Europe Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Country, 2025-2033

Europe Bancassurance Market Size and Share:

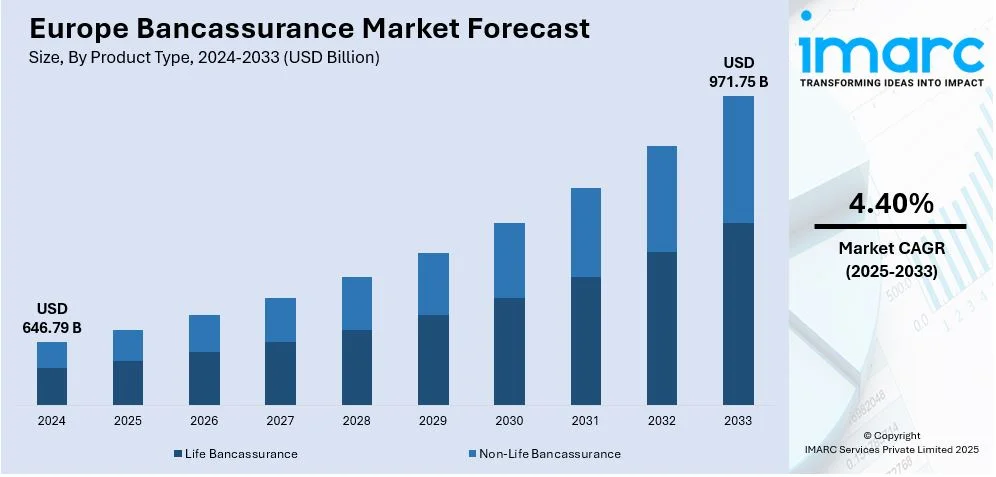

The Europe bancassurance market size was valued at USD 646.79 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 971.75 Billion by 2033, exhibiting a CAGR of 4.40% from 2025-2033. The market is driven by the growing digitization that allows customers to access services through digital platforms, along with the financial literacy initiatives in the regions are empowering people to make informed financial decisions, including insurance and banking services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 646.79 Billion |

|

Market Forecast in 2033

|

USD 971.75 Billion |

| Market Growth Rate (2025-2033) | 4.40% |

Partnerships and mergers are the driving forces behind the bancassurance market in Europe, allowing banks and insurance to improve service offerings and penetrate markets. A strategic alliance between two sectors supports the integration of banking and insurance products and provides customers with a one-stop solution. Finally, partnerships utilize the established base of customers and trust banks have, thus giving access to a broader market for insurers. This is based on the existing trust and large customer bases that banks provide in order to create easy access to bigger pools of potential customers for insurance businesses. The growing acquisition between the banks and insurance providers, especially in Europe is offering a positive outlook. According to the data published on the IMARC Group’s report the Europe private equity market is expected to reach US$ 590.3 Billion by 2032.

Financial literacy initiatives are indeed an important driver for the development of the Europe bancassurance market, as they empower people to make informed choices regarding their finances. With proper understanding of financial products including insurance, people can better understand the need for a more holistic solution to their banking and insurance needs. Bancassurance offers a comprehensive approach to wealth management, appealing to people seeking simplicity and convenience in managing their finances. The banks and insurance companies are launching programs and campaigns to create awareness about the benefits of insurance products. The initiatives include workshops, online courses, and interactive tools that convey the complicated concepts of finances to the mass. The IMARC Group’s report shows that the Europe e-learning market is anticipated to reach US$ 194.9 Billion by 2032.

Europe Bancassurance Market Trends:

Integrated financial solutions

With the growing demand for integrated financial management, many banks are collaborating with insurance companies to create a solution that includes savings, investments, loans, and insurance products. This one-stop solution is popular among masses looking simplicity and efficiency in managing their financial portfolios. Designed for individual needs, bancassurance models combine banking and insurance services to provide optimal financial necessity solutions. This assures that the banks can cross-sell insurance products like life insurance, health insurance, property insurance, alongside conventional financial products. Customers also get personalized services, usually with discounts or incentives for buying more products from one platform. As per the IMARC Group’s report the Europe fintech market is anticipated to reach US$ 380.8 Billion by 2032.

