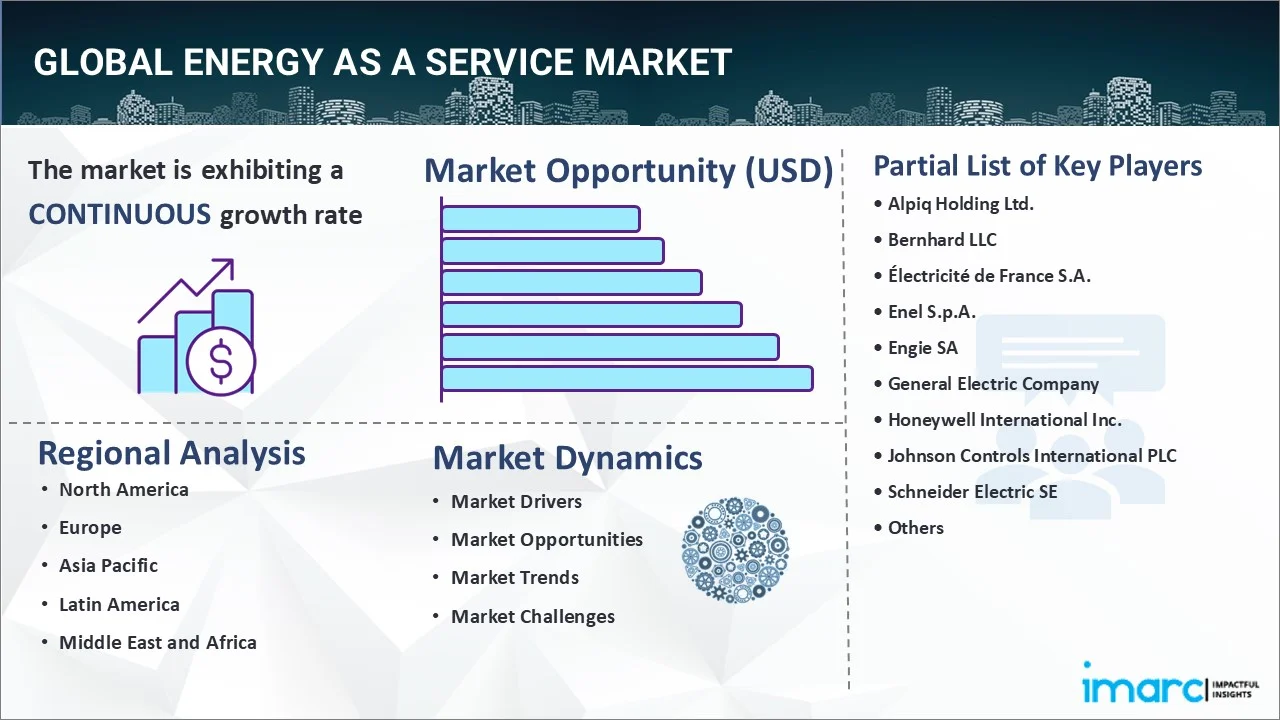

Energy as a Service Market Report by Service Type (Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services), End User (Commercial, Industrial), and Region 2026-2034

Market Overview:

The global energy as a service market size reached USD 82.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 156.4 Billion by 2034, exhibiting a growth rate (CAGR) of 7.18% during 2026-2034. North America dominates the market owing to its sophisticated technological infrastructure, notable investment in renewable energy options, and favorable regulatory policies. The increasing energy costs across the globe, rapid technological advancements, imposition of stringent environmental regulations, escalating demand for renewable energy, rising service adoption by corporate firms, and increasing service application in decentralized energy production are some of the major factors propelling the market.

Market Size & Forecasts:

- Energy as a service market was valued at USD 82.3 Billion in 2025.

- The market is projected to reach USD 156.4 Billion by 2034, at a CAGR of 7.18% from 2026-2034.

