Epilepsy Monitoring Device Market Report by Product (Conventional Devices, Wearable Devices), Patient Type (Paediatric, Geriatric, Adults), Distribution Channel (Retail Sales, Online Sales, Direct Tenders, and Others), End User (Hospitals and Clinics, Home Care Settings, and Others), and Region 2025-2033

Epilepsy Monitoring Device Market Size:

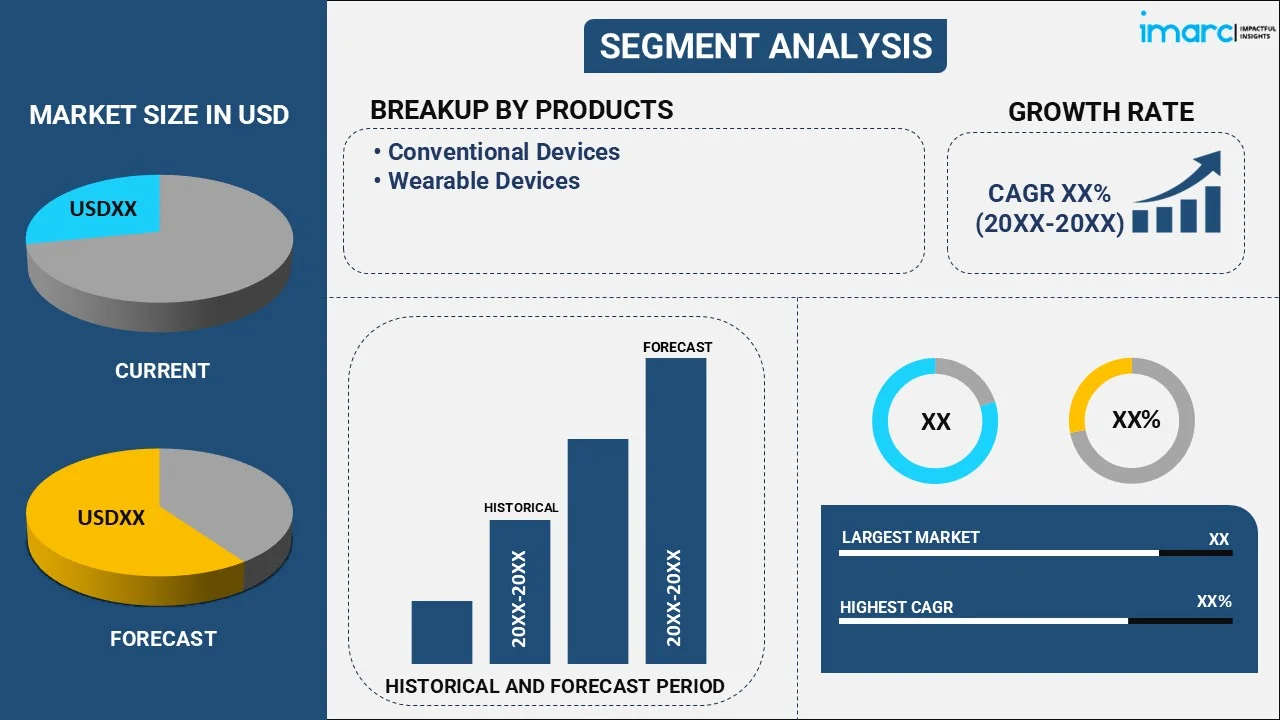

The global epilepsy monitoring device market size reached USD 685.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,028.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.38% during 2025-2033. The market is experiencing steady growth driven by the increasing prevalence of epilepsy, rapid technological advancements, growing awareness about the benefits of early detection and diagnosis of epilepsy, rising geriatric population, and the escalating integration of artificial intelligence (AI) and machine learning (ML) algorithms into monitoring devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 685.8 Million |

|

Market Forecast in 2033

|

USD 1,028.8 Million |

| Market Growth Rate 2025-2033 | 4.38% |

Epilepsy Monitoring Device Market Analysis:

- Market Growth and Size: The market is experiencing robust growth, driven by an increasing prevalence of epilepsy globally. The market size is expanding due to rising awareness, improved diagnostics, and a growing patient pool requiring long-term monitoring solutions. The market is expected to witness significant growth in the forecast period.

