Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2026-2034

Electric Two-Wheeler Market Size and Share:

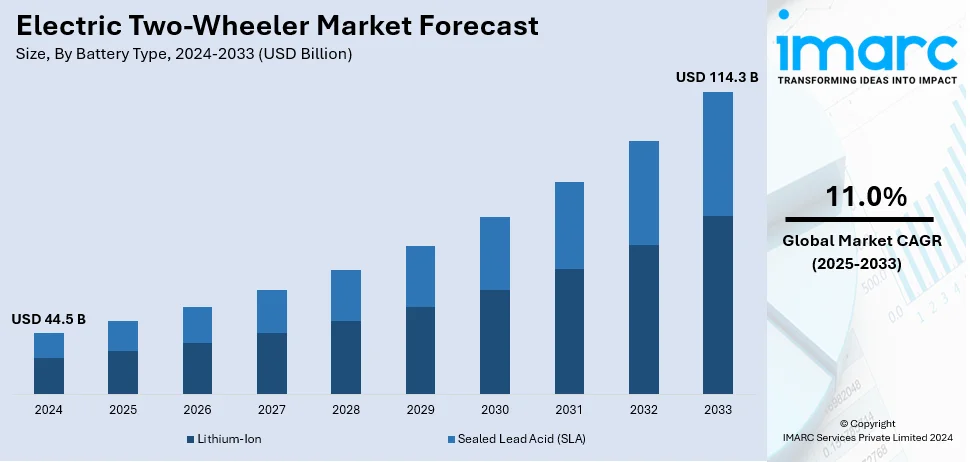

The global electric two-wheeler market size was valued at USD 44.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 114.3 Billion by 2034, exhibiting a CAGR of 11.0% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 97.3% in 2024. The adoption of electric vehicles (EVs), especially two-wheelers, is growing owing to heightened environmental awareness, supportive government policies, and increasing urban traffic congestion. Electric scooters and motorcycles allow riders to navigate busy city streets with greater ease, helping reduce travel time. The growing popularity of cycling for health and recreation, enhanced by electric assistance, is further encouraging their adoption. As sustainability becomes a priority, electric two-wheeler presents a cleaner option that generates no direct emissions and aligns well with the shift towards renewable energy, reinforcing their place in the modern transport sector.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 44.5 Billion |

|

Market Forecast in 2034

|

USD 114.3 Billion |

| Market Growth Rate (2026-2034) | 11.0% |

The electric two-wheeler market is propelled by several key drivers. Increasing environmental awareness and the need to reduce carbon emissions encourage consumers to choose sustainable transportation options. Government incentives such as subsidies and favorable policies significantly boost the adoption of electric two-wheelers. For instance, in September 2024, Ola Electric, JBM Auto and Olectra Greentech witnessed shares increase by over 8.2% following the launch of the PM E-drive scheme which has a budget of Rs 10,900 crore for two years. It aims to support 2.48 million electric two-wheelers along with 31,60,00 three-wheelers and 14,000 e-buses. Technological advancements in battery efficiency and range enhance vehicle performance addressing range anxiety and improving user experience. Rising fuel prices make electric alternatives more economically attractive. Rapid urbanization and traffic congestion favor the use of two wheelers for their maneuverability and efficiency.

The United States electric two-wheeler market is driven by several key factors. Growing environmental awareness and the commitment to reduce greenhouse gas (GHG) emissions encourage consumers to choose electric options. Federal and state incentives including tax credits and rebates make electric two-wheelers more affordable and attractive. Advances in battery technology enhance range and performance addressing range anxiety and improving user experience. Rising fuel prices increase the economic appeal of electric alternatives. Urbanization and traffic congestion in major cities boost demand for compacta and efficient transportation. The expansion of charging infrastructure, increasing consumer acceptance and supportive regulatory frameworks further propel the adoption of electric two-wheelers in the United States. For instance, in August 2024, the Biden-Harris Administration announced $521 million in grants to expand the national electric vehicle (EV) charging network deploying over 9,200 charging ports across 29 states and eight Tribes. Since their tenure began publicly available chargers have doubled to over 192,000, with around 1,000 new chargers added weekly.

