Emulsifiers Market Size, Share, Trends and Forecast by Product Type, Source, Application, and Region, 2025-2033

Emulsifiers Market Size and Share:

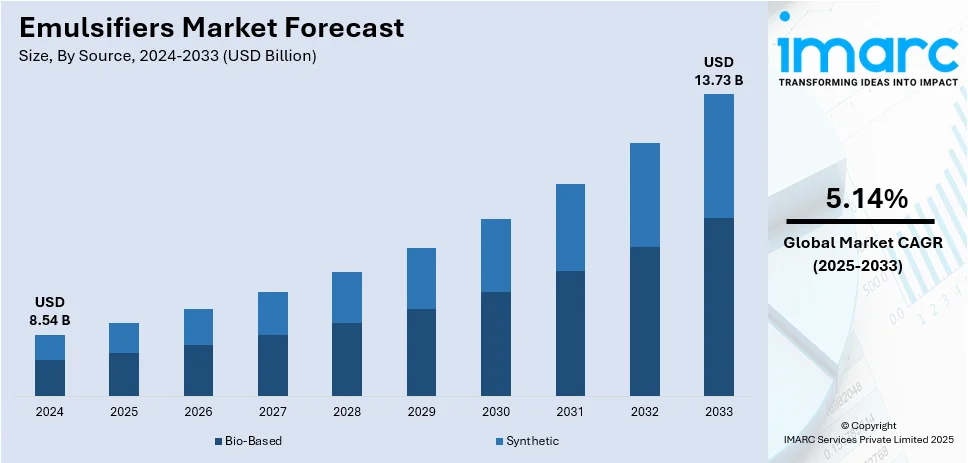

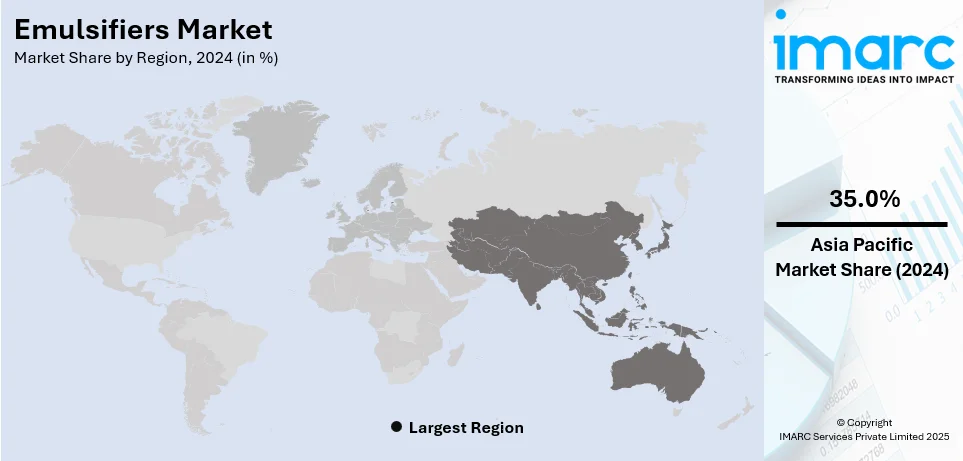

The global emulsifiers market size was valued at USD 8.54 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.73 Billion by 2033, exhibiting a CAGR of 5.14% during 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 35.0% in 2024. The market is driven by the escalating need for ready to eat (RTE) food products and increasing preferences for clean label products. Besides this, emulsifiers market share is influenced by continuous advancements in food processing technologies, creating opportunities for innovation and sustainability in the dynamic food industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.54 Billion |

|

Market Forecast in 2033

|

USD 13.73 Billion |

| Market Growth Rate (2025-2033) | 5.14% |

The growing demand for functional and nutritional ingredients is increasing emulsifier usage in food formulations. Customers seek products with enhanced texture, stability, and health benefits, driving innovation in emulsifier technology. Functional emulsifiers improve fat dispersion, moisture retention, and mouthfeel in processed food and beverages (F&B). Nutritional emulsifiers support low-fat, low-sugar, and fortified food formulations without compromising taste or texture. Food manufacturers are incorporating emulsifiers to enhance nutrient bioavailability and stability in functional food products. The rise of plant-based and protein-enriched food products is catalyzing demand for emulsifiers with improved solubility and dispersion properties. Emulsifiers help optimize texture in dairy alternatives, plant-based meat, and high-protein snack formulations. Nutritional beverages, including meal replacements and sports drinks, require emulsifiers for uniform consistency and ingredient suspension. According to the emulsifiers market report, functional emulsifiers contribute to satiety, controlled fat release, and improved digestion in specialized health-focused products, which is propelling market growth.