- Major Market Drivers: The increasing incidence of epilepsy, both in developed and developing regions, is a primary driver for the growth of these devices.

- Technological Advancements: Advances in wearable technology and implantable devices have revolutionized epilepsy monitoring, offering continuous and real-time tracking of seizure activity. Besides, the integration of AI in monitoring devices enhances data analysis, enabling more accurate seizure prediction, personalized treatment plans, and improved patient outcomes.

- Industry Applications: These devices find extensive application in clinical settings, facilitating accurate diagnosis, treatment optimization, and monitoring of drug effectiveness.

- Key Market Trends: The incorporation of data analytics tools for processing and interpreting large volumes of monitoring data is a prevailing trend, providing valuable insights for healthcare providers.

- Geographical Trends: Europe leads the epilepsy monitoring device market, attributed to high healthcare expenditure, technological advancements, and a well-established healthcare infrastructure.

- Competitive Landscape: Major players in the market include established healthcare technology companies and innovative start-ups focusing on developing advanced and user-friendly monitoring solutions.

- Challenges and Opportunities: Stringent regulatory requirements for medical devices pose challenges, but adherence to compliance standards also presents opportunities for market differentiation. Limited awareness and infrastructure in some developing regions pose challenges, but present opportunities for market penetration through education and awareness initiatives.

- Future Outlook: The future of the market is promising, with ongoing research and development expected to lead to more sophisticated devices, improved data analytics, and increased adoption of these technologies globally. The market is likely to witness continued growth, driven by technological advancements, increasing healthcare awareness, and a growing emphasis on personalized medicine in epilepsy management.

Epilepsy Monitoring Device Market Trends:

Increasing prevalence of epilepsy

The rising prevalence of epilepsy serves as a primary and potent driver for the growth of the market. Epilepsy, a neurological disorder characterized by recurrent seizures, affects millions of people worldwide. As awareness of the condition expands and diagnostic capabilities improve, there is a growing need for effective monitoring solutions to better understand and manage epileptic episodes. The demand for epilepsy monitoring devices is fueled by healthcare providers seeking accurate and continuous data on seizure activity, enabling personalized treatment plans. Moreover, the increasing incidence of epilepsy in both developed and developing regions contributes significantly to the expansion of the market, as these devices play a crucial role in diagnosis, treatment optimization, and long-term management.

Technological advancements in monitoring devices

Technological innovations in epilepsy monitoring devices represent a major driving force behind the market's growth. Recent advancements, including the development of wearable and implantable devices, have revolutionized the way seizures are monitored. Wearable devices provide patients with the flexibility to carry out their daily activities while continuously monitoring for seizure activity. Additionally, the integration of artificial intelligence (AI) in monitoring devices enhances data analysis capabilities, enabling more accurate and timely detection of seizures. AI algorithms can learn and adapt to individual patient patterns, leading to improved prediction and better customization of treatment plans. The continuous innovation in monitoring technologies, coupled with the integration of telemedicine solutions, is propelling the market forward by providing healthcare professionals with real-time insights and improving patient outcomes.

Growing emphasis on personalized medicine

There is a notable shift in the healthcare landscape towards personalized medicine, and this trend is influencing the market. Healthcare providers are increasingly recognizing the importance of tailoring treatment plans based on individual patient characteristics, including seizure patterns and triggers. Epilepsy monitoring devices play a pivotal role in this paradigm by providing comprehensive and real-time data, allowing for a more personalized approach to diagnosis and treatment. The ability to continuously monitor patients in various settings, including at home, supports the customization of therapeutic interventions. This growing emphasis on personalized medicine not only enhances patient care but also drives the adoption of advanced monitoring devices, contributing to the market's sustained growth.

