Europe Aroma Chemicals Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Europe Aroma Chemicals Market Size and Share:

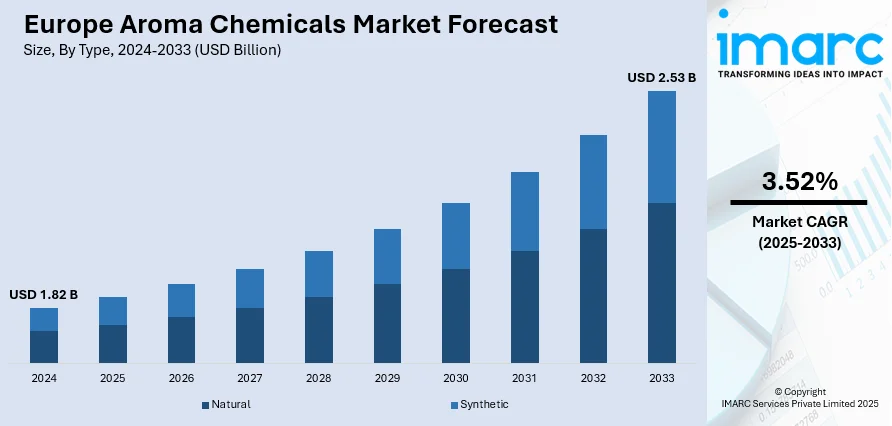

The Europe aroma chemicals market size was valued at USD 1.82 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.53 Billion by 2033, exhibiting a CAGR of 3.52% from 2025-2033. United Kingdom currently dominates the market driven by rising demand for natural and sustainable fragrances in personal care, cosmetics, and household products, alongside growing consumer preference for premium, long-lasting scents. Expansion of the food and beverage (F&B) industry, especially in flavors, further supports Europe aroma chemicals market share. Technological advancements in chemical synthesis and green manufacturing are enhancing production efficiency. Additionally, regulatory emphasis on safe, eco-friendly ingredients and increasing investments by key players in research and development (R&D) are accelerating market adoption across various applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.82 Billion |

| Market Forecast in 2033 | USD 2.53 Billion |

| Market Growth Rate (2025-2033) | 3.52% |

One of the key drivers of the Europe aroma chemicals market is the growing consumer shift toward natural, sustainable, and eco-friendly fragrances. Over 50% of European consumers now prefer eco‑friendly brands that demonstrate ethical sourcing and transparency, reflecting heightened awareness of synthetic chemicals' potential health and environmental impacts. This shift is especially prominent in personal care, cosmetics, and household products, where demand for safe, non-toxic, and long-lasting scents is rising rapidly. Regulatory frameworks across Europe promoting sustainability and reducing carbon footprints further bolstering Europe aroma chemicals market growth. Consequently, manufacturers are investing in green chemistry innovations and expanding bio-based portfolios to meet the surging demand for natural, renewable, and ethically sourced aromatic solutions.

To get more information on this market, Request Sample

European food and beverages growth is another major force driving the aroma chemicals market. Aroma chemicals find widespread application in enhancing flavour, sensorial appeal, and formulating distinctive taste profiles in processed foods, drinks, and confectionery. With rising consumer demands for varied and premium food experiences, companies are embracing newer flavour solutions, increasing demand for aroma chemicals. Furthermore, increased demand for functional and health foods has further increased the demand for personalized aromatic ingredients. Ongoing product development and food manufacturers' collaborations with flavor houses are driving market expansion in this segment, projecting a robust demand path.

Europe Aroma Chemicals Market Trends:

Rising Demand for Natural and Sustainable Fragrances

One of the most powerful driving factors in the Europe aroma chemicals market is the heightened consumer preference for sustainable and natural fragrances. The heightened awareness regarding the environmental and health hazards posed by synthetic ingredients has led to a shift toward bio-based and eco-friendly aroma chemicals. This trend is especially predominant in personal care, cosmetics, and home care products, wherein consumers desire safe, clean-label, and long-lasting fragrances. The regulatory environments in Europe, like REACH, promote the use of safe, biodegradable, and low-impact ingredients further, forcing the manufacturers towards green chemistry methods. Top players are heavily investing in R&D to develop novel, plant-based aroma chemicals that fulfill the sustainability criteria. This shift towards renewable, ethically sourced material is radically changing the aroma chemicals sector in Europe, enabling long-term growth based on environmental responsibility and consumer-driven choices.

Expansion of Food and Beverage Industry

The rapid expansion of the European food and beverage (F&B) industry is a major driver of the aroma chemicals market. As the EU’s largest manufacturing sector, employing 4.7 million people, generating €1.2 trillion in turnover, and contributing €250 billion in value added (2023–24), it creates substantial demand for flavoring solutions. Aroma chemicals are essential for enhancing flavor, improving sensory experiences, and differentiating products in a competitive marketplace. Rising consumer demand for premium, exotic, and functional food options, along with the shift toward healthier and plant-based alternatives, is fueling the need for customized aromatic compounds that replicate natural tastes. Countries with strong culinary traditions, such as Germany, France, and Italy, play a pivotal role. Additionally, collaborations between flavor houses and manufacturers, coupled with advancements in flavor synthesis, are driving innovation, boosting aroma chemical demand across Europe’s F&B sector.

