Electronic Ceramics Market Size, Share, Trends and Forecast by Material, Application, End User, and Region, 2025-2033

Electronic Ceramics Market Size and Share:

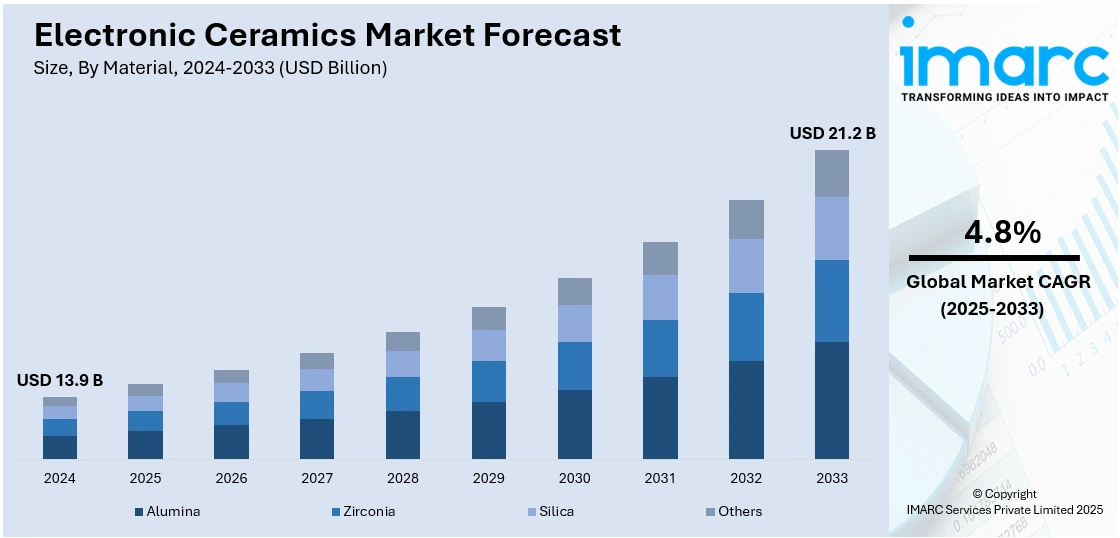

The global electronic ceramics market size was valued at USD 13.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.2 Billion by 2033, exhibiting a CAGR of 4.8% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 48.7% in 2024. The market is driven by rising demand for advanced electronic devices, including smartphones, wearables, and IoT systems. Significant growth in 5G technology, renewable energy solutions, and electric vehicles is further propelling demand for high-performance ceramics due to their superior thermal, mechanical, and electrical properties.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.9 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Market Growth Rate 2025-2033 | 4.8% |

The global electronic ceramics market is primarily driven by increasing demand for advanced electronic devices and components across industries such as telecommunications, automotive, and healthcare. The growing adoption of 5G technology, as well as the proliferation of smart devices, has resulted in an increased demand for high-performance ceramics known for their superior electrical properties, reliability, and durability. On September 18, 2024, Murata Manufacturing announced the launch of the world's smallest multilayer ceramic capacitor (MLCC), with dimensions of just 0.16mm × 0.08mm, designed especially for miniaturized electronic devices. In order to meet the quickly growing need for smaller components in wearables, smartphones, and the Internet of Things, the service maximizes space savings while offering exceptional performance. An illustration of Murata's continuous efforts to advance ceramic capacitor technology is this system. Ceramic materials can now be used in electronics thanks to developments in renewable energy technologies including solar panels and energy storage systems. The market will continue to expand due to the growing trend of electronic components shrinking and the emphasis on energy efficiency. The market potential in the global market will also be expanded by greater expenditure in research and development to produce innovative ceramic materials for novel uses.

