Esports Market Size, Share, Trends and Forecast by Revenue Model, Platform, Games, and Region, 2026-2034

Esports Market Size and Forecast:

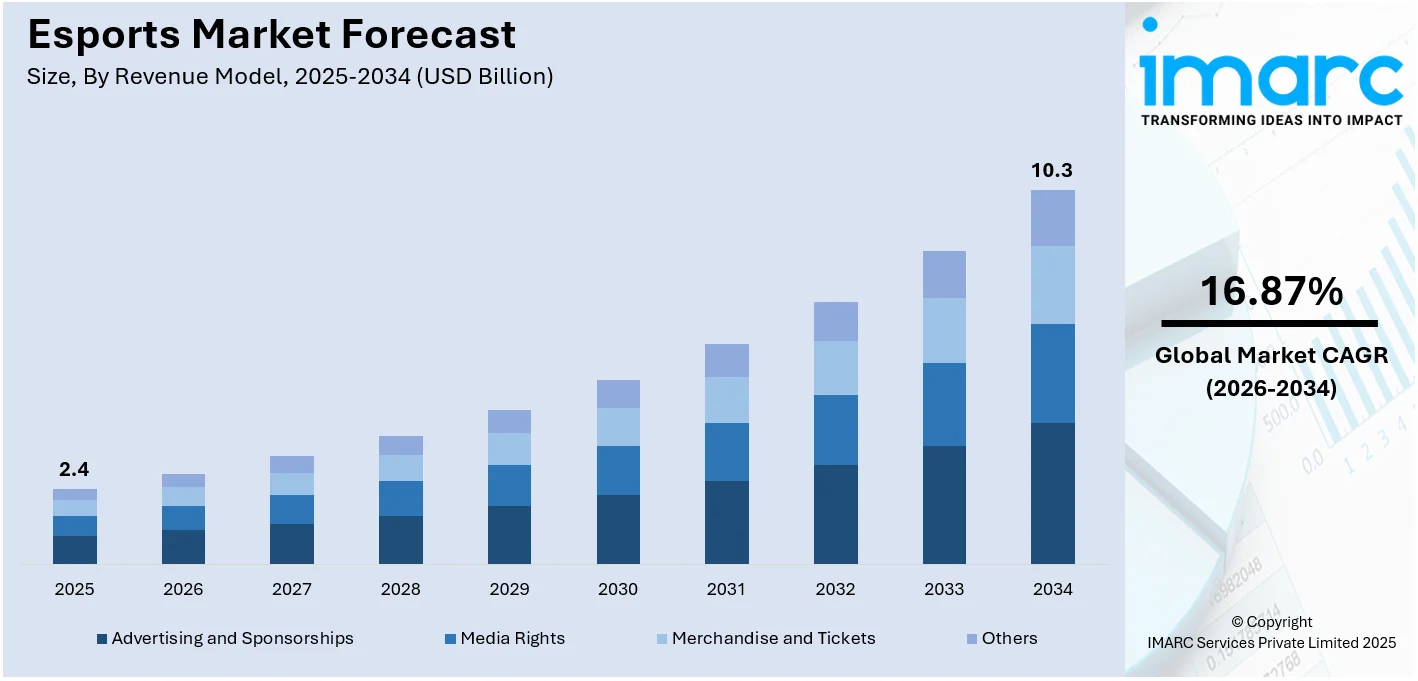

The global esports market size was valued at USD 2.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 10.3 Billion by 2034, exhibiting a CAGR of 16.87% during 2026-2034. Asia Pacific dominated the market, holding a significant market share of 30.0% in 2025. Rising internet penetration, significant innovations in gaming technology, increasing popularity of live-streaming platforms, and favorable investments from sponsors and advertisers are increasing the esports market value around the globe. Additionally, growing Gen Z engagement and the introduction of global events like the Olympic Esports Games are emerging as key trends, further accelerating the mainstream adoption and legitimacy of esports worldwide.

