Engineering Services Outsourcing Market Size, Share, Trends and Forecast by Service, Location, Application, and Region, 2026-2034

Engineering Services Outsourcing Market Size and Share:

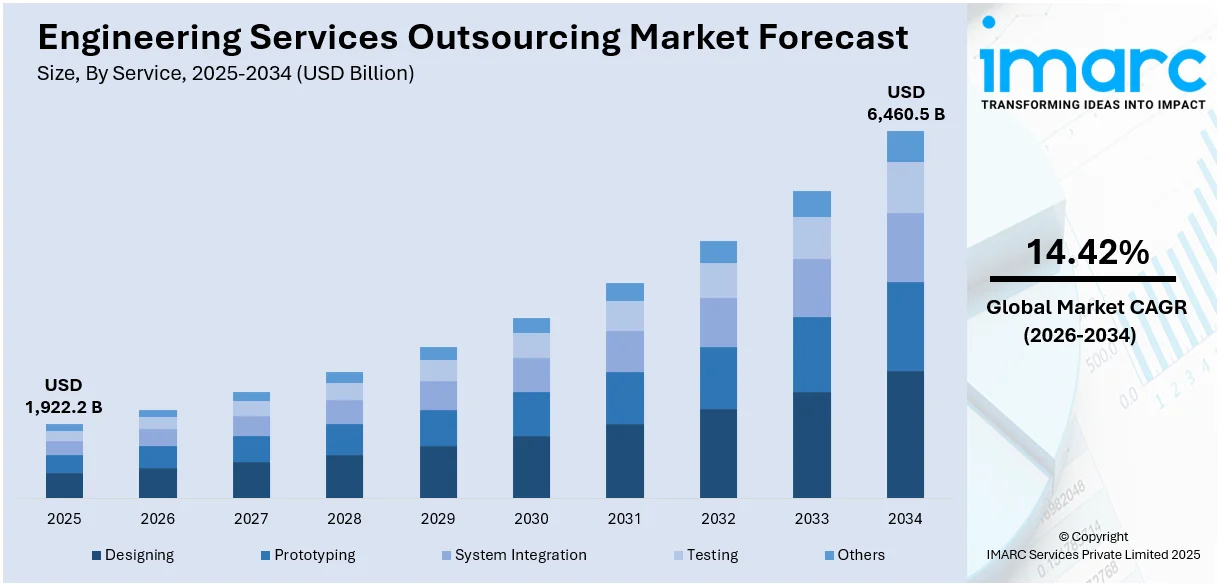

The global engineering services outsourcing market size was valued at USD 1,922.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6,460.5 Billion by 2034, exhibiting a CAGR of 14.42% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of 42.1% in 2025. The engineering services outsourcing market share in the Asia Pacific region is increasing because of its large pool of skilled engineers, competitive labor costs, and strong infrastructure in countries like India and China. The region also benefits from the growing industrialization, government support for digital innovation, and an expanding base of international clients seeking cost-effective and high-quality engineering solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,922.2 Billion |

| Market Forecast in 2034 | USD 6,460.5 Billion |

| Market Growth Rate (2026-2034) |

14.42%

|

Businesses encounter ongoing pressure to lower expenses related to product development and operations. Engineering services, particularly labor-intensive activities, can be costly when performed internally in high-cost nations. By outsourcing to various areas, businesses obtain skilled workers at reduced pay levels. This difference in costs is a key factor behind the growing trend of outsourcing as a strategic option for both large companies and medium-sized businesses. In addition, businesses in various sectors are increasing their investments in research and development (R&D) to create more sophisticated, innovative, and interconnected products. In fields like automotive, aerospace, and telecommunications, engineering roles are increasingly multidisciplinary. This complexity demands a wider range of skills, more flexible project management, and availability of specialized tools and platforms, which are resources that engineering services outsourcing providers are increasingly supplying.

To get more information on this market Request Sample

The United States plays a vital role in the market, influenced by the adoption of sophisticated technologies such as digital twins, artificial intelligence (AI)-enhanced design optimization, cloud-based computer-aided design (CAD), and Internet of Things (IoT)-enabled systems. Engineering services outsourcing firms provide extensive knowledge in these digital areas, facilitating product innovation, quicker iteration cycles, and integration with existing systems. Furthermore, top providers in the US are engaging in acquisitions to enhance their domain knowledge, especially in high-value, regulated industries. These agreements aim to deepen engineering capabilities, expand client portfolios, and speed up growth via cross-selling and operational synergies. In 2024, Cognizant revealed its purchase of Belcan for around $1.3 billion to enhance its engineering proficiency and secure a leading role in the aerospace and defense industry. The agreement was anticipated to generate over $100M in yearly revenue synergies within three years and positively impact the 2026 EPS. Belcan will maintain its name while more than 6,500 engineers integrate into Cognizant.

