Egypt Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2026-2034

Egypt Toys Market Summary:

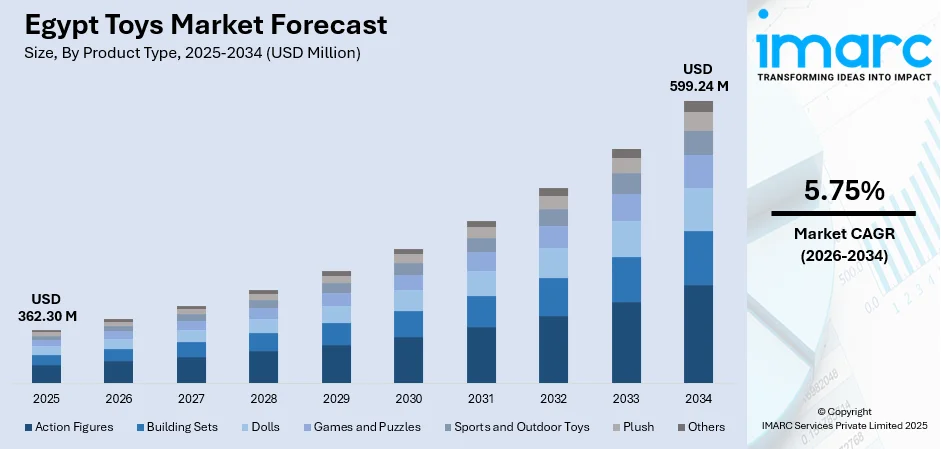

The Egypt toys market size was valued at USD 362.30 Million in 2025 and is projected to reach USD 599.24 Million by 2034, growing at a compound annual growth rate of 5.75% from 2026-2034.

The Egyptian toys market is experiencing robust growth driven by a young and expanding population. Rising disposable incomes among urban middle-class families and increasing parental emphasis on cognitive development and educational play are accelerating demand for diverse toy categories. The expansion of modern retail infrastructure, including specialty toy stores and e-commerce platforms, is enhancing product accessibility across major metropolitan areas. Government initiatives promoting digital transformation and the integration of STEM education principles into early childhood development are further stimulating demand for educational and technology-driven toys, positively influencing the Egypt toys market share.

Key Takeaways and Insights:

- By Product Type: Sports and outdoor toys dominate the market with a share of 20% in 2025, driven by Egypt's favorable climate conditions, expanding recreational infrastructure, and growing parental awareness of physical activity benefits for child development.

- By Age Group: The 5 to 10 years age group leads the market with a share of 42% in 2025, reflecting the substantial population of school-age children and increased demand for educational toys supporting curriculum-aligned learning.

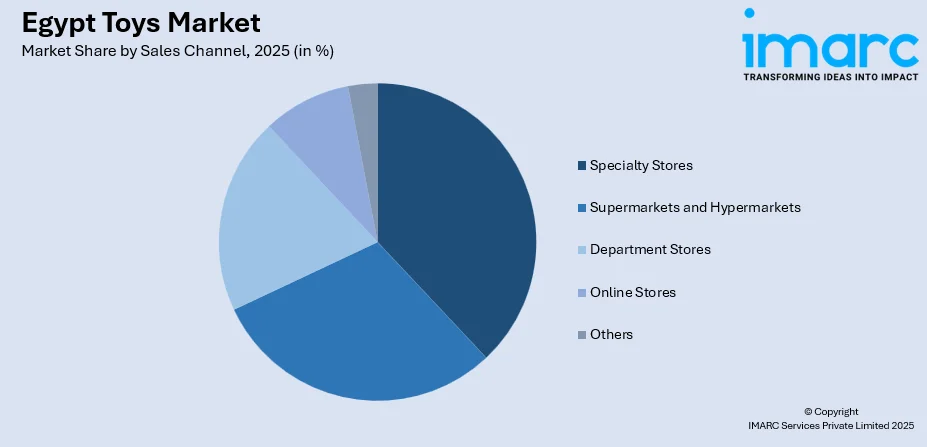

- By Sales Channel: Specialty stores represent the largest segment with a market share of 38% in 2025, owing to their curated product selections, expert guidance, and enhanced shopping experiences that appeal to quality-conscious parents.

