Europe Alfalfa Hay Market Size, Share, Trends and Forecast by Type, Application, End User, and Country, 2025-2033

Europe Alfalfa Hay Market Overview:

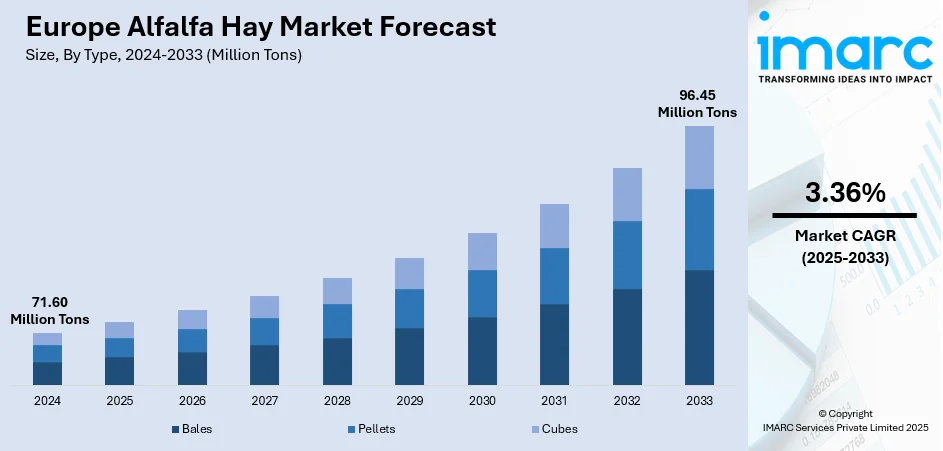

The Europe alfalfa hay market size was valued at 71.60 Million Metric Tons in 2024. Looking forward, the market is expected to reach 96.45 Million Metric Tons by 2033, exhibiting a CAGR of 3.36% during 2025-2033. The market is witnessing steady growth driven by rising demand for high-protein animal feed, especially in dairy and livestock farming. Improved harvesting technologies and increasing awareness about feed quality further support market expansion. Sustainable farming practices are also encouraging the cultivation of alfalfa. These dynamics collectively contribute to the rising Europe alfalfa hay market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 71.60 Million Metric Tons |

| Market Forecast in 2033 | 96.45 Million Metric Tons |

| Market Growth Rate 2025-2033 | 3.36% |

One of the primary drivers of the market is the increasing demand for high-protein animal feed, particularly from the dairy and livestock sectors. Alfalfa hay contains vital nutrients and is a good choice in boosting milk production and improving better health of the animals. The demand for quality feed has increased extensively because of the increase in the consumption of dairy products across Europe. The other key consideration is the development of sustainable farming methods. Alfalfa is a nitrogen-fixing crop that enhances soil health and cuts down the usage of synthetic fertilizer. This is synonymous with the environmental path and policy in Europe, and it motivates farmers to adopt alfalfa in crop combinations.

To get more information on this market, Request Sample

The Europe alfalfa hay market growth is also driven by technological advancements in harvesting, storage, and transportation have also improved the efficiency and quality of alfalfa hay production. These developments assist in minimizing post-harvest losses and providing a steady supply of feed for the year. Also, heightened awareness among farmers of the long-term advantages offered by alfalfa, coupled with government encouragement and subsidies, is driving market growth. The increasing popularity of organic livestock production further increases demand for natural, chemical-free feeds such as alfalfa hay, making it a sustainable and economically sound choice on European agricultural land.

Europe Alfalfa Hay Market Trends:

Rising Nutritional Awareness and Climate Adaptability

The Europe alfalfa hay market is growing due to increasing awareness among farmers about the nutritional value of alfalfa, which is rich in protein, fiber, and essential nutrients vital for animal health. Simultaneously, climate variability has led to a shift towards resilient forage crops like alfalfa, which can adapt to diverse weather conditions. To address climatic challenges, farmers are implementing advanced agricultural techniques and technologies that improve productivity and ensure stable yields. This dual focus on nutrition and adaptability is fostering demand across various European regions, particularly in areas where weather unpredictability affects traditional forage crops. According to the Europe alfalfa hay market trends, these factors are collectively accelerating the adoption of alfalfa hay throughout Europe.