The United States stands out as a key regional market, primarily driven by robust growth in the aerospace and defense sectors, where high-reliability components are critical. The country's strong emphasis on advanced manufacturing technologies, coupled with the increasing application of ceramic materials in electric vehicles (EVs) and energy storage systems, is propelling demand. Government initiatives that support local semiconductor manufacturing and innovation are enhancing the use of electronic ceramics in integrated circuits and sensors. In addition, the growing reliance of the healthcare industry on advanced medical devices and imaging technologies is also driving market growth. The increased consumer demand for wearable technology and Internet of Things (IoT) devices, coupled with a focus on reducing energy consumption in electronics, makes it possible to sustain improved development and application of electronic ceramics in many areas.

Electronic Ceramics Market Trends:

Expanding Role of Electronic Ceramics in Aerospace and Consumer Electronics

The aerospace industry’s rapid expansion globally is significantly driving the adoption of electronic ceramics. These materials are crucial in components such as sensors, lighting systems, high-intensity discharge lamps, LEDs, laser lighting, and antennas used in gliders, UAVs, and lighter-than-air crafts. The global LED lighting market, valued at USD 90.3 Billion in 2024, highlights the importance of this sector in driving demand for advanced ceramics. Simultaneously, the integration of electronic ceramics in consumer electronics, including smartphones, computers, and controllers for signal reception and voice transmission, continues to propel market growth. Moreover, global smartphone shipments recorded a 6.4% year-on-year increase in the second quarter of 2024, further reflecting this trend.

Increasing Focus on Sustainability and Energy Efficiency

The electronic ceramics market is witnessing an increase in demand, largely due to its integral role in sustainability and energy-efficiency programs. The shift from fossil fuels to renewable energy technologies, such as solar panels and certain types of wind turbines, is putting a strain on the supply of high-performance ceramic-based components in energy storage and energy conversion uses. The use of electronic ceramics is steadily increasing in products and technologies that are meant to improve the efficiency of economized energy. As governments and industries around the world enact more stringent energy policies, it stands to reason that this trend will continue. Additionally, when looking only at the product dimensions of sustainability, research initiatives exploring recyclable and environmentally friendly ceramic materials will facilitate innovation by addressing environmental issues and simultaneously moving with sustainability targets globally. As many of these innovations are transformative innovations, the rising importance of electronic ceramics in facilitating a more sustainable technology landscape is becoming apparent.

Advancements in Ceramic Manufacturing Processes

Advances in manufacturing processes are transforming electronic ceramics production and quality. Novel processes, including 3D printing and sophisticated sintering technologies, are allowing the production of intricate ceramic geometries with increased accuracy and efficiency. These advancements lower costs of production, increase scalability, and facilitate the customization of ceramics for niche applications across industries. Additionally, the use of nanotechnology in ceramic design is further enhancing their characteristics, such as conductivity, thermal stability, and strength. This revolution in the manufacturing process is enhancing product capabilities and the reach of the market by providing customized solutions to meet the needs of various industries.

Electronic Ceramics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global electronic ceramics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, application, and end user.

Analysis by Material:

- Alumina

- Zirconia

- Silica

- Others

Alumina is the market leader due to its superior thermal conductivity, electrical insulation, and mechanical properties. It is widely used in semiconductors, circuit boards, and resistors with high reliability and performance in harsh applications such as power electronics and telecommunication, where efficiency and longevity are indispensable. Further, the flexibility of alumina increases its attraction to high-tech ceramics and other industrial uses, solidifying its market leadership position.

Analysis by Application:

- Capacitors

- Data Storage Devices

- Optoelectronic Devices

- Actuators and Sensors

- Power Distribution Devices

- Others

Electronic ceramics are essential for capacitors, with outstanding dielectric strength and thermal stability. Applications range from consumer electronics, automotive systems, and industrial machinery, ensuring reliable energy storage and release. The demand for advanced capacitors is increasing, with the growth of electric vehicles and renewable energy technologies. The trend towards miniaturized electronic components and the quest for greater energy efficiency in various fields also drives this increasing demand.