Electric Two-Wheeler Market Trends:

Rise of Electric Vehicles in the Automotive Industry

Electric vehicles are rapidly gaining traction within the automotive industry, driven by mounting environmental concerns, increased government support, and a significant surge in global sales. As countries around the world implement stricter emission regulations and offer incentives for cleaner energy options, the adoption of electric vehicles has accelerated. Global EV Outlook 2025 by IEA suggests that electric two/three-wheelers will account for a third of all sales by 2030 in Southeast Asia, where they represent an important mode of road transport, marking a pivotal milestone in the shift toward sustainable transportation. Governments are increasingly providing subsidies, tax credits, and infrastructure investments to support the transition, which, combined with growing consumer demand for greener alternatives, is propelling the growth of the EV market.

Increasing Issues Pertaining to Traffic Congestion

The increasing traffic congestion is significantly contributing to the product demand. According to reports, the International Transport Forum estimates traffic congestion to cost an average 1% of GDP to more congested urban economies. As urban areas become more crowded with vehicles commuting times and frustrations related to traffic congestion have intensified. Electric two-wheelers offer a practical solution for navigating through congested streets more efficiently. Electric two-wheelers are compact and highly maneuverable allowing riders to weave through traffic and find alternative routes easily. They can bypass long lines of stationary vehicles and reach their destinations faster making them an appealing choice for urban commuters seeking to avoid the delays and frustrations associated with traffic congestion. The convenience and agility of electric two-wheelers in navigating through traffic congestion reduce commuting times and alleviate the stress and frustration associated with being stuck in traffic. As a result, more individuals are opting for electric two-wheelers as a means of transportation contributing to the growing demand for these vehicles.

Rising Trend of Cycling in Fitness and Leisure Activities

The rise in cycling for fitness and recreational purposes is a key factor driving the expansion of the electric two-wheeler market. According to an article, there are around 1 billion bicycles in use globally reflecting cycling's popularity as a fitness and leisure activity. Cycling has gained popularity as a form of exercise and leisure activity due to its numerous health benefits and the increasing focus on leading an active lifestyle. Electric two-wheelers such as electric bicycles provide an attractive option for individuals who want to engage in cycling but may face challenges such as physical fitness limitations or hilly terrains. The electric assistance offered by these vehicles allows riders to overcome physical exertion barriers and tackle challenging routes. For fitness enthusiasts electric two-wheelers offer the flexibility to adjust the electric motor’s level of assistance allowing riders to customize their workout intensity. This versatility makes e-bikes suitable for individuals of varying fitness levels enticing more people to incorporate cycling into their fitness routines. The utilization of electric two-wheelers for recreational activities has expanded due to their enhanced range and battery life. Riders can explore longer distances and engage in outdoor adventures without the worry of fatigue or the need for excessive physical exertion. This opens up new possibilities for weekend getaways, scenic rides and exploring nature contributing to the growth of the electric two-wheeler market.

Rising Demand for Eco-friendly Vehicles

The rising demand for ecofriendly vehicles is positively influencing the market. According to the International Energy Agency (IEA), global electric vehicle (EV) sales reached 10 million units in 2022 reflecting a 55% growth from 2021. With increasing awareness about environmental concerns there has been a growing emphasis on reducing carbon emissions and mitigating the impact of transportation on the planet. Electric two-wheelers offer a sustainable and ecofriendly alternative to conventional petrol or diesel-powered vehicles. They emit no pollutants from the tailpipe leading to lower air pollution levels and enhancing air quality in city environments. The increasing interest in environmentally friendly vehicles is fueled by the goal of decreasing reliance on fossil fuels. Electric scooters and motorcycles run on electricity which can be produced using renewable energy sources like solar or wind energy. This approach lessens dependence on limited fossil fuel supplies and encourages the use of cleaner energy alternatives.

