Europe Biosimilar Market Size, Share, Trends and Forecast by Molecule, Indication, Manufacturing Type, and Country, 2025-2033

Europe Biosimilar Market Size and Share:

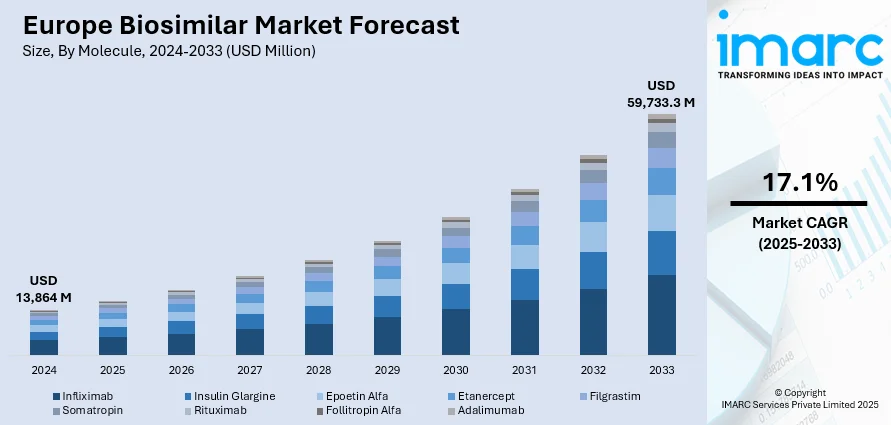

The Europe biosimilar market size was valued at USD 13,864 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 59,733.3 Million by 2033, exhibiting a CAGR of 17.1% during 2025-2033. Italy currently dominates the market, holding a significant market share of 20.8% in 2024. The market is driven by the escalating prevalence of chronic diseases that necessitates more affordable treatment options, along with supportive regulatory frameworks, notably by the European Medicines Agency (EMA), to facilitate streamlined approvals. The growing acceptance among healthcare providers and patients enhances biosimilar adoption, further contributing to the expanding Europe biosimilar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,864 Million |

| Market Forecast in 2033 | USD 59,733.3 Million |

| Market Growth Rate 2025-2033 | 17.1% |

A key factor influencing the market is the rising occurrence of chronic illnesses like diabetes, cancer, and autoimmune conditions, leading to a greater need for affordable biologic therapies. Additionally, Europe’s aging population, among the highest globally, further fuels this demand, as older individuals are more susceptible to chronic conditions requiring biologics. Favorable government policies and reimbursement frameworks across countries like Germany and France are also pivotal. These policies promote biosimilar adoption by reducing financial burdens on healthcare systems and improving patient access. Moreover, patent expirations of major biologics have opened the market for biosimilar alternatives, encouraging competition and innovation. For instance, in May 2025, Abiogen Pharma and mAbxience, a Fresenius Kabi-dominated company with Insud Pharma's joint ownership, announced a new strategic license deal to develop and market a biosimilar candidate in Italy.

To get more information on this market, Request Sample

The Europe biosimilar market growth is also fueled by technological advancements in bioprocessing and analytical methods, which are reducing production costs and accelerating development timelines. Furthermore, the expansion of manufacturing capacities and educational initiatives targeting healthcare professionals and patients is enhancing market penetration and acceptance. For instance, in May 2025, Alvotech and Advanz Pharma added three more biosimilar candidates for the European market to their strategic alliance. Their current relationship, which focuses on expanding their biosimilar portfolio in Europe, is strengthened by this deal. The enlarged partnership includes biosimilars to Kesimpta (ofatumumab), Ilaris (canakinumab), and an unidentified early-stage product.

