Embedded Finance Market Size, Share, Trends and Forecast by Type, Business Model, End Use, and Region, 2025-2033

Embedded Finance Market Size and Share:

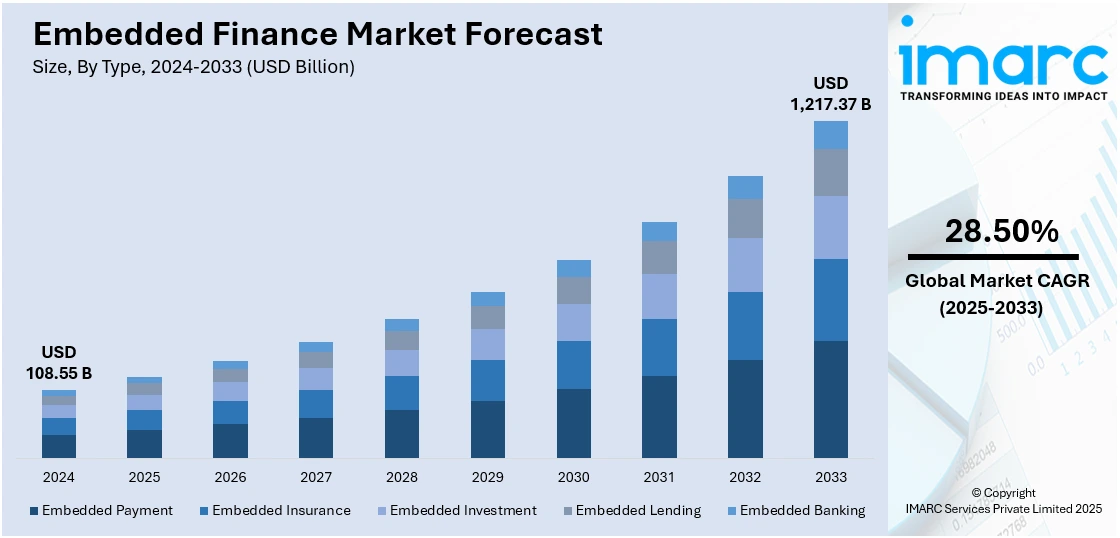

The global embedded finance market size was valued at USD 108.55 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,217.37 Billion by 2033, exhibiting a CAGR of 28.50% from 2025-2033. North America currently dominates the market, holding a market share of 31.5% in 2024. The market is driven by rapid digital transformation, rising fintech adoption, API integration, customer demand for seamless financial services, e-commerce growth, and increased smartphone usage. Moreover, businesses seek to enhance user experience and monetization by embedding payments, lending, insurance, and banking into non-financial platforms which are some of the other key factors driving the embedded finance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.55 Billion |

| Market Forecast in 2033 | USD 1,217.37 Billion |

| Market Growth Rate 2025-2033 | 28.50% |

The rise of digital platforms and mobile-first technologies has made financial services more accessible and seamless. Increasing consumer demand for integrated, real-time financial experiences, such as payments, lending, and insurance, within non-financial platforms is a major driver. Through open banking infrastructure and API adoption, companies can directly add financial services into their systems without constructing a new framework. Additionally, businesses are leveraging embedded finance to boost user engagement, increase revenue streams, and improve customer loyalty. The surge in e-commerce, gig economy platforms, and fintech innovation further accelerates this trend. Regulatory support and partnerships between traditional financial institutions and tech firms also contribute to market expansion.

The embedded finance market growth in the United States is expanding rapidly, driven by several key factors. High smartphone penetration and widespread internet access have enabled seamless integration of financial services into everyday digital platforms. The proliferation of e-commerce has further fueled demand for embedded payments and lending solutions. Additionally, the rise of Banking-as-a-Service (BaaS) models allows non-financial companies to offer financial products, enhancing customer experience and loyalty. Strategic partnerships, such as Walmart's collaboration with JPMorgan to expedite payments for online sellers, exemplify how embedded finance is transforming business operations. For instance, in February 2025, P2P, a cutting-edge digital banking platform designed for the Brazilian community in the US, went live two months ahead of schedule due to a partnership with Mbanq, a world leader in embedded finance and financial technology.