To get more information on this market, Request Sample

The growth of sustainable ingredient distribution is speeding up the demand for eco-friendly emulsifiers in the United States. Producers are focusing on responsibly sourced, biodegradable, and plant-derived emulsifiers to meet sustainability objectives. Increasing retailer and individual demand for ethically sourced ingredients is driving the market transition towards sustainable emulsifiers. Key distributors are broadening their supply chains to guarantee the wide accessibility of sustainable emulsifiers for manufacturers of food and skincare products. For instance, in October 2024, Brenntag Specialties enhanced its collaboration with Stephenson, becoming the sole distributor of Durosoft emulsifiers in North America. These bio-based components enhance sustainable personal care products by offering multiple benefits. The deal enhances Brenntag’s life sciences offerings, meeting the growing need for sustainable cosmetic products. Businesses are collaborating with agricultural providers to obtain non-GMO, organic, and sustainable raw materials. Enhanced logistics and distribution systems are lowering expenses, allowing small-scale producers to access sustainable emulsifiers more easily. The increasing acceptance of circular economy practices is influencing the need for upcycled and waste-based emulsifiers. Food brands are using sustainably sourced emulsifiers to align with corporate environmental responsibility and clean-label standards. Government regulations and industry certifications are urging suppliers to improve transparency and sustainability in sourcing emulsifiers.

Emulsifiers Market Trends:

Increasing demand for processed and convenience food products

The market is growing rapidly due to the increasing consumer demand for processed and convenience food products. Therefore, this is acting as one of the significant emulsifiers market trends. As consumer lifestyles become busier, there is a growing preference for ready-to-eat (RTE) and easy-to-prepare food products. Reports indicate that nearly 75% of frequent consumers of ready meals consume them regularly. Emulsifiers improve mouthfeel, aeration, and moisture retention in bakery, confectionery, and dairy products. Food manufacturers rely on emulsifiers to ensure uniformity and prolong freshness in large-scale production. Frozen and microwaveable meals require emulsifiers to maintain structural integrity and prevent phase separation. The demand for extended shelf-life products is fueling emulsifier innovation in preservatives-free formulations. Fast food and quick-service restaurant (QSR) sectors depend on emulsifiers for consistent texture in sauces and dressings. The shift toward plant-based processed food products is increasing the need for emulsifiers in dairy and meat alternatives. Emulsifiers enable fat reduction, sugar replacement, and enhanced nutrient stability in health-focused convenience food items. Manufacturers are investing in advanced emulsification technologies to improve functionality and cost efficiency. As processed food demand rises, emulsifiers remain essential for stability, texture optimization, and extended product shelf-life.

Growing trend of clean label products

People are increasingly seeking transparent and clean-label products, driving the demand for natural ingredients. Reports show that over 25% of people prioritize clean label products as a key part of their health-conscious choices. Emulsifier variants derived from natural sources such as plant-based or microbial sources, are gaining traction in response to this trend. Manufacturers are incorporating these clean-label products to meet consumer preferences for healthier and more environmentally friendly food options. According to the emulsifiers market forecast, this shift is providing kick to the market and driving innovation in the development of cleaner and more sustainable food formulations. Regulatory pressures and customer awareness are compelling brands to eliminate artificial additives and chemical stabilizers. Natural emulsifiers help improve texture, stability, and shelf-life while aligning with clean-label expectations. Manufacturers are investing in research and development (R&D) to create functional, label-friendly emulsifiers with enhanced performance and sustainability. Growing demand for allergen-free and plant-based products is opening up new possibilities for the use of clean-label emulsifiers. Leading international food companies are strengthening their portfolios of natural emulsifiers through strategic alliances and commitments to sustainable sourcing. Research and development investments are driving the innovation of next-generation emulsifier solutions, offering multiple benefits and a reduced environmental footprint. This innovation pipeline is accelerating entry into the convenience food, dairy, and bakery markets.