Advancement in Battery Technology

Ongoing advancements in battery design and materials are changing the performance of electric two-wheelers. Enhanced charge density enables batteries to hold greater energy in small units, increasing travel distance without significant weight addition. Manufacturers now offer flexible charging options, including portable chargers and home-based stations, giving users greater convenience and confidence. Research into advanced batteries, including silicon anode, lithium-sulfur, and solid-state types, offer quicker charging times and extended durability. For example, in 2025, Yadea unveiled its new electric two-wheeler in Hangzhou, featuring innovative sodium-ion battery technology. These developments make electric two-wheelers more reliable and practical for everyday use. By overcoming limitations linked to range, charging time, and battery durability, advances in battery technology play a crucial role in increasing user acceptance and accelerating the transition to cleaner urban mobility.

Government Incentives and Support Measures

Numerous national and local governing authorities offer direct purchase grants, tax breaks, and lower registration fees to decrease the initial expense of electric scooters and motorcycles. Some regions grant additional benefits, such as access to dedicated lanes or exemptions from congestion charges, making daily commuting more convenient for owners. These measures encourage both manufacturers and buyers to transition away from petrol-powered models. By allocating funds for charging infrastructure and battery swapping networks, authorities further remove barriers to adoption. Such comprehensive support helps establish a stable market environment, promotes domestic production, and aligns with broader environmental goals. Combined, these incentives ensure that electric two-wheelers remain a practical and appealing choice for a wide range of urban riders. In line with this trend, in 2025, Delhi's draft EV Policy 2.0 proposed a subsidy of up to ₹36,000 for the first 10,000 women buying electric two-wheelers. This includes ₹12,000 per kWh (up to 3 kWh) and aims to boost female EV adoption. The policy also outlines broader plans to phase out CNG and fossil fuel vehicles by 2026.

Electric Two-Wheeler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electric two-wheeler market report, along with forecasts at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology and motor placement.

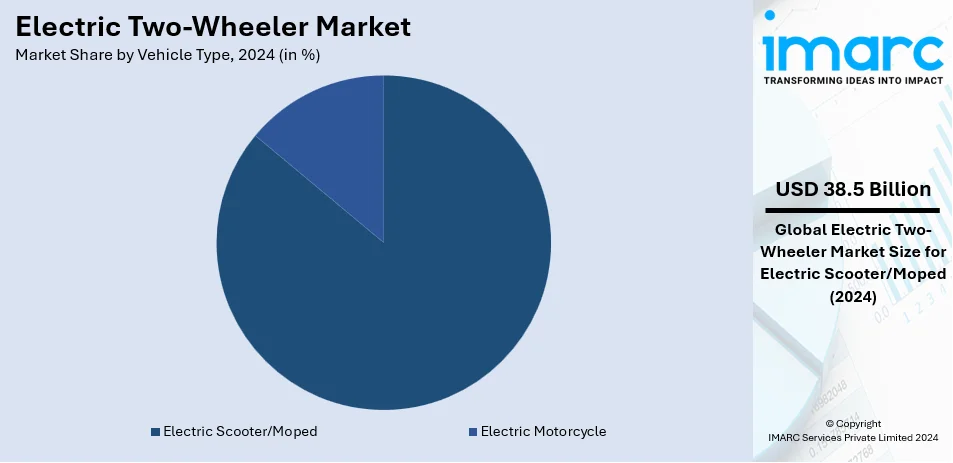

Analysis by Vehicle Type:

- Electric Scooter/Moped

- Electric Motorcycle

Electric scooter/moped leads the market with around 86.4% of market share in 2024.Electric scooters and mopeds have gained immense popularity due to their versatility, ease of use and practicality in urban environments. They offer numerous advantages that resonate with consumers. Offering a cost-effective and efficient transportation solution for short to medium distances, they are particularly well-suited for urban commuting, where traffic congestion and limited parking spaces present common challenges. Furthermore, electric scooters and mopeds are relatively affordable compared to electric motorcycles or cars making them more accessible to numerous consumers. This affordability factor and the growing availability of various models and brands contribute to the segment's dominant market share.