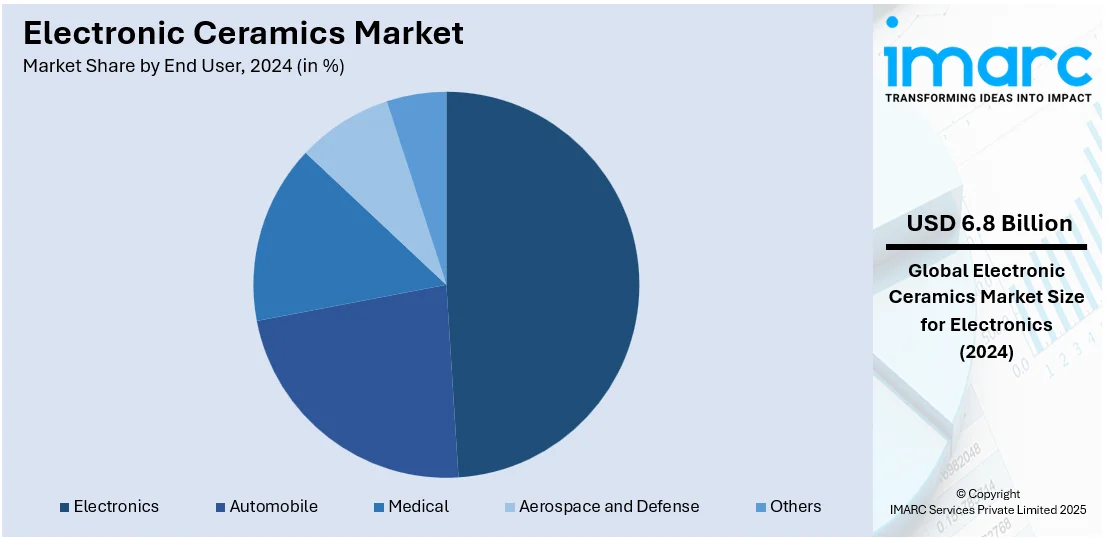

Analysis by End User:

- Electronics

- Automobile

- Medical

- Aerospace and Defense

- Others

Electronics leads the market with around 48.7% of market share in 2024, driven by the rapid advancements in consumer and industrial electronics. Electronic ceramics are essential in the manufacture of capacitors, resistors, sensors, and substrates that offer high thermal stability, electrical insulation, and mechanical strength. The growing need for smaller and energy-efficient devices, including smartphones, wearables, and Internet of Things (IoT) devices, is fueling the use of these materials. In addition, the growth of 5G technology and the growing demand for semiconductors and high-end circuit boards further increase their significance. As electronics become smaller and more advanced, the reliance on high-performance ceramics to enhance durability, reliability, and functionality keeps increasing, solidifying this segment's position as a key market driver.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 48.7%, driven by its dominance in electronics manufacturing and rapid industrialization. Countries such as China, Taiwan, Japan, and South Korea are among the major hubs for producing electronic devices and semiconductors, creating demand for high-performance ceramics. The region's high growth in consumer electronics, automotive, and telecommunication sectors, especially with the emergence of 5G and IoT technology, has a significant role to play in its market leadership. In addition, an established manufacturing base, coupled with government policies encouraging technological innovation and renewable energy technologies, enhances the use of electronic ceramics. The increase in middle-class inhabitants and increasing demand for high-level electronic devices makes Asia Pacific's position as an essential regional market even more sound.

Key Regional Takeaways:

United States Electronic Ceramics Market Analysis

In 2024, the US accounted for around 85.80% of the total North America electronic ceramics market. The American market for electronic ceramics is experiencing impressive growth partially as a result of the heavy usage of cloud computing technology. Statistics indicate that 98% of American businesses have incorporated the inclusion of cloud services into their business operations. Increased demand for cloud services is driving demand for high-level electronic components, most prominently ceramics applied exclusively in data centers and telecommunication infrastructure. The fast pace of developments in technologies such as 5G, artificial intelligence, and the Internet of Things is also influencing innovation in ceramic-based semiconductors and sensors capable of meeting the performance requirements of contemporary electronics. Furthermore, the expansion of electric vehicle technology and the mounting demand for renewable energy systems will further favor ceramic capacitors and power modules to facilitate reliability and efficiency in operation. The CHIPS and Science Act meant to advance domestic production of semiconductors, will also be helpful for the market. Further, the ongoing trend towards device miniaturization and demand for energy-saving solutions in high-end ceramic technologies are driving research and development of these technologies and thereby fueling market growth.

