Europe Bath Soap Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, and Country, 2025-2033

Europe Bath Soap Market Size and Share:

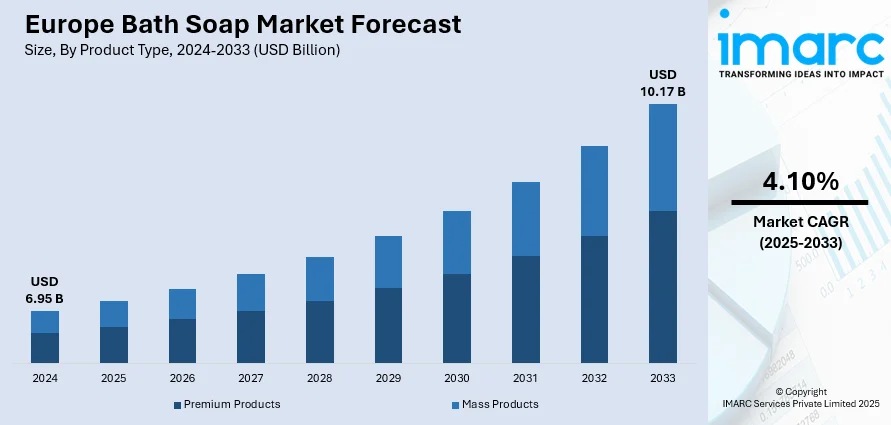

The Europe bath soap market size was valued at USD 6.95 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.17 Billion by 2033, exhibiting a CAGR of 4.10% during 2025-2033. Germany currently dominates the market, holding a significant market share of 27.6% in 2024. The rising demand for natural and organic products, heightened personal hygiene consciousness, growing inclination toward premium and sustainable soaps and increasing focus on biodegradable, plastic-free, or refillable packaging options are some of the major factors fueling the Europe bath soap market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.95 Billion |

|

Market Forecast in 2033

|

USD 10.17 Billion |

| Market Growth Rate 2025-2033 | 4.10% |

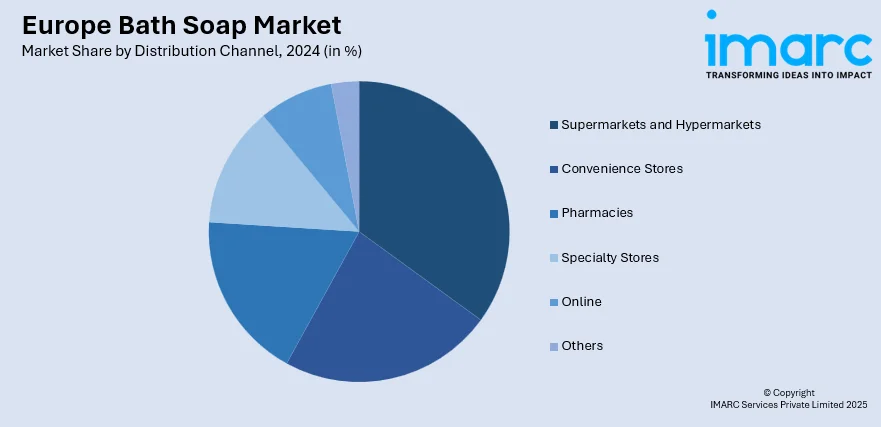

The market for bath soap in Europe is driven by a combination of evolving consumer preferences, environmental awareness, and product innovation. The interest in natural and organic products by consumers has made skin health awareness grow, which is a key factor. The industry is particularly strong in Germany, Sweden and the Netherlands due to their high level of eco-consciousness. Brand recognition and engagement with customers have improved due to social media and celebrity involvement in promoting products. Emphasizing hygiene after the pandemic has made using soap frequently more important, which has also increased demand. Retail channels such as supermarkets and hypermarkets dominate due to their convenience and wide product range, while online platforms are rapidly growing, offering personalized shopping experiences.

To get more information on this market, Request Sample

The Europe bath soap market growth is also driven by sustainability, with consumers favoring biodegradable soaps and plastic-free packaging. Solid soaps are gaining popularity due to their minimal environmental impact and affordability. Additionally, the market is seeing a surge in premium and artisanal products that offer added benefits like aromatherapy, moisturizing properties, and luxury appeal. For instance, in February 2024, Essity, a Tork producer, launched three new luxury soap products targeted at upscale hotels, restaurants, offices, gyms, and spas. The natural magnolia extract found in Tork Luxury Liquid Soap and Tork Luxury Foam Soap is well-known for its calming effects. Tork Luxury Foam Soap is made with 94% natural ingredients and feels good to the touch, while Tork Luxury Liquid Soap is made with 95% natural ingredients and is smooth and soft.

