Epilepsy Drugs Market by Generation Type (First Generation Drugs, Second Generation Drugs, Third Generation Drugs), Anti-Epileptics Drugs Type (Narrow-Spectrum AEDs, Broad-Spectrum AEDs), Distribution Channel (Hospital Pharmacy, Pharmacy Stores, and Others), and Region 2025-2033

Global Epilepsy Drugs Market:

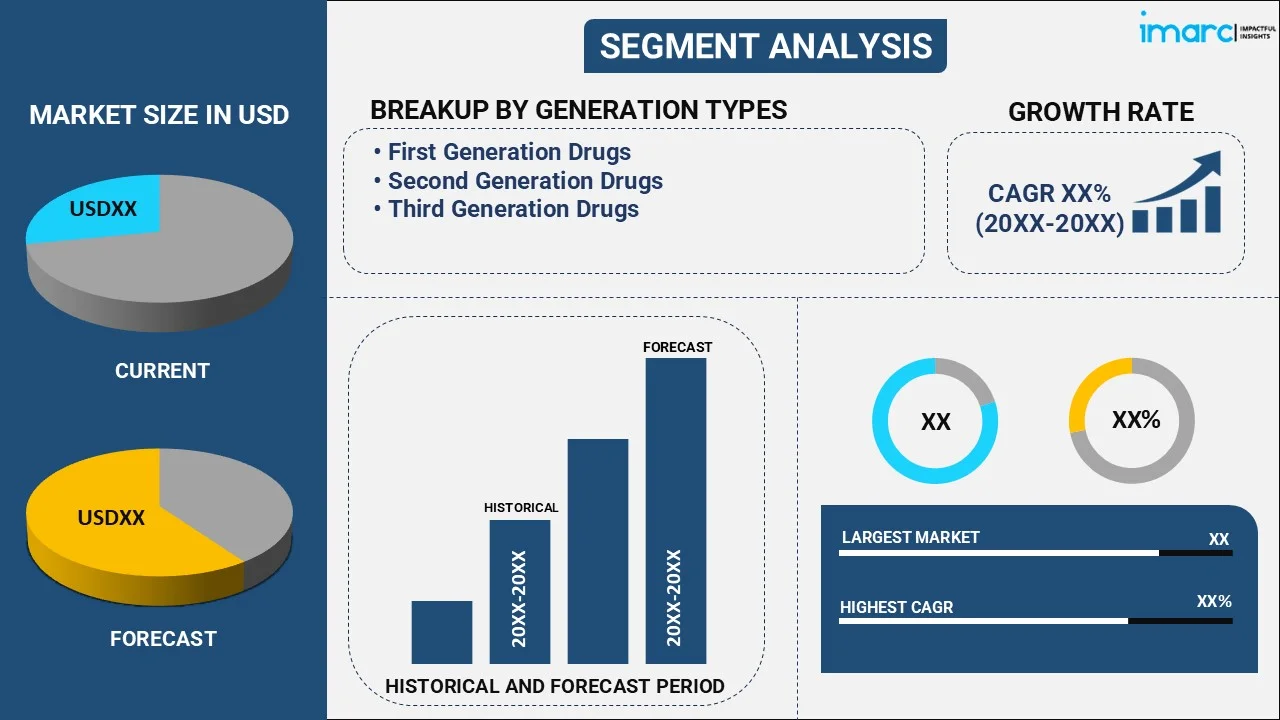

The global epilepsy drugs market size reached USD 2.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.87% during 2025-2033. The increasing prevalence of epilepsy worldwide, significant advancements in drug development and innovation, growing awareness about epilepsy and its treatment options, and rising healthcare expenditure and improving access to treatment are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 6.87% |

Epilepsy Drugs Market Analysis:

- Major Market Drivers: The increasing prevalence of epilepsy across the world and rising cases of drug-resistant epilepsy are the primary drivers bolstering the growth of the global market.

- Key Market Trends: Technological advancements, such as the development of novel drug delivery systems, like transdermal patches and implantable devices, as well as the utilization of artificial intelligence and machine learning in drug discovery and diagnosis, are significantly contributing to the growth of the market.