Emphasis on Sustainable and Eco-Friendly Practices

Growing environmental concerns and regulatory pressures are encouraging the adoption of sustainable farming and packaging solutions, significantly driving the alfalfa hay market. Farmers are embracing water-efficient irrigation methods and chemical-free cultivation techniques to align with eco-conscious trends. Additionally, the rising focus of industry players on sustainability has led to innovations in eco-friendly packaging. According to IMARC Group, Europe’s green packaging market reached USD 102.9 Billion in 2024 and is expected to hit USD 180.1 Billion by 2033, growing at a CAGR of 4.36% during 2025–2033. In the UK alone, the sustainable agriculture market was valued at USD 483.48 Million in 2024, with a projected CAGR of 10.40% through 2033.

Expanding International Trade and Strategic Investments

International trade dynamics and cross-border collaborations are creating a positive Europe alfalfa hay market outlook. The region is becoming a key player in global exports due to strong production capacity and strategic partnerships. Export opportunities, combined with rising demand from international markets, are enhancing Europe’s economic landscape. For instance, in August 2021, Spain-based Nafosa Firm, an established alfalfa hay producer, announced the launch of a new production facility in Argentina. This move aimed to expand their global footprint and reinforce their competitive edge in the alfalfa hay sector. Such strategic expansions and foreign investments are expected to support long-term market growth across Europe by strengthening supply chains and boosting regional competitiveness.

Europe Alfalfa Hay Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe alfalfa hay market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Bales

- Pellets

- Cubes

Bales stand as the largest component in 2024, holding 56.6% of the market due to their convenience in handling, storage, and transportation. According to the Europe alfalfa hay market forecast, they come in various sizes, small, large, and round, allowing flexibility to meet the specific needs of different livestock farms. Baling also helps preserve the nutritional quality of alfalfa by protecting it from moisture and spoilage during storage. Additionally, the established infrastructure for baling across Europe, coupled with widespread farmer familiarity with the method, contributes to its dominance. Bales are cost-effective, easy to stack, and compatible with mechanized feeding systems, making them a preferred choice for commercial livestock operations. Their durability and long shelf life further enhance their appeal in both domestic use and export activities across Europe.

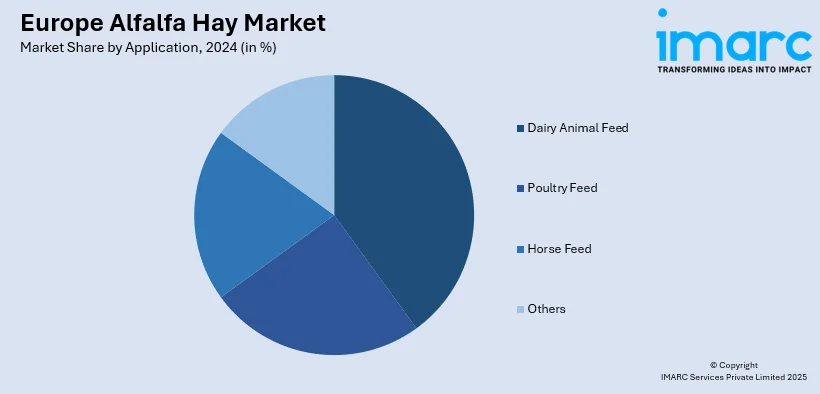

Analysis by Application:

- Dairy Animal Feed

- Poultry Feed

- Horse Feed

- Others

Dairy animal feed leads the market with 70.8% of market share in 2024 due to the high nutritional demands of dairy cattle, particularly for protein and fiber, which alfalfa hay naturally provides. Alfalfa enhances milk yield and quality, making it a critical component in dairy rations. With the growing demand for dairy products such as milk, cheese, and yogurt across Europe, farmers are increasingly focusing on improving herd productivity and health through quality feed. Alfalfa’s digestibility, energy content, and essential nutrients support optimal lactation and overall animal wellness. Moreover, advancements in feed formulation and increased awareness regarding feed efficiency among dairy producers further escalate Europe alfalfa hay market demand, solidifying dairy feed as the leading application segment in the European market.

Analysis by End User:

- Poultry

- Cattle

- Livestock

- Others

Cattle leads the market with 60.9% of market share in 2024 due to their significant presence in the region’s livestock industry and their high nutritional requirements. Alfalfa hay is a rich source of protein, fiber, and essential vitamins, making it ideal for promoting growth, digestion, and overall health in cattle. It supports weight gain in beef cattle and enhances milk production in dairy herds, aligning with the goals of both meat and dairy farmers. Europe’s strong demand for dairy and beef products drives the need for high-quality feed like alfalfa. Additionally, alfalfa’s palatability and digestibility make it a preferred forage choice. Its compatibility with existing feeding systems further reinforces its widespread use in cattle farming across Europe.