Engineering Services Outsourcing Market Trends:

Rising Demand for Automation Tools

The growing demand for automation tools currently represents one of the primary engineering services outsourcing market growth factors. Automation tools help lighten the workloads of employees, while simultaneously enhancing the overall productivity and revenue of businesses. By managing repetitive tasks, these tools enable employees to concentrate on more strategic and high-value activities. A sector analysis shows that 94% of firms continue to carry out repetitive, labor-intensive activities that are eligible for automation. Automation has enhanced roles for 90% of knowledge workers and boosted productivity for 66% of them, highlighting the evident operational advantages. These tools additionally assist in examining, testing, and constructing engineering systems with enhanced speed and precision. Moreover, the increasing use of automation tools by organizations, propelled by an emphasis on optimizing operations and prioritizing essential business functions, is additionally driving the overall market and development of the engineering services outsourcing sector.

Engineering Systems Utilization

At present, there is a rise in the adoption of engineering systems like CAD, computer-aided engineering (CAE), computer-aided manufacturing (CAM), and electronic design automation (EDA) software in various sectors, leading to an optimistic market forecast. These tools improve design precision, accelerate development schedules, and foster collaboration among teams located in different regions. Moreover, companies globally are experiencing an increasing need to shorten product lifecycles and lower expenses, resulting in a transition towards more efficient engineering methods. Coupled with this is the expanding application of engineering services outsourcing, which aids in minimizing the need for maintaining large office spaces, investing in additional infrastructure, and hiring or training permanent staff, leading to operational flexibility and significant cost savings. This change is also supported by market data: the Everest Group Engineering Services Top 50 list represented 89% (around USD 70 billion) of the projected USD 78 billion in total outsourced engineering expenditures in 2023.

Industrial Automation and Integrated Solutions

The swift advancement of industrial automation, coupled with the increasing use of integrated solutions for the analysis and design of engineering systems worldwide, is propelling the market growth. Businesses are progressively allocating resources to sophisticated tools and platforms that improve operational efficiency, minimize downtime, and facilitate scalable manufacturing processes. The most recent World Robotics report emphasized that 4,281,585 industrial robot units are currently active in factories globally, indicating a 10% increase compared to the previous year. For the third straight year, annual installations have exceeded the half-million threshold, highlighting the increasing dependence on automated systems. Furthermore, the rising reliance on outsourcing services, which offer access to specialized guidance, engineering expertise, and advanced technologies from talented professionals, is becoming more popular. This trend aids organizations in lowering fixed expenses and obtaining specialized skills as required, thus presenting appealing and sustainable growth prospects to industry participants, investors, and engineering service providers in multiple sectors. These developments are directly influencing engineering services outsourcing market revenue, as demand continues to rise across key application areas.

Engineering Services Outsourcing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global engineering services outsourcing market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on service, location, and application.

Analysis by Service:

- Designing

- Prototyping

- System Integration

- Testing

- Others

Testing dominates the market, as it guarantees the safety, performance, and reliability of complex engineered systems across various sectors. This service encompasses a broad spectrum of activities, including functional testing to confirm whether a product performs its intended task, stress testing to evaluate limits under extreme conditions, compliance testing to ensure adherence to industry-specific regulations, and software validation to detect bugs or malfunctions in embedded systems. Outsourcing these testing functions provides significant advantages for engineering companies, particularly in gaining access to advanced laboratories, specialized testing equipment, and a pool of experienced professionals who bring deep technical knowledge. It eliminates the need for heavy capital expenditure in setting up and maintaining dedicated in-house facilities. Moreover, outsourced testing partners often follow internationally accepted protocols, reducing risks related to product failure or regulatory non-compliance. This contributes to faster time-to-market and greater confidence in product integrity across global markets.