Europe Biosimilar Market Trends:

Patent Expiries and Cost Containment

One of the most prominent market drivers for the biosimilar industry in Europe is the expiry of patents for a host of high-revenue biologic drugs. Moreover, as European countries are grappling with rising healthcare costs, cost containment is becoming a crucial aspect. The World Health Organization (WHO) reports that up to 20% of households across Europe experience catastrophic health spending, largely due to out-of-pocket payments for medicines. In response to this, several European healthcare systems are encouraging the use of biosimilars as a cost-effective strategy. For instance, government organizations are introducing policies to incentivize the prescription of biosimilars. Additionally, according to a data report, as of August 2020, the European Medicines Agency, which evaluates biosimilars, approved a total of 72 entities since 2006, compared to 28 biosimilars approved by the US Food and Drug Administration. Furthermore, the rising healthcare costs in Europe are prompting patients to opt for biosimilars. For instance, health-related expenditure averaged almost €6,000 per inhabitant in 2019. In Germany, a consultation with a general practitioner cost around €75 for non-residents. As a result, the increasing cost and rising patent expirations of biological products are propelling the demand for biosimilars in Europe.

Increasing Prevalence of Chronic Diseases

The rising cases of various chronic diseases, such as COPD, asthma, cancer, diabetes, etc., are creating a positive Europe biosimilar market outlook. WHO highlights that 1 in 6 people in Europe still die before the age of 70 from cancer, diabetes, chronic respiratory or cardiovascular diseases. For instance, more than one-third (36.1%) of people in the EU reported having a long-standing (chronic) health problem in 2022. Moreover, non-communicable diseases (NCDs), including cardiovascular diseases, diabetes, chronic respiratory diseases, mental disorders, neurological disorders, and cancer, are responsible for 80% of the disease burden in the EU countries and are the leading causes of avoidable premature deaths. Additionally, the growing burden of cancer and increasing deaths due to it are creating the need for affordable treatment and thus boosting the growth of the biosimilar market. For instance, over 4 million new cancer cases and 1.9 million cancer-related deaths were estimated in Europe in 2020. Additionally, in 2022, the highest cancer rate for men and women among European countries was in Denmark, with 728.5 cancer cases per 100,000 population. Ireland and the Netherlands followed, with 641.6 and 641.4 people diagnosed with cancer per 100,000 population, respectively. The increasing incidence of cancer is expected to drive the need for advanced and affordable cancer drugs for the effective treatment of patients. This, in turn, is anticipated to significantly propel the market share in Europe in the coming years.

Expedited Approval of Drugs

The concerned authorities of Europe are expediting the approval of drugs in order to authorize promising treatments for urgent medical needs. The increasing burden of healthcare costs is prompting concerned government authorities in Europe to accelerate clinical trials and commercialize approved drugs. Reports indicate that over 100 biosimilar medicines have been approved for nearly 30 reference medicines in Europe, underscoring the rigorous scientific standards of the European authorization process. This, in turn, is positively impacting the biosimilar market outlook in Europe. For instance, in April 2024, the Committee for Medicinal Products for Human Use of the European Medicines Agency recommended marketing authorization for two biosimilar medicines intended for the treatment of rheumatoid arthritis, COVID-19, polyarticular juvenile idiopathic arthritis, and systemic juvenile. Similarly, in January 2024, a pharmaceutical company, Sandoz, announced that the European Commission (EC) granted marketing authorization for Pyzchiva (biosimilar ustekinumab). Pyzchiva was developed and registered by Samsung Bioepis to match the reference medicine. It is approved for autoimmune disorders within disease areas such as gastroenterology and dermatology. According to the Europe biosimilar market forecast, the quickness in approving and marketing drugs by the concerned European authorities is anticipated to augment the market growth in Europe.

Europe Biosimilar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe biosimilar market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on molecule, indication, and manufacturing type.

Analysis by Molecule:

- Infliximab

- Insulin Glargine

- Epoetin Alfa

- Etanercept

- Filgrastim

- Somatropin

- Rituximab

- Follitropin Alfa

- Adalimumab

Infliximab stands as the largest molecule in 2024, holding 17.5% of the market. In the European biosimilar market, Infliximab has emerged as a prominent product with significant market drivers. Infliximab, a monoclonal antibody used to treat various autoimmune diseases, has witnessed growing demand due to its efficacy and cost-effectiveness. Furthermore, Europe biosimilar market statistics by IMARC indicate that the rising prevalence of chronic conditions, such as rheumatoid arthritis, Crohn's disease, and psoriasis, has propelled the demand for Infliximab biosimilars in recent years.

