eSIM Market Size, Share, Trends and Forecast by Type, Solution, Application, Industry Vertical, and Region, 2025-2033

eSIM Market Size and Share:

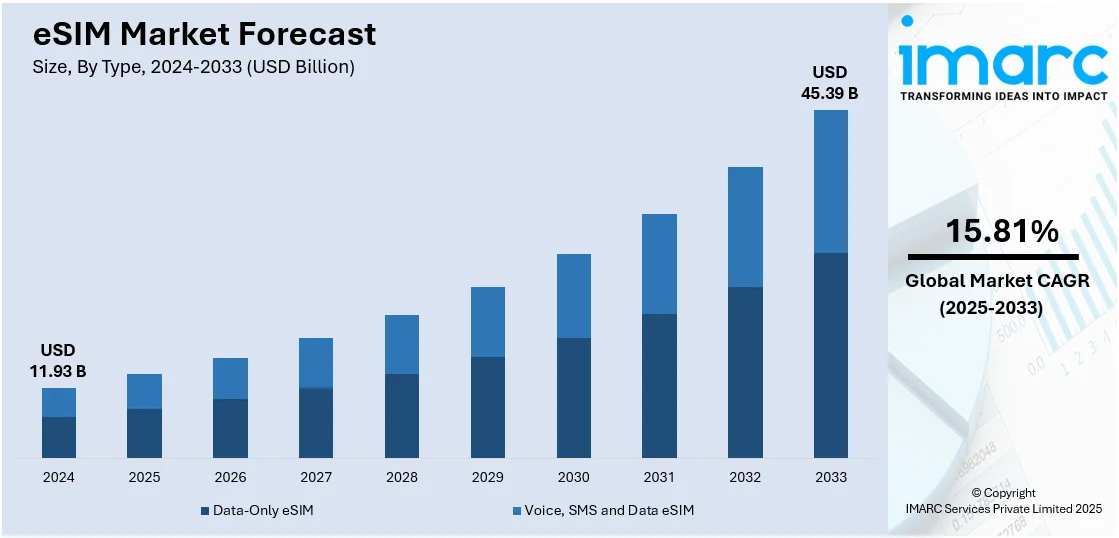

The global eSIM market size was valued at USD 11.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.39 Billion by 2033, exhibiting a CAGR of 15.81% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.2% in 2024. This dominance can be attributed to early 5G adoption, high smartphone penetration, strong presence of telecom giants, and favorable regulatory support. The region also benefits from growing IoT applications across automotive, healthcare, and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.93 Billion |

| Market Forecast in 2033 | USD 45.39 Billion |

| Market Growth Rate 2025-2033 | 15.81% |

The eSIM market is witnessing accelerated growth owing to increasing demand for remote SIM provisioning, especially in connected consumer electronics. Manufacturers are integrating eSIM technology to streamline logistics and enhance device compactness by eliminating traditional SIM slots. For instance, in March 2024, the Telecom Regulatory Authority of India (TRAI) issued recommendations to streamline M2M eSIM usage across industries like agriculture, logistics, transportation, healthcare, and industrial automation. The framework enhances network security, fraud prevention, and profile switching flexibility. The expansion of cross-border M2M applications and enterprise-level deployments in logistics, smart cities, and utilities further supports adoption. OEMs and chipset manufacturers are focusing on universal compatibility across networks, prompting broader device integration. Additionally, advancements in cloud-based connectivity management and growing traction of BYOD (Bring Your Own Device) policies in enterprises are fostering demand. Consumer preference for multi-profile, hassle-free connectivity experiences continue to push telecom operators toward eSIM-enabled service offerings globally.

To get more information on this market, Request Sample

In the United States, the eSIM market is driven by rapid digitization across consumer and enterprise sectors. Tech-forward consumers increasingly prefer eSIM-enabled smartphones, smartwatches, and laptops for seamless activation and network switching. For instance, in March 2025, HOAM launched its customized eSIM services in the U.S., offering affordable, destination-specific international data plans. Users can save up to 70% on roaming costs by selecting only the countries they visit. The eSIM remains on the device permanently, enabling easy reactivation. It supports over 600 global networks, offers 24/7 human customer service, and functions without a mobile app. With rising eSIM adoption and Apple removing SIM slots, HOAM’s model caters to the growing demand for flexible global connectivity. Mobile carriers are prioritizing eSIM integration to reduce operational costs associated with physical SIM logistics. The country’s robust automotive industry is also adopting eSIMs for connected vehicle platforms, supporting real-time diagnostics and over-the-air updates. Regulatory flexibility and interoperability initiatives by the FCC encourage innovation in eSIM provisioning. Additionally, the growing base of remote and hybrid workers’ demands flexible, secure connectivity, pushing device manufacturers and service providers to accelerate eSIM adoption in both personal and enterprise-grade communication devices.