Dominant Segments:

- Service Type: Energy supply services lead the market share owing to their essential function in providing dependable and sustainable energy access. Their ability to scale, economical nature, and capacity to address various energy requirements establish them as a fundamental component of advancing energy solutions across different sectors.

- End User: Commercial represents the largest segment because of its significant energy usage and the growing demand for affordable, sustainable energy options. The need for improved energy efficiency, dependability, and lower operating costs propels considerable uptake of these services.

- Region: North America dominates the market, accredited to its sophisticated technological infrastructure, significant investment in renewable energy options, and favorable regulatory policies. The region's increasing emphasis on energy efficiency and innovation boosts the implementation of energy service models in multiple sectors.

Key Players:

- The leading companies in energy as a service market include Alpiq Holding Ltd., Bernhard LLC, Électricité de France S.A., Enel S.p.A., Engie SA, General Electric Company, Honeywell International Inc., Johnson Controls International PLC, Schneider Electric SE, Siemens AG, and Veolia Environnement S.A.

Key Drivers of Market Growth:

- Growing Demand for Scalability and Flexibility: Companies are progressively seeking flexible energy options to align with changing operational demands. Energy as a service (EaaS) enables users to increase usage without needing infrastructure modifications or incurring penalties. This flexibility enhances cost management, reduces inefficiencies, and guarantees energy utilization corresponds accurately with current production or seasonal requirements.

- Affordability and Long-Term Access: Models with fixed costs are rendering advanced energy technologies economically accessible. EaaS eliminates the requirement for initial investment, substituting it with regular monthly payments. This framework facilitates the extensive adoption of sustainable systems by providing homeowners and businesses with cost-effective, long-term access to contemporary, emission-reducing energy alternatives.

- Advancements in Grid Modernization and Smart Grids: Smart grid technologies improve energy distribution by utilizing real-time data, automation, and facilitating communication between individuals and utilities. These enhancements boost efficiency, reliability, and assistance for renewable energy sources. EaaS providers utilize these systems to offer more adaptive, localized energy services that match changing infrastructure and policy objectives.

- Rise of Renewable Energy Adoption: With the rise in renewable energy investment, companies are looking for effective methods to tap into solar, wind, and hydropower. EaaS provides these solutions without the burden of ownership expenses, assisting users in achieving sustainability objectives. This framework encourages the use of clean energy, ensures cost predictability, and speeds up the integration of renewables across different industries and public sectors.

- Energy Efficiency and Cost Optimization: EaaS enhances financial efficiency through usage monitoring, immediate optimization, and pricing based on performance. Businesses minimize waste, synchronize usage with demand, and bypass infrastructure management. This approach based on data improves energy management, attracts cost-sensitive organizations, and supports larger objectives of sustainability and operational accuracy.

- Aging Infrastructure and Need for Modernization: Obsolete energy systems present financial and dependability issues. EaaS tackles this by offering effective infrastructure improvements via service agreements, removing capital obligations. Providers manage the implementation and maintenance of technology, allowing businesses to swiftly modernize, decrease downtime, and ensure compliance without the need to oversee intricate internal energy upgrades.

Future Outlook:

- Strong Growth Outlook: The energy as a service market is poised for growth, driven by increasing demand for sustainable energy solutions, technological advancements, and a rising emphasis on energy efficiency. This growth is further supported by favorable regulatory environments and the adoption of innovative energy management models across industries.

- Market Evolution: The energy as a service market is undergoing rapid evolution, shaped by advancements in digital technologies, renewable energy integration, and shifting user expectations. This transformation fosters increased efficiency, scalability, and sustainability, positioning the market for continued innovation and expansion across diverse sectors globally.

