Egypt Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Egypt Vegetable Oil Market Overview:

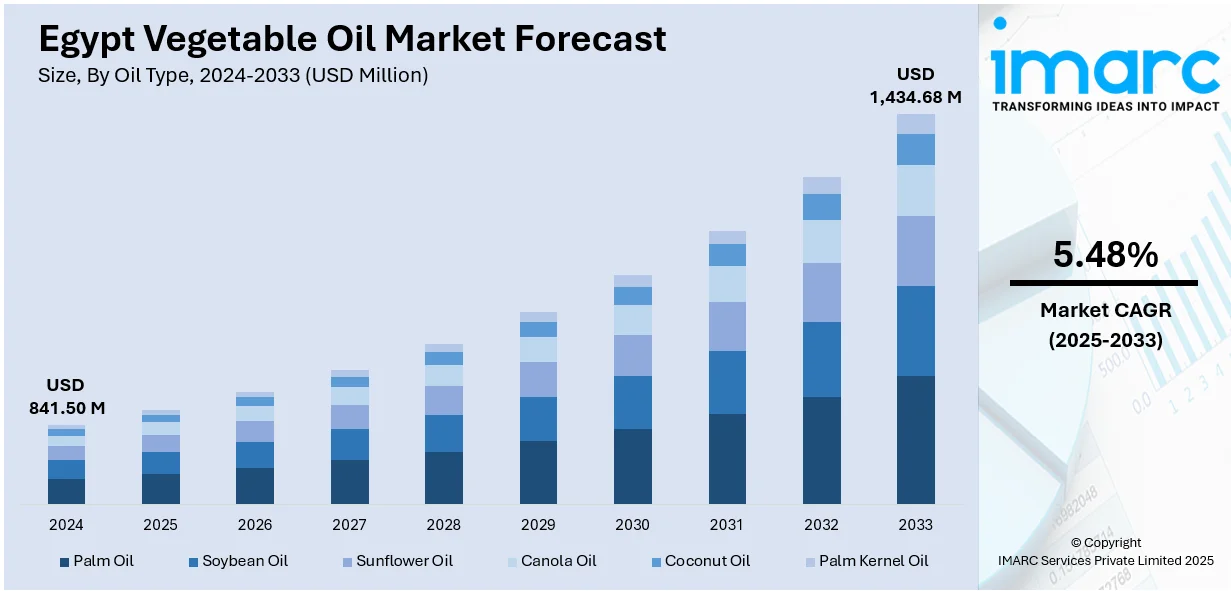

The Egypt vegetable oil market size reached USD 841.50 Million in 2024. Looking forward, the market is projected to reach USD 1,434.68 Million by 2033, exhibiting a growth rate (CAGR) of 5.48% during 2025-2033. The market is driven by strong household demand and state-backed subsidization of cooking oil as a dietary staple. Egypt’s import-reliant structure is reinforced by significant investments in domestic refining and distribution networks. Rising consumer health awareness and product diversification are further augmenting the Egypt vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 841.50 Million |

| Market Forecast in 2033 | USD 1,434.68 Million |

| Market Growth Rate 2025-2033 | 5.48% |

Egypt Vegetable Oil Market Trends:

High Domestic Consumption and Staple Food Status

Vegetable oil is a vital component of Egyptian diets, used extensively in frying, sautéing, and baking across all socioeconomic groups. It is considered a household staple, alongside flour and sugar, particularly in urban and low-income communities where deep-frying is a common cooking method. Sunflower and soybean oils are the most commonly used, often distributed through both open markets and the government’s subsidized food system. The Egyptian General Authority for Supply Commodities (GASC) procures massive volumes of vegetable oil annually to support the national ration card program, which benefits millions of citizens. Recent industry research reports highlighted that Egypt imported 98% of its edible oil needs in 2023, with palm oil comprising 67% of the USD 1.3 Billion market. With vegetable oil consumption projected to rise 15% by 2030, sustainable palm oil remains critical to Egypt’s food security and environmental goals. As a result, demand for edible oil remains price-sensitive but consistent, driven by necessity rather than discretionary spending. Ramadan and festive seasons also see seasonal spikes in oil consumption due to traditional food preparations. Despite inflationary pressures and global price fluctuations, the essential nature of cooking oil in daily meals ensures resilient demand. Both local refiners and government procurement bodies play crucial roles in ensuring oil availability across the country. This deep market entrenchment, reinforced by state intervention and cultural norms, remains a key enabler of Egypt vegetable oil market growth.