Embedded Finance Market Trends:

Growing Demand for Seamless Financial Services

Consumers increasingly expect financial services to be fast, integrated, and easy to use. Whether making payments, applying for loans, or purchasing insurance, users prefer these services to be embedded directly into apps and platforms they already use, like e-commerce sites, ride-sharing apps, or gig economy platforms. This demand for convenience and frictionless user experiences is pushing businesses to offer embedded financial services. Companies that integrate such features enhance customer satisfaction, improve retention, and gain a competitive edge. This trend reflects a shift from traditional banking toward more customer-centric, real-time financial interactions embedded into everyday digital experiences, which is creating a positive impact on the embedded finance market outlook. For instance, in February 2025, OMB Bank announced the introduction of OMBX, a specialized embedded finance division aimed at equipping fintechs and various digital firms with smooth banking services. With seven fintech clients currently active and numerous others forthcoming, OMBX is set to emerge as a leading embedded finance partner in the sector.

Proliferation of APIs and Open Banking

The rise of APIs and open banking frameworks has revolutionized how financial services are delivered. APIs allow seamless data exchange between banks and third-party platforms, enabling companies to integrate services like payments, lending, or account management without developing financial infrastructure themselves. Open banking further accelerates this by mandating data sharing, empowering consumers to connect their financial information securely across platforms. According to the embedded finance market forecast, this has lowered barriers to entry for non-financial companies and fintech startups, encouraging rapid innovation in embedded finance. As a result, businesses can create customized, embedded financial experiences that are faster to deploy and more responsive to user needs. For instance, in April 2025, VoPay, a prominent provider of integrated financial technology, unveiled its latest embedded Cross-Border Payments-as-a-Service offering. Designed for software platforms and financial organizations, the white-label technology allows entities to transfer funds worldwide with complete transparency, adherence to regulations, and instantaneous foreign exchange, without the need to develop their cross-border systems. VoPay’s offering is white-label and API-driven, allowing other organizations to embed sophisticated cross-border payment capabilities into their systems without building from scratch.

Digital Transformation Across Industries

Industries across the board are embracing digital transformation to enhance customer engagement, streamline operations, and unlock new revenue models. As companies move online, integrating financial services becomes a natural next step in the digital journey. Retailers embed payments and buy-now-pay-later options, logistics firms add insurance at checkout, and marketplaces offer financing to sellers. This cross-industry digitization has expanded the playing field for embedded finance beyond fintech, allowing diverse sectors to become financial service providers. By embedding these tools, companies not only improve customer experience but also gain deeper data insights and create scalable, tech-driven financial ecosystems. For instance, in March 2025, Bettr, a prominent AI-driven lending company under Ant International, declared its official launch in Brazil to enhance small and medium-sized enterprise (SME) financing aimed at fostering local and regional economic growth through collaborations with local partners. To start, it established a strategic alliance with AliExpress to introduce a novel financing solution, Bettr Working Capital, for local sellers on the AliExpress platform. This allows for easy and efficient access to working capital and aids in business growth in one of the globe's most rapidly evolving e-commerce markets.

Embedded Finance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global embedded finance market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, business model, and end use.

Analysis by Type:

- Embedded Payment

- Embedded Insurance

- Embedded Investment

- Embedded Lending

- Embedded Banking

Embedded payments lead the market with around 29.2% of market share in 2024 due to their widespread adoption across e-commerce, ride-sharing, food delivery, and subscription platforms. Consumers demand fast, seamless, and secure checkout experiences, which embedded payments deliver by integrating directly into digital platforms. Businesses benefit from reduced friction, higher conversion rates, and improved customer satisfaction. Additionally, advancements in APIs, mobile wallets, and contactless payments have made integration easier and more scalable. As digital transactions become the norm, companies prioritize embedded payment solutions to stay competitive, driving their dominance within the broader embedded finance ecosystem. This trend is reinforced by increasing global digitalization.