With increasing environmental concerns, both industries and individuals are pursuing sustainable energy options. The shift towards cleaner, renewable energy sources is catalyzing the demand for energy as a service. This transition allows companies to comply with regulations and lower their carbon emissions without the challenges of directly overseeing energy generation. Furthermore, energy as a service provides financial benefits by removing the requirement for significant capital investments in infrastructure. Rather than owning energy systems, companies can opt for service subscriptions, providing financial adaptability. This method also facilitates dynamic energy pricing, assisting companies in managing their energy costs according to market fluctuations. Besides this, advancements in energy storage, smart grids, and energy management systems are greatly improving the efficiency and effectiveness of energy services. These innovations allow for improved management of energy usage, support immediate tracking, and enhance energy efficiency, rendering energy as a service more appealing to both individuals and companies.

To get more information on this market Request Sample

Energy as a Service Market Trends:

Growing Demand for Scalability and Flexibility

As companies grow and face shifting operational demands, the ability to seamlessly adjust energy usage becomes increasingly valuable. Energy as a service (EaaS) provides businesses with the flexibility to align energy usage with real-time needs, whether due to seasonal changes, varying production schedules, or unforeseen disruptions. This level of adaptability is especially advantageous in industries with unpredictable or cyclical energy requirements, such as retail, logistics, and manufacturing. EaaS eliminates the need for businesses to commit to rigid energy contracts or invest in infrastructure that may exceed or fall short of actual demand. Instead, organizations can scale their energy usage up or down without financial penalties or operational delays. This reduces inefficiencies, prevents unnecessary expenditures, and enhances overall responsiveness. For companies that prioritize agility, cost control, and operational resilience, the flexibility built into EaaS solutions represents a strong incentive for adoption and continued use in competitive environments.

Affordability and Long-Term Access

The rising need for cost-effective, sustainable energy options is driving the demand for EaaS services, especially within the home sector. Individuals seek methods to cut energy expenses, decrease emissions, and utilize contemporary technologies without significant initial investments. EaaS models that provide consistent monthly pricing and eliminate capital expenditure obstacles are gaining appeal. For instance, in January 2024, Heatio collaborated with E.ON and Energy Systems Catapult to introduce an EaaS service as part of the Green Home Finance Accelerator. The 20-year subscription option enabled homeowners in North West England to set up heat pumps, solar panels, or battery storage without initial costs, paying around £150 monthly instead. This project aimed at 350 households and emphasized lowering energy costs and carbon emissions. The model’s effectiveness emphasizes that fixed-cost, service-oriented methods are enhancing the accessibility of clean energy, facilitating wider adoption and market growth.

Advancements in Grid Modernization and Smart Grids

Sophisticated grid technologies, featuring interconnected sensors, automation, and instant data analysis, are facilitating more agile, effective, and robust energy distribution networks. These technologies facilitate bilateral communication between utilities and individuals, enabling real-time monitoring, enhanced demand forecasting, and optimization of energy usage. As a result, energy suppliers can deliver more accurate, dependable, and tailored services while facilitating the incorporation of renewable resources and distributed energy assets. The transition towards smart grid infrastructure also supports decentralized energy frameworks like microgrids, improving energy security and regional independence. In 2025, the governing body of UK initiated the £9 billion Great Grid Partnership as part of the Great Grid Upgrade to support 50 GW of offshore wind by 2030. Such initiatives are strengthening the EaaS model's function in providing adaptable, technology-driven energy solutions.

Energy as a Service Market Growth Drivers:

Rise of Renewable Energy Adoption

Organizations striving to achieve sustainability goals frequently encounter obstacles like elevated capital expenses and the technical challenges associated with deploying solar, wind, or hydropower solutions. EaaS offers a solution to circumvent those challenges by granting access to renewable energy via service agreements, removing the necessity for direct ownership of infrastructure. This model promotes cleaner energy utilization while ensuring flexibility, performance reliability, and predictable costs. Moreover, the growing investment in renewable energy, aligning with sustainability goals, is impelling the market. A significant instance is the 2025 declaration by Governor Eugenio Jose Lacson, in which all local government units in Negros Occidental pledged to implement solar energy within three years as part of the SecuRE Negros initiative. The province finalized an agreement with WeGen Energy to supply electricity for government facilities, aiming for 40% of overall energy requirements. These initiatives demonstrate the growing importance of service-oriented models in facilitating widespread renewable adoption without initial financial pressure.