Analysis by Country:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

In Germany, the alfalfa hay market is driven by the country’s strong dairy sector and emphasis on sustainable farming. German farmers prioritize high-protein, fiber-rich feed to support efficient milk production. Additionally, growing awareness of organic and eco-friendly practices encourages the adoption of alfalfa as a nitrogen-fixing, soil-improving crop. Government incentives for sustainable agriculture and the integration of precision farming technologies further boost production efficiency. Germany's push toward reducing chemical inputs in farming also supports the expansion of alfalfa cultivation, aligning with environmental goals and boosting the market demand for nutrient-dense, natural forage options like alfalfa hay.

The United Kingdom’s alfalfa hay market growth is fueled by rising demand for high-quality livestock feed amid expanding dairy and beef industries. The increasing adoption of sustainable farming practices, coupled with government initiatives supporting regenerative agriculture, encourages farmers to incorporate alfalfa into crop rotations. The UK's growing focus on food security and domestic feed production post-Brexit also contributes to local alfalfa cultivation. Furthermore, the rising popularity of organic meat and dairy products promotes the use of natural, non-GMO forage like alfalfa. Water-efficient irrigation and eco-friendly packaging trends enhance the market's growth by aligning with the UK’s broader environmental sustainability goals.

France leads in alfalfa hay production due to its well-established livestock industry and favorable climate for alfalfa cultivation. The country promotes sustainable and organic farming, with farmers increasingly integrating alfalfa into crop rotations to improve soil health and reduce chemical fertilizer use. France also benefits from strong government support and EU funding for agro-environmental practices. The growing demand for premium dairy products and feed self-sufficiency further fuels alfalfa hay adoption. Advanced baling technologies and regional export capabilities strengthen the market position. Additionally, domestic initiatives supporting carbon footprint reduction in agriculture make alfalfa an attractive, eco-friendly forage option for French farmers.

In Italy, the alfalfa hay market is primarily driven by its robust dairy sector, particularly in regions producing high-quality cheeses like Parmigiano-Reggiano. Farmers prefer alfalfa for its digestibility and high protein content, which enhances milk yield and quality. Additionally, Italy’s Mediterranean climate supports optimal alfalfa growth. The government's incentives for sustainable farming and irrigation efficiency encourage the use of alfalfa in crop rotation systems. Increasing consumer preference for organic dairy and meat products also drives demand for chemical-free feed options. Export potential, especially for sun-dried and dehydrated alfalfa, further contributes to Italy’s strong position in the European alfalfa hay market.

Russia’s alfalfa hay market is expanding due to the rising need for high-protein livestock feed across its vast dairy and cattle industries. The government supports agricultural modernization, encouraging the adoption of nutrient-rich forage like alfalfa. With growing concerns about feed self-sufficiency, particularly due to import restrictions, domestic alfalfa production has gained momentum. Large arable land availability supports large-scale cultivation, while improved baling and storage technologies enhance efficiency. Additionally, the country’s focus on increasing meat and dairy output to meet domestic demand aligns with alfalfa’s benefits, further stimulating its adoption. Environmental concerns and soil health awareness also contribute to market growth.

Spain is a major exporter and producer of alfalfa hay in Europe, driven by favorable climatic conditions and a well-developed irrigation infrastructure. The country’s extensive livestock sector, particularly in dairy and meat production, fuels strong domestic demand. Spain also benefits from robust export relationships, especially with Middle Eastern and Asian countries. Government support for sustainable agriculture and efficient water management practices further enhances alfalfa cultivation. Leading producers like Nafosa have invested in international operations, strengthening Spain's global presence in the market. Moreover, advancements in dehydration and packaging technologies have boosted the quality and shelf life of Spanish alfalfa hay, supporting its market leadership.

In the Netherlands, the alfalfa hay demand is driven by a highly advanced dairy industry and the widespread adoption of precision agriculture. Dutch farmers prioritize high-efficiency, nutrient-dense feed to support high-yield milk production. Alfalfa hay is favored for its digestibility and sustainable characteristics. The Netherlands' commitment to reducing greenhouse gas emissions encourages the use of crops that enhance soil health, such as alfalfa. Additionally, technological innovations in harvesting, storage, and feeding systems contribute to the efficient use of alfalfa. Demand for organic dairy products and pressure to reduce imported feed further support domestic alfalfa production and its integration into livestock nutrition.