Asia Pacific Electronic Ceramics Market Analysis

The electronic ceramics market in the Asia-Pacific region benefits from the rapid adoption of cloud services in developed markets such as Australia, Japan, New Zealand, and Singapore, where over 70% of businesses utilize cloud technology, according to the ADB Institute. Thus, the advanced ceramic components are used in increasing data centers and telecommunication structures. Cloud uptake in emerging economies remains under 30% for the likes of India, Indonesia, and the Philippines, signifying great potential, as ever faster digital transformation spreads through these regions. In addition, other growth drivers propelling demand for electronic ceramics include the rollout of 5G technology, expanding EV production, and the growing use of renewable energy systems. Major manufacturing hubs including China, Japan, and South Korea, with support from government initiatives and technology progressions, continue to play a decisive role in sustaining market growth.

Europe Electronic Ceramics Market Analysis

The European market for electronic ceramics is driven by sustainability and technological advancement developments, particularly in the electric vehicle (EV) sector. As per International Energy Agency (IEA), new electric car registrations in Europe reached 3.2 Million in 2023, representing a 20% rise from 2022. This brings about a higher demand for ceramic-based devices, including capacitors, sensors, and power modules, which play a crucial role in electric vehicle battery packaging and energy management systems. German leadership in automotive and industrial innovation is a prime reason for integrating ceramic technologies into high-end electronic systems to increase efficiency and durability. Besides, investments in the production of semiconductors are also being aided by initiatives including the European Chips Act of the European Union, which will drive demand for high-performance ceramic materials. The growth in renewable energy and the expanding demand for medical devices in the region also contribute significantly to this trend since ceramics are a major constituent of diagnostic instruments and implantable devices. The European Court's historical focus on performance and sustainability continues to drive the adoption of cutting-edge ceramic technologies.

Latin America Electronic Ceramics Market Analysis

The electronic ceramics market in Latin America is influenced by socioeconomic disparities, with the World Bank reporting that, as of 2020, the middle class constituted 37.3% of the population, while 38.5% were classified as vulnerable, and 21.8% lived in poverty. Despite these challenges, growth in digital technology adoption and government initiatives to improve infrastructure are driving the need for advanced electronic components in energy networks and industrial automation. Countries such as Brazil and Mexico, major automotive and electronics manufacturing hubs, are fuelling the use of ceramic components in sensors and power modules. Digital connectivity and urbanization are also driving market growth in the segment.

Middle East and Africa Electronic Ceramics Market Analysis

The Middle East's electronic ceramics market is being driven by the region's transformation towards renewable energy and the adoption of cutting-edge technologies. According to Rystad Energy, renewable sources, such as hydro, solar, and wind, energy will make up to 70% of the region's energy by 2050. The shift toward renewables will have an increased German demand for ceramics in power electronics, energy storage, and sensors. In addition to population growth, development mega-projects such as NEOM in Saudi Arabia are driving the demand for advanced electronic materials. Demand for ceramics will also be driven by the increasing market for electric vehicles (EVs) and telecommunications infrastructure growth from rural urbanization and related economic diversification strategies.

Competitive Landscape:

The market for electronic ceramics is characterized by intense competition, fueled by major innovation and strategic initiatives from leading players in the industry. Firms are investing greatly in research and development to develop lightweight, high-performance ceramics with superior thermal, mechanical, and electrical properties to meet a broad variety of application requirements. Partnerships and collaborations are being formed in order to implement advanced manufacturing technologies, such as 3D printing and nanotechnology, that will provide cost-effective and scalable production processes. In addition, top companies are expanding their international presence through mergers and acquisitions, investments in domestic manufacturing bases, and sound supply chain management. There is also a growing focus on sustainability, with strategies that aim to create eco-friendly ceramic solutions in compliance with regulatory requirements and customer needs. Such methods enable firms to sustain their competitiveness in an environment of continually changing market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Almatis GmbH

- American Elements

- APC International Ltd.