Shift Toward Energy Efficiency and Cost Optimization

Organizations seek methods to control expenses while maintaining reliability. EaaS suppliers provide tools for monitoring, assessing, and enhancing energy usage, allowing companies to utilize data-driven insights and boost operational effectiveness. This model alleviates the responsibility of owning and managing energy infrastructure, enabling organizations to allocate resources to other areas. Consistent or foreseeable pricing structures are attractive to companies that must closely control their budgets. With EaaS, clients can synchronize their energy use with immediate requirements, eliminate excess waste, and lower energy-associated risks. This blend of financial transparency and operational oversight serves as a significant incentive for businesses embracing the EaaS model. These benefits are driving widespread interest, as highlighted in the latest energy as a service market report, which underscores growing adoption across sectors seeking sustainable and cost-effective energy solutions.

Aging Infrastructure and Need for Modernization

Numerous power systems globally are becoming outdated, ineffective, and progressively costlier to manage or fix. These outdated systems frequently lack adequate energy efficiency, dependability, and compatibility with current digital and renewable technologies. EaaS provides a viable and affordable option for businesses to update their energy systems without the financial and operational pressure of handling extensive upgrades in-house. Providers deliver advanced, energy-efficient equipment through long-term service agreements, managing installation, maintenance, and performance enhancement. This setup enables companies and organizations to take advantage of advanced infrastructure without handling procurement, integration, or technical maintenance. As a result, organizations can expedite energy modernization efforts that may have been delayed because of financial restrictions or technical challenges. The model enhances system reliability, minimizes unexpected outages, and fosters continuous advancements, guaranteeing that energy infrastructure stays in accordance with prevailing standards, regulatory requirements, and sustainability objectives over time.

Energy as a Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global energy as a service market report, along with forecasts at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on service type and end user.

Breakup by Service Type:

To get detailed segment analysis of this market Request Sample

- Energy Supply Services

- Maintenance and Operation Services

- Energy Efficiency and Optimization Services

Energy Supply Services holds the largest market share.

The report has provided a detailed breakup and analysis of the energy as a service market based on the service type. This includes energy supply services, maintenance and operation services, and energy efficiency and optimization services. According to the report, energy supply services represented the largest market segment.

Energy supply services are dominating the market as it offers tailored solutions that align with the specific demands of different consumers. This customization ensures that the energy provided is in sync with the unique needs of each client, fostering greater efficiency. Additionally, it enables the integration of various renewable energies, such as hydro, wind, and solar, which allow organizations to lower their carbon footprint and comply with environmental regulations. Furthermore, energy supply services provide a transparent and predictable pricing structure, which facilitates better budgeting and cost control, thus allowing businesses to manage their energy expenses effectively. Moreover, it offers enhanced reliability by utilizing diversified energy sources and advanced grid management to mitigate the risk of disruptions. Besides this, energy supply services ensure that energy provision can adapt to organizational changes without significant challenges or delays.

Breakup by End User:

- Commercial

- Industrial

Commercial holds the largest market share.

The report has provided a detailed breakup and analysis of the energy as a service market based on the end user. This includes commercial and industrial. According to the report, commercial represented the largest market segment.

Commercial end user is dominating the market due to the increasing demand for energy among commercial buildings and complexes. In line with this, EaaS provides tailored solutions that cater to the specific energy consumption patterns of the commercial sector, such as heating, cooling, lighting, and powering electronic devices. Furthermore, commercial spaces extensively utilize EaaS to reduce energy bills by optimizing energy consumption and demand-response strategies and integrating renewable sources. Besides this, EaaS aids commercial entities in complying with stringent environmental regulations and government standards by offering energy solutions that align with regulatory requirements. Moreover, it provides scalable and flexible energy solutions that allow the commercial sector to adapt to changing business needs without major disruptions or investments.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market, accounting for the largest energy as a service market share.