eSIM Market Trends

Increasing Product Demand in M2M Operations

The increasing demand for eSIMs in Machine-to-Machine (M2M) operations is catalyzing the market. M2M communication involves exchanging data between connected devices without human intervention. eSIMs play a pivotal role in M2M operations by providing a seamless and secure connectivity solution. As M2M deployment is expanding, the need for eSIM-enabled devices is rising to enable efficient data exchange and communication between machines. For instance, in March 2024, the Telecom Regulatory Authority of India (TRAI) released recommendations on ‘Usage of Embedded SIM for Machine-to-Machine (M2M) Communications’. These recommendations are aimed at streamlining the regulatory landscape of M2M embedded SIM (eSIM) in India. Through these recommendations, the Authority laid emphasis on ensuring security by way of proper Know Your Customer (KYC), which is essential for ensuring network security, mitigating fraud risks, and enhancing the overall integrity of the M2M eSIM ecosystem. Besides this, the rapid expansion in the M2M connection market is positively impacting the eSIM market outlook. For instance, according to IMARC, the global machine-to-machine (M2M) connections market size reached USD 21.2 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 30.6 Billion by 2032, exhibiting a growth rate (CAGR) of 4% during 2024-2032.

Growing Penetration of 5G Networks

The growing penetration of the 5G network is significantly bolstering the eSIM market by enabling faster data speeds, lower latency, and greater connectivity reliability. eSIMs play a crucial role in the 5G market by enabling seamless connectivity and flexibility for devices. They allow 5G-enabled devices to easily switch between networks and operators without physical SIM card changes, supporting the deployment of IoT devices, smart infrastructure, and connected vehicles with greater efficiency and scalability. Moreover, the ongoing development of 5G networks and the proliferation of IoT devices are expected to further increase the integration of eSIM in smartphones and other connected devices. According to industry reports, the number of cellular IoT connections with critical IoT and broadband globally in 2022 was approximately 1.5 Billion. In five years, the forecast is that the number of cellular IoT connections with the same connection type will continue to rise steadily each year, up to 3.3 Billion. Such a significant growth in the 5G market is anticipated to positively favor the eSIM market in the coming years.

Technological Advancements

Technological advancements in the eSIM market are transforming connectivity management. Advanced eSIM platforms offer dynamic subscription management, allowing seamless switching between mobile networks for optimal performance and cost efficiency. Furthermore, integration with IoT ecosystems and cloud-based solutions further enhances scalability and operational flexibility, supporting diverse applications from smart devices to industrial automation. Additionally, various key market players are increasingly investing in developing robust and more advanced eSIMs. For instance, in November 2022, Mobilise, a developer in eSIM as a Service and a telecom software supplier, launched its eSIM software development kit (SDK) in response to the increased demand for digital services from service providers (SPs) and their clients. The SDK enables SPs to provide clients with global connections within their current application, including an in-app eSIM activation feature. In the same month, STMicroelectronics collaborated with Thales, which powers secure, contactless convenience in the Google Pixel 7. The ST54K single-chip NFC controller and secure element combine with Thales' secure OS for superior performance in embedded SIM, transit ticketing, and digital car-key applications. These advancements are anticipated to bolster the eSIM market share in the coming years.

eSIM Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global eSIM market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, solution, application, and industry vertical.

Analysis by Type:

- Data-Only eSIM

- Voice, SMS and Data eSIM

Data-only eSIM stands as the largest component in 2024, holding around 55.2% of the market. Data-Only eSIMs are designed to provide connectivity solely for data services. These are commonly used in devices like tablets, smartwatches, and IoT devices that primarily require internet access but do not rely on traditional voice calls or SMS messaging. Data-only eSIMs enable seamless data connectivity without needing a physical SIM card, making them ideal for mobile data-intensive applications.

Analysis by Solution:

- Hardware

- Connectivity Services

Hardware led the market with around 60.9% of market share in 2024. The hardware segment encompasses the physical components required for technology. This includes the manufacturing and supplying eSIM chips, modules, and devices equipped with embedded SIM technology. Hardware solutions are crucial for device manufacturers and IoT integrators who must embed eSIM capabilities into their products. These hardware solutions provide the foundation for seamless connectivity, enabling devices to access and switch between mobile networks without a physical SIM card.