Epilepsy Monitoring Device Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, patient type, distribution channel, and end user.

Breakup by Product:

- Conventional Devices

- Wearable Devices

Conventional devices account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes conventional and wearable devices. According to the report, conventional devices represented the largest segment.

Conventional devices represent a significant segment within the market, constituting the majority of the market share. These devices encompass traditional monitoring equipment such as in-hospital electroencephalogram (EEG) machines and video monitoring systems. Widely utilized in clinical settings, conventional devices offer comprehensive monitoring capabilities and are integral in capturing detailed data during seizure events. Despite the growing popularity of wearable devices, conventional devices continue to play a pivotal role in providing healthcare professionals with precise and detailed information for accurate diagnosis, treatment planning, and ongoing patient management. The established reliability and effectiveness of conventional devices contribute to their continued dominance in the market.

On the other hand, wearable devices constitute a rapidly growing segment in the market, reflecting the industry's shift towards more patient-centric and flexible monitoring solutions. These devices, including smartwatches and portable EEG monitors, enable continuous monitoring outside of traditional healthcare settings, offering real-time insights into a patient's seizure activity. Wearable devices empower individuals with epilepsy by providing them the freedom to carry on with their daily activities while being under constant surveillance. The convenience, comfort, and enhanced mobility offered by wearable devices make them increasingly popular among patients, contributing to their adoption in home healthcare settings. As technology continues to advance, wearable devices are expected to play a pivotal role in transforming epilepsy management, offering a balance between effectiveness and improved quality of life for patients.

Breakup by Patient Type:

- Paediatric

- Geriatric

- Adults

A detailed breakup and analysis of the market based on the patient type have also been provided in the report. This includes paediatric, geriatric, and adults.

The paediatric segment is a crucial component of the market, representing a significant portion of patients requiring monitoring and diagnosis. Children with epilepsy often present unique challenges in terms of monitoring, necessitating specialized devices designed to cater to their smaller size and specific needs. Continuous monitoring in paediatric patients allows for early detection of seizures, providing valuable data for tailored treatment plans and ensuring the well-being of these young patients. The demand for epilepsy monitoring devices in paediatrics is driven by the importance of early intervention and personalized care to manage and improve the quality of life for children living with epilepsy.

On the other hand, the geriatric segment is another vital category within the market, considering the increasing prevalence of epilepsy among the elderly population. With age, the risk of developing epilepsy or experiencing seizures due to other medical conditions rises, making continuous monitoring essential for timely diagnosis and management. Epilepsy monitoring devices tailored for geriatric patients often account for comorbidities and age-related factors, providing healthcare professionals with crucial information for personalized treatment plans. As the global population ages, the geriatric segment's significance in the epilepsy monitoring device market is expected to grow, emphasizing the need for solutions that address the unique challenges associated with this patient demographic.

Moreover, the adult segment constitutes a substantial portion of the market, encompassing individuals who develop epilepsy in adulthood or continue to manage the condition into their adult years. Monitoring devices for adults play a pivotal role in capturing seizure activity, facilitating accurate diagnosis, and supporting the optimization of treatment plans. The diversity in epilepsy manifestations among adults underscores the importance of continuous monitoring to understand individual seizure patterns and triggers. As adults often seek solutions that integrate seamlessly into their daily lives, the market responds with a variety of devices, including wearable options, to enhance convenience and compliance. The adult segment remains a cornerstone of the market, reflecting the broad range of patients in need of effective and personalized monitoring solutions.

Breakup by Distribution Channel:

- Retail Sales

- Online Sales

- Direct Tenders

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail sales, online sales, direct tenders, and others.

Retail sales represent a significant distribution channel for epilepsy monitoring devices, involving the sale of these devices through brick-and-mortar stores, specialty healthcare retailers, and pharmacies. This channel provides accessibility to patients and caregivers who prefer an in-person shopping experience, enabling them to physically examine and purchase monitoring devices. Retail sales also facilitate the immediate availability of products, making it a convenient option for those in need of epilepsy monitoring solutions on short notice. The retail distribution channel serves as a vital touchpoint for raising awareness about monitoring devices, as it allows potential users to interact directly with the products and seek guidance from knowledgeable staff.