Key Insights:

- In terms of region, Asia Pacific held the leading position in revenue in 2025.

- The US accounted for 86.80% of the market share in North America in 2025.

- Among revenue models, advertising and sponsorships generated the highest revenue in 2025.

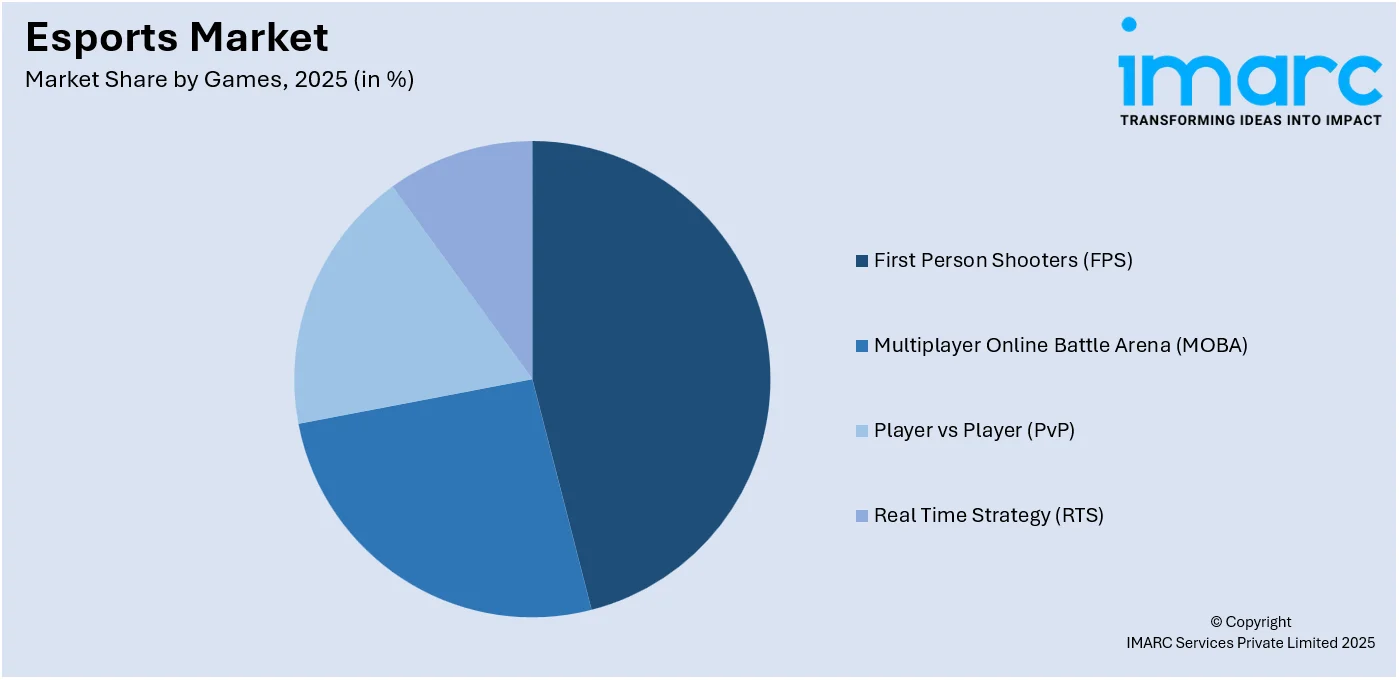

- First person shooters segment was the top-performing game.

Market Size and Forecast:

- Market Size in 2025: USD 2.4 Billion

- Projected Market Size in 2034: USD 10.3 Billion

- CAGR (2026-2034): 16.87%

- Largest Market in 2025: Asia Pacific

To get more information on this market Request Sample

The esports industry is changing at a breakneck speed, fueled by a few major drivers and trends. The growth of gaming as a mainstream source of entertainment has resulted in a boom in esports viewership and participation. The emergence of online streaming sites like Twitch and YouTube Gaming, along with social media interactions, has helped augment Esports' fan base to a great extent. In addition, increasing popularity of cloud gaming and mobile gaming technology has increased accessibility to esports, enabling participants and spectators alike to engage without requiring high-performance hardware. All these trends, coupled with advancements in wireless and 5G connectivity, are making the gaming experience more seamless and high-quality, driving the esports market growth.