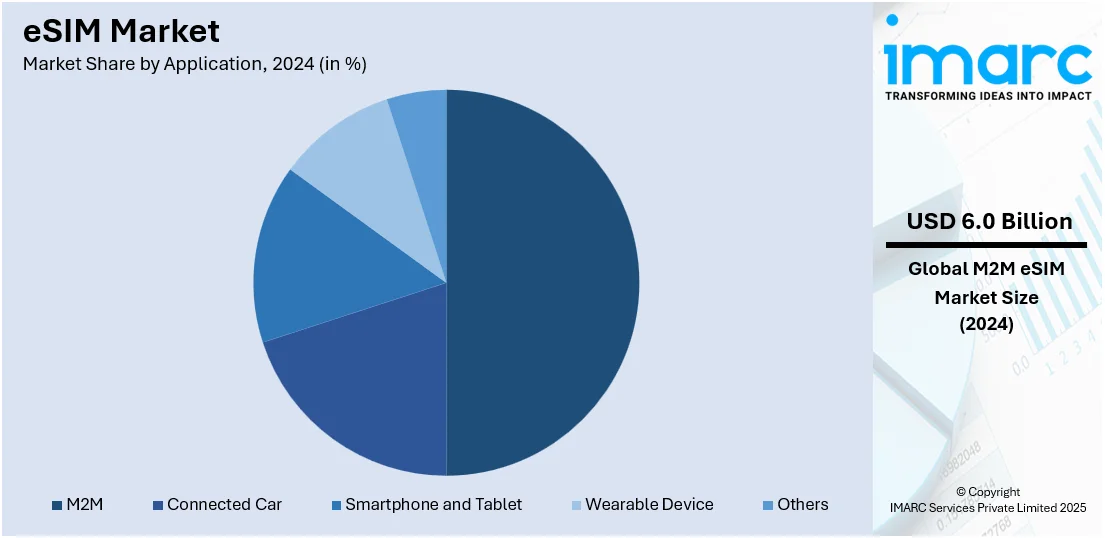

Analysis by Application:

- Connected Car

- Smartphone and Tablet

- Wearable Device

- M2M

- Others

M2M led the market with around 50.2% of market share in 2024. M2M applications involve the exchange of data between connected devices. eSIMs play a crucial role in various industries, including healthcare, logistics, agriculture, and manufacturing, by providing secure and efficient connectivity for M2M communications. These applications enable remote monitoring, predictive maintenance, and automation. Furthermore, significant expansion in M2M connections is offering lucrative growth opportunities to the overall market. For instance, in 2020, there were 8.9 Billion machine-to-machine (M2M) connections globally. That was a 20% increase from 2019. This in turn provides a positive outlook to the eSIM market industry.

Analysis by Industry Vertical:

- Automotive

- Consumer Electronics

- Manufacturing

- Telecommunication

- Transportation and Logistics

- Others

Automotive led the market with around 45% of market share in 2024. The automotive industry has witnessed a significant transformation with the integration of technology. Connected cars leverage them to provide advanced telematics, in-car entertainment, and navigation services. The product enables seamless connectivity, OTA updates, and enhanced safety features, driving the evolution of autonomous and smart vehicles. Furthermore, the escalating adoption of semi and fully autonomous vehicles is further catalyzing the market for eSIMs as they enable seamless connectivity and data management. For instance, in 2019, there were some 31 Million cars with at least some level of automation in operation worldwide. It is expected that their number will surpass 54 Million in 2024.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.2%. In North America, the adoption of technology has been robust. The region's tech-savvy population and strong smartphone penetration have driven the demand for eSIM-enabled devices. Additionally, the deployment of 5G networks in North America has been gaining momentum. eSIM technology complements the capabilities of the 5G network by providing seamless connectivity and making it easier for consumers to switch between carriers and plans. According to Cisco Systems, North America had the most 5G connections made using wearable devices in 2022. The 439 Million connections in North America were 222 Million more than those made to 4G networks in 2017. Additionally, the presence of leading market players in the region is also favoring the market growth. For instance, in December 2022, Grover, one of the top subscription providers for consumer technology, unveiled Grover Connect, an MVNO for clients renting technology in the United States. The country clients can quickly activate any eSIM-enabled technology gadget using Grover Connect. Also, Grover partnered with Gigs, one of the global leaders in telecom-as-a-service platforms in the world that enables any business or brand to become an MVNO, to introduce this innovative new offering. Such collaborations among the leading market players are anticipated to propel the eSIM market revenue in the coming years.

