Embedded Banking Market Size, Share, Trends and Forecast by Type, Industry Vertical, and Region, 2025-2033

Embedded Banking Market Size and Share:

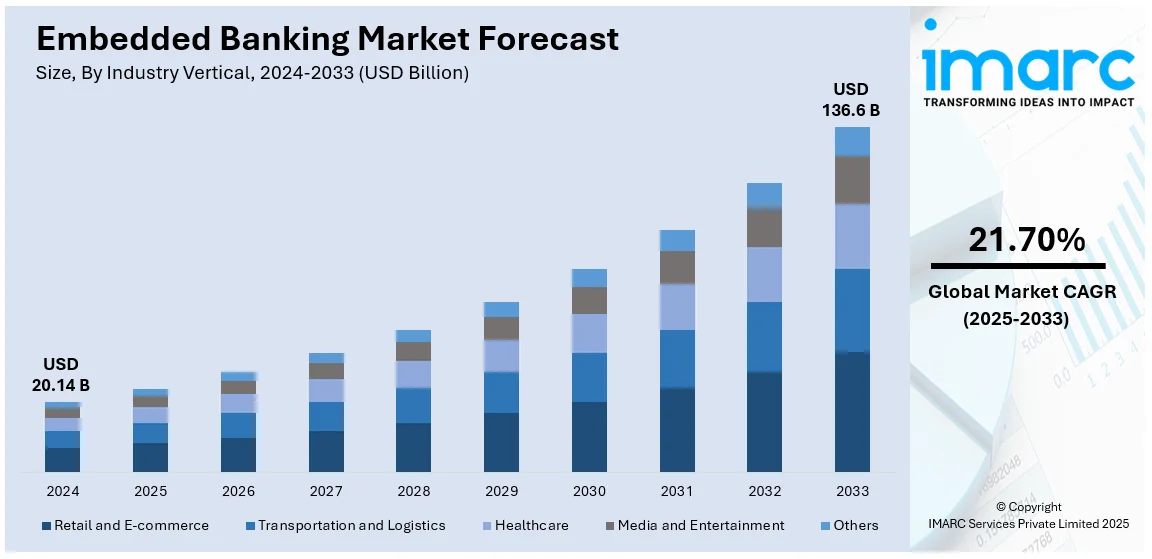

The global embedded banking market size was valued at USD 20.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 136.6 Billion by 2033, exhibiting a CAGR of 21.70% from 2025-2033. North America currently dominates the market, holding a market share of over 36.5% in 2024. In this region, the embedded banking market share is propelled by the increasing adoption of digital payments and fintech solutions, rising demand for seamless and integrated banking experiences, strong growth in e-commerce and online transactions, increased investment in financial technology by traditional banks, and consumer preference for personalized and convenient financial services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.14 Billion |

| Market Forecast in 2033 | USD 136.6 Billion |

| Market Growth Rate (2025-2033) | 21.70% |

The main drivers of the global market for embedded banking include the demand for seamless, holistic digital experiences, which propels businesses toward providing financial services on non-financial platforms, giving consumers more comfort. Moreover, the exponential growth of e-commerce and digital transactions provides a significant drive for the implementation of integrated financial solutions that enable smooth, real-time, and hassle-free payments across online platforms for users. According to the IMARC Group, the global e-commerce market reached USD 26.8 Trillion in 2024 and is projected to reach USD 214.5 Trillion by 2033, exhibiting a CAGR of 25.83% during 2025-2033. Besides this, innovations in fintech, such as blockchain, artificial intelligence (AI), and machine learning (ML), are enriching the ease and accessibility with which embedded banking solutions can become available, giving a faster means of transaction through a secure framework.

The United States has emerged as a key regional market for embedded banking, driven by the transformation of financial services into faster digital modes and increasing demand for smooth, integrated user experiences. Consumers now use e-commerce, mobile apps, and other digital platforms more frequently, and their expectation is to have payments, lending, and savings all integrated into these platforms. Fintech innovations such as blockchain, artificial intelligence (AI), and machine learning (ML) are further augmenting the efficiency and security of embedded banking services. As per a report published by the IMARC Group, the United States fintech market is expected to reach USD 157.9 Billion by 2032, exhibiting a CAGR of 14.67% during 2024-2032. Besides this, the growth in digital payments and online transactions in various sectors also propels the adoption of embedded banking solutions in the United States.