The US is leading the way in this growth, with major investments in esports infrastructure and technology. Specifically, the advent of 5G networks is revolutionizing how esports events are carried out and consumed. With more than 90% of the U.S. population now covered under 5G low-band and mid-band networks, players and spectators can now experience low-latency gaming and high-definition live-streamed events. This technological growth is propelling esports to new levels, with US telecommunication providers ongoing to invest in the rollout of the 5G to enable higher speeds and greater reliability of connection for the industry. Consequently, esports is becoming increasingly available and immersive for players and spectators nationwide, reinforcing the country's leadership in the esports market size by country.

Esports Market Trends:

Surge in Esports Betting Activities

Esports betting has emerged as a significant driver in the esports industry growth globally. With the rise of professional gaming tournaments and increased viewer engagement, fans are placing real-money wagers on match outcomes, player performances, and in-game events. This trend mirrors traditional sports betting but is tailored to a younger, digitally native audience. Online betting platforms are now integrating esports sections, offering odds and real-time analytics for major titles like League of Legends, CS:GO, and Dota 2. Regulatory advancements and improved legitimacy of esports competitions are attracting major betting operators, increasing trust among bettors. As the esports audience continues to grow, esports growth is expected to become a mainstream vertical within the global gambling industry.

Growing Popularity of Gaming and Digital Platforms

The rapid expansion of digital ecosystems has fueled the mainstream adoption of gaming and esports. Streaming platforms like Twitch, YouTube Gaming, and Kick have created vibrant communities where players and fans interact in real-time. Simultaneously, social media and mobile apps provide instant access to live tournaments, game updates, and fan-driven content. Younger demographics, particularly Gen Z and millennials, are spending more time on digital platforms, leading to exponential growth in esports industry size. Cloud gaming and mobile esports are further broadening access, reducing hardware barriers. This shift to digital-first entertainment is redefining how consumers engage with competitive gaming, making esports not just a niche interest but a dominant force in modern pop culture and online media.

Rise of Brand Sponsorships and Strategic Investments

Brand sponsorships and investments have become crucial to the financial infrastructure of esports. Leading non-endemic brands, ranging from energy drinks and apparel to financial services, are investing heavily in esports teams, tournaments, and streamers to tap into a young, loyal, and tech-savvy audience. Sponsorship deals often include jersey branding, in-stream advertising, and exclusive content creation, enhancing brand visibility. Additionally, venture capital and corporate investments are pouring into esports organizations and platforms, boosting innovation and infrastructure. From Nike sponsoring esports teams to Intel funding tournament technology, the industry is witnessing a surge in cross-industry collaborations. These investments not only validate the esports industry worth but also accelerate its transformation into a global entertainment powerhouse.

Increasing Internet Penetration

The worldwide proliferation of internet use, combined with the rising accessibility of high-speed connections, is fueling the development of online gaming communities and esports competitions. In 2024, 5.35 Billion individuals, or 66.2% of the global population, are actively engaged on the internet, a major leap in connectivity. This jump is evident from a 1.8% yearly growth in netizens, with 97 Million individuals accessing the web for the first time in 2023. With internet infrastructure further developing and keeping pace with contemporary lifestyles, users are likely to increase at an ever-faster rate in the years to come. Broadband internet connectivity, especially that facilitated by the introduction of 5G networks, is boosting the gaming experience by allowing instant streaming and lag-free competitive gaming. These improvements are drawing increasing numbers of participants, enthusiasts, and spectators to the esports market, thus making it a prominent sector in the latest esports market data.