Analysis by Location:

- Onshore

- Offshore

Onshore stands as the largest component in 2025, holding 68.7% of the market, driven by a growing need for close collaboration, improved control over project execution, and adherence to local regulations and standards. Businesses frequently favor onshore outsourcing to minimize time zone issues, enhance communication, and guarantee higher transparency during the development process. This model facilitates faster feedback cycles, immediate updates, and enhanced intellectual property safeguards, all of which are vital in critical sectors such as aerospace, automotive, and defense. The presence of proficient local engineering professionals and cutting-edge technological infrastructure strengthens this trend even more. Onshore providers can additionally provide improved cultural alignment and sector-specific knowledge, which elevates the overall quality and applicability of solutions. In industries where adherence, safety, and swift action are essential, onshore outsourcing offers a dependable and effective option.

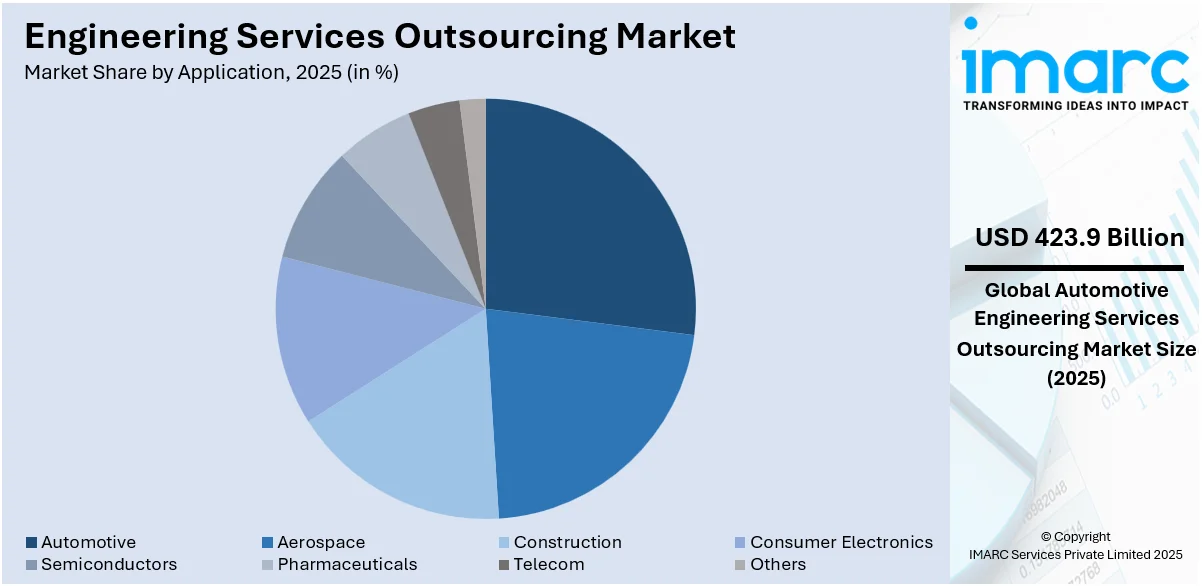

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Aerospace

- Automotive

- Construction

- Consumer Electronics

- Semiconductors

- Pharmaceuticals

- Telecom

- Others

Automotive leads the market with 25.4% of market share in 2025 owing to its significant emphasis on innovation, safety, and adherence to regulations. Automakers are progressively depending on outsourced engineering skills to speed up development timelines, cut costs, and incorporate advanced technologies like electric powertrains, autonomous driving systems, and connected vehicle platforms. The intricacy of creating contemporary vehicles, encompassing mechanical systems, electronics, embedded software, and simulations, requires specialized expertise frequently obtained from outside engineering companies. Original equipment manufacturers (OEMs) and Tier 1 suppliers are collaborating with service providers to oversee design validation, prototyping, system integration, and compliance testing. Additionally, the rising emphasis on sustainable transportation and electrification is driving the need for battery management systems, lightweight materials, and energy-efficient parts, further propelling outsourced R&D efforts. With the automotive sector experiencing a technological shift, the demand for flexible, scalable engineering assistance is rising, reinforcing its leading position in the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of 42.1% because of to the its robust demand from the consumer electronics and telecommunications sectors, which necessitate ongoing innovation and swift product advancement. Nations like India and China provide a large talent pool of highly skilled engineering experts with specialized knowledge in fields such as embedded systems, simulation, and CAD design. The existence of numerous established and new service providers enhances the attractiveness of the region, allowing global companies to access high-quality, affordable solutions in different engineering fields. In 2024, Sumitomo Corporation and India-based Tech Mahindra established SCTM Engineering to address the growing shortage of automotive engineers in Japan. The joint venture leveraged Indian engineering expertise and Sumitomo’s industry knowledge to support the development of next-generation mobility solutions. Through the deployment of “bridge engineers,” SCTM aimed to facilitate seamless collaboration between Indian engineers and Japanese manufacturers.