Technological Advancements and Green Manufacturing Practices

Technological breakthrough in the synthesis and manufacturing of aroma chemicals is another major Europe aroma chemicals market trend. Progress in biotechnology, fermentation, and green chemistry is facilitating the production of high-value, cost-efficient, and eco-friendly aroma chemicals. Precision profiling of aroma is possible with nano-encapsulation, electronic nose technology, and computer-aided system design technologies, ensuring consistency and innovation in final-use applications like perfumery, cosmetics, and food flavoring. In addition, increasing regulatory pressure towards environmentally friendly manufacturing processes has prompted businesses to implement green production strategies, including enzymatic synthesis and the use of renewable feedstocks. Not only do these advancements minimize environmental effects, but also product quality, as they satisfy changing consumer and regulatory requirements. Businesses are also using AI-based formulation methods to develop customized aroma fragments that conform to market trends. This emphasis on sustainable innovation and state-of-the-art manufacturing capacity is assisting Europe in keeping its ground as a world leader in the aroma chemicals market.

Europe Aroma Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe aroma chemicals market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on type, product, and application.

Analysis by Type:

- Natural

- Synthetic

According to the Europe aroma chemicals market forecast, the synthetic aroma chemicals have a commanding 60.0% market share in the Europe region due to their affordability, reliability, and adaptability in uses. In contrast to natural materials, synthetic aroma chemicals provide stable quality, scalable convenience, and broader availability, making them extremely popular among large-scale production of perfumes, cosmetics, toiletries, and household goods. Their capacity to reproduce complex natural odors at reduced expenses also fuels their upswing in the use of flavoring in food and beverages. Also, technological improvement in chemical synthesis allows the creation of safe, sustainable, and more advanced aroma compounds that meet uncompromising European standards. This equilibrium of affordability, stability, and tailoring makes synthetic aroma chemicals the leading force driving market growth across various end-use markets in the region.

Analysis by Product:

- Benzenoids

- Musk Chemicals

- Terpenoids

- Others

Terpenoids lead the market with a share of 40.2%, owing to their widespread application in fragrances, flavorings, and therapeutic products. Terpenoids are known for their wide range of aromatic features and are extensively used in perfumes, cosmetics, and toilet preparations to provide natural, delectable odors. Their usage in the food and beverage sectors as flavoring agents significantly adds to demand. Moreover, the increasing demand for bio-based and plant-derived products favors the increasing adoption of terpenoids as they are usually derived from natural sources such as essential oils. They are also favored for use in pharmaceuticals and aromatherapy products due to their antimicrobial, antioxidant, and wellness properties. Improved innovations in extraction and synthesis methods are improving their quality and sustainability, further establishing terpenoids as the strong leader in the Europe aroma chemicals market outlook.

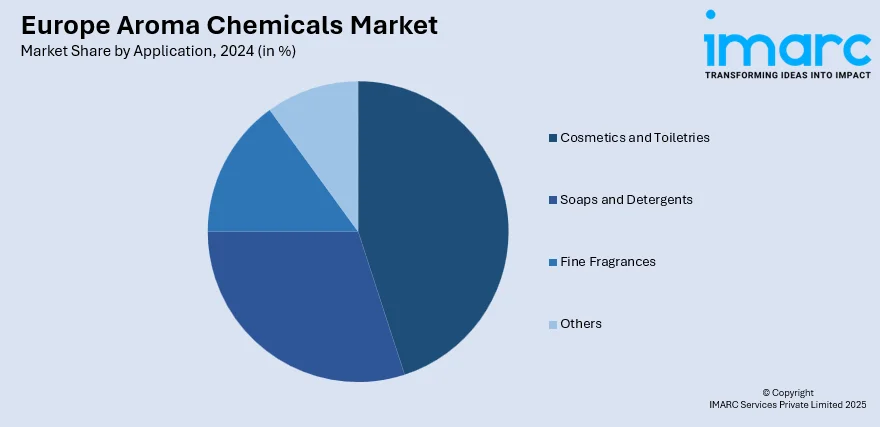

Analysis by Application:

- Soaps and Detergents

- Cosmetics and Toiletries

- Fine Fragrances

- Others

Cosmetics and toiletries account for the largest share of 35.8% in the Europe aroma chemicals market due to the high demand for fragrances in personal care products such as perfumes, skincare, haircare, and hygiene items. Consumers increasingly prefer premium, long-lasting, and natural scents, driving manufacturers to incorporate advanced aroma chemicals into product formulations. The rise in beauty and grooming trends, along with the influence of social media and fashion, further fuels demand in this segment. Additionally, the growing focus on sustainable and clean-label cosmetics encourages the use of bio-based and eco-friendly aroma chemicals. Continuous innovation in fragrance profiles and customized solutions for diverse consumer preferences solidifies cosmetics and toiletries as the dominant segment in the European aroma chemicals market.