Rising Investments from Sponsors and Advertisers

Substantial financial backing from leading brands and advertisers has significantly strengthened the professional esports sector. Capital investment in gaming has surged 3.7 times from 2014 to 2024 YTD, outpacing the broader venture capital market, which grew by around 1.5 times over the same period. This influx of funding supports tournament prize pools, player salaries, and infrastructure development, positioning esports as a viable and lucrative career path while increasing its visibility and legitimacy. For example, in June 2024, the International Olympic Committee (IOC) proposed integrating esports into the global sports community through the "Olympic Esports Games," a topic set for discussion at the 142nd IOC Session during the Paris 2024 Olympics. Additionally, esports made history by debuting as an official medal event at the 2022 Asian Games in Hangzhou, further solidifying its standing in the world of competitive sports. Such significant events aid in substantially increasing the e sport market size around the globe.

Growing Recognition of Esports as a Legitimate Sport

The increasing recognition of esports as a competitive sport, complete with organized leagues and tournaments, is driving both demand and its widespread popularity. This growing acceptance has paved the way for structured competitions that attract participants and audiences alike. For example, in July 2024, Skyesports hosted India’s first LAN event, the Finals Esports Revolution Showdown, in Chennai. The success of such high-profile tournaments highlights the professionalization of esports, drawing extensive media coverage and increasing audience engagement. As esports gains legitimacy as both a mainstream entertainment option and a professional career path, the industry continues to expand. In April 2024, NODWIN Gaming further strengthened its position by partnering with the Global Esports Federation (GEF), becoming the Portfolio Management Company (PMC) for emerging markets in South and Central Asia, Africa, the Middle East, and parts of Southeast Asia. The agreement marks a significant milestone in NODWIN's efforts to expand its influence and promote esports industry trends worldwide, which, in turn, is expected to boost esports revenue.

Esports Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the esports market size 2025, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on revenue model, platform, and games.

Analysis by Revenue Model:

- Media Rights

- Advertising and Sponsorships

- Merchandise and Tickets

- Others

In 2025, the advertising and sponsorships segment led the market, holding 43.6% of the market share. Advertising and sponsorships represent a major portion of the esports market statistics, offering substantial financial backing and enhanced visibility for both events and players. Brands are increasingly investing in esports to target a young, highly engaged audience through sponsorships, team affiliations, and in-game ads. These investments help fund tournaments, player salaries, and promotional campaigns, contributing to the industry’s expansion. With high viewership and strong fan involvement, esports presents an ideal platform for advertisers aiming to reach a tech-savvy demographic.

For example, in June 2025, KFC India partnered with Krafton India, the developers behind Battlegrounds Mobile India (BGMI), to provide exclusive in-game rewards. The collaboration introduced the "Winner Winner Chicken Lunch" promotion, allowing BGMI players to earn rewards with the purchase of a KFC Zinger Box. This initiative capitalizes on the growing popularity of gaming among young Indians, a demographic projected to reach 750 Million users by 2025. Such partnerships play a vital role in shaping the positive dynamics of the esports market, driving engagement and boosting growth.

Analysis by Platform:

- PC-based Esports

- Consoles-based Esports

- Mobile and Tablets

PC-based esports are propelled by the advanced capabilities of personal computers, which offer superior graphics, processing power, and customization options to enhance the gaming experience. The popularity of various game titles, combined with high-speed internet and powerful hardware, supports competitive gameplay and live streaming, drawing both professional players and large audiences. Furthermore, the well-established infrastructure within the PC gaming community encourages engagement and tournament organization, contributing to market growth. The continuous innovation in PC hardware and peripherals further fuels the growth of this segment, catering to both casual and professional gamers.

Console-based esports benefit from the accessibility and user-friendly nature of gaming consoles like PlayStation and Xbox. These platforms deliver a seamless gaming experience with standardized hardware that ensures consistent performance across different games. The integration of consoles with live streaming services and social media amplifies viewer engagement and creates more monetization opportunities. Additionally, exclusive game releases and partnerships with major gaming events and leagues are boosting the popularity and growth of console-based esports.

