Egypt Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Egypt Online Travel Market Overview:

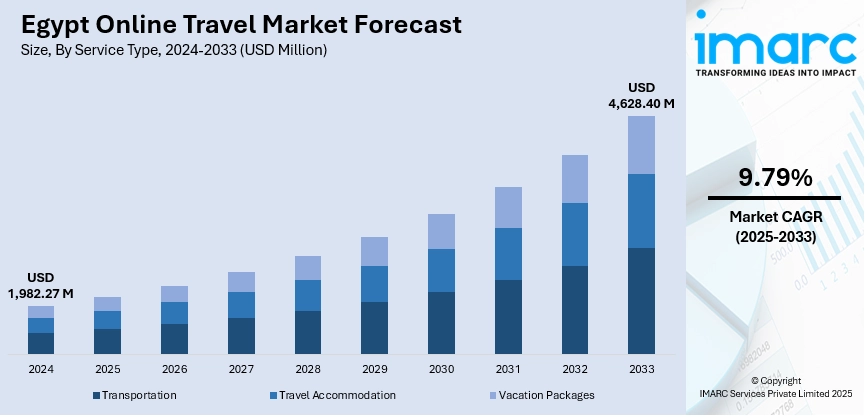

The Egypt online travel market size reached USD 1,982.27 Million in 2024. The market is projected to reach USD 4,628.40 Million by 2033, exhibiting a growth rate (CAGR) of 9.79% during 2025-2033. The market is witnessing steady expansion due to greater access to digital platforms, widespread smartphone adoption, and evolving consumer behavior toward online booking. Services such as flights, accommodation, and complete travel packages are now more commonly reserved through websites and mobile apps. Different age groups are embracing online modes of booking, supported by secure payment systems and user-friendly interfaces. Regional growth and service diversification are also contributing to the overall rise in Egypt online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,982.27 Million |

| Market Forecast in 2033 | USD 4,628.40 Million |

| Market Growth Rate 2025-2033 | 9.79% |

Egypt Online Travel Market Trends:

Streamlined Booking Lead Times

The speed of travel planning in Egypt has accelerated notably in recent years. In June 2025, the average time between initial planning and final booking for trips to Egypt was just 21 days, reflecting a growing consumer trust in the efficiency of online platforms. This accelerated timeline is underpinned by improvements in mobile-first design, secure payment options, and AI-based itinerary suggestions that allow users to instantaneously compare availability and pricing. Nationwide enhancements in internet coverage and e‑visa processing have significantly reduced friction in the booking journey. In response, service providers from airlines to tour operators have optimized backend systems to support real-time confirmations and automated booking reminders. These innovations not only enhance user satisfaction but also cut operational costs and reduce manual inefficiencies. As a result, this trend toward shorter lead times highlights how digital capabilities are reshaping the planning cycle. It is a foundational element of the ongoing Egypt online travel market growth.

To get more information on this market, Request Sample

Extended Visitor Itineraries

Tourism behavior in Egypt is shifting toward deeper and more immersive travel experiences. According to sources, in April 2024, the average duration of stay by international visitors reached 9.5 nights. This increase signals a growing interest in extended exploration, combining the Pyramids, Nile cruises, Red Sea resorts, and southern heritage sites. Digital platforms play a pivotal role by enabling users to craft complex, multi-leg itineraries via a single interface. Features such as geo-tagged attractions, bundled experiences, and flexible lodging options support longer stays that once required multiple bookings. Vacation rental platforms have aligned their offerings with this trend, advertising longer-stay discounts, easy-to-navigate amenities, and seamless booking flows for stays lasting a week or more. As travelers linger longer, the impact extends into local economies: longer-stay tourists spend more on dining, excursions, and transportation. This evolution toward extended itineraries underscores changing traveler priorities and is a key driver in Egypt online travel market trends.

Strong Urban Hotel Occupancy

Egypt’s urban hospitality sector continues to show resilience and digital integration, particularly in the capital. In November 2024, Cairo’s hotel occupancy rate reached record levels according to a report by Daba Finance, highlighting the city’s strong recovery trajectory and renewed traveler interest. This sustained demand is closely linked to the growing reliance on digital booking platforms, where travelers prioritize convenience, price transparency, and verified guest reviews. Most bookings are now completed online, with mobile applications offering streamlined experiences, loyalty program integration, and instant confirmations. Urban hotels have also adopted data-driven tools to manage demand more effectively leveraging algorithms to optimize pricing and promotions in real time. Beyond individual bookings, bundled offerings like weekend city escapes and event-based packages are becoming popular, all facilitated through digital interfaces. Marketing efforts are increasingly geo-targeted, using online behavior data to capture potential visitors at the planning stage. As Cairo continues to attract both business and leisure travelers, digital tools are essential in sustaining high occupancy levels.

Egypt Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

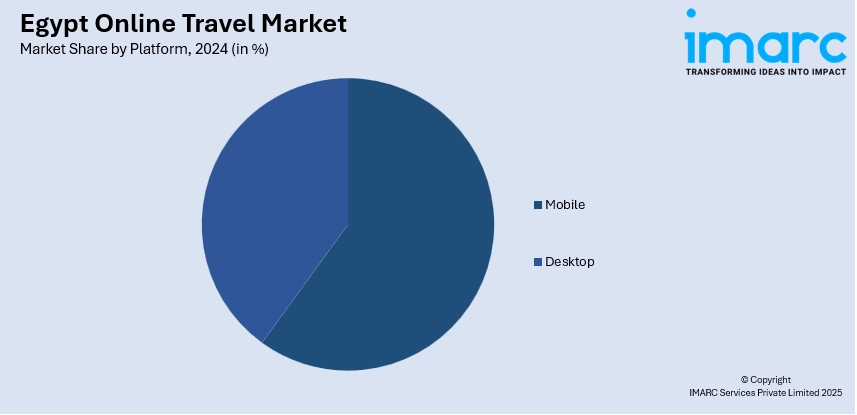

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Online Travel Market News:

- June 2025: KlasJet and Air Cairo have formed a strategic partnership to introduce new summer charter flights linking Italy and the UAE with Egypt. The partnership will facilitate Egypt's expanding tourism industry by increasing accessibility and convenience for travel in the prime season. Run between May and October, the flights intend to address increased demand for recreational travel to Egypt's top destinations. The partnership reinforces both companies' interest in cementing Egypt's role as a prime travel hub in the region.

- March 2025: Wego and the Egyptian Tourism Authority have prolonged their collaboration to market Egypt as a top holiday destination. The collaboration emphasizes Egypt's diverse landscapes, rich history, and lively culture, inviting travelers to go off the beaten path beyond spots such as the Pyramids of Giza and temples of Luxor. It also features some off-the-beaten-path destinations like Siwa Oasis and the Red Sea coast. Both groups prioritize sustainable tourism and cultural conservation to promote Egypt's heritage responsibly for future generations.

Egypt Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages. |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt online travel market on the basis of service type?

- What is the breakup of the Egypt online travel market on the basis of platform?

- What is the breakup of the Egypt online travel market on the basis of the mode of booking?

- What is the breakup of the Egypt online travel market on the basis of age group?

- What is the breakup of the Egypt online travel market on the basis of the region?

- What are the various stages in the value chain of the Egypt online travel market?

- What are the key driving factors and challenges in the Egypt online travel market?

- What is the structure of the Egypt online travel market and who are the key players?

- What is the degree of competition in the Egypt online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)