Embedded Banking Market Trends:

Growing demand for seamless digital experiences

The rising demand for seamless and integrated digital experiences across the globe is fueling the embedded banking market growth. Consumers who increasingly use digital platforms for shopping, entertainment, and financial services expect a seamless experience that includes multiple services within one platform. Traditional banking services are evolving toward this demand, integrating banking capabilities such as payments, loans, and savings directly within non-financial applications. This trend allows users to perform financial transactions without leaving their preferred digital environments, thereby enhancing convenience and consumer satisfaction. This frictionless digital experience has inspired businesses to embed banking solutions into their services, driving growth in the market.

Rise of fintech innovations

The rapid increase in fintech innovations is significantly driving the industry. According to the IMARC Group, the global fintech market size reached USD 218.8 Billion in 2024 and is forecasted to reach USD 828.4 Billion by 2033, exhibiting a CAGR of 15.82% during 2025-2033. Fintech companies are pioneering digital-first solutions that offer various banking services, including payment processing, lending, and wealth management, directly from third-party platforms. Through artificial intelligence (AI), blockchain, and machine learning (ML), fintech startups have opened up new avenues for embedded financial services. These innovations make banking faster, more efficient, and more accessible, enabling companies to offer tailored financial products to their consumers and fueling the overall embedding banking market demand.

Changing consumer expectations

Changing consumer expectations significantly influence the embedded banking market outlook. Consumers now want to interact with personalized financial services on demand, tailored to their lifestyles. As the use of mobile phones and online apps is on the rise, there is rising demand for the ability to access necessary financial tools alongside other day-to-day applications. Instead of opening separate bank apps or portals, consumers want instant capabilities for making immediate payments, remittances, and microloans. Under these exigencies, businesses are prompted to implement embedded banking solutions that facilitate a unified, easy experience for the user. With these integrated services offered to consumers, companies enhance their productivity in terms of consumer satisfaction and also acquire useful insights regarding consumer behavior, which further propels the demand for embedded banking across industries.

Embedded Banking Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global embedded banking market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and industry vertical.

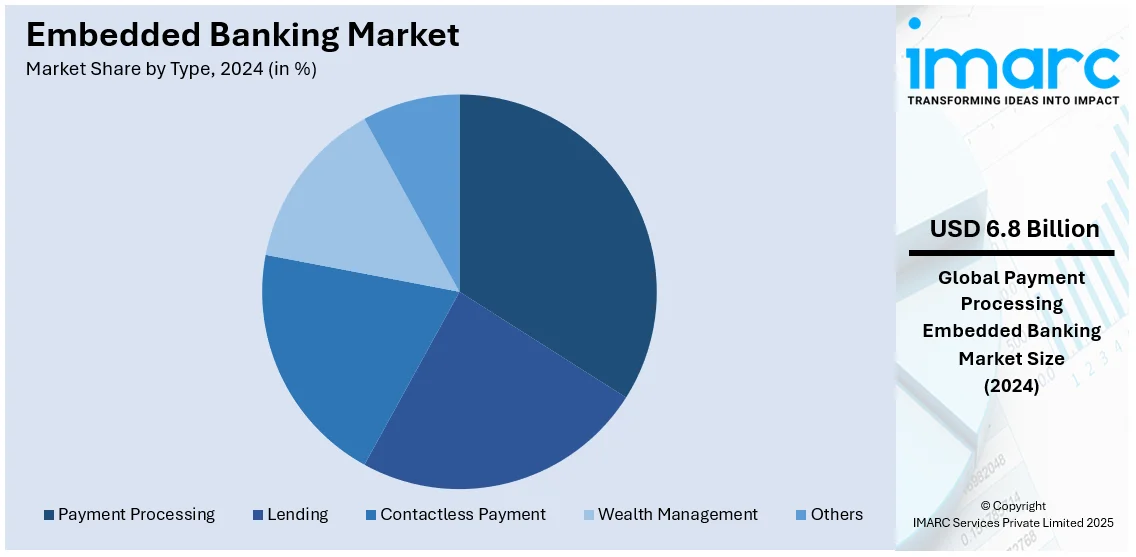

Analysis by Type:

- Payment Processing

- Lending

- Contactless Payment

- Wealth Management

- Others

Payment processing stands as the largest component in 2024, holding around 33.6% of the embedded banking market share. Payment processing is the largest segment in the global embedded banking market because it plays a very important role in making transactions across digital platforms seamless and efficient. As individuals opt more for online shopping, mobile apps, and e-commerce sites, integrated payment solutions are in greater demand. The provision of frictionless transactions on business websites or mobile applications makes user experience smoother, and satisfaction improves accordingly. Other than this, real-time payment, cross-border transactions, and mobile wallets are further adding to the requirement for effective payment solutions. Embedded payment systems also support businesses in adding value-added services such as instant payments, automatic invoicing, and fraud prevention tools. Furthermore, financial institutions and fintech firms continue to evolve payment systems, such as AI-based fraud detection and blockchain, which include payment processing solutions that are becoming more efficient and secure. These make them dominate the market and lead to further adoption across industries.