- Key Players: The Egypt toys market exhibits a moderately competitive landscape with a mix of international brands and local manufacturers. Leading specialty retailers compete alongside emerging e-commerce platforms, creating a diverse distribution ecosystem.

To get more information on this market Request Sample

The Egypt toys market is positioned for sustained expansion as demographic tailwinds and evolving consumer preferences reshape the industry landscape. With a predominantly youthful population, the country presents a substantial addressable market for toy manufacturers and retailers seeking growth opportunities in the region. Rising urbanization and the expansion of modern retail infrastructure across major metropolitan areas are enhancing product accessibility and consumer engagement. The government's commitment to educational reform and the integration of technology-focused curricula in schools is catalyzing demand for STEM-based and technology-integrated learning toys. Parents are increasingly prioritizing products that support cognitive development, creativity, and skill-building, driving manufacturers to innovate across educational and interactive toy categories. These converging factors establish a favorable environment for continued market development and diversification across age groups and product segments.

Egypt Toys Market Trends:

Rising Demand for STEM and Educational Toys

Egyptian parents and educators are increasingly prioritizing toys that enhance cognitive development, critical thinking, and STEM literacy. The Ministry of Education's curriculum modernization efforts, including the establishment of STEM model schools equipped with Fab Lab facilities, are driving demand for robotics kits, building sets, and interactive learning devices. Schools such as Scholars International Language School and Westview International Language School have incorporated LEGO Robotics programs, while GEMS International School Cairo utilizes Arduino kits for electronics and programming education, fostering early engagement with technology-based play.

E-Commerce and Digital Retail Expansion

Digital platforms are transforming toy retail distribution in Egypt, with e-commerce channels projected to reach USD 193.1 Million by 2033, exhibiting a growth rate (CAGR) of 8.36% during 2025-2033. In February 2024, the expansion of the Digital Egypt program was announced by the Ministry of Communications and Information Technology, which has allocated EGP 1.7 Billion to improve cloud services, cybersecurity, and e-commerce infrastructure for small and medium-sized businesses throughout all governorates. Amazon Egypt and Jumia are leading online toy retailers, with mobile commerce accounting for majority of digital transactions.

Growing Preference for Licensed and Character-Based Products

Consumer demand for licensed toys featuring popular entertainment franchises and characters is intensifying across Egypt. Parents increasingly seek products associated with recognized media properties, driving retailers to expand their assortments of branded action figures, dolls, and themed playsets. International franchises from animation studios and film productions command premium positioning in specialty stores and department retailers, with character-based products demonstrating stronger sell-through rates during peak seasonal periods including Eid al-Fitr and back-to-school seasons.

Market Outlook 2026-2034:

The Egypt toys market outlook remains positive as demographic fundamentals and modernization initiatives create favorable conditions for sustained expansion. Urbanization trends, with 43.1% of the population residing in urban areas, coupled with rising household incomes in Greater Cairo and Alexandria, are expected to drive premium product adoption. The expansion of modern retail infrastructure and e-commerce platforms is enhancing product accessibility across major metropolitan centers. Government investment in youth development and recreational facilities is further stimulating demand for sports and educational toy categories throughout the forecast period. The market generated a revenue of USD 362.30 Million in 2025 and is projected to reach a revenue of USD 599.24 Million by 2034, growing at a compound annual growth rate of 5.75% from 2026-2034.

Egypt Toys Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Sports and Outdoor Toys | 20% |

| Age Group | 5 to 10 Years | 42% |

| Sales Channel | Specialty Stores | 38% |

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The sports and outdoor toys segment dominates with a market share of 20% of the total Egypt toys market in 2025.

Sports and outdoor toys have emerged as the leading product category in Egypt, benefiting from the country's favorable year-round climate and growing emphasis on physical fitness for children. The segment encompasses bicycles, sports equipment, ride-on vehicles, water toys, and playground apparatus that encourage active outdoor play. The Egyptian government's 2024/2025 development plan, which includes the establishment of 157 new youth and sports centers, 10 modern sports stadiums, and 8 inclusive sports facilities for individuals with disabilities, is creating expanded recreational spaces that stimulate demand for sports-related toys.