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

On the basis of the Europe aroma chemicals market analysis, the United Kingdom dominates the market because it has a strong base of well-established personal care, cosmetics, food, and household product industries, which are huge consumers of aroma chemicals. A highly advanced manufacturing base, combined with cutting-edge research and innovation facilities, fuels the growth of eco-friendly and customized aromatic solutions. The UK regulatory framework supports the use of safe, environmentally friendly, and high-quality ingredients, consistent with increasing consumer demand for natural and clean-label products. Furthermore, increasing disposable incomes and demand for premium fragrances in personal care and luxury items enhance market expansion. Strategic partnerships, technological development, and a strong supply chain further establish the United Kingdom as an integral hub for the production and consumption of aroma chemicals in Europe.

Competitive Landscape:

The competitive landscape is highly dynamic, characterized by intense competition among established players and emerging manufacturers. Companies are focusing on expanding their product portfolios with natural, bio-based, and sustainable aroma chemicals to meet evolving consumer preferences and regulatory requirements. Innovations in sophisticated synthesis techniques, biotechnology, and green chemistry are made possible by large investments in research and development. In an effort to increase their market presence, players frequently engage in strategic alliances, acquisitions, and capacity expansions. Additionally, firms are emphasizing cost efficiency, quality enhancement, and customized solutions to cater to diverse applications across personal care, food and beverage, and household products, driving continuous evolution in this competitive market environment.

The report provides a comprehensive analysis of the competitive landscape in the Europe aroma chemicals market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: LANXESS showcased its wide range of high-purity, nature-identical aroma chemicals at SIMPPAR 2025 in Paris, including floral, spicy, and earthy notes for perfumery and personal care. It also presented various benzyl benzoate grades, such as Ultrapure and Ultrapure Scopeblue, emphasizing fixative use, olfactory performance, and sustainability in aroma chemicals.

- April 2025: The Circular Aromatics project was launched with a total investment of 23 million euros, including a 10 million euro CPNL grant, to advance circular chemistry through innovative recycling. It used BioBTX’s ICCP technology to convert plastic waste and biomass into aroma chemicals such as benzene, toluene, and xylenes.

- March 2025: Aromsyn launched a range of eco-friendly aroma chemicals using low-pollution synthesis routes that reduced carbon emissions and complied with global environmental standards. The new aroma chemicals received strong feedback across European, U.S., and Asian markets and boosted the company’s global sustainability profile.

Europe Aroma Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Synthetic |

| Products Covered | Benzenoids, Musk Chemicals, Terpenoids, Others |

| Applications Covered | Soaps and Detergents, Cosmetics and Toiletries, Fine Fragrances, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe aroma chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe aroma chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe aroma chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aroma chemicals market in the Europe was valued at USD 1.82 Billion in 2024.

The aroma chemicals market is projected to exhibit a CAGR of 3.52% during 2025-2033, reaching a value of USD 2.53 Billion by 2033.

The Europe aroma chemicals market is driven by rising demand from cosmetics, personal care, and household product industries. Growing consumer preference for natural and sustainable ingredients, coupled with clean-label trends, encourages innovation in bio-based aroma compounds. Advancements in green chemistry and increasing applications in fine fragrances further fuel market growth.

Cosmetics and toiletries account for the largest 35.8% share in the Europe aroma chemicals market due to rising demand for premium, long-lasting, and natural fragrances in personal care products. Growing beauty and grooming trends, clean-label preferences, and continuous innovation in scent formulations drive strong adoption in this dominant segment.

Terpenoids dominate the Europe aroma chemicals market with a 40.2% share, driven by their wide use in perfumes, cosmetics, food flavors, and aromatherapy products. Their natural origin, diverse aromatic profiles, and health benefits, combined with growing demand for bio-based ingredients, make them a preferred choice across multiple end-use industries.

Synthetic aroma chemicals hold a dominant 60.0% share in the Europe market owing to their cost efficiency, consistent quality, and ability to replicate complex natural scents. Their scalability, versatility across cosmetics, food, and household products, and advancements in sustainable synthesis make them highly preferred by manufacturers seeking affordable and innovative fragrance solutions.

The United Kingdom currently dominates the Europe aroma chemicals market, driven by its advanced personal care, cosmetics, and food industries, coupled with strong R&D capabilities and innovation in sustainable fragrances. Favorable regulations, high consumer demand for premium and eco-friendly products, and a robust supply chain further strengthen its market leadership.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)