Analysis by Industry Vertical:

- Retail and E-commerce

- Transportation and Logistics

- Healthcare

- Media and Entertainment

- Others

Retail and e-commerce lead the market with around 41.5% of market share in 2024. Retail and e-commerce are taking the lead in the global embedded banking market, as shopping online is highly in demand by individuals around the world, increasing the demand for seamless financial services. Most consumers now prefer convenient digital platforms instead of visiting other places for financial transactions. Therefore, integrating financial transactions with e-commerce sites or mobile apps has become a business requirement. Embedded banking solutions enable retailers to provide seamless payment processing, instant financing options, and personalized financial services, all within the application, without sending users to external banking systems. This results in a better user experience, less friction, and increased conversion rates. Additionally, digital wallets, buy-now-pay-later options, and subscription-based models within e-commerce further propel the adoption of embedded banking solutions. Retailers and e-commerce platforms can also leverage data from embedded banking to personalize offers, streamline operations, and improve consumer loyalty. As the digital economy expands, embedded banking in retail and e-commerce continues to be a key driver of innovation and market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 36.5%. Key factors driving the North America embedded banking market include the rising adoption of digital payments and fintech solutions. This is prompting traditional banking services to be integrated into digital platforms. With e-commerce continuously on the rise, consumers need more convenient and accessible payment methods, which embedded banking provides. In addition, data analytics-fueled personalized financial services enable companies to offer custom banking solutions directly within non-financial platforms. A preference for seamless, frictionless experiences also fosters demand for embedded banking, particularly in mobile apps and online services. Furthermore, the heavy investments of traditional banks in fintech startups and partnerships with tech companies are encouraging innovation in this space. Lastly, with the regulatory environments in North America becoming more favorable for embedded banking, the potential for market growth is enhanced.

Key Regional Takeaways:

United States Embedded Banking Market Analysis

In 2024, the United States accounts for over 78.60% of the embedded banking market in North America. The United States embedded banking market is primarily driven by changing consumer preferences and technological progress. A vital factor is that consumers increasingly seek digital-first financial solutions, and they expect banks to be present in the existing platforms they already use, be it retail apps, ride-sharing platforms, or social media sites. The main impetus for this shift is driven by speed and convenience. Consumers want faster and more efficient methods of addressing their financial needs, all from a preferred environment, without having to leave. On the regulatory side, the landscape has become more defined with open banking initiatives and the general guidelines related to data sharing, thus giving banks and fintech companies ample room to innovate and cooperate in bringing forward integrated financial services. Moreover, the rapid growth in mobile payment adoption and P2P platforms has increased the demand for embedded banking tools that facilitate real-time transactions. As per a report published by the IMARC Group, the United States mobile payment market size is forecasted to reach USD 3,901.8 Billion by 2032, exhibiting a CAGR of 22.2% during 2024-2032. Thus, the U.S. market for embedded banking is expanding as more businesses include financial services in their offerings, opening up opportunities for traditional financial institutions as well as new entrants such as fintech players.

Europe Embedded Banking Market Analysis

Several factors are contributing to the growth of the Europe embedded banking market, including regulatory advancements. Open banking regulation by the European Union has opened an avenue for combining banking services with non-financial platforms. This fosters more cooperation among fintech and traditional banks, creating the opportunity for more business in embedded financial services. The high level of digital adoption in Europe, particularly in the UK, Germany, and the Netherlands, is also driving the demand for seamless, integrated financial experiences across platforms. Consumer preference for convenience, personalized services, and faster transaction processing further fuels the growth of embedded banking. Moreover, mobile payments, e-commerce, and digital wallets are on the rise in Europe, creating a need for embedded banking solutions that ensure secure, real-time financial transactions. This places Europe as one of the prime markets for innovation and adoption in embedded banking.

Asia Pacific Embedded Banking Market Analysis

The Asia Pacific embedded banking market is driven by rapid digitalization, growing mobile penetration, and increasing adoption of e-commerce across the region. More consumers and businesses are turning to digital platforms, hence increasing the demand for integrated financial services, including payments, lending, and wealth management within apps and websites. The spread of smartphones across China, India, and Southeast Asia further helps this shift in conducting financial transactions with ease. Moreover, embedded banking solutions are also gaining popularity in the Asia Pacific fintech ecosystem, with investments and friendly regulatory frameworks supporting innovation. In addition, a younger population, which is technology-friendly and values convenience and personalization, continues to fuel growth in the region. These factors continue to make the Asia Pacific environment dynamic for embedded banking.