Electric scooters and mopeds are known for their compact size and maneuverability allowing riders to easily navigate through congested city streets. They offer a convenient and agile transportation option enabling riders to reach their destinations quickly and effortlessly. Moreover, electric scooters and mopeds are environmentally friendly producing zero tailpipe emissions and contributing to cleaner air in urban areas. As sustainability and eco-consciousness continue to prominence the demand for electric scooters and mopeds as ecofriendly transportation solutions is further driving market growth.

Analysis by Battery Type:

- Lithium-Ion

- Sealed Lead Acid (SLA)

Sealed Lead Acid (SLA) leads the market with around 74.6% of electric two-wheeler market share in 2024. Sealed Lead Acid (SLA) batteries dominate the electric two-wheeler market due to their cost-effectiveness and widespread availability. These batteries offer a lower upfront cost compared to lithium-ion alternatives making them attractive for budget conscious consumers in price sensitive markets. SLA batteries are known for their robust design, easy recyclability and reliable performance in standard conditions. Their established supply chain and compatibility with existing charging infrastructure further contribute to their dominance. Despite their heavier weight and shorter lifespan compared to advanced options SLA batteries continue to be the preferred choice in regions where affordability outweighs the need for higher energy density or longer cycle life.

Analysis by Voltage Type:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

48-60V leads the market with around 60.4% of market share in 2024. The 48-60V segment represents a range of mid-power electric two-wheelers that provide a balance between affordability and performance. These vehicles offer higher speed capabilities and increased range compared to <48V counterparts. They are suitable for urban commuting and have gained popularity among riders who require slightly more power and versatility in their electric two-wheelers. With the rising demand for ecofriendly transportation solutions and government incentives promoting electric vehicles the 48-60V category continues to attract consumers seeking a practical and cost-effective alternative for daily transportation needs.

Analysis by Peak Power:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

The <3 kW segment represents low power electric two wheelers often used for short distance commuting, urban travel or recreational purposes. These vehicles offer an affordable and efficient mode of transportation making them popular among budget conscious consumers and those seeking ecofriendly alternatives.

Furthermore, the 3-6 kW segment caters to mid power electric two-wheelers that balance affordability and performance. These vehicles offer improved acceleration, increased range and higher speeds than lower power options. They appeal to riders who require more power for commuting in urban areas or for longer distances.

Moreover, the 7-10 kW segment represents electric two wheelers with higher power output. These vehicles offer enhanced performance, greater speed capabilities and increased range. They are popular among riders who desire power and versatility for daily commuting or leisure activities.

Additionally, the>10 kW segment targets high-performance electric two-wheelers designed for enthusiasts and riders seeking top-notch power and performance. These vehicles often feature advanced technology, superior components and cutting-edge design. They cater to riders prioritizing speed, acceleration and a thrilling riding experience.

Analysis by Battery Technology:

- Removable

- Non-Removable

Non-removable leads the market with around 69.8% of market share in 2024. Non-removable batteries also known as integrated or built-in batteries are directly integrated into the electric two-wheeler's frame and cannot be removed or replaced by the user. The dominance of the non-removable battery segment can be attributed to several factors. Non-removable batteries offer a streamlined design seamlessly integrated into the vehicle's overall structure. This integration enhances the aesthetic appeal and overall functionality of electric two wheelers.

Furthermore, these batteries provide better security against theft or tampering. Since they are securely built into the vehicle the risk of battery theft is significantly reduced. This factor contributes to consumer confidence and encourages the adoption of electric two-wheelers. Moreover, non-removable batteries are more convenient for everyday use. Users do not have to worry about carrying an extra battery or finding charging facilities for a separate battery pack. This ease of use appeals to consumers who prioritize convenience and simplicity in their daily transportation needs.

Additionally, continual advancements in battery technology have led to improved energy storage and range capabilities of non-removable batteries. Manufacturers have been able to integrate higher capacity batteries into electric two-wheelers enabling longer travel distances and reducing range anxiety.