On the other hand, online sales have emerged as a dynamic and rapidly growing distribution channel for epilepsy monitoring devices. The convenience of browsing and purchasing products from the comfort of one's home has fueled the popularity of online sales. E-commerce platforms provide a wide range of monitoring devices, including detailed product information and user reviews, empowering consumers to make informed decisions. This channel is particularly advantageous for individuals in remote or underserved areas, offering them access to a diverse selection of epilepsy monitoring devices. The online sales distribution channel also facilitates the integration of telemedicine solutions, enabling healthcare professionals to recommend and prescribe devices directly to patients.

Moreover, direct tenders form a specialized distribution channel for epilepsy monitoring devices, involving the procurement of these devices through government agencies, healthcare institutions, and large organizations. Tenders are often issued for bulk purchases, catering to the needs of hospitals, clinics, and other healthcare facilities. This channel ensures a systematic and organized procurement process, promoting transparency and adherence to specific requirements outlined in the tender documents. Direct tenders are a common distribution method in healthcare systems where centralized purchasing decisions are made, ensuring standardized and cost-effective acquisition of epilepsy monitoring devices for large-scale healthcare operations. This channel is critical for reaching institutional buyers and contributing to the widespread deployment of monitoring solutions in healthcare settings.

Breakup by End User:

- Hospitals and Clinics

- Home Care Settings

- Others

Hospitals and clinics represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, home care settings, and others. According to the report, hospitals and clinics represented the largest segment.

Hospitals and clinics stand as the predominant end user segment in the market, holding a leading market share. These healthcare settings serve as central hubs for the diagnosis, treatment, and management of epilepsy. Epilepsy monitoring devices in hospitals and clinics are integral components of comprehensive patient care, facilitating the continuous tracking and analysis of seizure activity. In these settings, healthcare professionals can deploy advanced monitoring equipment, such as in-hospital electroencephalogram (EEG) machines and video monitoring systems, to ensure accurate diagnostics and timely intervention. The presence of trained medical staff and access to a range of diagnostic tools make hospitals and clinics key adopters of epilepsy monitoring devices, playing a crucial role in enhancing patient outcomes.

On the other hand, the home care settings segment is gaining prominence within the market, reflecting a growing trend toward patient-centric care and remote monitoring. Epilepsy monitoring devices designed for home use empower individuals with epilepsy to manage their condition more actively. These devices, including wearable EEG monitors and portable seizure detection tools, offer the flexibility for continuous monitoring in a familiar environment. Home care settings enhance patient comfort, reduce the need for extended hospital stays, and promote long-term monitoring, ultimately contributing to improved quality of life for individuals with epilepsy. The convenience and accessibility of monitoring devices in home care settings align with the broader healthcare paradigm shift towards personalized and patient-centered approaches.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest epilepsy monitoring device market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.

Europe stands as the leading region in the market, holding the largest market share. The region's dominance can be attributed to a well-established healthcare infrastructure, a high prevalence of epilepsy cases, and robust research and development activities. European countries prioritize advanced healthcare technologies, fostering the adoption of epilepsy monitoring devices in hospitals, clinics, and home care settings. Additionally, favorable reimbursement policies and a proactive approach to epilepsy management contribute to the market's growth in this region. European nations often serve as early adopters of innovative medical technologies, driving advancements in epilepsy monitoring devices and positioning the region at the forefront of market leadership.

North America is a significant player in the market, characterized by a strong healthcare system, technological innovation, and a high prevalence of epilepsy cases. The region benefits from a large patient pool, sophisticated healthcare facilities, and supportive regulatory frameworks that encourage the adoption of advanced medical technologies. The presence of leading market players and ongoing research initiatives contribute to the continuous growth of the epilepsy monitoring device market in North America. The United States, in particular, plays a pivotal role in shaping market dynamics, with a considerable emphasis on personalized medicine and patient-centric care.

