Europe Air Separation Unit Market Size, Share, Trends and Forecast by Process, Gas, End User, and Country, 2025-2033

Europe Air Separation Unit Market Size and Share:

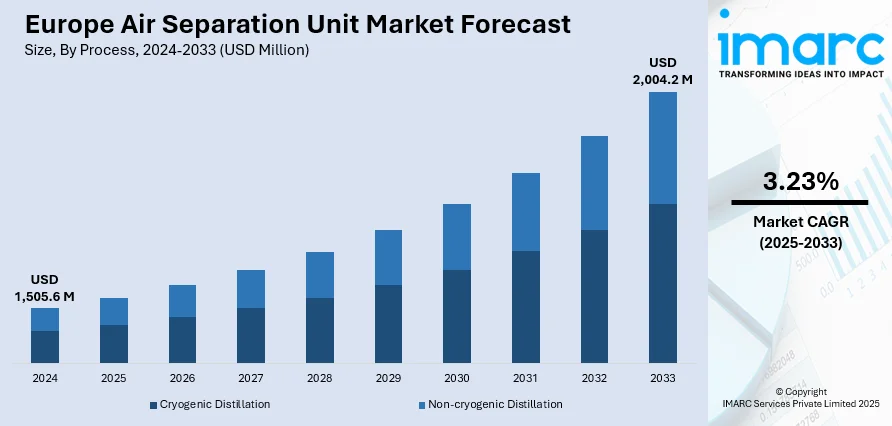

The Europe air separation unit market size was valued at USD 1,505.6 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,004.2 Million by 2033, exhibiting a CAGR of 3.23% during 2025-2033. Germany currently dominates the market in 2024. The market is expanding due to rising industrial gas demand across healthcare, chemicals, and food processing sectors. In addition, ongoing investments in clean energy and localized production continue to support Europe air separation unit market share across key manufacturing and infrastructure development applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,505.6 Million |

| Market Forecast in 2033 | USD 2,004.2 Million |

| Market Growth Rate (2025-2033) | 3.23% |

The growing focus on clean energy across Europe is increasing the demand for air separation units (ASUs), especially in green hydrogen production. Producing hydrogen through electrolysis requires large volumes of pure oxygen, which ASUs provide efficiently. As governments invest in hydrogen infrastructure and electrolyzer installations rise, ASUs are becoming an essential part of the supply chain. Countries like Germany, France, and the Netherlands are expanding hydrogen projects under national energy transition plans, creating new opportunities for ASU installations. This trend reflects how the shift to low-carbon energy sources is directly contributing to the expansion of the ASU market.

To get more information on this market, Request Sample

In Europe, the food and beverage industry is playing a growing role in driving demand for air separation units. Gases like nitrogen and oxygen are widely used for food preservation, packaging, and controlled atmosphere storage. As consumer demand increases for packaged and frozen foods, companies are scaling up gas usage to meet safety and shelf-life standards. Modern ASUs are being deployed to support continuous, high-purity gas supply in food processing plants. This trend highlights how evolving industry needs and stricter food safety regulations are pushing businesses to invest in dedicated, on-site ASUs, further strengthening the regional market outlook.

Europe Air Separation Unit Market Trends:

Regional Demand for Industrial Gases

The European market is witnessing strong momentum due to growing demand for industrial gases in key sectors like healthcare, chemicals, metallurgy, and energy. As industrial activity rises, there is a heightened need for consistent and high-purity supplies of gases such as oxygen, nitrogen, and argon. These gases play a critical role in various applications, including medical treatments, metal fabrication, and clean energy technologies. The ongoing push for modernization across manufacturing processes has made reliable gas infrastructure a necessity rather than a choice. Industrial users now expect minimal downtime, faster delivery, and efficient integration with existing systems, prompting producers to scale up localized capacity. In July 2025, SIAD Group and SOL Group inaugurated a €50 million Air Separation Unit in Zagreb, Croatia, via their joint venture OXY. The facility began producing liquid oxygen, nitrogen, and argon, enhancing regional supply capabilities and strengthening Europe's industrial gas infrastructure and market competitiveness. Such strategic investments reflect a clear trend toward proximity-based production models that reduce logistical risks and shorten response times. Companies are also prioritizing cost efficiency and sustainability by operating closer to demand centers. This approach supports uninterrupted supply chains and meets stricter regulatory expectations, highlighting the growing importance of regional units across the Europe air separation market growth.