Analysis by Motor Placement:

- Hub Type

- Chassis Mounted

Electric two-wheelers with hub-mounted motors have gained popularity due to their compact design and efficient power delivery. These motors are integrated into the wheels providing direct power transmission and eliminating the need for a separate drivetrain. Hub motors offer advantages such as better torque control, regenerative braking and improved handling. They also allow for more design flexibility and enable the integration of features like all-wheel drive or independent wheel control. The hub type segment appeals to consumers seeking compact and agile electric two wheelers with enhanced performance and handling capabilities.

Moreover, the chassis-mounted systems feature electric motors mounted on the frame or chassis of the vehicle. This configuration provides advantages such as improved weight distribution, better stability and easier maintenance access. Chassis-mounted motors are commonly found in electric motorcycles and high-performance electric scooters catering to riders prioritizing power, speed and overall performance. These systems often offer greater customization options and are favored by enthusiasts looking for dynamic riding experiences. Manufacturers can cater to different riding preferences and requirements by segmenting electric two-wheelers based on motor placement.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 97.3%. The Asia Pacific region emerged as the largest market and several factors contributed to its growth. The growing environmental concerns played a crucial role in adopting electric two-wheelers. As countries in the region grapple with air pollution and its impact on public health consumers increasingly opt for ecofriendly transportation solutions such as electric two-wheelers to reduce their carbon footprint.

In addition to this, supportive government initiatives and policies have promoted the use of electric vehicles including two wheelers throughout the Asia Pacific region. Authorities have implemented subsidies, tax benefits and infrastructure development strategies to foster the adoption of electric mobility. These encouraging actions have rendered electric two wheelers more available and affordable for consumers thereby contributing to market expansion.

Moreover, the region has witnessed significant advancements and innovations in battery technology a crucial component of electric two-wheelers. The appeal of electric two-wheelers among consumers has been enhanced by the development of high-performance batteries that offer longer ranges, faster charging times, and greater durability.

Key Regional Takeaways:

North America Electric Two-Wheeler Market Analysis

North America’s electric two-wheeler market is rapidly expanding fueled by increasing environmental awareness and robust government support across the United States, Canada, and Mexico. In the United States federal incentives and significant investments in charging infrastructure are accelerating the adoption of electric scooters and motorcycles. Canada complements this growth with substantial subsidies and grants aimed at reducing carbon emissions while Mexico is witnessing a surge in electric two-wheeler use in its growing urban areas. Key players like Zero Motorcycles, Gogoro and emerging local startups are driving innovation and offering diverse models to meet consumer demands. Factors such as rising fuel prices, urban congestion and a shift towards sustainable transportation are further propelling market growth.

United States Electric Two-Wheeler Market Analysis

In 2024, United States accounted for a share of 81.90% of the North America market. The electric two-wheeler market in the United States is witnessing significant growth with an increased demand towards sustainable transportation solutions and the government's incentives. As reported by the U.S. Department of Energy, sales of electric two-wheelers are expected to surpass 400000 units in 2024 due to the increased interest of consumers towards an ecofriendly mode of mobility and the reduced dependence on fossil fuels. Federal efforts including USD 7.5 billion for charging infrastructure for electric vehicles are important to support adoption in part by easing one of the main hindrances to growth for electric vehicles-charging availability. California still leads all markets with nearly 40% of U.S. electric two-wheeler sales in 2023 because of the state's strict emission standards and far-reaching incentives. Another force that is propelling the market forward are electric models by manufacturers like Zero Motorcycles and Harley-Davidson. Urban congestion, fuel price hikes and also an efficient, cost-effective alternative to traditional fuel-powered commuting for an urban commuter make electric two-wheelers the perfect option. The US is gradually positioning itself as the world leader in this category.

Europe Electric Two-Wheeler Market Analysis

Strict environmental regulations and government incentives and awareness among the consumers in Europe have been driving the electric two-wheeler market. According to an industrial report, in its European Electric Motorcycle Market it projects that the market is growing with a compound annual growth rate (CAGR) of 28% from 2023 to 2030. More than 77,671 units were sold in the year 2023 itself and those sales happened especially in countries such as the Netherlands, France and Germany which take strong encouragement from incentives and policies implemented for this purpose. The European Union's Green Deal along with all its efforts for carbon reduction while aiming at transportation supports these developments. The key players are BMW Motorrad, KTM, and Peugeot they are innovating further and consumers are welcoming advanced battery technologies and improved range capabilities. Growth in the popularity of shared mobility platforms and electric scooter rentals in cities is further driving market expansion.

