Egypt Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Egypt Meat Market Overview:

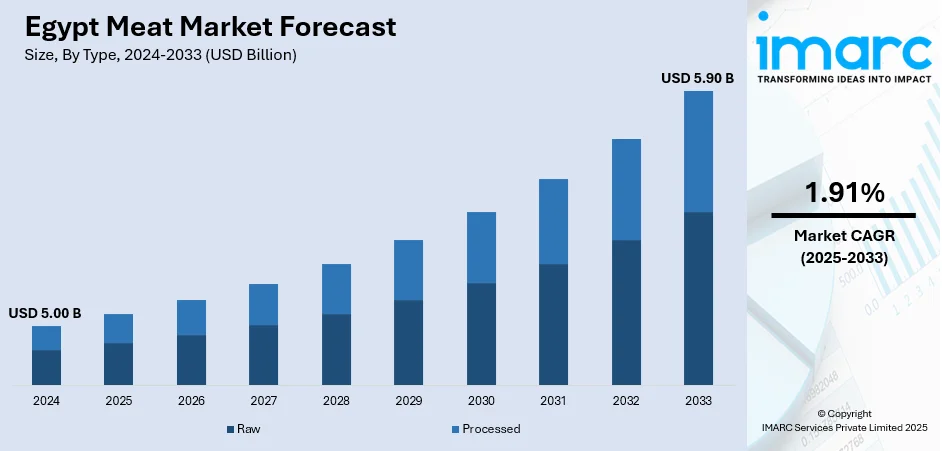

The Egypt meat market size reached USD 5.00 Billion in 2024. The market is projected to reach USD 5.90 Billion by 2033, exhibiting a growth rate (CAGR) of 1.91% during 2025-2033. The market is driven by the rising population and urbanization, which increase demand for animal protein. Economic growth and higher incomes also boost meat consumption. Government efforts to improve food security and local livestock production impact supply. However, price volatility, inflation, and import dependency affect affordability and accessibility. Cultural preferences for fresh meat, growing retail chains, and demand for halal-certified products further boost the Egypt meat market share. Technological advances in cold storage and logistics also support market development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.00 Billion |

| Market Forecast in 2033 | USD 5.90 Billion |

| Market Growth Rate 2025-2033 | 1.91% |

Egypt Meat Market Trends:

Population Growth and Urbanization

Egypt's increasing population of over 110 million is one of the main contributors to meat demand. With the growing population, especially in urban centers, comes the demand for affordable and convenient sources of protein. Urbanization influences food patterns, with an increase in people moving from the traditional vegetarian diet to increased consumption of meat as a result of changing lifestyles and improved access to modern retail facilities. This urbanization also creates demand for convenience foods and processed meat products. Along with this, a younger population with changing tastes is shaping the patterns of meat consumption, compelling suppliers to offer more variety. The increasing middle class in urban areas such as Cairo and Alexandria not only increases the consumption in terms of quantity but also quality, demanding hygienic, branded, and value-added meat products thus aiding the Egypt meat market demand.

To get more information on this market, Request Sample

Economic and Income Growth

Economic growth and growing household incomes have a profound impact on Egypt's meat industry. When purchasing power increases, customers spend a growing proportion of income on animal protein, such as beef, chicken, and lamb. This is particularly noticeable in middle-class consumers, who are pushing demand for higher-quality, branded, and processed meat. Higher income also alters consumers' expectations, making them more likely to make purchases from formal retail outlets that provide increased hygiene, cold chain handling, and product traceability. In addition, this economic boom supports the growth of supermarkets, hypermarkets, and online food websites. Yet, Egypt's economy is still volatile to inflation and exchange rate movements, potentially affecting meat prices and affordability. The government interventions and subsidies also help stabilize prices, particularly for chicken. In general, though economic growth increases demand, it also makes things more complicated as consumers grow more educated and price-conscious when there is financial uncertainty.

Government Policy and Food Security Initiatives

Government policy is one of the key Egypt meat market trends, especially through policies that increase food security and cut dependence on imports. Egypt depends on substantial imports of red meat, and thus it is exposed to international price fluctuations and supply interruptions. Therefore, government action has been put in place to enhance local livestock production through improvement in breeding schemes, veterinary cover, and infrastructure investment. Strategies for encouraging local feed crops also serve to reduce costs and stabilize supply. The government subsidies, particularly on poultry, also enable prices to remain reasonable to the larger society. Strategic alliances with Sudan and Brazil mean constant imports of meat when local production does not meet demand. The government's effort to enhance cold chain logistics as well as increase slaughterhouse capacity further enables a more efficient meat supply chain. These interventions are of vital importance in providing meat availability, price stability, and long-term sustainability.

Egypt Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

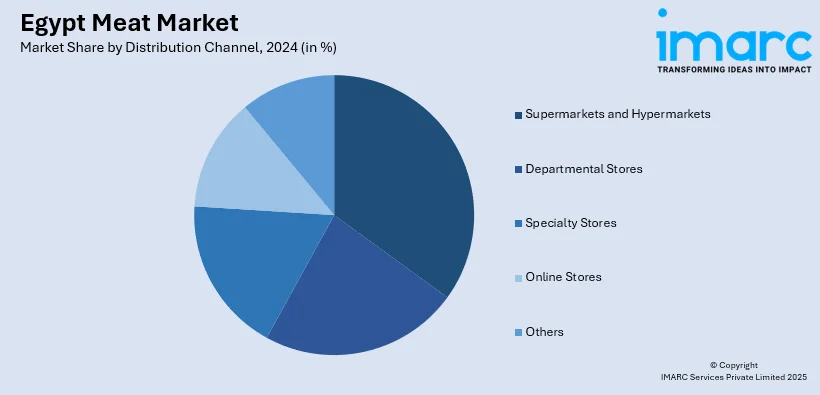

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Meat Market News:

- In August 2024, Uganda exported its first trial shipment of 50 tonnes of beef to Egypt through the Egypt-Uganda Food Security Company, based in Luweero District. Established in 2016, the company operates Africa’s largest slaughterhouse. This export follows three trade agreements between Uganda and Egypt. Project manager Hishem Jahffal noted that the shipment marks a milestone after overcoming multiple challenges, aiming to strengthen food security and bilateral trade between the two nations.

Egypt Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt meat market on the basis of type?

- What is the breakup of the Egypt meat market on the basis of product?

- What is the breakup of the Egypt meat market on the basis of distribution channel?

- What is the breakup of the Egypt meat market on the basis of region?

- What are the various stages in the value chain of the Egypt meat market?

- What are the key driving factors and challenges in the Egypt meat market?

- What is the structure of the Egypt meat market and who are the key players?

- What is the degree of competition in the Egypt meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)