Analysis by Business Model:

- B2B

- B2C

- B2B2B

- B2B2C

B2B leads the market with around 60.5% of market share in 2024 due to the growing demand among businesses for streamlined financial operations, such as invoicing, payments, lending, and cash flow management. Companies increasingly integrate financial services directly into software platforms like ERP, payroll, and procurement systems to reduce operational friction and improve efficiency. The rise of digital-first B2B platforms and marketplaces further fuels adoption, enabling real-time financial solutions within business workflows. Additionally, embedded finance empowers SaaS providers to create new revenue streams by offering tailored financial products. These factors make B2B a dominant segment as enterprises prioritize automation, transparency, and scalability in finance.

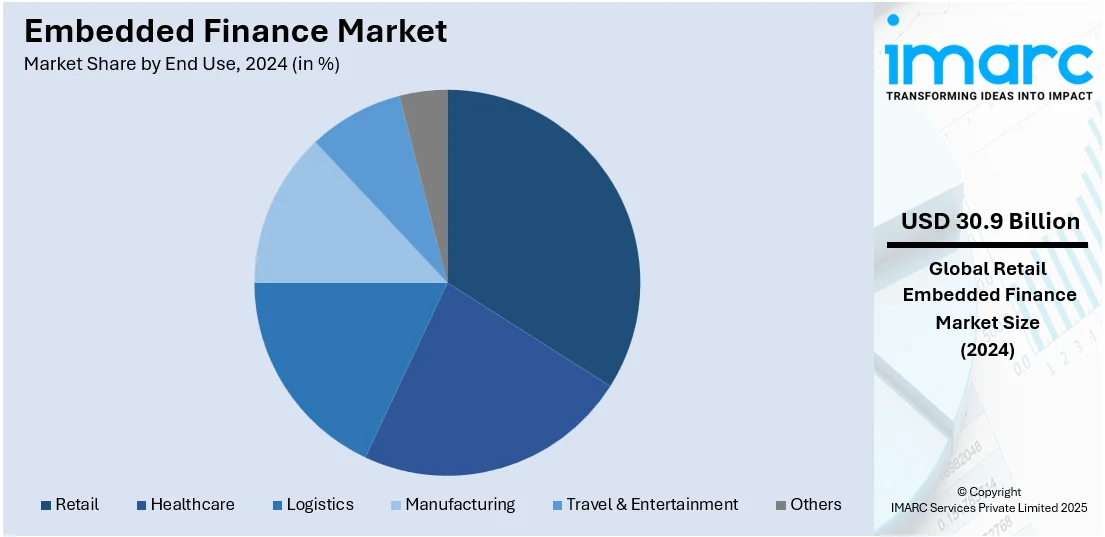

Analysis by End Use:

- Retail

- Healthcare

- Logistics

- Manufacturing

- Travel & Entertainment

- Others

Retail leads the market with around 28.5% of market share in 2024 due to its early and widespread adoption of integrated financial services, such as embedded payments, buy-now-pay-later (BNPL), and in-app financing. As e-commerce and omnichannel shopping grow, retailers embed financial tools to enhance customer convenience, boost conversion rates, and increase basket sizes. These solutions offer seamless checkout experiences, instant credit, and loyalty-driven incentives that drive consumer engagement. Additionally, embedded finance helps retailers collect valuable customer data and build deeper relationships. With high transaction volumes and frequent customer interactions, the retail sector naturally leads in leveraging embedded finance to drive growth and competitiveness.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 31.5%. The embedded finance market in North America is propelled by several interrelated factors. Foremost is the escalating consumer demand for seamless financial services integrated within everyday digital platforms, enhancing user experience and convenience. This demand is met by the widespread adoption of APIs and open banking frameworks, which facilitate the embedding of financial services into various applications. Additionally, the region's robust digital infrastructure and high smartphone penetration enable the efficient deployment of embedded finance solutions. The thriving fintech ecosystem in North America, particularly in hubs like San Francisco and New York, further accelerates innovation and adoption in this sector.