Latin America Electric Two-Wheeler Market Analysis

With various government initiatives, environmental consciousness and increasing urbanization the electric two-wheeler market is seeing growth in Latin America. As per an industrial report, Brazil is the region's largest market for electric two-wheelers with a sale of over 90,000 units in the year 2023. The government has been able to introduce tax incentives and subsidies for electric vehicles particularly including two-wheelers as important in expanding the market. With traffic congestion on roads and fuel price hoppers consumers are gravitating more towards electric two-wheelers as a cost-effective ecofriendly alternative. Companies such as Voltz Motors and Super Soco expand its operations in Brazil and Argentina offering affordable electric two-wheeler options which drive this demand. Moreover, increasing investment in the construction of charging infrastructure speeds the penetration of electric two-wheeler adoption across this geography.

Middle East and Africa Electric Two-Wheeler Market Analysis

The Middle East and Africa markets for electric two wheelers expand slowly due to a combination of such factors as government initiatives and rising fuel prices. Meanwhile, the International Energy Agency indicated that electric two-wheeler adoption in the region is expected to grow by around 15% annually from 2024 onwards. Countries like the UAE and South Africa are on the frontline while the former targets sustainable transportation solutions with incentives towards electric vehicles. In Africa, Nigeria and Kenya lead by example with demand for electric motorcycles where Ampersand and EcoBici top the charts of providing affordable electric two wheelers to the markets.

Competitive Landscape:

Top companies are crucial in driving market growth through various strategies and initiatives. Recognizing the potential of the market, these companies have taken proactive measures to capitalize on the rising demand for sustainable transportation solutions. Additionally, they are making substantial investments in research and development to advance electric vehicle technologies, with a focus on enhancing battery performance, range, charging infrastructure, and overall efficiency. These advancements are key drivers in attracting consumers who value enhanced features and capabilities in electric two-wheelers. Moreover, top companies are expanding their product portfolios to cater to a wide range of customer preferences and needs. They are introducing diverse models, designs, and price points to attract different market segments. By offering options such as electric scooters, motorcycles and bicycles they can appeal to a broader customer base. Besides, these companies actively collaborate with governments, organizations, and other stakeholders to promote electric mobility. They are participating in incentive programs, forming partnerships for infrastructure development and advocating for favourable policies and regulations. Additionally, top companies are investing in marketing and awareness campaigns to educate consumers about the benefits of electric mobility. They highlight the environmental advantages, cost savings and convenience of electric two-wheelers to generate interest and increase adoption.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AIMA Inc.

- Ather Energy Limited

- Bajaj Group

- BMW AG

- Greaves Electric Mobility Limited

- Helbiz

- Jiangsu Xinri E-Vehicle Co., Ltd

- Kawasaki Motors Corp., U.S.A

- Niu International

- Ola Electric Mobility Ltd

- TVS Motor Company

- Vmoto Limited

- Yadea Technology Group Co., Ltd

- Zero Motorcycles Inc.

Latest News and Developments:

- April 2025: Ampere Electric Scooters launched Ampere.AI, India’s first EV AI buddy, revolutionizing electric vehicle customer support. This AI-powered assistant offers 24/7 real-time, accurate information on Ampere’s electric scooter range, pricing, specifications, and dealer locations. It guides users in making informed purchase decisions and engages in discussions on sustainability and cost savings from switching to electric vehicles. Designed with a simple, user-friendly interface, Ampere.AI enhances the EV buying experience by providing seamless, personalized support.