Rapid advancements in food processing technologies

Progress in food processing technologies is greatly propelling the emulsifiers market growth. These advancements enhance the quality of food products by improving texture, consistency, and longevity. The advancement of more effective emulsifying techniques allows for improved ingredient compatibility, enhancing food formulations. As food producers are consistently embracing cutting-edge technologies, the need for emulsifiers in different applications is growing. Therefore, this is acting as one of the major emulsifiers market growth factors. Contemporary food processing techniques, like high-pressure processing, necessitate emulsifiers to preserve product quality and stability. Emulsifiers are vital for developing new, creative food items that satisfy consumer demands for convenience and flavor. As food production becomes increasingly automated, emulsifiers are becoming essential to large-scale processing systems, guaranteeing uniform outcomes throughout mass production. These technologies enable the creation of cleaner, more efficient emulsifiers that correspond with health-focused trends. With increasing awareness of clean labels, emulsifiers from natural sources are becoming popular, fostering progress in plant-based and bio-based emulsifiers.

Emulsifiers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global emulsifiers market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, source, application and end user.

Analysis by Product Type:

- Lactic Esters of Fatty Acids

- Lecithin

- Mono & Di-glycerides of Fatty Acid

- Esters of Monoglycerides of Fatty Acid

- Polysorbates

- Polyglycerol Esters

- Polyglycerol Polyricinoleate

- Others

Mono & di-glycerides of fatty acid stand as the largest component in 2024, holding 48.7% of the market. They are widely used in bakery, dairy, confectionery, and processed food products for improved consistency and shelf-life extension. Their compatibility with fats, proteins, and carbohydrates makes them highly efficient across diverse food formulations. Cost-effectiveness compared to lecithin and natural emulsifiers further strengthens the market growth. Food manufacturers prefer mono- and di-glycerides for their ability to prevent fat separation and improve mouthfeel. Their multifunctional properties including anti aeration and dispersion, contribute to their extensive usage in food and beverage (F&B) processing. The emulsifiers market dynamics suggest that the growing demand for convenience foods and ready-to-eat (RTE) meals is accelerating the adoption of these emulsifiers worldwide. Pharmaceutical and personal care industries use mono- and di-glycerides in creams, lotions, and drug formulations for stability. Their emulsifying properties help maintain homogeneity in cosmetic and pharmaceutical products, driving demand in non-food sectors. Technological advancements in production processes are improving their efficiency, making them a preferred choice among manufacturers.

Analysis by Source:

- Bio-Based

- Synthetic

Synthetic source leads the market with 78.6% of market share in 2024. It provides enhanced shelf-life, better emulsification, and consistent performance compared to natural alternatives. Food manufacturers favor synthetic emulsifiers for its controlled properties and reliable results in large-scale production. It guarantees even distribution of fat and water, stopping phase separation in food and drink formulations. Its presence in multiple grades enables tailoring for diverse sectors, such as pharmaceuticals, cosmetics, and industrial uses. Synthetic emulsifiers, including mono- and di-glycerides, polysorbates, and sorbitan esters, provide enhanced solubility and processing benefits. Strict quality assurance in the production of synthetic emulsifiers guarantees adherence to regulatory norms and food safety protocols. Its longer shelf-life minimizes waste, making it economical for producers in high-volume sectors. The increasing appetite for processed food, personal care items, and pharmaceuticals supports the market growth of synthetic emulsifiers.