Latin America Embedded Banking Market Analysis

The growth in the Latin America embedded banking market is driven by the increasing digitalization of financial services and the rising penetration of mobile internet. The increased demand for integrated financial solutions within digital platforms has resulted in more consumers in the region shopping, banking, and conducting other services using their smartphones. Increased growth in e-commerce and online transactions further drives this demand as businesses seek to provide smooth payment processing and financial services. Further, the growing fintech ecosystem in the region and financial inclusion are stimulating innovation in embedded banking solutions. The need for convenience and digital-first experience is also growing, which is propelling the growth of embedded banking in Latin America.

Middle East and Africa Embedded Banking Market Analysis

Rapid digital transformation and increased mobile technology adoption in the Middle East and Africa are driving the embedded banking market. With the increase in smartphone and digital platform usage, consumers are demanding more integrated financial services that are convenient and accessible. The growth of e-commerce and online transaction sectors in the region is also driving demand for seamless payment solutions. In addition, fintech innovation is growing, along with the favorable regulatory environment in countries such as the UAE and South Africa, which are encouraging the development of embedded banking solutions. Besides this, the increasing focus on financial inclusion, particularly in under-banked markets, is further stimulating digital and embedded banking services throughout the Middle East and Africa.

Competitive Landscape:

Key players in the embedded banking market are driving growth with strategic partnerships, innovative product offerings, and investments in technology. Traditional banks have entered into alliances with fintech companies to make banking services available directly on digital platforms, hence bringing financial services closer and making them more convenient for consumers. Partnerships are enabling seamless payment, loans, and financial management tools within e-commerce setups and mobile applications. Also, by using AI and data analytics to provide personalized banking solutions, companies are upgrading consumer experiences. These players are significantly contributing to the growth and development of the market by expanding their digital capabilities and aligning with the evolving consumer preference for frictionless services.

The report provides a comprehensive analysis of the competitive landscape in the embedded banking market with detailed profiles of all major companies, including:

- Banxware GmbH

- Cybrid Inc.

- Finastra

- Flywire

- Lendflow

- OpenPayd Services Ltd

- Payrix (Worldpay, LLC)

- Powens

- Railsr

- Tink AB

- Zopa Bank Limited

Latest News and Developments:

- 23 December 2024: Fiserv, a global fintech giant, has completed the acquisition of Payfare Inc., a provider of program management services, to expand its embedded banking capabilities. With this acquisition, Payfare solutions will improve Fiserv’s embedded finance, payments, and lending services and assist in meeting the demands of financial organizations and large corporations.

- 22 October 2024: American fintech company Green Dot has introduced Arc by Green Dot, a new embedded banking platform with a full suite of various embedded finance features. Arc offers customizable, comprehensive solutions that aim to increase the value, retention, and growth of businesses by integrating Green Dot’s financial and processing services on an innovative, one-stop platform.

- 3 October 2024: HSBC, a leading international financial solutions group based in London, has launched a new embedded banking venture, SemFi, which will provide organizations with cutting-edge embedded banking services. The new fintech business is a collaboration between HSBC and Tradeshift, a B2B international trading network.

Embedded Banking Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Payment Processing, Lending, Contactless Payment, Wealth Management, Others |

| Industry Verticals Covered | Retail and E-commerce, Transportation and Logistics, Healthcare, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Banxware GmbH, Cybrid Inc., Finastra, Flywire, Lendflow, OpenPayd Services Ltd, Payrix (Worldpay, LLC), Powens, Railsr, Tink AB, Zopa Bank Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the embedded banking market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global embedded banking market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the embedded banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The embedded banking market was valued at USD 20.14 Billion in 2024.

IMARC estimates the embedded banking market to exhibit a CAGR of 21.70% during 2025-2033.

The rising demand for seamless, integrated financial services, increasing adoption of digital payments and fintech innovations, growth in e-commerce and online transactions, consumer preference for personalized and convenient banking experiences, and strategic partnerships between banks and fintech companies are the primary factors driving the embedded banking market.

North America currently dominates the market due to the rising adoption of fintech solutions and technological advancements in banking solutions.

Some of the major players in the embedded banking market include Banxware GmbH, Cybrid Inc., Finastra, Flywire, Lendflow, OpenPayd Services Ltd, Payrix (Worldpay, LLC), Powens, Railsr, Tink AB, Zopa Bank Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)