- Geographical Landscape: According to the report, North America accounted for the largest market share. This can be attributed to numerous factors, such as the high prevalence of epilepsy, advanced healthcare infrastructure, significant investments in research and development, and robust regulatory frameworks.

- Competitive Landscape: Some of the leading epilepsy drugs market companies are Abbott Laboratories, Alkem Laboratories Limited, Bausch Health Companies Inc., Eisai Co. Ltd., GSK plc, H. Lundbeck A/S, Jazz Pharmaceuticals plc, Novartis AG, Pfizer Inc., Sunovion Pharmaceuticals Inc. (Sumitomo Dainippon Pharma Co. Ltd.), and UCB S.A., among many others.

- Challenges and Opportunities: The epilepsy drug market faces challenges, such as the need for improved efficacy and reduced side effects to meet diverse patient needs. Opportunities lie in the development of novel therapeutic approaches, including precision medicine and targeted therapies, to address specific epilepsy subtypes.

Epilepsy Drugs Market Trends:

Increasing Prevalence of Epilepsy

Epilepsy is one of the most common neurological disorders across the globe, affecting individuals of all ages. The rising prevalence of epilepsy is primarily driving the growth of the market. As per the World Health Organization's February 2023 update, around 50 million people worldwide suffer from epilepsy, making it one of the most common neurological diseases globally. Moreover, it is estimated that about 1.2% of the U.S. people have active epilepsy. This comes out to about 3.4 million people nationwide and more than 65 million people globally. Additionally, about 1 in 26 people will develop epilepsy at some point during their lifetime. Moreover, according to an article published by Healthline, a quarter of all newly diagnosed cases of epilepsy are in children. Of the more than 3 million Americans with epilepsy, 470,000 cases are children. Children account for 6.3 out of every 1000 cases of epilepsy. Such a massive rise in the cases of epilepsy is augmenting the epilepsy drugs market demand. Furthermore, the increasing prevalence of drug-resistant epilepsy, where patients do not respond to conventional treatments, presents opportunities for the development of novel therapeutics.

Increasing Product Offerings

The growing focus on neurological disorders, including epilepsy, has prompted increased research and development activities in the pharmaceutical industry. This rise in R&D investments is driven by the need to address unmet medical needs, improve treatment outcomes, and introduce affordable drugs and treatment options to treat epilepsy. Nearly 80% of people with epilepsy live in low and middle-income countries. In response to this, various leading drug manufacturers are launching epilepsy drugs at affordable prices, which is also contributing to the growth of the market. For instance, in March 2021, India-based Alkem Laboratories launched Brivasure, an affordable anti-epileptic drug for treating epilepsy in India. Similarly, in February 2021, Sun Pharmaceutical Industries reported its plans to introduce a complete range of anti-epilepsy drugs, including Brivaracetam, in India at an affordable price. Besides, the market players are also acquiring other firms to expand their product portfolio, which is anticipated to propel the epilepsy drugs market revenue. For instance, in January 2022, UCB acquired Zogenix for US$ 1.9 Billion to bolster its epilepsy portfolio by adding Fintepla (fenfluramine). It is a marketed drug for treating seizures associated with Dravet syndrome, a rare form of childhood epilepsy. This deal continues to expand UCB's extensive therapeutic offering in the epilepsy market.

Favorable Regulatory Environment and Rising Awareness

The rising awareness regarding epilepsy and its available treatment options, along with the strategic alliance of government authorities, is positively impacting the epilepsy drugs market outlook. The World Health Organization (WHO) published a report in April 2022 stating that 100% of countries are expected to include at least one functioning awareness campaign or advocacy program for neurological disorders by 2031. Such initiatives by the renowned organization are expected to drive the market in the coming future. Moreover, in the United States, November is celebrated as National Epilepsy Awareness Month (NEAM). Every year, the Epilepsy Foundation launches the #RemoveTheFilter social media campaign to reduce fear surrounding epilepsy and bring hope to those facing challenges. Such awareness campaigns are also propelling the epilepsy drugs market share. In addition to this, the concerned regulatory authorities are also expediting the approval of new drugs which is also boosting the market growth. For instance, in August 2021, UCB received United States Food and Drug Administration (FDA) approval for an expanded indication for BRIVIACT (brivaracetam) CV tablets, oral solution, and injection to treat partial-onset seizures in patients as young as one month of age.