Heightened Focus on Digitalization

Digital technologies are seamlessly integrating banking and insurance services, delivering customers ease of accessibility to access both offline and online services. Thus, allowing banks and insurers to offer a more convenient and user-friendly experience that enables customers to purchase, manage, and claim insurance products directly from their mobile devices or computers. Digitalization also improves personalization since banks and insurance companies rely on customer data to customize their products and services as per the requirement. With the use of data analytics and artificial intelligence (AI), insurance companies are developing more relevant insurance options, which is propelling the growth of the market. The advent of e-commerce platforms for buying financial services, particularly in European market, is driving the growth of the market. The data published on the website of the IMARC Group shows that the Europe e-commerce market is expected to reach US$ 7.2 Billion by 2032.

Growing aging population

As per the data published on the website of the IMARC Group, the Europe health insurance market size reached USD 493.5 Billion in 2024. The bancassurance market is influenced by the aging population of Europe due to the demand for financial products that ensure long-term securities and healthcare. As a result, increased demand for life insurance, retirement planning, and health insurance products is developing among elderly population. This demographic change is encouraging banks and insurers to come up with specific products for senior citizens like annuities, long-term care insurance, and pension plans and services. Bancassurance is popular among older generation because it permits them to avail both banking and insurance services from a single provider, which is impelling the Europe bancassurance market growth.

Europe Bancassurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe bancassurance market, along with forecast at the regional and country levels from 2025-2033. The market has been categorized based on product type and model type.

Breakup by Product Type:

- Life Bancassurance

- Non-Life Bancassurance

Life bancassurance dominates the market due to high demand for long-term financial security, especially among Europe’s aging population. People prefer life insurance policies offered through banks, which integrate seamlessly with savings and investment plans. The convenience of bundling life insurance with banking services enhances accessibility and customer retention. Additionally, life insurance products align with banks' focus on wealth management, making them a natural extension of banking services. Regulatory incentives and tax benefits for life insurance further drive the adoption of life bancassurance.

Analysis by Model Type:

.webp)

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The pure distributor model represents the largest segment as it allows banks to engage in distribution while avoiding any form of underwriting risk. Therefore, making is an attractive option driven by its simplicity and low operational costs. Banks can take advantage of their extensive networks of customers to market a range of insurance products while transferring the risk management to the insurer. This arrangement guarantees specialization since banks can focus on satisfying customers while insurers will be in charge of product design.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany occupies an important role in the European bancassurance market because of its matured financial sector alongside significant insurance penetration. Germany's demand for integrated insurance products is primarily backed by a stable economy coupled with strong consumer confidence in banks. Advanced regulatory framework relating to retirement planning and life insurance in Germany, further strengthens the Europe bancassurance market share.

France features a well-established bancassurance model where banks and insurance companies often work together on different products. With its focus on life insurance products and tax incentives, bancassurance is quite appealing to consumers. A strong regulatory environment that fosters transparency and customer protection is another benefit of the French market, thus propelling the adoption of bancassurance.

The financial sector in the United Kingdom is highly competitive, with banks adopting digital technology to deliver bancassurance. Growing market demand for easy and integrated services generates higher demand in this market. A mix of cultures and a strong regulatory environment are driving the propagation of bancassurance.

The bancassurance market in Italy is proliferating, bringing new clients interested in financial products that combine banking and insurance services. Strong emphasis on wealth management and retirement, combined with the rapidly aging population, is driving the overall sales of insurance products in the region.

The growing financial literacy among people and the rising penetration of insurance products are driving the bancassurance market in Spain. Spanish people are more receptive to packaged financial solutions offered by banks. This trend is particularly significant for life and health insurance products, as demand is gradually shifting to long-term financial security, thereby enhancing the expansion of bancassurance.