Key Regional Takeaways:

United States Engineering Services Outsourcing Market Analysis

In North America, the market portion held by the United States was 87.80%, driven by the increasing demand for cost-efficient solutions. In line with this, the rising complexity of engineering projects requiring specialized expertise, is propelling the market growth. Moreover, the heightened need for faster time-to-market in product development motivating firms to leverage external resources, is supporting the market growth. Furthermore, continual advancements in digital technologies, such as artificial intelligence (AI) and internet of things (IoT), are expanding the market scope. Additionally, the growing emphasis on sustainability and energy efficiency in engineering projects, promoting outsourcing to specialized providers, is stimulating market appeal. The escalating need for scalability in large projects driving firms to outsource engineering functions to manage fluctuating workloads is further augmenting sales. Additionally, the increasing focus on core competencies, allowing companies to outsource non-core engineering functions, is enhancing overall productivity and impacting the market trends.

Europe Engineering Services Outsourcing Market Analysis

The European market is majorly influenced by the increasing need for innovation in product development. In accordance with this, the growing demand for customized solutions in industries such as automotive and aerospace is positively influencing the market. Cost optimization remains a key market motivator as companies seek to reduce operational expenses by leveraging external engineering resources. Furthermore, the rapid evolution of technology, particularly in AI and automation, is strengthening the market demand. A study shows that 76% of producers in North America and Europe have started to adopt digital strategies. Moreover, 98% of European participants are investigating possible AI applications in their operations, showing a robust dedication to AI integration. The rising complexity of regulatory requirements in Europe encouraging businesses to rely on experienced engineering service providers, is enhancing accessibility in the market. Additionally, the ongoing shift towards digital transformation leading companies to outsource technical expertise for system integration and process optimization, is fueling market expansion. Besides this, the growing need for specialized knowledge in emerging technologies such as 5G and renewable energy is accelerating changes in the market.

Asia Pacific Engineering Services Outsourcing Market Analysis

The Asia Pacific engineering services outsourcing market is growing due to the region's rapid industrialization creating demand for advanced engineering solutions across sectors. As per CEIC Data, India's industrial output rose by 5.0% year-on-year in January 2025, after a 3.5% year-on-year rise in December 2024. Similarly, competitive labor costs render outsourcing an attractive option for businesses seeking cost-efficient engineering services, thereby impelling the market growth. The increasing adoption of digital transformation and industry 4.0 technologies encouraging companies to outsource specialized engineering expertise, is also supporting market development. Furthermore, the growing need for product innovation across automotive, electronics, and manufacturing industries is stimulating market appeal. The rising demand for sustainable and green engineering practices, driving the need for specialized outsourcing partners. Moreover, the region's strategic location and access to a skilled workforce are making Asia Pacific an appealing hub and creating lucrative opportunities in the market.

Latin America Engineering Services Outsourcing Market Analysis

In Latin America, the market is progressing propelled by the region's expanding manufacturing sector. In addition to this, the rise of digitalization in industries, like automotive and energy, encouraging companies to outsource technical expertise, is fueling the market growth. Consequently, Brazil allocated BRL 186.6 billion towards digital transformation, concentrating on semiconductors, robotics in industry, and artificial intelligence. Public and private investments target the digitization of 50% of the industrial sector by 2033, enhancing productivity, competitiveness, and technological advancement. Furthermore, the growing availability of a skilled and cost-effective workforce making outsourcing attractive, is offering a favorable market outlook. Apart from this, the rising emphasis on sustainability and environmental engineering in industries, such as construction and energy, is accelerating the need for outsourced engineering solutions to meet regulatory and market demands.

Middle East and Africa Engineering Services Outsourcing Market Analysis

The engineering services outsourcing market in the Middle East and Africa is experiencing growth attributed to rapid infrastructure development in key regions, such as the Gulf Cooperation Council (GCC) countries. Furthermore, the heightened shift towards energy diversification, particularly renewable energy projects, driving the need for expert engineering support. The growth of smart cities and urbanization in Africa is catalyzing the demand for advanced engineering solutions. Moreover, increasing government investments in technological advancements and industrialization in both regions are positively influencing the market.