Europe Bath Soap Market Trends:

Increasing Awareness About Personal Hygiene

Personal hygiene awareness has risen sharply in Europe, especially after the COVID-19 pandemic, which reinforced the importance of regular hand and body washing. Governments and health organizations promoted hygiene campaigns that encouraged frequent use of soap, contributing to a sustained increase in consumption. Educational efforts, public health messaging, and improved access to hygiene products in public and private settings have played key roles. This growing hygiene consciousness extends across demographics, including schools, workplaces, and homes, reinforcing steady demand for bath soap and related cleansing products in both liquid and solid formats. For instance, OECD research shows that in 34 OECD and EU/EEA countries, every USD 1 invested in improving hand hygiene in healthcare settings yields approximately USD 24.6 in economic benefits through reduced health costs and increased productivity.

Rising Demand for Premium and Functional Products

Consumers are increasingly seeking bath soaps that offer more than just basic cleansing. There is a rising demand for premium products with added benefits such as moisturizing, anti-aging, exfoliation, and aromatherapy effects. These functional soaps often contain ingredients like shea butter, activated charcoal, essential oils, and vitamins, which create a positive Europe bath soap market outlook. Luxury bath soaps are perceived as part of self-care routines, particularly in urban areas where wellness is a lifestyle trend. As disposable incomes rise and consumers seek indulgent and multi-purpose skincare products, the premium segment continues to grow, influencing innovation and competition among both mass-market and niche soap brands. For instance, in July 2024, Celine expanded its bath and body line this fall with new hand creams, liquid hand soaps, body milk, and hair mists in signature scents. This follows recent beauty and wellness launches, including Rouge Triomphe lipstick and a Pilates collection, with a broader cosmetics range set for 2025.

Growing Focus on Sustainability and Eco-Friendly Packaging

Environmental concerns are influencing consumer choices and brand strategies across the European bath soap market. Buyers are actively seeking biodegradable, plastic-free, or refillable packaging options and favor brands that commit to sustainable sourcing and low-carbon production. Regulatory pressure from the EU and local governments also encourages companies to reduce their environmental footprints. Many brands are eliminating microplastics, using recycled materials, and adopting circular packaging models. According to the Europe bath soap market forecast, this green transition is not only a market differentiator but a requirement to remain competitive, as eco-conscious consumers increasingly align their purchasing behavior with environmental values and climate responsibility. An NCBI report states that 88 toxic chemicals present in over 73,000 personal care products are linked to headaches, dizziness, allergic reactions, skin irritation, and long-term health problems like cancer and reproductive disorders. Additionally, several companies are offering products in recycled plastic packaging on account of the rising environmental consciousness, which is contributing to the market growth. Therefore, as part of the Green Deal, the European Parliament targets recycling 55% of plastic packaging waste by 2030.

Europe Bath Soap Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe bath soap market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product type, form, and distribution channel.

Analysis by Product Type:

- Premium Products

- Mass Products

Mass products stand as the largest product type in 2024, holding 70.2% of the market due to their affordability, accessibility, and widespread availability across retail channels. These products cater to a broad consumer base, offering essential hygiene at competitive prices. Mass bath soaps are often backed by strong brand recognition and extensive marketing, making them a go-to choice for everyday use. Their presence in supermarkets, hypermarkets, and convenience stores ensures high visibility and easy access. Additionally, mass products frequently offer a variety of scents and formulations, appealing to diverse preferences while maintaining cost-effectiveness, which is especially important in price-sensitive segments of the European market.

Analysis by Form:

- Solid Bath Soaps

- Liquid Bath Soaps

Solid bath soaps lead the market with 59.8% of market share in 2024 due to their affordability, long shelf life, and minimal packaging, which aligns with growing environmental concerns. Consumers increasingly prefer solid soaps for their eco-friendliness, as they often come in recyclable or plastic-free packaging. Additionally, solid soaps are perceived as more natural and less processed, appealing to health-conscious buyers. Their compact size makes them convenient for travel and storage. Traditional preferences and the wide availability of solid soaps in supermarkets and local stores further reinforce their dominance, especially among older demographics and budget-conscious consumers across Europe.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies

- Specialty Stores

- Online

- Others

Supermarket and hypermarkets leads the market with 49.9% of market share in 2024 due to their extensive reach, convenience, and wide product variety. These retail formats offer consumers easy access to both premium and budget-friendly soap brands under one roof. Their strong supply chains and promotional strategies, such as discounts and bundled offers, attract a broad customer base. Additionally, in-store visibility and shelf placement enhance brand recognition and impulse buying. The trust and familiarity associated with established retail chains also influence consumer purchasing decisions, making supermarkets and hypermarkets the preferred choice for regular personal care purchases like bath soaps.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share of 27.6%. The Europe bath soap market demand in Germany is driven by German consumers gradually prioritizing sustainability, thus leading to a surge in demand for eco-friendly, biodegradable, and plastic-free soap products. Natural and organic ingredients are highly favored, reflecting a broader trend toward health-conscious living. The market also benefits from rising awareness of personal hygiene, especially post-pandemic. Premium and artisanal soaps with unique scents and skin benefits are gaining popularity, supported by strong online retail growth. Additionally, Germany’s regulatory emphasis on environmental standards encourages innovation in green packaging and formulations, further shaping consumer preferences and brand strategies in the competitive landscape.

Competitive Landscape:

The Europe bath soap market is highly competitive, driven by both established multinational brands and emerging local players. Key companies like Unilever, L’Oréal, Beiersdorf, and Procter & Gamble dominate with strong brand portfolios and wide distribution networks. However, niche brands focusing on organic, vegan, and sustainable products are rapidly gaining traction. Innovation in formulations, such as plant-based and dermatologically tested soaps, along with eco-friendly packaging, is a major differentiator. Premiumization is also reshaping the landscape, with luxury and artisanal soaps appealing to health-conscious and environmentally aware consumers. Online retail and influencer marketing further intensify competition, enabling smaller brands to reach broader audiences and challenge traditional market leaders.

The report provides a comprehensive analysis of the competitive landscape in the Europe bath soap market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Unilever acquired Wild, a UK-based personal care brand known for its sustainable, refillable products. Founded in 2020, Wild offers a range of bath soaps, deodorants, body washes, and lip balms made with plant-based ingredients and packaged in plastic-free materials. The acquisition aligns with Unilever's strategy to enhance its portfolio with premium and high-growth brands as part of its Growth Action Plan 2030.

- March 2025: A sustainable soap bar made using fermentation-derived palm oil was created by Colgate-Palmolive in collaboration with Dutch start-up NoPalm Ingredients. The yeast-derived oil, requiring less land and emitting 90% fewer emissions, aims to reduce reliance on palm oil. This innovation aligns with regulatory pressures in the EU and UK to phase out deforestation-linked ingredients.

- February 2025: Bob, a refillable hard body wash, was launched in the UK, targeting the male grooming market. Designed as an alternative to traditional soap bars and liquid body washes, Bob features a refillable applicator with medical-grade bristles and a hydrating wash bar, offering sustainability and convenience for men’s grooming routines.

- November 2024: Amplify Goods launched the Solidarity Gentle Exfoliating Bar Soap, blending luxury, sustainability, and social impact. It uses upcycled materials and is vegan, cruelty-free, and plastic-free.

- November 2024: The Somerset Toiletry Company, in partnership with social enterprise BillyChip and graffiti artist Inkie, launched the limited-edition 'Soap with Hope' to support the homeless. Priced at GBP 6.95, all proceeds go to BillyChip.

- April 2024: The Somerset Toiletry Company celebrated its 25th anniversary with a multi-million-pound expansion, doubling soap production at a new Hallatrow factory. The move enhances sustainability, augments efficiency, and supports its global presence in 50+ countries.

Europe Bath Soap Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Premium Products, Mass Products |

| Forms Covered | Solid Bath Soaps, Liquid Bath Soaps |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies, Specialty Stores, Online, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe bath soap market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe bath soap market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe bath soap industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe bath soap market in Europe was valued at USD 6.95 Billion in 2024.

The Europe bath soap market is projected to exhibit a CAGR of 4.10% during 2025-2033, reaching a value of USD 10.17 Billion by 2033.

Key factors driving the Europe bath soap market include rising demand for natural and organic ingredients, growing environmental awareness, premium product innovations, and strong social media marketing. Additionally, consumer focus on personal hygiene and sustainability, along with eco-friendly packaging trends, significantly contributes to market growth and product diversification.

Germany holds the largest share of the Europe bath soap market due to rising eco-conscious consumer preferences, increasing demand for natural ingredients, and sustainable packaging.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)