According to the global esports market research report, the trend of increasing penetration of smartphones and tablets, making gaming accessible to a broader audience. The convenience and portability of mobile devices allow gamers to play anywhere, attracting both casual and competitive players. The low cost and ease of use have made mobile gaming widely adopted. Advances in mobile technology, such as improved graphics and processing power, further elevate the gaming experience and are fostering the growth of mobile-based esports.

Analysis by Games:

Access the comprehensive market breakdown Request Sample

- Multiplayer Online Battle Arena (MOBA)

- Player vs Player (PvP)

- First Person Shooters (FPS)

- Real Time Strategy (RTS)

In 2025, the first person shooters led the esports market. First-person shooters (FPS) dominate the esports market due to their fast-paced action, strategic complexity, and wide appeal among both players and viewers. Popular titles like Call of Duty, Counter-Strike, and Overwatch have cultivated large, dedicated fanbases and established professional leagues. The competitive nature of these games, coupled with regular updates, ensures ongoing player and viewer engagement. For example, the release of Counter-Strike 2 in September 2023 introduced the most significant technical advancements in the game’s history, with new features and planned updates set to keep the game evolving for years. Additionally, the visually dynamic nature of FPS games makes them perfect for live streaming, driving significant sponsorship and esports market size 2024 revenue.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

As per the IMARC Group’s esports industry report, the Asia Pacific led the esports market, holding 30.0% of the market share in 2025. The Asia Pacific region leads the global esports market, fueled by its large, tech-savvy population and high internet penetration. Countries like China and South Korea have a strong cultural connection to gaming, with major tournaments and professional teams emerging from these areas. For example, in September 2023, China hosted its largest esports event at the 19th Asian Games in Hangzhou, with Tencent at the forefront. This event marked the first time competitive video games were awarded medals at the Games. Tencent aims to expand its esports presence to boost its entertainment portfolio and restore national pride in the face of economic challenges. The company also developed an esports hotel in Hangzhou, catering to the growing lifestyle trend among young people. Despite recent setbacks in the esports market, China remains a significant force, with 400 million fans driving growth in the sector.

Government support and investments in digital infrastructure further enhance the competitive landscape. For instance, the India Game Developer Conference (IGDC) announced in May 2024 that it would expand its Developer Day program to seven key Indian cities: Delhi, Pune, Ahmedabad, Cochin, Chennai, Guwahati, and Kolkata. This initiative aims to nurture a vibrant game development ecosystem across India, offering opportunities for networking, skill-building, and talent showcases. The IGDC also unveiled the creation of the Game Developers Association of India (GDAI) to support developers through advocacy, education, professional development, and promoting ethical practices within the industry. The presence of major esports organizations and a strong gaming infrastructure further solidify the region's dominance in the global esports market.

Key Regional Takeaways:

United States Esports Market Analysis

In 2025, United States accounted for 86.80% of the market share in North America. United States is experiencing a surge in esports adoption due to the growing trend of online gaming, which has fueled competitive gaming culture and professional leagues. For instance, the United States had approximately 197.16 Million online gamers in 2024. Increasing internet speeds and cloud gaming services have enhanced accessibility, allowing players to engage in high-quality gameplay without expensive hardware. Sponsorships and media rights deals have driven financial investments, making esports a lucrative industry. Educational institutions integrating esports programs and scholarships have legitimized gaming as a career path. Streaming platforms and social media engagement have further expanded audiences, increasing participation. esports tournaments and events continue to attract massive viewership, enhancing mainstream acceptance. Technological advancements in virtual reality and augmented reality are contributing to immersive gaming experiences, strengthening industry growth and sustainability.

Asia Pacific Esports Market Analysis

Asia Pacific is witnessing significant esports expansion owing to its large and young population, which has propelled demand for competitive gaming and content creation. For instance, India's youth population is set to reach 420 Million in 2024, comprising 29% of the total population. The region’s widespread internet connectivity and affordable gaming devices have made esports accessible to Millions. Streaming services and gaming influencers have contributed to a rapidly growing fan base, driving engagement across multiple platforms. Localized gaming content and language support have further fuelled player participation. Gaming cafes and esports training centers have emerged as hubs for professional development. Brand sponsorships and corporate investments have strengthened the commercial appeal of esports, while increasing prize pools in tournaments have incentivized professional players. esports leagues and collaborations with traditional sports organizations have bolstered industry recognition and mainstream integration.