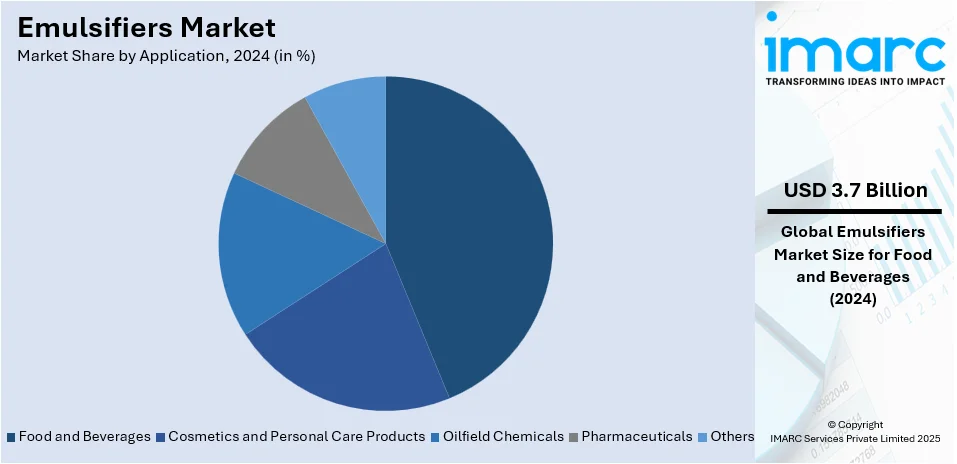

Analysis by Application:

- Food and Beverages

- Cosmetics and Personal Care Products

- Oilfield Chemicals

- Pharmaceuticals

- Others

Food and beverages dominate the market with 43.6% of market share in 2024. Emulsifiers improve texture, stability, and consistency in dairy, bakery, confectionery, and convenience food products. They help prevent ingredient separation in sauces, dressings, and beverages, ensuring uniform texture and quality. In bakery applications, emulsifiers enhance strength, volume, and crumb softness, improving product shelf-life. Dairy manufacturers use emulsifiers to prevent fat separation in ice cream, cheese, and flavored milk products. Confectionery producers rely on emulsifiers for chocolate tempering, moisture retention, and smooth mouthfeel enhancement. The shift towards plant-based and functional food further increases emulsifier demand in alternative dairy and meat products. Emulsifiers enable low-fat and sugar-reduced formulations without compromising texture, appeal, or customer acceptance. Their role in aeration, viscosity control, and foam stabilization supports their necessity in beverage formulations. Processed food and beverages expansion in developing economies drives emulsifier consumption for mass-market and ready-to-eat (RTE) products. Regulatory approvals and technological innovations ensure the continued use of emulsifiers in maintaining food quality and stability.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 35.0%. The rising number of middle-class people, along with inflating income levels, is contributing to higher consumption of convenience food products. Expanding food manufacturing industries in China, India, and Southeast Asia catalyzes emulsifier demand significantly. Bakery, confectionery, dairy, and food and beverage (F&B) sectors in the region rely heavily on emulsifiers for product consistency. Increasing fast-food chains and ready-to-eat (RTE) meal consumption drive emulsifier usage in food service applications. Government initiatives supporting food processing industries further strengthen market growth across developing Asian economies. The pharmaceutical and personal care sectors are expanding, increasing emulsifier usage in creams, ointments, and cosmetics. For instance, in November 2024, Safic-Alcan acquired a majority stake in Avees Biocos, an Indian distributor of personal care ingredients including emulsifiers to expand its presence in Asia Pacific. APAC serves as a major production hub, with key players establishing manufacturing facilities for cost advantages. The availability of raw materials, coupled with low labor costs, enhances regional competitiveness in emulsifier production.

Key Regional Takeaways:

United States Emulsifiers Market Analysis

The United States hold 87.80% of the market share in North America. The increasing need for processed and ready-to-eat (RTE) food products mainly fuels the market growth. As individuals look for fast, simple-to-make meals, emulsifiers are more frequently utilized to improve texture, stability, and shelf-life of products. In the US, the ready-to-eat (RTE) sector produces USD 48 billion in revenue, indicating a strong demand for convenient food choices. Growing demand for clean-label products is prompting manufacturers to use natural and organic emulsifiers, promoting transparency and healthier choices. The need for low-fat, low-sugar, and gluten-free items is also impacting the use of emulsifiers to preserve product quality and consistency. Additionally, the growing beverage industry, which encompasses non-dairy milk, smoothies, and functional drinks, is bolstering the expansion of the emulsifier market. Advancements in plant-derived food items are another important factor, since emulsifiers are essential for attaining the preferred texture and mouthfeel in dairy substitutes. The growing awareness about the health advantages tied to functional food products is further driving the demand for emulsifiers that improve product attractiveness without sacrificing nutritional quality. Regulatory backing and progress in food processing technology are also propelling market growth.

