Egypt Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End User, and Region, 2025-2033

Egypt Online Education Market Overview:

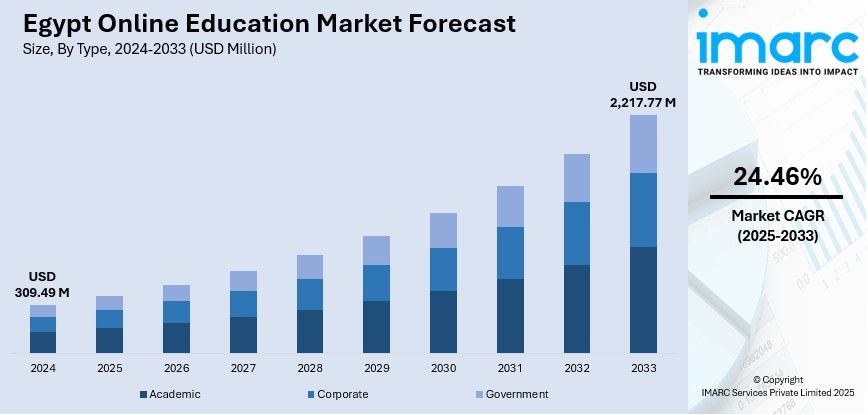

The Egypt online education market size reached USD 309.49 Million in 2024. The market is projected to reach USD 2,217.77 Million by 2033, exhibiting a growth rate (CAGR) of 24.46% during 2025-2033. The market is fueled by government initiatives like the "Education 2.0" reform strategy and the "Digital Egypt" initiative, which incorporates technology in the education sector, promoting digital competence and access. These are accompanied by the rising internet and mobile penetration, creating wider access to online courses. Emergence of localized e-learning websites, with content in Arabic also aligns with the Egyptian curriculum, which has spurred demand for online learning. The increasing focus on lifelong learning and continuing professional development further shapes the dynamics of the Egypt online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 309.49 Million |

| Market Forecast in 2033 | USD 2,217.77 Million |

| Market Growth Rate 2025-2033 | 24.46% |

Egypt Online Education Market Trends:

Government-Led Digital Transformation

The Egyptian government has led the way in adopting technology within the education system through schemes such as the "Education 2.0" reform plan and the "Egypt Vision 2030" framework. These initiatives seek to modernize the education system by integrating digital tools and supporting digital literacy among learners and educators. For example, the Egyptian Knowledge Bank (EKB) offers access to a comprehensive library of learning resources for free, enhancing learners at all levels. Moreover, public-private collaborations have enabled the creation of digital infrastructure, including the provisioning of tablets and high-speed internet in schools, to enhance e-learning. These are examples of the government's efforts to promote a digitally accessible education system.

To get more information on this market, Request Sample

Emergence of Localized E-Learning Platforms

To meet the increasing needs for affordable and localized educational material, many Egyptian edtech startups have been launched, providing localized e-learning solutions. Nafham, Noon Academy, and Edraak are some examples of platforms that offer curriculum-mapped courses customized according to the requirements of Egyptian students. These sites tend to be equipped with interactive lessons, video tutorials, and quizzes aimed at improving student engagement and learning outcomes. The popularity of these platforms may be traced to the fact that they have managed to serve the region's particular educational needs by providing content in Arabic and fitting into local curriculum. This is an indication of a shift toward online learning in Egypt that is more personalized and context specific, which contributes to the Egypt online education market growth.

Focus on Digital Skills and Continuing Professional Development

Attuned to the need for digital literacy in contemporary workplaces, Egypt has made a significant priority of building digital competencies among its citizens. The "Digital Egypt Cubs Initiative" and "Egypt FWD" initiative are designed to empower young Egyptians with competency in software development, digital arts, and artificial intelligence. Training and certification, typically with partnerships from international technology firms, are made available to boost employability. In addition, universities and online courses teach courses in new areas such as data science and machine learning for professionals who want to upskill. Such an emphasis on digital skills reflects Egypt's seriousness about equipping its workforce with what it needs to perform in the digital economy.

Egypt Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider has also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

A detailed breakup and analysis of the market based on technology has also been provided in the report. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

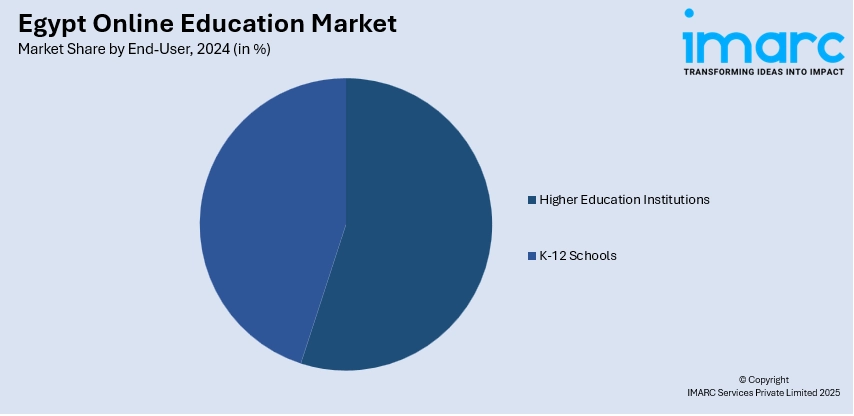

End-User Insights:

- Higher Education Institutions

- K-12 Schools

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes higher education institutions and K-12 schools.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant have been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Online Education Market News:

- In January 2024, according to a news statement, the Kuwaiti edtech business Bai ms acquired the Egyptian live learning platform Orcas Tutoring in order to expand the $100 Billion MENA region's education market. Leading investors like Algebra Ventures, Access Bridge Ventures, NFX Ventures, Rasameel Investment Company, Seedstars International Ventures, AlWazzan Educational Group, and AK Holding helped Orcas and Baims raise more than $11 million.

- In March 2024, the Egypt-based education technology company Sprints.ai obtained $3 Million to support its growth into 10 additional markets. The funding round was spearheaded by Disruptech Ventures, with involvement from EdVentures and CFYE, among other participants, as per a statement. The start-up driven by AI aims to provide graduates with essential technological skills they need through its employment initiatives. Prospective job candidates who register on the platform will receive training and are permitted to make payments only after securing employment within three years.

- In January 2025, Egyptian edtech firm Eyouth collaborated with Singapore-based global education consultancy EDT& Partners to enhance digital skills for one million young people in Africa and the Middle East. Supported by a $6 million funding, the collaboration will concentrate on educating those aged 15 to 35 in essential fields like AI, programming, data analysis, digital marketing, and contemporary teaching methods, as stated in a press release. The initiative will combine Eyouth’s proven platform and knowledge in skills development within the MENA region with EDT&Partners’ cutting-edge educational technologies and methodologies.

Egypt Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt online education market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt online education market on the basis of type?

- What is the breakup of the Egypt online education market on the basis of provider?

- What is the breakup of the Egypt online education market on the basis of technology?

- What is the breakup of the Egypt online education market on the basis of end-user?

- What is the breakup of the Egypt online education market on the basis of region?

- What are the various stages in the value chain of the Egypt online education market?

- What are the key driving factors and challenges in the Egypt online education market?

- What is the structure of the Egypt online education market and who are the key players?

- What is the degree of competition in the Egypt online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt online education market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)