Europe Esports Market Analysis

Europe is experiencing increasing esports adoption due to favorable government support and investment in digital infrastructure, which have strengthened the ecosystem for competitive gaming. According to European Investment Bank, 69% of EU firms implemented advanced digital technologies in 2022. Policy frameworks promoting gaming education and esports regulations have created an organized competitive landscape. Fiber-optic internet expansion and 5G deployment have enabled low-latency gaming experiences, attracting casual and professional players. Universities and academic institutions are integrating esports curricula, recognizing its potential for career development. Media broadcasting deals and sponsorship agreements have generated revenue streams, ensuring industry sustainability. Large-scale esports events and tournaments are drawing international audiences, increasing visibility and engagement. Cross-industry collaborations with sports clubs and entertainment brands have further solidified esports as a mainstream entertainment sector.

Latin America Esports Market Analysis

Latin America is witnessing increasing esports adoption due to rising internet penetration, which has improved accessibility to competitive gaming and online tournaments. According to reports, in the last decade, Internet penetration in Latin America jumped from 43% to 78%, even reaching 90% in Chile, driven by the inclusion of the middle and lower-income classes. Affordable data plans and expanding broadband infrastructure have enabled more players to participate in esports ecosystems. Social media platforms and streaming services have fueled community engagement, driving content creation and viewership growth. Investments from gaming organizations and sponsorship deals have provided financial support, enhancing the industry’s sustainability. Local gaming competitions and regional leagues are fostering grassroots development, encouraging young players to pursue professional esports careers.

Middle East and Africa Esports Market Analysis

Middle East and Africa is seeing significant esports expansion due to growing smartphone users, making mobile gaming a dominant force in the competitive landscape. For instance, a total of 42.50 Million cellular mobile connections were active in Saudi Arabia in early 2023. Low-cost mobile devices and affordable data plans have increased accessibility, enabling a broader audience to engage in esports. Streaming platforms and social media influencers have played a key role in promoting gaming culture and attracting sponsorship investments. Regional gaming tournaments and leagues are gaining traction, creating opportunities for emerging players to compete at higher levels. Corporate investments and partnerships with international gaming organizations are driving professionalization, while local gaming hubs and esports centers are supporting industry growth.

Top 14 Companies in Esports Industry:

Ongoing advancements in gaming technologies, event management strategies, and fan engagement techniques drive the esports market. Companies in the industry are focused on enhancing game graphics, performance optimization, and the overall user experience, which is crucial for attracting both players and viewers. Market players compete by offering high-quality gaming platforms, content streaming, and immersive experiences that cater to the growing demand for professional-level gameplay. Strategic partnerships, global market expansion, and customized gaming solutions are helping firms broaden their presence. According to esports market forecasts, demand is expected to rise as more sectors emphasize interactive entertainment, competitive gaming, and digital content, prompting increased investment in technology, player development, and content innovation.

The report provides a comprehensive analysis of the competitive landscape in the esports market with detailed profiles of all major companies, including:

- Activision Blizzard Inc.

- Capcom Co. Ltd.

- Electronic Arts Inc.

- Epic Games Inc.

- FACEIT

- Gameloft SE (Vivendi SE)

- Gfinity PLC

- Intel Corporation

- Modern Times Group

- Nintendo Co. Ltd.

- NVIDIA Corporation

- Riot Games Inc.

- Valve Corporation

- Zynga Inc.

Latest News and Developments:

- April 2025: The FIA revealed a new esports sim racing competition aimed at females aged 16 and above. Named the FIA Girls on Track Esports Cup, the event is being organized in collaboration with simulation rig producer Advanced SimRacing and the widely used racing platform iRacing.