Epilepsy Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the epilepsy drugs market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on generation type, anti-epileptics drugs type, and distribution channel.

Breakup by Generation Type:

- First Generation Drugs

- Phenytoin

- Carbamazepine

- Oxcarbazepine

- Valproate

- Ethosuximide

- Primidone

- Phenobarbital

- Second Generation Drugs

- Levetiracetam

- Lamotrigine

- Topiramate

- Pregabalin

- Rufinamide

- Zonisamide

- Third Generation Drugs

- Lacosamide

- Perampanel

- Eslicarbazepine Acetate

- Ezogabine/Retigabine

Second generation drugs accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the generation type. This includes first generation drugs (phenytoin, carbamazepine, oxcarbazepine, valproate, ethosuximide, primidone, and phenobarbital), second generation drugs (levetiracetam, lamotrigine, topiramate, pregabalin, rufinamide, and zonisamide), and third generation drugs (lacosamide, perampanel, eslicarbazepine acetate, and ezogabine/retigabine). According to the report, second generation drugs represented the largest segment.

Second-generation epilepsy drugs, also called newer or advanced AEDs, comprise medications such as lamotrigine, levetiracetam, and topiramate. These drugs are developed to address the limitations of first-generation drugs, aiming for improved efficacy and reduced side effects. As per the epilepsy drugs market forecast, the rising cases of drug-resistant epilepsy are also driving the demand for advanced AEDs. The International League Against Epilepsy (ILAE) identified that over 30% of epilepsy patients do not respond to the combination of two prescribed anti-seizure medications. As a result, second-generation drugs are in high demand.

Breakup by Anti-Epileptics Drugs Type:

- Narrow-Spectrum AEDs

- Broad-Spectrum AEDs

Broad-spectrum AEDs holds the largest share in the industry

A detailed breakup and analysis of the market based on the anti-epileptics drugs type have also been provided in the report. This includes narrow and broad-spectrum AEDs. According to the report, broad-spectrum AEDs accounted for the largest market share.

As per the epilepsy drugs market overview, broad-spectrum AEDs offer a wider spectrum of activity, targeting multiple seizure types. Drugs, such as levetiracetam, lamotrigine, and topiramate fall into this category. Broad-spectrum AEDs are preferred for patients with mixed seizure types or those who have not responded to narrow-spectrum AEDs. They provide a versatile treatment option, offering better seizure control and improved quality of life for many epilepsy patients.

Breakup by Distribution Channel:

- Hospital Pharmacy

- Pharmacy Stores

- Others

Hospital pharmacy represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacy, pharmacy stores, and others. According to the report, hospital pharmacy represented the largest segment.

As per the epilepsy drugs market statistics by IMARC, hospital pharmacies serve as primary sources of epilepsy drugs for inpatients and outpatients receiving treatment in healthcare facilities. They offer a wide range of antiepileptic medications prescribed by healthcare providers, ensuring immediate access to critical drugs during emergencies. According to Seizure – European Journal of Epilepsy, in 2020, approximately 1,00,000 to 1,20,000 children were hospitalized for epilepsy-related conditions. Such a massive footfall of patients in the hospitals and increasing funding by the government authorities in the healthcare sector are some of the significant epilepsy drugs market recent opportunities. Moreover, hospital pharmacies maintain stringent quality control measures and adhere to regulatory standards to guarantee the safety and efficacy of medications.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest epilepsy drugs market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America holds the leading position in the market due to factors such as the high prevalence of epilepsy, advanced healthcare infrastructure, significant investments in research and development, and robust regulatory frameworks. In November 2022, a press release by the CDC stated that epilepsy affects about 3.4 million Americans. About 1 out of 10 people may suffer from a seizure during their lifetime. There are over 260 epilepsy centers in the U.S. Consequently, the prevalence of epilepsy in the region is expected to increase the demand for its treatment and thus affect the epilepsy drugs market recent prices. Moreover, the presence of key market players, such as Pfizer Inc., UCB Pharma, and Eisai Co., Ltd., in the region who continuously innovate and collaborate to introduce novel therapies is also contributing to the region's growth. Furthermore, various organization-initiated research in the region. For instance, in October 2022, Avicanna Inc. expanded its research collaboration in epilepsy with a new collaboration with the University of Toronto. It is to explore the efficacy of Avicanna's proprietary formulations in pre-clinical models for epilepsy.