- Central Electronics Limited

- CeramTec GmbH

- Compagnie de Saint-Gobain S.A.

- CoorsTek Inc.

- Ferro Corporation

- Ishihara Sangyo Kaisha Ltd.

- Noritake Co. Limited

- Physik Instrumente (PI) GmbH & Co. KG.

- Sensor Technology Ltd.

- Venator Materials PLC (Huntsman Corporation)

Latest News and Developments:

- September 2024: Murata Manufacturing introduced the first 006003-inch multilayer ceramic capacitor (MLCC), measuring 0.16 mm x 0.08 mm. The design was modelled to provide minuscule components in restricted devices such as mobile phones and is consistent with a move toward high-density electronic assemblies.

- July 2024: Cerabyte introduced Ceramic Nano Memory to the U.S., providing recyclable ceramic-on-glass storage with indefinite retention and no energy use. This technology allows quick read/write operations and lower archival costs.

- June 2024: CeramTec introduced its new product, Sinalit®, shortly before the PCIM Europe power electronics trade fair in Nuremberg. This product launch extends the portfolio of this company with silicon nitride-based substrates, therefore giving an indication of CeramTec's continued commitment to developing a ceramics potpourri aligned with the changing demands of the power electronics industry.

- April 2024: SCHOTT launched projects to recycle used specialty glass and glass-ceramics, supporting the transition to a circular economy. This initiative aligns with the EU Green Deal's goals of sustainability, resource conservation, and reduced reliance on external raw materials. By focusing on recyclability, SCHOTT aims to advance the electronics ceramics sector's shift from a linear to a circular economy.

Electronic Ceramics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Region |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Alumina, Zirconia, Silica, Others |

| Applications Covered | Capacitors, Data Storage Devices, Optoelectronic Devices, Actuators and Sensors, Power Distribution Devices, Others |

| End Users Covered | Electronics, Automobile, Medical, Aerospace and Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Almatis GmbH, American Elements, APC International Ltd., Central Electronics Limited, CeramTec GmbH, Compagnie de Saint-Gobain S.A., CoorsTek Inc., Ferro Corporation, Ishihara Sangyo Kaisha Ltd., Noritake Co. Limited, Physik Instrumente (PI) GmbH & Co. KG., Sensor Technology Ltd., Venator Materials PLC (Huntsman Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the electronic ceramics market from 2019-2033.

- The electronic ceramics market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electronic ceramics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Electronic ceramics are advanced materials used in electronic components due to their exceptional thermal, mechanical, and electrical properties. They are critical in applications including capacitors, sensors, and energy storage, supporting industries such as telecommunications, automotive, and renewable energy.

The global electronic ceramics market was valued at USD 13.9 Billion in 2024.

IMARC estimates the global electronic ceramics market to exhibit a CAGR of 4.8% during 2025-2033.

The market is driven by increasing demand for advanced electronic devices such as smartphones and IoT systems, adoption of 5G technology, advancements in renewable energy solutions, and the growing need for miniaturized and energy-efficient components in industries such as healthcare and automotive.

Alumina represented the largest segment by material due to its superior thermal conductivity, electrical insulation, and mechanical strength make it essential for high-performance applications.

Capacitors represented the largest segment by material due to their high dielectric strength and thermal stability drive their extensive use in energy storage for electronics and renewable technologies.

Electronics represented the largest segment by end user, driven by rapid advancements in consumer and industrial electronics and the proliferation of miniaturized devices.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market

Some of the major players in the global electronic ceramics market include Almatis GmbH, American Elements, APC International Ltd., Central Electronics Limited, CeramTec GmbH, Compagnie de Saint-Gobain S.A., CoorsTek Inc., Ferro Corporation, Ishihara Sangyo Kaisha Ltd., Noritake Co. Limited, Physik Instrumente (PI) GmbH & Co. KG., Sensor Technology Ltd. and Venator Materials PLC (Huntsman Corporation), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)