- March 2025: M80 and IMG Academy launched an esports camp in Florida this May, offering pro training for teens in Valorant, Rocket League, and League of Legends. The three-week program blends online learning with hands-on coaching from esports professionals. Aiming to develop the next generation of competitive gamers, it emphasizes strategy, teamwork, and mental health. This initiative strengthens North America's grassroots esports scene.

- February 2025: The inaugural Olympic Esports Games was planned to be hosted in Riyadh, Saudi Arabia, in 2027, marking a major milestone for the global esports industry. The "Road to the Games" had begun in 2024 with the first Olympic esports competitions. This event signified growing recognition of esports within the Olympic Movement and highlighted its rising global influence and legitimacy as a competitive sport.

- June 2024: PrizePicks launched The Esports Lab, a digital platform introducing fantasy sports players to esports. Featuring stats, live matches, and major titles like CS2, League of Legends, and DOTA2, it bridges the gap between fantasy and competitive gaming. Unlike other esports sites, it focuses on education and accessibility for newcomers. This move strengthens esports' integration into the fantasy sports ecosystem.

- May 2024: Esports players in North America got a global stage with the International Esports Exchange by USEF and Ghost Gaming. Kicking off with a Tekken tournament at 404 Esports, Atlanta, the winner will represent the U.S. at the 2024 Global Esports Camp in South Korea. Supported by the Korean Ministry of Culture, the camp offers pro training and wellness workshops.

- April 2024: SC State partnered with Blaze Fire Games to launch a competitive esports program. The initiative aims to engage students through gaming while boosting recruitment and retention. With esports growing in higher education, the program offers career opportunities in a lucrative industry. University leaders see it as a way to turn student passion into professional success.

- July 2024: Electronic Arts has revealed information about its upcoming football title, EA SPORTS FC 25, scheduled for worldwide launch on September 27. The game features numerous advancements developed through Rush and FC IQ. This fresh mode will be accessible in Football Ultimate Team, Clubs, and Kick-Off.

Esports Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Models Covered | Media Rights, Advertising and Sponsorships, Merchandise and Tickets, Others |

| Platforms Covered | PC-based Esports, Consoles-based Esports, Mobile and Tablets |

| Games Covered | Multiplayer Online Battle Arena (MOBA), Player vs Player (PvP), First Person Shooters (FPS), Real Time Strategy (RTS) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Activision Blizzard Inc., Capcom Co. Ltd., Electronic Arts Inc., Epic Games Inc., FACEIT, Gameloft SE (Vivendi SE), Gfinity PLC, Intel Corporation, Modern Times Group, Nintendo Co. Ltd., NVIDIA Corporation, Riot Games Inc., Valve Corporation, Zynga Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the esports market from 2020-2034.

- The esports market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the esports industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The esports market was valued at USD 2.4 Billion in 2025.

The esports market is projected to exhibit a CAGR of 16.87% during 2026-2034, reaching a value of USD 10.3 Billion by 2034.

Key factors driving the esports market include growing global viewership, increased sponsorship and advertising, mobile gaming expansion, streaming platform popularity, and rising investments. Technological advancements, franchise leagues, and youth engagement also fuel growth. Additionally, esports' integration with traditional sports and education enhances legitimacy, attracting more brands and fans worldwide.

Asia Pacific dominated the esports market in 2025, accounting for a share of 30.0% due to its large gaming population, advanced internet infrastructure, mobile gaming popularity, government support, and strong presence of major esports companies and tournaments.

In 2025, the United States held 86.80% of the total market share within the North America esports market.

Some of the major players in the esports market include Activision Blizzard Inc., Capcom Co. Ltd., Electronic Arts Inc., Epic Games Inc., FACEIT, Gameloft SE (Vivendi SE), Gfinity PLC, Intel Corporation, Modern Times Group, Nintendo Co. Ltd., NVIDIA Corporation, Riot Games Inc., Valve Corporation, Zynga Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)