madbouly launched the ‘Advanced Customs Logistics Centre’ for the Economic Zone, which was established in collaboration with Agility, involving an investment of USD 60 Million. Covering 100,000 square metres, the zone was expected to create 2,500 jobs, both directly and indirectly. The logistics hub featured a digital system for effective shipment handling, guaranteeing prompt customs processing via advanced technologies.

Egypt Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt logistics market on the basis of model type?

- What is the breakup of the Egypt logistics market on the basis of transportation mode?

- What is the breakup of the Egypt logistics market on the basis of end use?

- What is the breakup of the Egypt logistics market on the basis of region?

- What are the various stages in the value chain of the Egypt logistics market?

- What are the key driving factors and challenges in the Egypt logistics market?

- What is the structure of the Egypt logistics market and who are the key players?

- What is the degree of competition in the Egypt logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)