Key Regional Takeaways:

United States eSIM Market Analysis

In 2024, the United States held 82% of the market share in North America. The United States eSIM market is experiencing strong growth due to the increasing adoption of IoT devices, rising demand for seamless connectivity, and advancements in mobile network technologies. The expansion of 5G infrastructure and consumer preference for remote SIM provisioning are key drivers of this growth. The proliferation of connected devices, including smartwatches, smart cars, and industrial IoT applications, is further fueling market demand. Around three-in-ten Americans living in households say they regularly wear a smart watch or fitness tracker. This surge is driving the need for eSIM technology, which offers enhanced flexibility and remote provisioning capabilities. The consumer electronics sector remains a major contributor, with eSIM integration in smartphones, tablets, and laptops becoming increasingly widespread. Enterprises are also embracing eSIM-enabled solutions to improve security, streamline device management, and support global connectivity. The rise of digital transformation initiatives across industries is accelerating adoption. With ongoing innovations, industry collaborations, and increasing reliance on connected technologies, the U.S. eSIM market is poised for sustained expansion in the coming years.

Europe eSIM Market Analysis

The Europe eSIM market is growing rapidly, driven by increasing digitalization, IoT adoption, and the expansion of smart mobility solutions. The proliferation of connected devices, including smart home products and industrial IoT applications, is fueling demand for eSIM technology. According to the International Data Corporation, the number of installed IoT-connected devices is projected to rise from approximately 40 Billion in 2023 to 49 Billion by 2026, reflecting an annual growth rate of 7%. This surge in IoT adoption is further accelerating the demand for eSIM solutions across various sectors. Businesses are integrating eSIM technology to enhance security, optimize connectivity, and reduce operational costs. The widespread rollout of 5G networks further supports adoption, enabling seamless and efficient communication between connected devices. Additionally, sustainability initiatives are encouraging industries to transition from traditional SIM cards to eSIMs, reducing electronic waste. With technological advancements and strategic industry collaborations, the market is expected to witness continuous growth in the coming years.

Asia Pacific eSIM Market Analysis

The Asia Pacific eSIM market is expanding rapidly due to increasing smartphone penetration, IoT adoption, and advancements in network infrastructure. The rising use of connected devices, including smartwatches, automotive applications, and industrial IoT solutions, is driving demand. The rollout of 5G networks and growing investments in smart city initiatives further support market growth. A major milestone in this expansion is the surge in 5G mobile phone subscriptions, with the region witnessing rapid adoption. Notably, 5G mobile phone subscriptions reached 1.0 Billion by the end of November in China, underscoring the strong momentum in the world's leading telecom market, according to data from the Ministry of Industry and Information Technology (MIIT). This rapid shift to 5G is fueling eSIM adoption, as consumers and enterprises seek seamless, high-speed connectivity. Enterprises are increasingly adopting eSIM solutions for enhanced security, operational efficiency, and seamless cross-border connectivity. With digitalization accelerating, the Asia Pacific eSIM market is poised for sustained growth.

Latin America eSIM Market Analysis

The Latin America eSIM market is witnessing steady growth, driven by increasing digital adoption across industries. The rising use of connected devices and expanding telecom infrastructure fuel demand. Businesses are leveraging eSIM solutions to optimize connectivity, enhance security, and support IoT-driven applications. The integration of eSIMs in wearables, automotive solutions, and industrial IoT is further boosting market expansion. According to the International Trade Organization, Brazil’s telecom market size is estimated to reach USD 32.13 Billion in 2024 and USD 43.34 Billion by 2029, growing at a CAGR of 6.17%. This growth is further supported by regulatory authorities facilitating the transition to 5G networks. With increasing investments in advanced connectivity solutions and digital transformation efforts, the region’s eSIM market is expected to continue its upward trajectory.

Middle East and Africa eSIM Market Analysis

The Middle East and Africa (MEA) eSIM market is witnessing significant growth, driven by the increasing adoption of connected devices that support eSIM technology. The region is experiencing a shift towards more flexible mobile connectivity solutions, with eSIM offering advantages such as remote provisioning, cost-effectiveness, and enhanced security. Countries with advanced telecom infrastructure, such as the UAE, Saudi Arabia, and South Africa, are leading the adoption of eSIM, while other nations are catching up as the demand for IoT, M2M connectivity, and 5G services rises. It has been reported that the GCC is forecast to have 62 million 5G mobile subscriptions by the end of 2026. The expansion of eSIM-enabled devices, along with support from telecom operators and device manufacturers, is expected to further fuel market growth. Additionally, the growing trend of digitalization and increased travel within the region contribute to the adoption of eSIM, as users seek convenience and cost savings when managing multiple networks.