Key Regional Takeaways:

United States Embedded Finance Market Analysis

In 2024, the United States accounted for over 86.30% of the embedded finance market in North America. The increasing smartphone penetration and widespread internet access have enabled seamless integration of financial services into everyday digital platforms. According to industry reports, at the beginning of 2024, the United States had 331.1 million internet users, with internet penetration reaching 97.1%. Moreover, the proliferation of e-commerce, accounting for 22% of U.S. retail sales in 2023, has further fueled demand for embedded payments and lending solutions. Additionally, the rise of Banking-as-a-Service (BaaS) models allows non-financial companies to offer financial products, enhancing customer experience and loyalty. Strategic partnerships, such as Walmart's collaboration with JPMorgan to expedite payments for online sellers, exemplify how embedded finance is transforming business operations. For instance, in March 2025, JPMorgan Chase and Walmart collaborated on an embedded finance solution, enabling merchants who sell products via the retailer's marketplace platform to handle payments and manage their cash flow.

Europe Embedded Finance Market Analysis

The European Union's regulatory frameworks, such as the revised Payment Services Directive (PSD2) and the proposed Financial Data Access (FIDA) regulation, promote open banking and secure data sharing, allowing non-financial companies to provide integrated financial services. The region's advanced digital infrastructure and high smartphone penetration enable the integration of financial services into a wide variety of platforms. The rise of fintech innovation, coupled with the adoption of APIs and real-time data analytics, allows businesses to embed sophisticated financial products effortlessly. Additionally, the growing demand for convenient, on-platform financial solutions among consumers and small to medium-sized enterprises (SMEs) further propels the market's growth. For instance, in November 2024, Adyen, an international financial technology platform providing solutions for top companies, teamed up with Spendesk, a spend management platform aimed at medium-sized enterprises. This ongoing partnership seeks to assist in the creation and implementation of cutting-edge embedded financial services.

Asia Pacific Embedded Finance Market Analysis

Rapid digital adoption and widespread smartphone usage have facilitated the integration of financial services into non-financial platforms, enhancing accessibility for consumers and businesses alike. The proliferation of super apps, such as Alipay and WeChat, has created ecosystems where users can seamlessly access a variety of financial services, including payments, lending, and insurance, within a single platform. Additionally, supportive government initiatives aimed at promoting financial inclusion have further accelerated the adoption of embedded finance solutions, enabling underserved populations to access essential financial services. For instance, in March 2025, Smartpay Corporation declared the introduction of embedded insurance solutions in Japan through a partnership with Chubb Insurance Japan, after a year of working together. The project seeks to update the conventional insurance industry, which predominantly depends on paper methods, by incorporating digital, immediate, and tailored insurance options into the payment system.

Latin America Embedded Finance Market Analysis

High mobile penetration and widespread smartphone usage facilitate the integration of financial services into various platforms, enhancing accessibility for consumers and businesses alike. A large segment of the population is still without banking services, creating a demand for inclusive financial solutions. Government initiatives and evolving regulatory frameworks, such as Mexico's Fintech Law, support the growth of fintech and embedded finance. The rise of super-apps and digital platforms enables seamless financial transactions within non-financial ecosystems. Additionally, strategic partnerships between fintech companies and traditional institutions are fostering innovation and expanding the reach of embedded financial services across Latin America. For instance, in March 2025, the fintech company FitBank introduced a new platform enabling businesses of every size to manage their finances directly from their management systems. The launch is in line with FitBank’s goal of transforming the integration of financial services within ERP systems, and since the Brazilian ERP market ranks fifth largest worldwide, there is significant potential for this new offering.