Europe Emulsifiers Market Analysis

The evolving preferences for healthier food options and clean-label products is bolstering the market growth. Consumers in Europe are increasingly concerned about the quality of ingredients in their food, which is leading to the demand for more natural and plant-based emulsifiers. In line with this, the rise of veganism and vegetarianism in various countries in the region are influencing the use of emulsifiers in plant-based alternatives, such as dairy-free cheese, plant-based milk, and vegan spreads. As of 2023, the vegan population in the European Union is approximately 6.62 million, with projections indicating this number is expected to rise to 8.25 million by 2033, according to reports. Additionally, the increasing popularity of gluten-free and low-sugar products is catalyzing the demand for emulsifiers that improve product consistency without compromising health benefits. The region's regulatory landscape, with stringent food safety standards and sustainability efforts, is compelling manufacturers to innovate in terms of ingredient sourcing and emulsifier formulations. The clean-label movement, combined with heightened concerns over artificial additives, is encouraging food producers to rely on emulsifiers obtained from natural sources. The rising demand for functional food and beverages (F&B), along with growing awareness about the importance of food texture and quality, continues to drive the emulsifier market in the region.

Latin America Emulsifiers Market Analysis

In Latin America, the emulsifiers market is expanding on account of the increasing consumption of processed food items, particularly in countries like Brazil and Mexico. As urbanization and disposable incomes rise, there is a growing preference for convenience food that require emulsifiers to maintain product texture and shelf life. In 2023, approximately 87.8% of Brazil’s total population resides in urban areas, according to the CIA. Furthermore, the expanding bakery, confectionery, and dairy industries are driving demand for emulsifiers to improve product quality. Besides this, the rising number of health-conscious individuals is also influencing the market. As more consumers opt for healthier food alternatives, manufacturers are incorporating emulsifiers that are non-GMO and free from artificial additives.

Middle East and Africa Emulsifiers Market Analysis

The market for emulsifiers in the Middle East and Africa region is driven by the growing consumption of RTE food products, particularly in urban areas. As lifestyles become busier, there is a growing demand for products that offer longer shelf lives and better texture. The expansion of fast-food chains and a rising demand for bakery and dairy products in the region are key contributors to the market growth. The rising employment of emulsifiers in skincare and beauty products is strengthening the market growth. Moreover, rising preferences for plant-based diets among people in the region is supporting the market growth. Reports indicate that the plant-based food market in the MENA region is expected to grow significantly, reaching between USD 8 and 9 billion by 2030.

Competitive Landscape:

Key players are funding R&D projects to create innovative, natural, and clean-label emulsifiers for customers. They are expanding production capacities to meet growing demand in food, pharmaceuticals, and personal care industries. For instance, in October 2024, BASF SE launched the Emulgade Verde line of organic emulsifiers for personal hygiene products, made from renewable feedstocks. These biodegradable, vegan-friendly ingredients are mild on the skin and microbiome-compatible. The portfolio ranges from Emulgade Verde 10 OL and 10 MS, which is particularly used for eco-friendly cosmetic applications. Strategic mergers, acquisitions, and partnerships help companies enrich product portfolios and extend their reach to the global market. Companies are working to improve supply chain efficiency to reduce costs in producing and distributing emulsifiers worldwide. Efforts to obtain non-GMO, organic, and allergen-free certifications are undertaken for regulatory compliance to meet industry demands. Leading companies are increasingly adopting environmentally friendly sourcing and production practices to reduce the environmental footprint and cater to customer preference. Investment in advanced emulsification technology, such as nano-emulsions and enzymatic processes improve the functionality and stability of products. Market leaders collaborate with the food manufacturer to customize emulsifiers to match their requirements in terms of texture and shelf-life. Companies are using artificial intelligence (AI) and big data analytics to optimize formulations and hence production efficiency.

The report provides a comprehensive analysis of the competitive landscape in the emulsifiers market with detailed profiles of all major companies, including:

- Archer Daniels Midland Company

- BASF SE

- Cargill Incorporated

- Koninklijke DSM N.V.

- Evonik Industries AG

- Kerry Group plc

- Palsgaard A/S

- Puratos Group

- Spartan Chemical Company Inc.