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represented the largest market segment.

North America is dominating the market due to the presence of leading technology companies and research institutions that are actively engaged in innovations in areas, such as smart grids, data analytics, and the Internet of Things (IoT). Furthermore, the implementation of supportive policies by regional governments to encourage energy efficiency, renewable energy adoption, and emissions reduction is positively influencing the market growth. Apart from this, the widespread adoption of EaaS solutions by North American corporations to achieve sustainability goals is acting as another growth-inducing factor. Moreover, the region’s strong economy enables businesses to invest in innovative energy solutions and prioritize energy efficiency and sustainability. Besides this, the growing expectation of regional consumers regarding energy efficiency, transparency, and sustainability is contributing to the market growth.

Competitive Landscape:

The leading EaaS providers are investing in research and development (R&D) to create innovative solutions, including the development of smart energy management systems, integration with renewable energy sources, and utilization of artificial intelligence (AI) and IoT for enhanced efficiency. Furthermore, several key players are forming alliances with technology companies, energy providers, and other stakeholders to enhance their services and expand their reach into new markets. Apart from this, many companies are acquiring or merging with other firms to consolidate market position, gain access to new technologies, and broaden their customer base. Moreover, leading market players are offering customized energy solutions, which assist them in catering to specific customer requirements and distinguishing their services in a competitive market. Besides this, key market players are promoting green energy solutions and offering services that help clients achieve their environmental targets, which is positively influencing the energy as a service market forecast.

The report has provided a comprehensive analysis of the competitive landscape in the global energy as a service market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alpiq Holding Ltd.

- Bernhard LLC

- Électricité de France S.A.

- Enel S.p.A.

- Engie SA

- General Electric Company

- Honeywell International Inc.

- Johnson Controls International PLC

- Schneider Electric SE

- Siemens AG

- Veolia Environnement S.A.

Energy as a Service Market News:

- In May 2025, Redaptive announced a $650 million credit facility from CDPQ and Nuveen to expand its Energy-as-a-Service platform. The funding will support large-scale deployments of energy-efficient and renewable solutions across enterprise portfolios. This move enhances Redaptive’s ability to deliver cost-saving, sustainable, and AI-driven infrastructure upgrades globally.

- In March 2025, Turbo Energy S.A. announced its expansion into Latin America with the launch of Turbo Energy Solutions in Chile. The company introduced a new Energy-as-a-Service model, enabling commercial clients to adopt AI-powered solar systems without upfront costs. Their first successful installation in Temuco, Chile, proved its reliability during a major blackout.

- In March 2025, Tata Consultancy Services (TCS) presented its Energy-as-a-Service platform at DTECH Northeast in Boston. The platform supports utilities and large C&I consumers with tools for renewable asset management, power trading, and energy monitoring. Developed with TATA Power, it helps reduce costs and improve sustainability through smart energy management.

Energy as a Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Service Types Covered | Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services |

| End Users Covered | Commercial, Industrial |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alpiq Holding Ltd., Bernhard LLC, Électricité de France S.A., Enel S.p.A., Engie SA, General Electric Company, Honeywell International Inc., Johnson Controls International PLC, Schneider Electric SE, Siemens AG, Veolia Environnement S.A. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global energy as a service market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global energy as a service market?

- What is the impact of each driver, restraint, and opportunity on the global energy as a service market?

- What are the key regional markets?

- Which countries represent the most attractive energy as a service market?

- What is the breakup of the market based on the service type?

- Which is the most attractive service type in the energy as a service market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the energy as a service market?

- What is the competitive structure of the global energy as a service market?

- Who are the key players/companies in the global energy as a service market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the energy as a service market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global energy as a service market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the energy as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)