Leading Key Players in the Epilepsy Drugs Industry:

Key players in the epilepsy drugs market are continuously engaged in activities aimed at innovation, expansion, and strategic partnerships to strengthen their market presence. Companies, such as Pfizer Inc., are focusing on the development of novel therapies and expanding their product portfolio through acquisitions and collaborations with research institutions. UCB Pharma is investing in research and development to introduce advanced treatments and enhance patient outcomes. Similarly, Eisai Co., Ltd. is emphasizing the development of innovative drugs and expanding its geographical reach through partnerships and licensing agreements. Overall, these players are committed to addressing unmet medical needs and improving the quality of life for epilepsy patients through their concerted efforts in drug development and market expansion.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abbott Laboratories

- Alkem Laboratories Limited

- Bausch Health Companies Inc.

- Eisai Co. Ltd.

- GSK plc

- H. Lundbeck A/S

- Jazz Pharmaceuticals plc

- Novartis AG

- Pfizer Inc.

- Sunovion Pharmaceuticals Inc. (Sumitomo Dainippon Pharma Co. Ltd.)

- UCB S.A.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Epilepsy Drugs Market Recent Developments:

- January 2024: Akumentis Healthcare introduced a drug for the treatment of epilepsy. The Mumbai-based company launched Clasepi, a DCGI-approved prescription cannabidiol (CBD) specifically formulated to address seizures linked with Lennox-Gastaut Syndrome (LGS), Dravet Syndrome, or Tuberous Sclerosis Complex (TSC) in patients aged 1 year and older.

- November 2023: The EpiSafe project, funded by the National Institute for Health and Care Research over five years, announced its plan to create an evidence-based, personalised care bundle specifically designed for pregnant women with epilepsy.

- May 2023: Angelini Pharma announced its plans to provide an upfront payment and invest an additional US$ 505.5 Million in JCR Pharmaceuticals Co., Ltd. for the development of a new treatment for epilepsy.

Epilepsy Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Generation Types Covered |

|

| Anti-Epileptics Drugs Types Covered | Narrow- Spectrum AEDs, Broad-Spectrum AEDs |

| Distribution Channels Covered | Hospital Pharmacy, Pharmacy Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Alkem Laboratories Limited, Bausch Health Companies Inc., Eisai Co. Ltd., GSK plc, H. Lundbeck A/S, Jazz Pharmaceuticals plc, Novartis AG, Pfizer Inc., Sunovion Pharmaceuticals Inc. (Sumitomo Dainippon Pharma Co. Ltd.), UCB S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the epilepsy drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global epilepsy drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the epilepsy drugs industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The epilepsy drugs market was valued at USD 2.5 Billion in 2024.

The epilepsy drugs market is projected to exhibit a CAGR of 6.87% during 2025-2033.

The epilepsy drugs market is driven by factors such as increasing prevalence of epilepsy worldwide, advancements in drug formulations, and the growing awareness about the condition. Additionally, ongoing research into novel therapies, improved healthcare infrastructure, and the development of targeted treatments for different epilepsy types are contributing to market growth.

North America currently dominates the market driven by factors such as the high prevalence of epilepsy, advanced healthcare infrastructure, significant investments in research and development, and robust regulatory frameworks.

Some of the major players in the epilepsy drugs market include Abbott Laboratories, Alkem Laboratories Limited, Bausch Health Companies Inc., Eisai Co. Ltd., GSK plc, H. Lundbeck A/S, Jazz Pharmaceuticals plc, Novartis AG, Pfizer Inc., Sunovion Pharmaceuticals Inc. (Sumitomo Dainippon Pharma Co. Ltd.), UCB S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)