To get more information on this market, Request Sample

Public Health Awareness and Market Diversification Trends

Health concerns related to obesity, cardiovascular issues, and diabetes are leading to increased awareness around dietary fats in Egypt. Urban, middle-income consumers, particularly in Cairo, Alexandria, and Giza, are shifting preferences toward oils perceived as healthier, such as sunflower, corn, olive, and canola. On October 1, 2024, Egyptian officials unveiled plans to boost olive oil exports to 1,000 metric tons and table olive exports to 100,000 tons for the 2023/24 crop year, reinforcing the country's expanding agri-food trade ambitions. Egypt, which produced 600,000 tons of table olives (approximately 25% of global output), has also planted 23 million olive trees since 2015, with an additional 77 million targeted to strengthen supply. This expanding footprint in olive cultivation and exports reflects not only Egypt’s agronomic capacity but also its alignment with growing domestic demand for healthier edible oil alternatives, amid rising public health awareness and evolving consumer preferences. Brands are responding with fortified oils containing vitamins A and D, non-GMO options, and products marketed as low in saturated fat or cholesterol. These offerings are positioned at premium price points in supermarkets and health food outlets, targeting a growing segment of health-conscious consumers. Food influencers, medical professionals, and media campaigns play a role in educating the public about healthier cooking alternatives. Additionally, multinational and domestic producers are exploring blended oils that combine affordability with health benefits. Although palm oil remains dominant in the industrial sector due to cost-efficiency, retail consumer trends are pushing the market toward diversification and quality enhancement. This transition is further supported by government nutrition policies and voluntary reformulations by food producers. As Egyptian consumer preferences evolve with lifestyle and health priorities, oil manufacturers are adapting their product lines, contributing to segmentation and resilience across the broader edible oil market.

Egypt Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

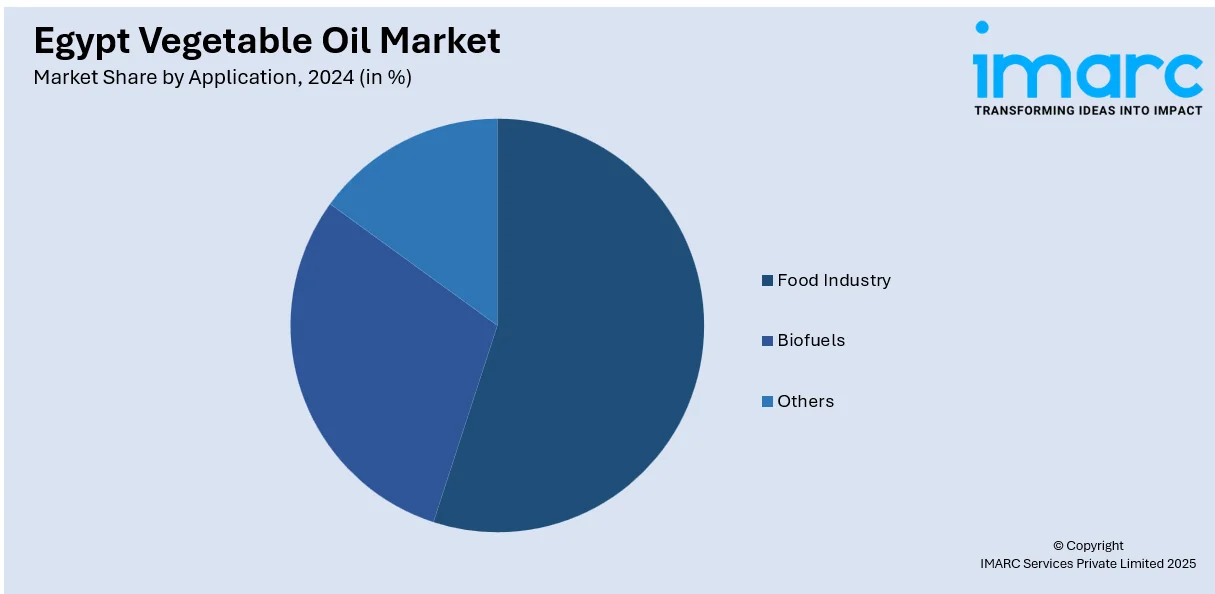

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Greater Cairo, Alexandria, Suez Canal, Delta, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Egypt Vegetable Oil Market News:

- On May 28, 2025, Egypt’s Ministry of Supply announced plans to double edible oil storage capacity at Alexandria port from 75,000 tons to 150,000 tons, aiming to enhance national food security and stabilize vegetable oil supply chains. The expansion project, backed by state investments and international partnerships, is scheduled for completion by 2026. As one of the country’s key logistical hubs, Alexandria’s upgraded infrastructure will reduce import vulnerability and support Egypt’s broader vegetable oil market resilience strategy.

Egypt Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Greater Cairo, Alexandria, Suez Canal, Delta, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Egypt vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Egypt vegetable oil market on the basis of oil type?

- What is the breakup of the Egypt vegetable oil market on the basis of application?

- What is the breakup of the Egypt vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Egypt vegetable oil market?

- What are the key driving factors and challenges in the Egypt vegetable oil market?

- What is the structure of the Egypt vegetable oil market and who are the key players?

- What is the degree of competition in the Egypt vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Egypt vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Egypt vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Egypt vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)