The segment's growth is further supported by increasing parental awareness of childhood obesity concerns and the developmental benefits of outdoor physical activity. Urban areas including Greater Cairo and Alexandria feature expanding networks of family-oriented recreational spaces, public parks, and entertainment complexes that create usage occasions for sports and outdoor toys. Major retailers report strong seasonal demand patterns, with sales peaking during summer months and school holiday periods when families engage in outdoor leisure activities along the Red Sea coast and Nile-side recreational areas.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

The 5 to 10 years segment leads the market with a share of 42% of the total Egypt toys market in 2025.

The 5 to 10 years age segment represents the largest consumer demographic in Egypt's toys market, reflecting the substantial population of primary school-age children and their diverse developmental needs. This age group encompasses children transitioning from preschool play patterns to more structured educational engagement, creating demand across multiple product categories including building sets, educational games, action figures, and sports equipment. According to UNICEF Egypt's 2024 Situation Analysis, adolescents aged 10-19 years represent 19% of the total population, with the broader youth demographic constituting nearly one-third of Egyptian society.

Parents of children in this age bracket demonstrate heightened engagement with educational toy purchases, seeking products that complement school curricula and support cognitive skill development. The segment benefits from Egypt's educational reform initiatives, which emphasizes competency-based learning and inquiry-driven pedagogy. Toy manufacturers targeting this demographic increasingly incorporate STEM principles, literacy support, and creative expression elements into their product designs to align with parental expectations for learning-oriented play experiences.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

Specialty stores hold the largest share accounting for 38% of the total Egypt toys market in 2025.

Specialty toy stores maintain market leadership in Egypt through their differentiated value proposition of curated assortments, product expertise, and enhanced shopping experiences. Leading retailers including Hamleys at Mall of Egypt, Hedeya with multiple locations across Cairo and Giza, Our Kids stores, and Top Toys outlets offer comprehensive selections spanning international and domestic brands. These retailers invest in store environments featuring interactive product demonstrations, play areas, and knowledgeable staff who guide parents through purchasing decisions. Hedeya, positioned as Egypt's leading kids store, combines toys, video games, dolls, action figures, and baby equipment under one roof, partnering with international brands including Chicco, Graco, and Stokke.

The specialty channel's dominance reflects Egyptian consumers' preference for tactile product evaluation and personalized service when making toy purchases, particularly for premium and educational products. These stores benefit from strategic positioning within major shopping malls and commercial districts in Greater Cairo, Alexandria, and other urban centers, capturing high-intent family shoppers during weekend outings and seasonal gifting occasions. Gift wrapping services, loyalty programs, and trusted product authenticity further reinforce customer preference for dedicated toy retail environments.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Greater Cairo is driven by its status as the largest metropolitan area in Africa with a population exceeding 22 million residents. The region encompasses Cairo Governorate, Giza Governorate, and Qalyubia Governorate, concentrating approximately half of Egypt's GDP and the highest concentration of middle and upper-income households. Major shopping destinations including Mall of Egypt, City Centre Almaza, and Cairo Festival City host flagship specialty toy stores and department retailers catering to affluent family shoppers.

Alexandria is anchored by its position as the country's primary Mediterranean port city. The El Manshya Market stands as Egypt's second-biggest toy marketplace after Cairo's El Mosky, offering diverse product selections across price points. The region benefits from its coastal location supporting seasonal demand for water toys and beach equipment during summer tourism season.

The Suez Canal Region encompasses the governorates of Ismailia, Port Said, Suez, North Sinai, and South Sinai, with a combined population engaged in trade, logistics, and tourism activities. Port Said's status as a customs-free zone supports affordable toy imports, while the Red Sea coastal areas generate demand for water sports equipment and outdoor toys catering to both residents and tourists visiting Sharm El-Sheikh and other resort destinations.

The Nile Delta Region represents a significant market opportunity encompassing the governorates of Damietta, Gharbia, Kafr El Sheikh, Dakahlia, and Monufia. This agriculturally productive area features growing urbanization in cities such as Tanta and Mansoura, where expanding retail infrastructure and rising household incomes are driving increased toy consumption. E-commerce penetration is accelerating in Delta governorates as logistics networks improve.

Market Dynamics:

Growth Drivers:

Why is the Egypt Toys Market Growing?