- March 2025: Microchip Technology launched its Electric Two-Wheeler (E2W) ecosystem, a comprehensive suite of pre-validated reference designs to accelerate development of e-scooters and e-bikes. The ecosystem offers scalable, automotive-grade solutions addressing power efficiency, system integration, safety, and time-to-market. Key features include advanced battery management, high-efficiency power conversion, fast charging designs, high-performance motor control, smart vehicle control units, and connected user interfaces with cloud diagnostics. These modular, flexible solutions enable manufacturers to build reliable, feature-rich electric two-wheelers faster and more efficiently.

- March 2025: Hero MotoCorp announced plans to invest up to INR 525 crore (USD 61 million) in electric vehicle manufacturer Euler Motors, acquiring a 32.5% stake through primary and secondary investments. The deal involves purchasing equity shares and Series D compulsory convertible preference shares. Euler Motors operates in over 30 Indian cities, and manages more than 500 charging hubs in major locations like Delhi NCR, Hyderabad, and Bengaluru.

- March 2025: Yadea unveiled its latest smart electric motorcycle, the Velax, at the Bangkok International Motor Show (BIMS). The Velax stands out for its advanced technology, including smart features and fast-charging capabilities, positioning it as a modern, eco-friendly option for urban mobility.

- February 2025: Ola Electric entered the electric motorcycle segment with the launch of the Roadster X series, featuring five variants. Deliveries started mid-March, aiming to boost EV adoption in India’s growing electric two-wheeler market. The Roadster X offers battery options from 2.5kWh to 9.1kWh, all backed by a three-year/50,000 km warranty. Ola leverages in-house battery tech and a direct-to-customer model with 800+ stores nationwide.

- January 2025: Greaves Electric Mobility Limited (GEML) launched the Ampere Magnus Neo, an enhanced electric scooter variant. Building on the Magnus EX, it offers improved style with five dual-tone colors, a top speed of 65 kmph, 12" alloy wheels for durability, and a 5-year/75,000 km battery warranty. Featuring a 100+ km certified range, three riding modes including reverse, portable battery, USB charging, and optional smart connectivity, it aims to provide affordable, eco-friendly, and comfortable urban commuting nationwide.

Electric Two-wheeler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Netherlands, Norway, China, Japan, India, South Korea, Australia, Brazil, Mexico,Turkey, Saudi Arabia, Egypt |

| Companies Covered | AIMA Inc., Ather Energy Limited, Bajaj Group, BMW AG, Greaves Electric Mobility Limited, Helbiz, Jiangsu Xinri E-Vehicle Co., Ltd, Kawasaki Motors Corp., U.S.A, Niu International, Ola Electric Mobility Ltd, TVS Motor Company, Vmoto Limited, Yadea Technology Group Co., Ltd, Zero Motorcycles Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electric two-wheeler market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global electric two-wheeler market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the electric two-wheeler industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

An electric two-wheeler is a motorized vehicle with two wheels that operates on electric power. These vehicles include electric scooters, mopeds, and motorcycles, offering an eco-friendly alternative to traditional gasoline-powered two-wheelers by utilizing rechargeable batteries and electric motors for propulsion.

The electric two-wheeler market was valued at USD 44.5 Billion in 2024.

IMARC estimates the global electric two-wheeler market to exhibit a CAGR of 11.0% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for electric two-wheelers.

In 2024, Electric Scooters and Mopeds represented the largest segment by vehicle type, driven by their versatility, affordability and practicality in urban environments.

Sealed Lead Acid (SLA) leads the market by battery type owing to its low cost, durability, and established recycling infrastructure.

The 48-60V is the leading segment by voltage type, driven by its balance of performance, range, and affordability for urban commuting.

Non-removable leads the market by battery technology owing to streamlined design, enhanced security, and improved durability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global electric two-wheeler market include AIMA Inc., Ather Energy Limited, Bajaj Group, BMW AG, Greaves Electric Mobility Limited, Helbiz, Jiangsu Xinri E-Vehicle Co., Ltd, Kawasaki Motors Corp., U.S.A, Niu International, Ola Electric Mobility Ltd, TVS Motor Company, Vmoto Limited, Yadea Technology Group Co., Ltd, Zero Motorcycles Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)