- Stepan Company

- The Dow Chemical Company

- The Lubrizol Corporation

Latest News and Developments:

- June 2025: MaGie Creations launched PowerBond, the world's first clean-label emulsifier derived from upcycled brewer's grain, 85% of which is byproducts of the beer sector. It is specifically designed for baked goods and meat alternatives to compete with synthetic emulsifiers in terms of cost and efficiency. The milestone product showcases the contribution of circular food technology to the emulsifier industry, with low processing and zero residue waste.

- May 2025: Indovinya, Indorama Ventures' specialty chemicals business, introduced ALKEST SP 80 K® and ALKEST SP 60 K®, Kosher, Halal, and Non-GMO food-grade Sorbitan® esters for use in bread, dairy, confectionery, and beverages. The emulsifiers enhance product stability, texture, and shelf life, as well as the company's existing polysorbates portfolio. The introduction aims to address the increasing global demand for certified, clean-label emulsification solutions in the food processing industry.

- March 2025: Perstorp has introduced the Neptem™ range of emulsifiers, designed to facilitate the transition from solvent-based to waterborne alkyd resins, offering high-performance, low-VOC solutions for the coatings industry. These emulsifiers enable the formulation of waterborne alkyds with diverse oil lengths, expanding application possibilities beyond traditional uses.

- November 2024: Godrej Industries acquired the food additives and emulsifier business of Savannah Surfactants Limited for USD 0.912 Million. This acquisition strengthens Godrej’s position in the food and beverages sector, complementing its leadership in oleochemicals, surfactants, specialties, and biotechnology.

- October 2024: Clariant launched Pickmulse, an innovative O/W emulsifier and encapsulation system based on Lucas Meyer Cosmetics’ patented quinoa starch technology. This new solution is surfactant-free, offers high skin tolerance, and is microbiota-friendly. It aims to enhance cosmetic formulations with a focus on sustainability and skin health.

Emulsifiers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lactic Esters of Fatty Acids, Lecithin, Mono & Di-glycerides of Fatty Acid, Esters of Monoglycerides of Fatty Acid, Polysorbates, Polyglycerol Esters, Polyglycerol Polyricinoleate, Others |

| Sources Covered | Bio-based, Synthetic |

| Applications Covered | Food and Beverages, Cosmetics and Personal Care Products, Oilfield Chemicals, Pharmaceuticals, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, China, Japan, India, South Korea, Australia, Indonesia, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Archer Daniels Midland Company, BASF SE, Cargill Incorporated, Koninklijke DSM N.V., Evonik Industries AG, Kerry Group plc, Palsgaard A/S, Puratos Group, Spartan Chemical Company Inc., Stepan Company, The Dow Chemical Company, The Lubrizol Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, emulsifiers market outlook, and dynamics of the market from 2019-2033.

- The emulsifiers market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the emulsifiers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The emulsifiers market was valued at USD 8.54 Billion in 2024.

The emulsifiers market is projected to exhibit a CAGR of 5.14% during 2025-2033, reaching a value of USD 13.73 Billion by 2033.

The emulsifiers market growth is driven by increasing demand in the food and beverage (F&B) sector, where emulsifiers enhance texture, stability, and shelf life. Rising consumer preference for convenience food products is increasing emulsifier usage in ready-to-eat (RTE)meals. Technological advancements in food processing are improving emulsifier efficiency and product formulations. The expanding personal care and cosmetics industry is increasing the need for emulsifiers in skincare products, which is strengthening market growth.

Asia Pacific currently dominates the emulsifiers market, accounting for a share of over 35.0% in 2024. The region’s large population, along with the inflating income levels, is catalyzing the demand for processed and convenience food products, increasing emulsifier use. Additionally, expanding cosmetics and personal care industries, especially in countries like China and India, are propelling the market growth.

Some of the major players in the emulsifiers market include Archer Daniels Midland Company, BASF SE, Cargill Incorporated, Koninklijke DSM N.V., Evonik Industries AG, Kerry Group plc, Palsgaard A/S, Puratos Group, Spartan Chemical Company Inc., Stepan Company, The Dow Chemical Company, The Lubrizol Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)