Sustainable Demand and Infrastructure Growth

The air separation unit (ASU) market in Europe is witnessing steady growth, supported by multiple driving factors. One of the main contributors is the rising demand for industrial gases like oxygen and nitrogen across sectors including healthcare, manufacturing, chemicals, and electronics. These gases are essential for applications such as medical treatments, metal processing, and semiconductor fabrication. In 2024, Europe’s industrial gases market was valued at USD 17.3 Billion and, according to IMARC Group, is expected to reach USD 24.2 Billion by 2033, growing at a CAGR of 3.57% from 2025 to 2033. This increasing requirement has encouraged industries to invest in reliable gas generation systems like ASUs. At the same time, the region’s focus on sustainable development and environmental responsibility is reshaping investment strategies. A European Investment Bank (EIB) survey showed that 94% of EU citizens believe adapting to climate change is necessary, and 85% support urgent spending in this area to avoid larger economic consequences later. Companies are turning to efficient ASU technologies that reduce emissions and support compliance with strict environmental regulations. Data shows a 31% drop in net greenhouse gas emissions in the EU-27 between 1990 and 2022, including emissions from international transport sectors under EU policy. In addition to sustainability goals, infrastructure development is another strong driver. New projects in steel, chemical, and healthcare industries require dependable gas supply systems. This has led to growing installations of ASUs to meet production needs without interruption. Whether for expanding hospitals or industrial complexes, demand for on-site, high-capacity gas generation systems is on the rise. Collectively, growing industrial use, climate-conscious investments, and infrastructure upgrades are shaping a resilient and forward-looking air separation unit market in Europe, setting the foundation for long-term growth and innovation in gas supply technologies.

Technological Advancements in Gas Production

The Europe air separation unit market trends are witnessing strong growth, heavily influenced by ongoing technological innovation in gas production processes. New-generation ASUs are now designed with advanced automation, smart control systems, and energy-efficient components that optimize production output while significantly reducing operational costs. These improvements have enabled real-time monitoring, predictive maintenance, and dynamic load management, allowing manufacturers to enhance uptime, reduce system failures, and extend equipment lifespan. Additionally, modular ASU designs have become more prevalent, providing flexible deployment options for facilities with space constraints or fluctuating production requirements. Energy efficiency remains a central focus, especially in a region where power costs are high and environmental standards are strict. New technologies are enabling operators to cut energy consumption by improving heat integration and reducing air compression requirements. These systems are also helping to reduce carbon footprints, meeting the expectations of regulators and customers alike. As industries prioritize sustainable operations and digital transformation, the demand for technologically advanced air separation solutions is expected to rise further. From large-scale steel producers to pharmaceutical companies, many sectors are upgrading outdated equipment with modern ASUs to gain a competitive edge. These technological shifts are not just improving operational performance but also influencing procurement decisions across the European ASU landscape. With a strong push toward innovation, the market is evolving quickly, making advanced technology one of the primary drivers shaping its current and future direction.

Europe Air Separation Unit Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe air separation unit market, along with forecasts at the regional, and country levels from 2025-2033. The market has been categorized based on process, gas, and end user.

Analysis by Process:

- Cryogenic Distillation

- Non-cryogenic Distillation

As per the Europe air separation unit market outlook, in 2024, the commercial aviation segment led the market, accounted for the 75.3%. This dominance is primarily due to the sector's high and continuous demand for oxygen and nitrogen in aircraft maintenance, fuel systems, cabin pressurization, and fire suppression systems. As air travel recovered post-pandemic and airlines expanded operations across Europe, the need for consistent, high-purity gases increased. Airlines also adopted stricter safety and maintenance protocols, driving the use of on-site or near-site gas production solutions. Moreover, growing investments in aircraft manufacturing and fleet upgrades—especially those focused on lightweight and energy-efficient models—boosted gas requirements further. The aviation industry's dependency on reliable industrial gas supply systems has strengthened the commercial case for new ASU installations at key aviation hubs and MRO (Maintenance, Repair, and Overhaul) facilities, supporting the sector's continued lead in the market.

Analysis by Gas:

- Nitrogen

- Oxygen

- Argon

- Others

Based on the Europe air separation unit market forecast, in 2024 the Nitrogen led the market, accounted for the for the market share of 43.7%. This strong position is largely driven by nitrogen’s widespread industrial use across sectors like food packaging, electronics, pharmaceuticals, and metal manufacturing. In food and beverage processing, nitrogen ensures product freshness and extends shelf life through modified atmosphere packaging. In electronics and chemical production, it serves as an inert gas for purging and blanketing, improving process reliability and product safety. The growing demand for cold storage and cryogenic preservation in healthcare also contributed to its high consumption. Nitrogen’s versatility, combined with low production costs and minimal environmental risk, makes it a preferred choice in both large-scale and small-scale industries. These factors, together with advancements in ASU efficiency and reliability, have reinforced nitrogen’s leading role in driving market growth for air separation units across Europe.

