Europe Digital OOH Advertising Market Report by Format Type, Application, End Use Industry, and Country 2025-2033

Europe Digital OOH Advertising Market Overview:

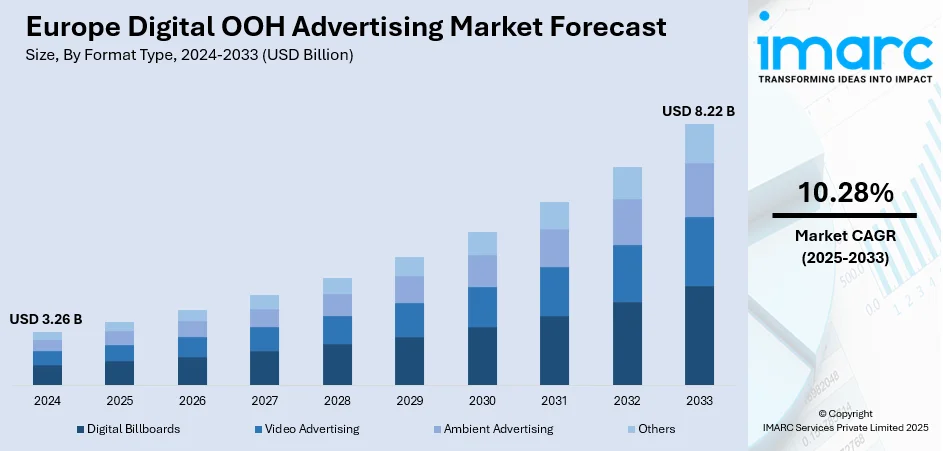

The Europe digital OOH advertising market size was valued at USD 3.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.22 Billion by 2033, exhibiting a CAGR of 10.28% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. Rapid urbanization, smart city development, rising adoption of programmatic DOOH, real-time audience targeting, improved data analytics, and increasing demand for dynamic, context-aware content to enhance consumer engagement and advertising effectiveness across high-traffic public environments are some of the major factors driving the Europe digital OOH advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.26 Billion |

|

Market Forecast in 2033

|

USD 8.22 Billion |

| Market Growth Rate 2025-2033 | 10.28% |

The European market for digital out-of-home (DOOH) advertising is expanding rapidly due to rapid urbanization, with several Europeans living in cities, creating dense, high-footfall locations ideal for DOOH displays. Simultaneously, smart city developments are driving infrastructure upgrades, enabling the integration of digital screens in transit hubs, shopping centers, and public spaces. For instance, in June 2025, HYGH and Wildstone joined forces in a strategic alliance aimed at creating a nationwide digital billboard network throughout Germany. With aggressive growth objectives, both companies intend to roll out state-of-the-art, digitally connected out-of-home (OOH) advertising sites across the country. Technological innovation is also boosting market growth. High-definition displays, touchscreens, motion sensors, and augmented reality features allow for interactive experiences that enhance viewer engagement. These tools, combined with advanced audience analytics, enable context-aware messaging based on time, location, and demographics.

To get more information on this market, Request Sample

The Europe digital OOH advertising market analysis growth is also driven by the widespread adoption of programmatic DOOH. Advertisers increasingly use real-time bidding, location-based targeting, and AI-powered automation to deliver dynamic content tailored to specific audiences. This precision improves ad efficiency and campaign performance while reducing costs. For instance, in February 2024, JCDecaux SE, recognized as the global leader in outdoor advertising, unveiled the world’s first programmatic digital out-of-home (DOOH) solution tailored specifically for airports. This innovative offering allows brands and agencies to effortlessly launch highly targeted, dynamic, and context-specific ad campaigns across JCDecaux’s network of programmatic-ready airport locations. The platform operates via the VIOOH Supply Side Platform (SSP) and connects seamlessly with over 30 Demand Side Platforms (DSPs), including Displayce, where the service is already active. Moreover, post-pandemic shifts in marketing strategies have further accelerated DOOH adoption. Advertisers are favoring flexible, data-driven platforms that support quick content updates and remote campaign management, advantages DOOH offers

Europe Digital OOH Advertising Market Trends:

Surge in Programmatic DOOH and Real-Time Bidding

Programmatic technology is revolutionizing how DOOH advertising is bought and managed in Europe. Advertising space can be dynamically purchased by advertisers through real-time bidding (RTB), which enhances targeting and efficiency. Platforms like VIOOH and Displayce are streamlining access across multiple demand-side platforms (DSPs), enabling brands to deliver tailored, time-sensitive content. This automation not only reduces manual work but also provides deeper analytics and performance tracking. As more advertisers shift budgets toward data-driven strategies, programmatic DOOH offers flexibility, scalability, and higher ROI. With increased adoption among agencies and growing integration with mobile data and geolocation targeting, programmatic advertising is becoming a core component of digital OOH media planning across the region. For instance, in April 2025, VIOOH established a partnership with the UAE’s DOOH firm Elevision to allow advertisers to programmatically access Elevision's premium screen inventory throughout the UK and the UAE through a variety of demand-side platforms (DSPs), like Google's Display and Video 360, The Trade Desk, and The Neuron.