Competitive Landscape:

The top engineering services outsourcing market companies are employing AI to automate tasks, such as product development, testing, and quality assurance, and divert resources toward more strategic and creative work. In 2024, HCLTech launched its first delivery center in Kochi, Kerala, with a focus on AI silicon solutions, IoT, and semiconductor support. The center aimed to accelerate product development for industries such as automotive and medical devices. This expansion aligned with HCLTech’s 10.5% quarterly profit growth, which was driven by increased demand in AI and digital engineering. Besides this, key players are adopting cloud computing and big data to collaborate with partners and suppliers, gain insights into client behavior and preferences, and reduce costs and improve agility. These technologies help their users design better products and services by monitoring and optimizing manufacturing and development processes. This is further supported by the utilization of IoT and augmented reality (AR) and virtual reality (VR) technologies that enable market players to collect data and insights, create immersive and interactive experiences, and improve the accuracy and efficiency of engineering projects.

The report provides a comprehensive analysis of the competitive landscape in the engineering services outsourcing market with detailed profiles of all major companies, including:

- Accenture Plc

- Altair Engineering Inc.

- ALTEN

- Cybage Software Pvt. Ltd.

- EPAM Systems Inc.

- HCL Technologies Limited

- Infosys Ltd.

- QuEST Global Services Pte. Ltd.

- Sonata Software Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited (Mahindra Group)

- Wipro Limited

Latest News and Developments:

- March 2025: CGI signed an exclusivity agreement to acquire Apside, a leading French digital and engineering services firm. The acquisition, subject to regulatory approvals, is expected to close by June 2025.

- December 2024: YRH Inc. and Pinargon Ltd. announced their merger to create a fully integrated telecommunications engineering service. The combined entity offered expertise in wireless communications, civil structures, fiber optics, and intelligent transportation systems.

- July 2024: Accenture acquired Cientra, a silicon design and engineering services firm, to enhance its capabilities in custom silicon solutions. Based in New Jersey with offices in Europe and India, Cientra has expertise in IoT and circuit design, augmenting Accenture's semiconductor innovation efforts to support growing data computing needs.

- June 2024: Cognizant announced an agreement to provide engineering services to Gentherm, a company involved in thermal management and comfort technologies for the automotive industry. The collaboration included a dedicated delivery center and a test facility in Hyderabad, India.

Engineering Services Outsourcing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Designing, Prototyping, System Integration, Testing, Others |

| Locations Covered | Onshore, Offshore |

| Applications Covered | Aerospace, Automotive, Construction, Consumer Electronics, Semiconductors, Pharmaceuticals, Telecom, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture Plc, Altair Engineering Inc., ALTEN, Cybage Software Pvt. Ltd., EPAM Systems Inc., HCL Technologies Limited, Infosys Ltd., QuEST Global Services Pte. Ltd., Sonata Software Limited, Tata Consultancy Services Limited, Tech Mahindra Limited (Mahindra Group), Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the engineering services outsourcing market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global engineering services outsourcing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the engineering services outsourcing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The engineering services outsourcing market was valued at USD 1,922.2 Billion in 2025.

The engineering services outsourcing market is projected to exhibit a CAGR of 14.42% during 2026-2034, reaching a value of USD 6,460.5 Billion by 2034.

The engineering services outsourcing market is driven by rising demand for cost optimization, access to global talent, accelerated product development cycles, and increasing adoption of digital engineering technologies. Companies seek specialized expertise in areas like CAD, simulation, and embedded systems, while shifting focus to core operations, prompting partnerships with external engineering service providers across industries.

Asia Pacific currently dominates the engineering services outsourcing market, accounting for a share of 42.1%. The dominance of the region is because of its large pool of skilled engineers, competitive labor costs, and strong infrastructure in countries like India and China. The region also benefits from growing industrialization, government support for digital innovation, and an expanding base of global clients seeking cost-effective and high-quality engineering solutions.

Some of the major players in the engineering services outsourcing market include Accenture Plc, Altair Engineering Inc., ALTEN, Cybage Software Pvt. Ltd., EPAM Systems Inc., HCL Technologies Limited, Infosys Ltd., QuEST Global Services Pte. Ltd., Sonata Software Limited, Tata Consultancy Services Limited, Tech Mahindra Limited (Mahindra Group), Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)