Competitive Landscape:

The eSIM market features a highly competitive landscape characterized by rapid technological innovation, strategic partnerships, and product diversification. Market participants are actively focusing on expanding their global reach through collaboration with mobile network operators and device manufacturers. Emphasis is placed on developing secure, interoperable eSIM solutions that support remote provisioning and seamless switching between networks. Several players are investing in R&D to enhance eSIM management platforms and improve integration across IoT, consumer electronics, and automotive applications. For instance, in March 2025, Thales and Cubic partnered to enhance eSIM solutions for connected vehicles, integrating Thales’s GSMA-compliant eSIM management platform into Cubic’s multi-network ecosystem. This collaboration simplifies global connectivity, automating subscription activation and eliminating manual SIM swaps. It benefits major automotive manufacturers, enabling seamless connectivity across borders. Vehicles can now be pre-configured at the factory level and activated dynamically. This partnership strengthens Cubic’s IoT connectivity capabilities while supporting standardization, interoperability, and innovation for the evolving automotive and transportation industries. In addition, regulatory support and standardized specifications from global telecom bodies are creating a level playing field, encouraging new entrants. The market also sees consolidation efforts and strategic acquisitions to strengthen portfolios, improve customer reach, and enhance capabilities across different verticals and geographic regions.

The report provides a comprehensive analysis of the competitive landscape in the eSIM market with detailed profiles of all major companies, including:

- AT&T Inc.

- IDEMIA

- Giesecke+Devrient GmbH

- Infineon Technologies AG

- Kigen

- KORE Wireless

- STMicroelectronics

- Thales Group

- Trasna

- Valid S.A.

Latest News and Developments:

- December 2024: Apple announced plans to launch eSIM-only iPhones globally by 2025 with the iPhone 17 series, eliminating physical SIM trays. This shift, first introduced in the U.S. with the iPhone 14, enhances security, flexibility, and design efficiency, enabling larger batteries, improved waterproofing, and seamless network switching for travelers and multi-network users.

- September 2024: TIM Brasil launched a web portal for customers to convert physical SIM cards to eSIMs for free, enhancing 5G access and reducing costs. IDEMIA provided the eSIM management platform. The portal automatically recognizes SIMs, allowing users to migrate seamlessly and improving efficiency, convenience, and future network accessibility in Brazil.

- June 2024: STMicroelectronics introduced the first embedded SIM (eSIM) in the industry to meet the incoming SGP.32 GSMA standard for eSIM IoT deployment. The ST4SIM-300 introduces special features to manage the mass rollout of IoT devices connected to cellular networks.

- March 2024: Vodafone Idea launched eSIM services for its prepaid customers in Mumbai. As per Vodafone Idea, its eSIM for prepaid customers is accessible to iOS and Android users, and can be availed of on several handsets, including Apple iPhone XR and above models, Vivo X90 Pro, Nokia G60 and Nokia X30, as well as Samsung flagships such as Galaxy Z Flip, Galaxy Fold, Galaxy Z Fold 2, and others.

- February 2024: G+D and the telecommunications company China Unicom signed a Memorandum of Understanding (MoU) to establish a strategic partnership in the areas of eSIM technology and services. The agreement aims to establish a comprehensive and in-depth cooperation to promote the further development of eSIM technology and explore new use cases in vertical areas.

eSIM Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Data-Only eSIM, Voice, SMS and Data eSIM |

| Solutions Covered | Hardware, Connectivity Services |

| Applications Covered | Connected Car, Smartphone and Tablet, Wearable Device, M2M, Others |

| Industry Verticals Covered | Automotive, Consumer Electronics, Manufacturing, Telecommunication, Transportation and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T Inc., IDEMIA, Giesecke+Devrient GmbH, Infineon Technologies AG, Kigen, KORE Wireless, STMicroelectronics, Thales Group, Trasna, Valid S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the eSIM market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global eSIM market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the eSIM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The eSIM market was valued at USD 11.93 Billion in 2024.

The eSIM market is projected to exhibit a CAGR of 15.81% during 2025-2033, reaching a value of USD 45.39 Billion by 2033.

Key factors driving the eSIM market include rising adoption of connected devices, remote SIM provisioning, and increasing demand for flexible, multi-network connectivity. Growth in IoT, M2M communication, and international travel also contributes, along with support from telecom operators and device manufacturers for eSIM-compatible products and infrastructure.

North America currently dominates the eSIM market, accounting for a share of 40.2% in 2024. The region’s eSIM market is driven by high smartphone penetration, strong carrier support, advanced IoT deployments, and early adoption of remote SIM provisioning technologies.

Some of the major players in the eSIM market include AT&T Inc., IDEMIA, Giesecke+Devrient GmbH, Infineon Technologies AG, Kigen, KORE Wireless, STMicroelectronics, Thales Group, Trasna, Valid S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)