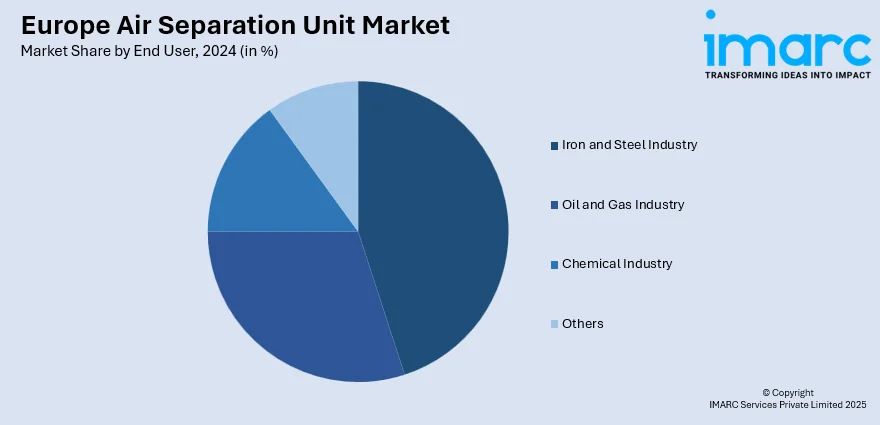

Analysis by End User:

- Oil and Gas Industry

- Iron and Steel Industry

- Chemical Industry

- Others

In 2024 the iron and steel industry led the market, accounted for the for the market share of 35.3%. This sector’s dominance stems from its high-volume requirement for oxygen during steelmaking processes, particularly in basic oxygen furnaces and electric arc furnaces. Oxygen is used to increase combustion temperatures, reduce impurities, and improve overall energy efficiency in steel production. Nitrogen and argon are also used for degassing, cooling, and protective atmospheres. With Europe focusing on energy-efficient, low-emission steel production under climate goals, demand has increased for advanced ASUs that can deliver high-purity gases reliably. The rise of green steel initiatives and hydrogen-based steelmaking has further pushed the industry to modernize its gas infrastructure. As major steel producers upgrade facilities and expand capacity, the sector’s reliance on on-site ASU systems has grown, reinforcing its position as a core driver of market demand.

Country Analysis:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

In 2024 the Germany led the Europe air separation unit market, driven by its large industrial base, advanced manufacturing capabilities, and strong commitment to clean energy solutions. The country is home to major steel, automotive, and chemical production hubs, all of which require steady supplies of oxygen, nitrogen, and argon. Germany’s push toward decarbonization and energy efficiency has led to increased adoption of ASUs that support low-emission processes, particularly in hydrogen production and green steel manufacturing. Additionally, the country has invested heavily in research and innovation, supporting advancements in ASU technology and integration. The presence of key market players, strategic infrastructure, and favorable government policies have created a supportive ecosystem for ASU deployment. These combined factors have positioned Germany as the leading contributor to market growth, setting benchmarks for other countries in Europe in terms of both technology adoption and industrial gas infrastructure development.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- May 2025: Air Products acquired IJsfabriek Strombeek in Belgium, strengthening its presence in Belgium and France. This acquisition enhances CO₂ production capacity and supply chain efficiency. IJsfabriek Strombeek provides a range of gases, including industrial, medical, and food sector applications, supported by air separation unit technologies.

- March 2025: Air Liquide and Aurubis launched a EUR 100 Million project to expand an air separation unit (ASU) at the Pirdop copper mine in Bulgaria. The facility, set to operate in 2027, will produce oxygen, nitrogen, and argon, reducing electricity consumption and CO2 emissions for Aurubis.

- November 2024: Aurubis announced a EUR 40 Million investment in a new air separation unit at its Lünen plant in Germany. This project will enhance in-house production, reduce CO2 emissions by 8,500 tons annually, and improve efficiency by eliminating external oxygen deliveries, with completion expected by late 2025.

- October 2024: Carver Group expanded its UK HVAC presence by acquiring S&P Coil Products Limited. This acquisition strengthens Carver's product portfolio, including heating and cooling coils, and enhances its position in the UK market. It aligns with Carver’s strategy to deliver innovative and energy-efficient climate solutions.

- September 2024: Envision Energy announced plans to build a USD 1 Billion green hydrogen industrial park in Spain, aimed at supporting Spain's renewable energy goals. The park will produce electrolyzers and include an air separation unit for ammonia production, contributing 5 GW of electrolysis capacity toward Spain's 2030 target.

Europe Air Separation Unit Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Cryogenic Distillation, Non-cryogenic Distillation |

| Gases Covered | Nitrogen, Oxygen, Argon, Others |

| End Users Covered | Oil and Gas Industry, Iron and Steel Industry, Chemical Industry, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe air separation unit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe air separation unit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe air separation unit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air separation unit market in Europe was valued at USD 1,505.55 Million in 2024.

The Europe air separation unit market is projected to exhibit a CAGR of 3.23% during 2025-2033, reaching a value of USD 2,004.23 Million by 2033.

The Europe air separation unit market is driven by rising demand for industrial gases across sectors such as healthcare, food processing, chemicals, and metal production. Investments in clean energy, green hydrogen, and infrastructure upgrades are also accelerating adoption, along with increasing focus on energy-efficient and automated ASU technologies.

In 2024, Germany dominated the Europe air separation unit market, accounted for the market, driven by its strong industrial base, advanced manufacturing capabilities, and high demand for oxygen and nitrogen in steel, chemical, and automotive sectors. Government support for decarbonization, hydrogen production, and adoption of energy-efficient systems further reinforced Germany’s leadership in the regional market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)