Egypt Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Egypt Steel Market Overview:

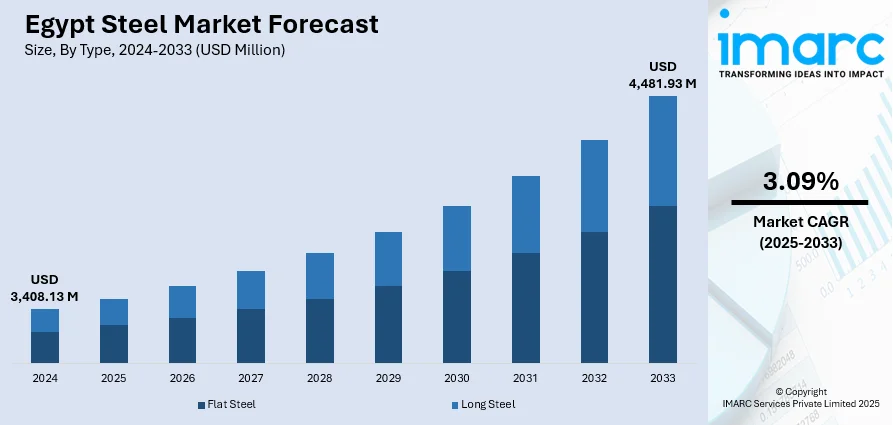

The Egypt steel market size reached USD 3,408.13 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,481.93 Million by 2033, exhibiting a growth rate (CAGR) of 3.09% during 2025-2033. The market is primarily driven by large-scale construction projects and infrastructure development, fueled by economic growth and government initiatives. Growing urbanization and population also contribute significantly to demand. The government's focus on industrial development and reducing reliance on imports further contributes to Egypt steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,408.13 Million |

| Market Forecast in 2033 | USD 4,481.93 Million |

| Market Growth Rate 2025-2033 | 3.09% |

Egypt Steel Market Trends:

Expansion in Steel and Manufacturing Sector

A significant step is being taken in Egypt's industrial sector with the development of a new metal containers manufacturing facility in the Sokhna Industrial Zone. The project will contribute to job creation and aims to strengthen local manufacturing capacity. Initially, the plant will focus on meeting domestic demand, but has plans to eventually export its products. The establishment of this facility marks an important milestone as it becomes the first metal containers plant in the region, showcasing the country's expanding industrial base. This development is part of Egypt's broader strategy to enhance its manufacturing sector, reduce reliance on imports, and provide new employment opportunities in critical industrial zones, supporting economic growth and strengthening its position in the global market. These factors are intensifying the Egypt steel market growth. For example, in April 2025, the chairman of the Suez Canal Economic Zone (SCZone) witnessed the signing of Massoud Steel Company's metal containers project contract in the Sokhna Industrial Zone. With an investment of EGP 965 Million, the 31,000 sqm facility would create 130 jobs. Initially focusing on the local market, the project plans to export later. Production is set to begin in Q1 2026, marking the first metal containers plant in the SCZone.

To get more information on this market, Request Sample

Boosting Steel Industry through Strategic Partnerships

There is a growing trend of strategic partnerships between local and international investors in Egypt’s steel and manufacturing sectors. These collaborations are driving the development of advanced production facilities focused on meeting both domestic demand and expanding into global markets. By leveraging foreign expertise and technology, these partnerships are enhancing the quality and capacity of Egypt's industrial output, positioning the country as a key player in regional and international supply chains. The increasing number of such joint ventures reflects Egypt's evolving industrial landscape, attracting significant investments and fostering long-term growth in the manufacturing sector. This shift is also contributing to the creation of new jobs and economic opportunities within the country’s industrial zones. For instance, in January 2025, an Egyptian-Qatari partnership took place with a USD 100 Million iron and steel plant in Qena, southern Egypt. The project aims to produce rebar and export large quantities to regional and international markets. The factory plans to apply for a production license in the first half of 2025, with production expected to start in 2026. The company will also collaborate with Italy's Danieli Group to purchase the necessary production lines before the 2026 launch.

Egypt Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

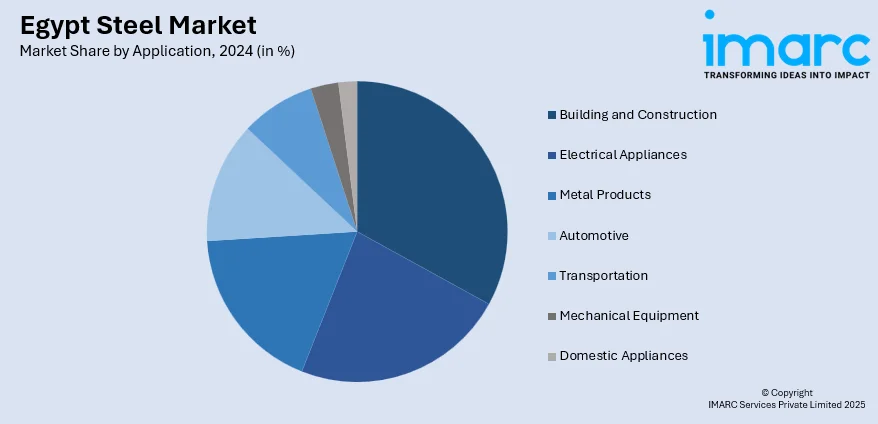

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Steel Market News:

- In June 2025, ABB secured an order from Al Ezz Dekheila Steel Co. (EZDK) to upgrade three central water treatment plants at the Ezz Steel plant in Alexandria, Egypt. The project involves implementing ABB Ability System 800xA for enhanced control and monitoring across key operations. EZDK, Egypt's leading steel producer, aims for more efficient, integrated plant operations, supporting its high-quality Direct Reduced Iron (DRI) production of 3.1 Million Tons annually.

Egypt Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt steel market on the basis of type?

- What is the breakup of the Egypt steel market on the basis of product?

- What is the breakup of the Egypt steel market on the basis of application?

- What is the breakup of the Egypt steel market on the basis of region?

- What are the various stages in the value chain of the Egypt steel market?

- What are the key driving factors and challenges in the Egypt steel market?

- What is the structure of the Egypt steel market and who are the key players?

- What is the degree of competition in the Egypt steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)