Rise of Interactive and Experiential DOOH Campaigns

A growing trend in the European market for digital OOH advertising is the increased adoption of interactive and experiential campaigns. For instance, in December 2023, Thomas Cook (India) Limited, a leading travel services provider, launched an outdoor advertising campaign promoting Europe as a premier holiday destination. Brands are leveraging digital screens equipped with touch functionality, QR code integration, motion sensors, and augmented reality to create engaging, two-way interactions with audiences in real-world settings. According to the Europe digital OOH advertising market trend, these campaigns go beyond passive messaging by inviting consumer participation, enhancing brand recall, and emotional connection. For example, interactive kiosks, gamified billboards, and AR-enabled transit ads are being deployed across high-traffic urban locations. As consumer expectations shift toward immersive experiences, advertisers are investing in DOOH formats that not only capture attention but also provide memorable and measurable engagement, boosting campaign effectiveness and return on investment.

Expansion of Smart Cities and Digital Infrastructure

The growth of smart cities across Europe is playing a pivotal role in the expansion of digital OOH networks. Investments in urban infrastructure, public transportation upgrades, and connected technologies are creating more opportunities to install high-tech, interactive digital billboards in public spaces. Cities like London, Paris, and Berlin are deploying smart kiosks, transit screens, and large-format displays that support Wi-Fi, real-time updates, and dynamic advertising. According to the Europe digital OOH advertising market analysis, these environments enable advertisers to reach large, mobile audiences with vivid, adaptable content. As governments and private players continue to invest in smart city initiatives, DOOH becomes an essential element of the urban communication ecosystem, enhancing both civic engagement and commercial messaging. For instance, in June 2024, Clear Channel Europe teamed up with Vistar Media, a global leader in programmatic technology and digital signage solutions for out-of-home (OOH) advertising, to broaden the footprint of its programmatic platform, LaunchPAD, in Belgium. This strategic collaboration aims to enhance automated media buying capabilities and offer advertisers more efficient, data-driven, and targeted campaign delivery across the region’s growing DOOH landscape.

Europe Digital OOH Advertising Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe digital OOH advertising market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on format type, application, and end use industry.

Analysis by Format Type:

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

Digital billboards stand as the largest format type in 2024, holding 45.7% of the market due to their high visibility, flexibility, and strategic placement in high-traffic urban areas. These billboards offer dynamic content capabilities, allowing advertisers to display real-time, contextually relevant messages that can be updated remotely and frequently. Their large format ensures maximum impact and brand exposure, making them ideal for both local and international campaigns. Additionally, advancements in display technology and integration with data-driven platforms have made digital billboards more attractive for targeted and programmatic advertising. Their ability to deliver engaging visuals and measurable results has solidified their dominance in the European DOOH landscape.

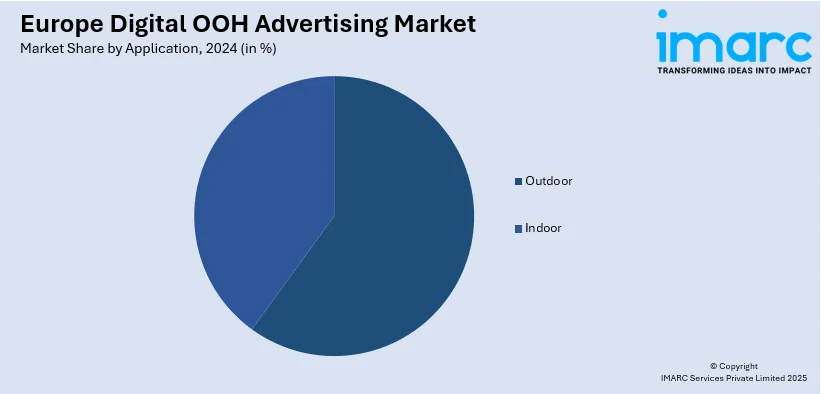

Analysis by Application:

- Outdoor

- Indoor

Outdoor leads the market with 68.7% of market share in 2024 due to its widespread presence in high-footfall and high-traffic locations such as streets, highways, public squares, and transit hubs. These locations offer maximum visibility and reach, making them highly effective for brand exposure and mass communication. The flexibility of digital outdoor displays enables real-time updates, dynamic content, and targeted messaging based on time, location, or audience demographics. Moreover, the increasing adoption of programmatic advertising and advanced data integration has enhanced the value of outdoor DOOH formats. Their scalability, visual impact, and technological adaptability make outdoor formats the preferred choice for advertisers across Europe, which is creating a positive Europe digital OOH advertising market outlook.