Switzerland’s alfalfa hay market is growing due to the country’s focus on sustainable and organic livestock farming. Swiss regulations favor natural, chemical-free feed options, making alfalfa a popular choice among environmentally conscious farmers. The dairy sector, known for premium cheese and milk products, requires high-quality forage to maintain production standards. Alfalfa’s soil-enriching properties and compatibility with crop rotations align with the country’s ecological farming goals. Additionally, Switzerland's investment in modern farming equipment and irrigation systems supports efficient cultivation. Rising consumer demand for organic and locally sourced dairy products is further encouraging the adoption of alfalfa hay in Swiss animal nutrition.

Poland’s alfalfa hay market is expanding due to its growing livestock sector and increasing focus on feed quality. As dairy and beef production scale up to meet domestic and export demand, farmers are turning to nutrient-rich alfalfa hay to improve animal health and productivity. The government’s support for sustainable agriculture, including subsidies for environmentally friendly practices, encourages alfalfa cultivation. Poland also has vast arable land and favorable conditions for growing alfalfa. Rising interest in organic farming and efforts to reduce reliance on imported feed further drive local production. Technological upgrades in harvesting and baling contribute to more efficient alfalfa supply across the country.

Competitive Landscape:

The Europe alfalfa hay market features a moderately fragmented competitive landscape, with several key players dominating regional and export operations. Leading companies such as Nafosa, Grupo Osés, and Al Dahra Europe focus on high-quality production, advanced processing technologies, and strategic international partnerships. These players emphasize sustainability, offering sun-cured and dehydrated alfalfa variants tailored to livestock nutrition. Innovation in baling, storage, and eco-friendly packaging enhances product appeal. Additionally, smaller regional producers compete by offering locally sourced, organic options aligned with rising environmental and health-conscious trends. Market competition is further shaped by pricing strategies, distribution networks, and export capabilities, particularly to Middle Eastern and Asian markets, where European alfalfa is increasingly in demand for its superior quality.

The report provides a comprehensive analysis of the competitive landscape in the Europe alfalfa hay market with detailed profiles of all major companies.

Latest News and Developments:

- January 2024: The Italian Forage Supply Chain Association (AIFE) and Spain’s AEFA (National Association of Dehydrated Alfalfa Producers) have jointly initiated a major three-year campaign (2024–2026) to promote European dried and dehydrated fodder across strategic Asian markets, including Japan, Vietnam, Indonesia, and Taiwan. Backed by the European Union, which contributed 80% of the total €1,180,000 budget, the initiative focuses on raising awareness of the qualities and benefits of European alfalfa products. These four Asian countries have been identified as high-potential markets, showing strong interest in exploring European dried forage options for integration into their agricultural and livestock systems. The campaign aims to strengthen trade ties and expand export opportunities within these rapidly growing regions.

- April 2024: Siberian agricultural company Mayak announced an investment of USD 60 Million for the construction of a processing facility that transforms alfalfa hay into meal for animal feed. The resulting product will be processed into a vitamin-herbal meal by artificially drying it. The company intends to export a sizable portion of its manufactured output to China.

- September 2023: Denmark-based DLF, a global leader in turf and forage seed solutions, has finalized the acquisition of Corteva Agriscience’s alfalfa breeding operations. The deal includes Corteva’s global alfalfa germplasm and research program, the Alforex Seeds brand and trademarks, its current portfolio of commercial alfalfa varieties, and select Corteva personnel involved in the alfalfa initiative.

Europe Alfalfa Hay Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Metric Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bales, Pellets, Cubes |

| Applications Covered | Dairy Animal Feed, Poultry Feed, Horse Feed, Others |

| End Users Covered | Poultry, Cattle, Livestock, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe alfalfa hay market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe alfalfa hay market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe alfalfa hay industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alfalfa hay market in Europe reached 71.60 Million Metric Tons in 2024.

The Europe alfalfa hay market is projected to exhibit a CAGR of 3.36% during 2025-2033, reaching a volume of 96.45 Million Metric Tons by 2033.

The Europe alfalfa hay market is driven by rising demand for high-protein livestock feed, growing adoption of sustainable farming practices, and expanding dairy and cattle industries. Technological advancements in harvesting and baling, along with increasing export opportunities and government support for eco-friendly agriculture, further contribute to the market's steady growth.

Dairy animal feed currently dominates the Europe alfalfa hay market due to its high protein content, which boosts milk production. Growing dairy consumption and the need for nutrient-rich, natural forage further drive demand among European dairy farmers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)