Expanding Young Population and Favorable Demographics

Egypt's demographic profile presents exceptional growth fundamentals for the toys market, with the country maintaining one of the youngest populations in the Middle East and Africa region. According to Egypt's Central Agency for Public Mobilization and Statistics (CAPMAS), the under-18 population reached 39.5 million in early 2024, representing 37.3% of the total population and establishing Egypt as having the highest number of children in the Arab world. The median age of 24.5 years and a fertility rate of approximately 2.54 children per woman ensure continued population growth in key toy-consuming demographics. This substantial addressable market creates sustained baseline demand across all toy categories, from infant and toddler products through age-appropriate offerings for school-age children and pre-teens.

Rising Disposable Income and Middle-Class Expansion

Economic development and urbanization are expanding Egypt's middle-class consumer base with increasing purchasing power for discretionary products including toys. The concentration of higher-income households in Greater Cairo, Alexandria, and new urban communities creates premium market segments willing to invest in quality educational and branded toys. Rising household incomes enable parents to move beyond basic toy purchases toward premium products, licensed merchandise, and technology-enhanced educational offerings. The growth of dual-income households and changing gifting patterns during seasonal celebrations including Eid al-Fitr, Eid al-Adha, and birthday occasions are driving increased per-child toy expenditure.

Government Investment in Education and Youth Development

Egyptian government initiatives promoting education reform and youth development are creating favorable conditions for educational toy demand. In August 2025, Minister of Education Mohamed Abdel Latif announced the introduction of artificial intelligence curricula in schools beginning the 2025-2026 academic year, signaling increased emphasis on technology literacy from early ages. Additionally, the U.S. Embassy in Cairo launched the GLOBE environmental education program in partnership with the Ministry of Education, donating atmospheric monitoring tools to STEM schools in Maadi, 6th of October, Obour, Alexandria, and Menoufia.

Market Restraints:

What Challenges the Egypt Toys Market is Facing?

Currency Volatility and Import Cost Pressures

Egypt's currency fluctuations have significantly impacted imported toy pricing, with the Egyptian pound experiencing substantial depreciation affecting purchasing power. According to industry sources, imported toy prices increased year, with additional price jumps during peak seasons. These cost escalations squeeze retailer margins and limit consumer access to international branded products.

Preference for Imported Products Over Local Alternatives

Despite the presence of domestic toy manufacturing capabilities, Egyptian children and parents continue to demonstrate strong preference for foreign brands and imported products. Research indicates that international toys remain the favored choice among Egyptian families, limiting market opportunities for local manufacturers seeking to compete on quality perception rather than price alone.

Limited Organized Retail Penetration in Non-Urban Areas

While major metropolitan areas benefit from modern retail infrastructure and e-commerce accessibility, significant portions of Egypt's population in rural and semi-urban areas have limited access to organized toy retail channels. Logistical challenges, including last-mile delivery constraints and lower internet penetration, restrict market reach beyond primary urban centers.

Competitive Landscape:

The Egypt toys market features a competitive structure characterized by the presence of international toy brands, regional distributors, and emerging local manufacturers. Global toy industry leaders maintain market presence through authorized distributors and retail partnerships, offering popular product lines across action figures, dolls, building sets, and games categories. Specialty toy retailers operate extensive store networks in major shopping destinations, while e-commerce platforms are capturing growing online market share. The competitive environment is evolving as local manufacturers enter the market with artisanal and culturally relevant product offerings. Price competition remains intense, particularly in mass-market segments, while premium positioning strategies emphasize product quality, educational value, and brand authenticity.

Egypt Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Egypt toys market size was valued at USD 362.30 Million in 2025.

The Egypt toys market is expected to grow at a compound annual growth rate of 5.75% from 2026-2034 to reach USD 599.24 Million by 2034.

Sports and outdoor toys dominated the product type segment with a 20% market share in 2025, driven by Egypt's favorable climate conditions, expanding recreational infrastructure, and growing parental emphasis on physical activity for children's development.

Key factors driving the Egypt toys market include the expanding young population, rising disposable incomes among urban middle-class families, government investment in education and youth development programs, and growing e-commerce retail channel accessibility.

Major challenges include currency volatility and import cost pressures that have increased toy prices substantially, strong consumer preference for imported products over local alternatives, and limited organized retail penetration in non-urban and rural areas affecting market accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)