Middle East and Africa Embedded Finance Market Analysis

The Middle East and Africa region is undergoing significant digital transformation, creating opportunities to deliver seamless financial services within non-financial platforms. High mobile and internet penetration has further enabled the adoption of these solutions, particularly among the region’s large, tech-savvy youth population. Additionally, fintech innovation is thriving, supported by increased investment and the rise of digital startups. Governments and institutions are also promoting financial inclusion, aiming to serve unbanked and underbanked communities. For instance, in March 2025, NymCard, an embedded finance platform, secured $33 million to broaden its presence in the MENA region. The Series B funding round for the company, revealed, was spearheaded by QED Investors, representing that group's largest investment in the MENA (Middle East and North Africa) area. NymCard has collaborated with over 50 banks, FinTech companies, and businesses on personal finance solutions across the region. This has involved efforts such as assisting Saudi Arabia's Vision 2030 initiative for a cashless economy and encouraging digital currency transactions in the United Arab Emirates (UAE).

Competitive Landscape:

The embedded finance market is highly competitive, with a mix of fintech startups, traditional banks, and technology providers vying for dominance. Key players like Stripe, Square, and Plaid offer API-driven financial services, while legacy banks partner with tech firms to stay relevant. Banking-as-a-Service (BaaS) providers such as Solarisbank and Mbanq enable non-financial companies to embed banking products. Tech giants like Apple and Amazon are also entering the space, leveraging massive user bases. The competition centers on innovation, speed to market, regulatory compliance, and user experience. As demand for integrated financial solutions grows, partnerships and platform capabilities define market leadership.

The report provides a comprehensive analysis of the competitive landscape in the embedded finance market with detailed profiles of all major companies, including:

- Stripe, Inc.

- PAYRIX

- Cybrid Technology Inc.

- Walnut Insurance Inc.

- Lendflow

- Finastra

- Zopa Bank Limited

- Fortis Payment Systems, LLC

- Transcard Payments

- Fluenccy Pty Limited

Latest News and Developments:

- In April 2025, European embedded finance fintech Froda secured €20 million (224 million SEK) in a Series B funding round headed by Stockholm's Incore Invest, aiming to enhance its embedded SME finance services throughout Europe. Froda plans to utilize the new funds to grow its operations, recruit new embedded finance partners, and enter more European markets.

- In February 2025, Okoora, a leading supplier of foreign exchange (FX) risk management and embedded finance solutions, declared its arrival in the US market. The company supplies financial institutions, fintech firms, and non-financial service providers in the United States with its embedded finance solutions and a variety of basic APIs. To improve the advantages for their clients, these organizations can integrate Okoora's products into their service offerings or use them for their operations. Okoora offers solutions such as multi-currency accounts, international payments, foreign exchange conversions, and currency risk management via hedging, among others.

Embedded Finance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Embedded Payment, Embedded Insurance, Embedded Investment, Embedded Lending, Embedded Banking |

| Business Models Covered | B2B, B2C, B2B2B, B2B2C |

| End Uses Covered | Retail, Healthcare, Logistics, Manufacturing, Travel & Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Stripe, Inc., PAYRIX, Cybrid Technology Inc., Walnut Insurance Inc., Lendflow, Finastra, Zopa Bank Limited, Fortis Payment Systems, LLC, Transcard Payments, Fluenccy Pty Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the embedded finance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global embedded finance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the embedded finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The embedded finance market was valued at USD 108.55 Billion in 2024.

The embedded finance market is projected to exhibit a CAGR of 28.50% during 2025-2033, reaching a value of USD 1,217.37 Billion by 2033.

Key factors driving the embedded finance market include rising consumer demand for seamless financial experiences, the growth of fintech and digital platforms, API and open banking advancements, and digital transformation across industries. Businesses embed financial services to enhance user engagement, streamline operations, and create new revenue opportunities.

North America currently dominates the embedded finance market due to advanced digital infrastructure, fintech innovation, API adoption, evolving consumer expectations, and strong e-commerce and platform economies.

Some of the major players in the embedded finance market include Stripe, Inc., PAYRIX, Cybrid Technology Inc., Walnut Insurance Inc., Lendflow, Finastra, Zopa Bank Limited, Fortis Payment Systems, LLC, Transcard Payments, Fluenccy Pty Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)