Analysis by End Use Industry:

- Retail

- Recreation

- Banking

- Transportation

- Education

- Others

Retail leads the market with 35.8% of market share in 2024 due to their proximity to the point of purchase and ability to influence consumer behavior in real time. Digital displays in malls, supermarkets, and retail stores provide brands with direct access to shoppers when they are most receptive to messaging. These screens enable highly targeted, contextually relevant ads based on shopper demographics, location, and time of day. Additionally, the controlled indoor environment ensures optimal screen visibility and consistent foot traffic. The integration of data analytics and interactive technologies in retail DOOH further enhances engagement, making it a powerful channel for driving sales and brand recall within purchasing environments.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In Germany, the Europe OOH Advertising Industry market demand is driven by the country’s high urban population density, and extensive public transportation infrastructure provides prime locations for digital screens, ensuring high visibility and audience reach. Advancements in programmatic technology allow advertisers to automate buying and deliver real-time, targeted messaging. The widespread adoption of data analytics and digital tools enables context-aware campaigns, improving engagement and effectiveness. Additionally, rising investment in smart city initiatives is increasing the deployment of connected, high-resolution digital displays in urban areas. Strong support from both public and private sectors for sustainable and tech-integrated advertising further accelerates DOOH growth across Germany’s commercial and transportation hubs.

Competitive Landscape:

The Europe digital out-of-home (DOOH) advertising market is highly competitive, with a mix of established players and emerging tech-driven firms. Leading companies such as JCDecaux, Clear Channel Europe, Ströer SE, and Ocean Outdoor dominate the landscape with extensive digital screen networks across major cities. These players are investing heavily in programmatic capabilities, audience analytics, and high-impact digital formats to enhance campaign performance and advertiser value. Additionally, partnerships with programmatic platforms like VIOOH and Vistar Media are reshaping ad delivery models. Regional players and niche operators are also expanding through smart city collaborations and retail-based deployments. The market’s evolution is driven by innovation, technological integration, and a strong push toward real-time, data-driven, and context-aware DOOH advertising solutions.

The report provides a comprehensive analysis of the competitive landscape in the Europe digital OOH advertising market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Bauer Media successfully acquired Clear Channel Europe-North, a provider of various OOH advertising services based in England. With this acquisition, Bauer Media will be able to reinforce its core media-related operations and explore new digital opportunities in the OOH advertising sector.

- January 2025: ECN, a digital-out-of-home office media publisher, established a collaborative alliance with VIOOH, an international digital-out-of-home (DOOH) supply-side platform. With this partnership, advertisers globally will be able to access ECN’s inventory in upscale office buildings positioned in the commercial districts of both major cities and rural areas, expanding their network of digital OOH advertising space. It will also enable VIOOH to expand its presence across France, Germany, and the UK.

- October 2024: JCDecaux SE, an international provider of outdoor advertising services, revealed that its majority-owned subsidiary JCDecaux Top Media SA has purchased 70% of IMC, a prominent digital OOH advertising company in Central America, from its founders. In exchange for a 9% stake in a recently established joint venture, the remaining IMC stockholders contributed their 30% shares in IMC as part of the deal. JCDecaux SE, Publigrafik, Top Partners, and former IMC stockholders will all own a portion of this new joint venture.

- September 2024: Displayce became the first specialized platform to incorporate generative AI for suggesting customized digital OOH advertising strategies. Following a year of research and development, Displayce introduced CampaignAI, an intelligent assistant that will revolutionize the way agencies and marketers create their DOOH campaigns.

Europe Digital OOH Advertising Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Format Types Covered | Digital Billboards, Video Advertising, Ambient Advertising, Others |

| Applications Covered | Outdoor, Indoor |

| End Use Industries Covered | Retail, Recreation, Banking, Transportation, Education, Others |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe digital OOH advertising market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe digital OOH advertising market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe Digital OOH Advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital OOH advertising market in Europe was valued at USD 3.26 Billion in 2024

The Europe digital OOH advertising market is projected to exhibit a CAGR of 10.28% during 2025-2033, reaching a value of USD 8.22 Billion by 2033.

Key factors driving the Europe digital OOH advertising market include growing urbanization, rising adoption of programmatic advertising, increasing investments in smart city infrastructure, enhanced audience targeting through data analytics, and the expansion of digital display networks across transport, retail, and public spaces, enabling dynamic, real-time, and contextually relevant advertising campaigns.

Germany holds the largest share of the Europe digital OOH advertising market due to dense urban transit networks, widespread adoption of programmatic buying, smart city infrastructure deployment, advanced digital display technologies, and real-time audience analytics enabling targeted, context-aware campaigns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)