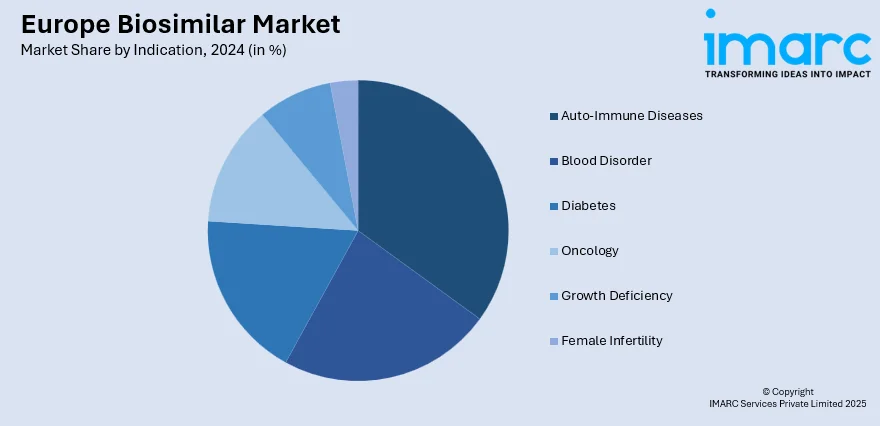

Analysis by Indication:

- Auto-Immune Diseases

- Blood Disorder

- Diabetes

- Oncology

- Growth Deficiency

- Female Infertility

Auto-immune diseases lead the market with 38.2% of market share in 2024. In the region, the rising cases of auto-immune diseases have emerged as a significant driver for growth. Auto-immune diseases, encompassing a wide range of conditions like rheumatoid arthritis, psoriasis, and inflammatory bowel disease, affect a substantial number of patients across Europe. The growing prevalence of these chronic disorders is driving the demand for cost-effective and accessible treatment options.

Analysis by Manufacturing Type:

- In-house Manufacturing

- Contract Manufacturing

In-house manufacturing leads the market with 80.3% of market share in 2024. In-house manufacturing refers to the practice of biosimilar companies producing their products internally rather than outsourcing the manufacturing process. Additionally, in-house manufacturing allows for better control over the entire production process, ensuring higher quality standards and reducing the risk of supply chain disruptions. Moreover, it offers greater flexibility in responding to market demands and regulatory changes, enabling companies to adapt quickly to emerging opportunities and challenges.

Analysis by Country:

- Italy

- Germany

- United Kingdom

- France

- Spain

- Rest of Europe

In 2024, Italy accounted for the largest market share of 20.8%. The biosimilar market in Italy is driven by the rising prevalence of chronic diseases in the country, such as autoimmune disorders, cancer, and diabetes, which has led to an increased demand for cost-effective treatment options. For instance, chronic diseases (or non-communicable diseases) afflict about 24 million people in Italy. In 2021, around 23.7 million people in Italy suffered from at least one chronic disease. Such a massive rise in chronic disease cases in Italy is further augmenting the need for affordable biosimilars. Moreover, the Italian government is launching numerous policies and incentives to encourage the adoption of biosimilars, recognizing their potential to improve patient access to essential therapies while reducing healthcare expenditures. Besides this, the country's well-established regulatory framework and robust guidelines for biosimilar approval have instilled confidence in these products, further fostering their acceptance and utilization in the Italian market.

Competitive Landscape:

The key players in the market are investing significantly in research and development to identify suitable reference biologics and develop biosimilar versions. This involved conducting pre-clinical and clinical studies to demonstrate similarity in efficacy, safety, and quality with the originator biologics. Along with this, the rising utilization of pricing and marketing initiatives to gain market share and compete with originator biologics effectively is significantly supporting the market. In addition, companies are managing their supply chains to ensure a consistent and reliable supply of biosimilar products to meet market demand, such as establishing partnerships with contract manufacturing organizations and distribution networks. Thus, it is positively influencing the market. With increasing competition in the biosimilar market, manufacturers are employing cost-effective pricing and value-added services and developing a strong brand reputation. Furthermore, negotiating reimbursement and formulary inclusion to ensure widespread adoption is contributing to the market.