Competitive Landscape:

The key players play an important role in the European bancassurance market by setting a pace for innovation, extending their reach, and enhancing experiences for the customer. Leading banks and insurance companies co-create life insurance, health insurance, and property insurance products to suit the different customer segments. The distribution networks are both physical and digital, thus enabling a larger market penetration. By partnering with the companies offering latest technologies like AI, data analytics, and digital platforms, influential players in the industry are streamlining their operations while enhancing customer engagement. Insurance companies also utilize the customer data of banks to target their market¸ while banks benefit from the expertise of insurers for product development. In October 2024, Zurich, a bancassurance partner of Bance, increased its stake in Banco Sabadell by 3%, making it the fourth-largest shareholder in the Spanish bank.

The report provides a comprehensive analysis of the competitive landscape in the Europe bancassurance market with detailed profiles of all major companies, including:

- BNP Paribas

- Banco Santander

- ING Group

- Lloyds Banking Group

- Barclays Bank Plc

- Intesa Sanpaolo

- ABN AMRO

- Banco Bradesco Europa

- American Express Company

- Wells Fargo

Latest News and Developments:

- April 2025: Hellenic Bank Public Company Limited completed the acquisition of CNP Cyprus Insurance Holdings Ltd. from CNP Assurances SA. The deal was valued at approximately €180 million and expands Hellenic Bank’s insurance portfolio in Cyprus.

- March 2025: Crédit Mutuel Alliance Fédérale announced plans to acquire 100% of German bank Oldenburgische Landesbank (OLB) through its subsidiary TARGOBANK, marking a major expansion in Germany, Europe’s largest economy. This strategic move accelerates TARGOBANK’s transformation into a universal bancassurer, combining retail banking, corporate financing for Mittelstand companies, and wealth management. The combined group will become Germany’s tenth largest bank, serving 4.8 million customers with €79 billion in assets.

- March 2025: Piraeus Bank signed an agreement to acquire a 90.01% stake in Ethniki Insurance, a leading Greek insurer, from CVC Capital Partners for €600 million. The acquisition will diversify Piraeus’ revenue, enhance product offerings, and improve earnings.

- November 11, 2024: AXA Switzerland and additiv recently announced the launch of a new digital bancassurance solution called addProtect. This offers banks the opportunity to easily protect mortgage customers with low setups. Additionally, it provides death and payment protection insurance for higher financial protection and value for clients.

- September 2024: UniCredit announced the internalization of its life bancassurance business in Italy, acquiring full control of CNP UniCredit Vita and UniCredit Allianz Vita to enhance growth and synergies.

- June 13, 2023: Admiral Seguros and ING Spain unveiled the 100% digital bancassurance product, ING Orange Auto Insurance, which was meant to change the auto insurance industry. It combines the insurance capabilities of Admiral Group with the banking service capabilities of ING to create flexible, digitally-integrated solutions for customers. The partnership is one of the key steps in the digital transformation of bancassurance.

Europe Bancassurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | BNP Paribas, Banco Santander, ING Group, Lloyds Banking Group, Barclays Bank Plc, Intesa Sanpaolo, ABN AMRO, Banco Bradesco Europa, American Express Company, Wells Fargo, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe bancassurance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe bancassurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Bancassurance is a business model where banks work with insurance companies to provide insurance products directly to their customers. It is a direct integration of banking and insurance services, providing cost-effective and affordable care service under one roof. Banks act as a distributor, while insurers underwrite and manage claims benefiting both parties from this arrangement.

The Europe bancassurance market was valued at USD 646.79 Billion in 2024.

IMARC estimates the Europe bancassurance market to exhibit a CAGR of 4.40% during 2025-2033.

The primary factors propelling the bancassurance industry in Europe are integrated banking solutions, banks offer access to insurance in addition to conventional banking services. Digital transformation also enables efficient distribution and customized offerings, thus improving customer experience. Furthermore, awareness of financial security and benefits about insurance is spurring the demand for bancassurance products across various segments.

In 2024, Life bancassurance represented the largest segment by product type, driven by high demand for financial security and wealth management integration, along with aging population needs.

Pure distributor leads the market by model type owing its simplicity, cost efficiency and risk segregation coupled with banks’ focus on distribution excellence.

On a regional level, the market has been classified into Germany, France, United Kingdom, Italy, Spain, Others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)