The Asia-Pacific region is experiencing rapid growth in the market, fueled by increasing healthcare awareness, rising healthcare spending, and a growing prevalence of epilepsy. Countries such as China, India, Japan, and Australia contribute significantly to market expansion. The adoption of epilepsy monitoring devices is driven by the region's changing healthcare infrastructure, rising disposable income, and a shift towards advanced medical technologies. Additionally, efforts to improve epilepsy diagnosis and management contribute to the increased demand for monitoring devices in the Asia-Pacific region, making it a key growth area for the market.

Latin America is emerging as a noteworthy market for epilepsy monitoring devices, driven by improving healthcare facilities, growing awareness of neurological disorders, and an increasing focus on patient care. Brazil, Mexico, and Argentina are among the countries contributing to market growth in the region. The adoption of epilepsy monitoring devices in Latin America is facilitated by collaborations with global manufacturers, advancements in healthcare technologies, and efforts to enhance epilepsy management programs. As healthcare infrastructure continues to develop, Latin America presents untapped opportunities for market expansion.

The Middle East and Africa region are witnessing a gradual but steady growth in the market. Factors such as increasing healthcare investments, rising awareness of neurological disorders, and a growing patient population contribute to market development. Countries like the United Arab Emirates, Saudi Arabia, and South Africa play pivotal roles in driving market growth. The adoption of epilepsy monitoring devices in the region is supported by initiatives to enhance healthcare accessibility, technological advancements, and collaborations with international healthcare organizations.

Leading Key Players in the Epilepsy Monitoring Device Industry:

The key players in the market are driving growth through strategic initiatives, technological advancements, and market expansion efforts. These players, often comprising established healthcare technology companies and innovative startups, are investing in research and development to introduce cutting-edge monitoring devices with enhanced capabilities. Collaborations and partnerships with healthcare institutions and research organizations are common strategies, allowing key players to leverage expertise and expand their product portfolios. Moreover, market leaders are actively involved in mergers and acquisitions to strengthen their market presence, acquire advanced technologies, and broaden their geographic reach.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Cadwell Industries Inc.

- Compumedics Limited

- Emotiv Inc.

- Empatica Inc.

- Lifelines Neuro Company LLC

- Medpage Ltd.

- Mitsar Co. Ltd.

- Natus Medical Incorporated

- Neurosoft

- Nihon Kohden Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- June 6, 2022: Cadwell Industries Inc. launched live chat for support and e-store.

- January 8, 2024: Compumedics Limited received new MEG orders from Tsinghua and Tianjin Universities in China.

- July 25, 2023: NICA announced its partnership with EMOTIV to leverage human emotion in the design of cities of longevity.

Epilepsy Monitoring Device Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Conventional Devices, Wearable Devices |

| Patient Types Covered | Paediatric, Geriatric, Adults |

| Distribution Channels Covered | Retail Sales, Online Sales, Direct Tenders, Others |

| End Users Covered | Hospitals and Clinics, Home Care Settings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cadwell Industries Inc., Compumedics Limited, Emotiv Inc., Empatica Inc., Lifelines Neuro Company LLC, Medpage Ltd., Mitsar Co. Ltd., Natus Medical Incorporated, Neurosoft, Nihon Kohden Corporation, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global epilepsy monitoring device market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global epilepsy monitoring device market?

- What is the impact of each driver, restraint, and opportunity on the global epilepsy monitoring device market?

- What are the key regional markets?

- Which countries represent the most attractive epilepsy monitoring device market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the epilepsy monitoring device market?

- What is the breakup of the market based on the patient type?

- Which is the most attractive patient type in the epilepsy monitoring device market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the epilepsy monitoring device market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the epilepsy monitoring device market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global epilepsy monitoring device market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the epilepsy monitoring device market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global epilepsy monitoring device market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the epilepsy monitoring device industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)