The report provides a comprehensive analysis of the competitive landscape in the Europe biosimilar market with detailed profiles of all major companies, including:

- Novartis

- Pfizer

- Teva

- Celltrion

- Merck Sharp & Dohme

- Samsung Bioepis

- Eli Lilly

- Accord Healthcare Ltd.

- Amgen

- Boehringer Ingelheim

- Hexal Ag

- Apotex

- Stada Arzneimittel Ag

- Ratiopharm

- Mylan

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- May 2025: Sandoz launched Pyzchiva, the first ustekinumab biosimilar in Europe available as an autoinjector, enhancing patient comfort and adherence. Developed by Samsung Bioepis, it treats conditions like psoriasis and Crohn’s disease. The rollout began in Spain.

- April 2025: Dong-A ST expanded the launch of its Stelara biosimilar, Imuldosa, to the UK and Ireland after its January debut in Germany. Approved by the European Commission in December 2024, Imuldosa targets autoimmune diseases, with further rollouts planned in France, Spain, and Italy, supporting broader European commercialization through Intas Pharmaceuticals.

- February 2025: Celltrion received EMA approval to initiate a Phase 3 clinical trial in Europe for CT-P55, its biosimilar to Cosentyx. The trial involves 375 plaque psoriasis patients to compare efficacy and safety with the reference drug. This move aims to expand Celltrion’s autoimmune treatment portfolio through global clinical validation.

- February 2025: Biocon launched its generic liraglutide products, Liraglutide Biocon and Biolide, in the UK to treat type 2 diabetes and obesity. This followed UK approval in March 2024 and EU approval with partner Zentiva in December 2024, marking Biocon’s expansion in the European biosimilar diabetes treatment market.

- January 2025: Teva partnered with Klinge Biopharma and Formycon to commercialize FYB203, a biosimilar to Eylea (aflibercept), across major European countries. Following positive regulatory recommendations, Teva plans to market FYB203 under the brand AHZANTIVE, expanding its ophthalmology biosimilar portfolio.

Europe Biosimilar Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Molecules Covered | Infliximab, Insulin Glargine, Epoetin Alfa, Etanercept, Filgrastim, Somatropin, Rituximab, Follitropin Alfa, Adalimumab |

| Manufacturing Types Covered | In-House Manufacturing, Contract Manufacturing |

| Indications Covered | Auto-Immune Diseases, Blood Disorder, Diabetes, Oncology, Growth Deficiency, Female Infertility |

| Countries Covered | Italy, Germany, United Kingdom, France, Spain, Rest of Europe |

| Companies Covered | Novartis, Pfizer, Teva, Celltrion, Samsung Bioepis, Amgen, Apotex, Ratiopharm, Mylan, Merck Sharp & Dohme, Eli Lilly, Accord Healthcare Ltd, Boehringer Ingelheim, Hexal Ag, Stada Arzneimittel Ag etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe biosimilar market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe biosimilar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe biosimilar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe biosimilar market in Europe was valued at USD 13,864 Million in 2024.

The Europe biosimilar market is projected to exhibit a CAGR of 20.8% during 2025-2033, reaching a value of USD 59,733.3 Million by 2033.

The Europe biosimilar market is driven by patent expirations of major biologics, increasing demand for affordable therapies, and rising chronic disease prevalence. Supportive regulatory frameworks from the European Medicines Agency and growing acceptance among healthcare providers and patients further fuel adoption, strengthening the expanding Europe biosimilar market share.

Italy holds the largest share of the Europe biosimilar market due to patent expirations, rising healthcare costs, increasing chronic diseases, and strong regulatory support from AIFA, promoting market access.

Some of the major players in the Europe biosimilar market include Novartis, Pfizer, Teva, Celltrion, Samsung Bioepis, Amgen, Apotex, Ratiopharm, Mylan, Merck Sharp & Dohme, Eli Lilly, Accord Healthcare Ltd, Boehringer Ingelheim, Hexal Ag, Stada Arzneimittel Ag, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)