Europe Direct Drive Wind Turbine Market Size, Share, Trends and Forecast by Capacity, Location of Deployment, and Country, 2026-2034

Europe Direct Drive Wind Turbine Market Overview:

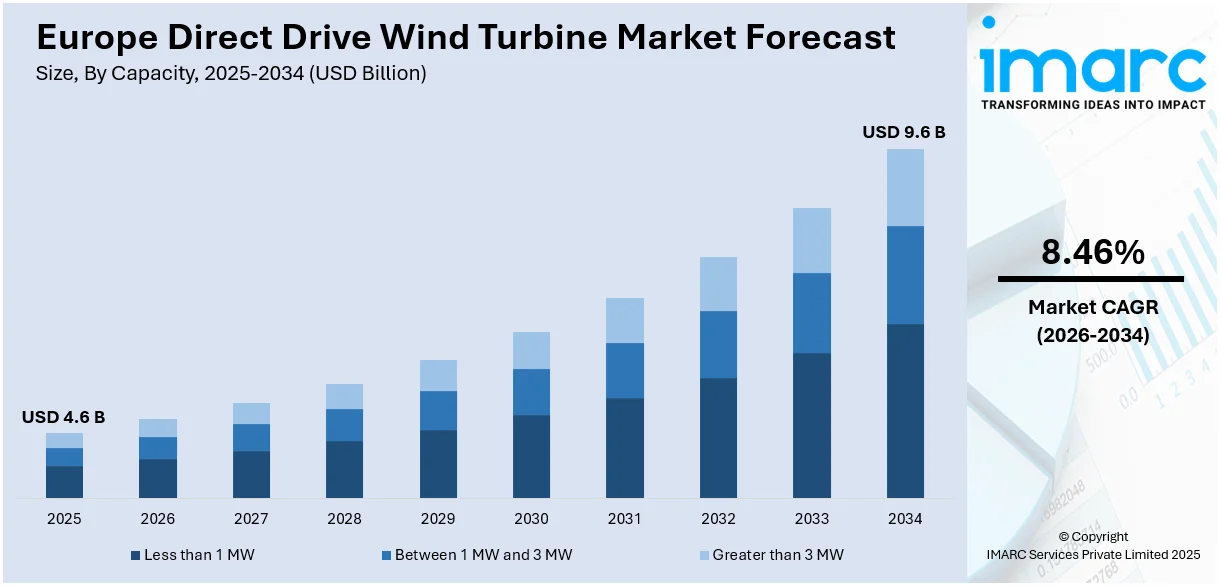

The Europe direct drive wind turbine market size reached USD 4.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.6 Billion by 2034, exhibiting a growth rate (CAGR) of 8.46% during 2026-2034. The shift toward renewable energy, enhanced efficiency with lower maintenance needs, government incentives for offshore wind projects, advances in rare-earth magnet technology, improved grid integration, and increasing investments in large-capacity wind farms are creating a positive outlook for market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.6 Billion |

| Market Forecast in 2034 | USD 9.6 Billion |

| Market Growth Rate 2026-2034 | 8.46% |

Europe Direct Drive Wind Turbine Market Trends:

Expansion of Offshore Wind Energy Projects

Europe's commitment to renewable energy has led to a substantial surge in offshore wind energy projects. Offshore wind farms capitalize on stronger and more consistent wind speeds, enhancing their efficiency in energy generation. Direct drive wind turbines, which eliminate the need for gearboxes, are particularly suited for these environments due to their reduced maintenance requirements and enhanced reliability. In 2019, Europe integrated around 500 new offshore wind turbines across 10 projects, increasing its capacity by 3,627 MW. This trend is expected to continue, with projections indicating a significant increase in offshore installations by 2025, boosting the demand for direct drive wind turbines. In addition to this, companies like Siemens Gamesa Renewable Energy are providing an impetus to the market growth, having installed over 1,000 offshore wind turbines equipped with direct drive systems as of 2019. This number is expected to rise as more projects come online by 2025. Moreover, the preference for Permanent Magnet Synchronous Generators (PMSG) in direct drive systems due to their reliability and lighter weight, which are crucial for offshore applications, is aiding in market expansion.

To get more information on this market Request Sample

Technological Advancements and Cost Reduction

Technological improvements have significantly impacted the direct drive wind turbine market, leading to enhanced efficiency and reduced costs. Innovations, such as increased-capacity turbines, ranging from 1 MW to 3 MW direct drive systems, floating wind turbines, and the integration of 3D printing, have collectively contributed to making offshore wind power more accessible and economically viable. Between 2010 and 2020, the levelized cost of electricity (LCOE) for onshore wind decreased by 56%. Direct drive technology has contributed to this reduction by eliminating gearboxes, thereby cutting maintenance costs and increasing turbine reliability, which in turn, has further heightened its demand. Furthermore, the integration of the Internet of Things (IoT) and artificial intelligence (AI) in wind turbine operations is revolutionizing maintenance and performance monitoring. Recent developments in predictive analytics allow operators to anticipate and address potential issues before they lead to failures, enhancing the reliability and efficiency of direct drive systems. These technological advancements have not only improved the performance of direct drive wind turbines but have also made them more competitive by lowering operational and maintenance costs. The focus on digital transformation initiatives, including predictive maintenance and performance optimization, is expected to further drive the adoption of direct drive systems in Europe's wind energy sector.

Europe Direct Drive Wind Turbine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on capacity, location of deployment, and country.

Capacity Insights:

- Less than 1 MW

- Between 1 MW and 3 MW

- Greater than 3 MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes less than 1 MW, between 1 MW and 3 MW, and greater than 3 MW.

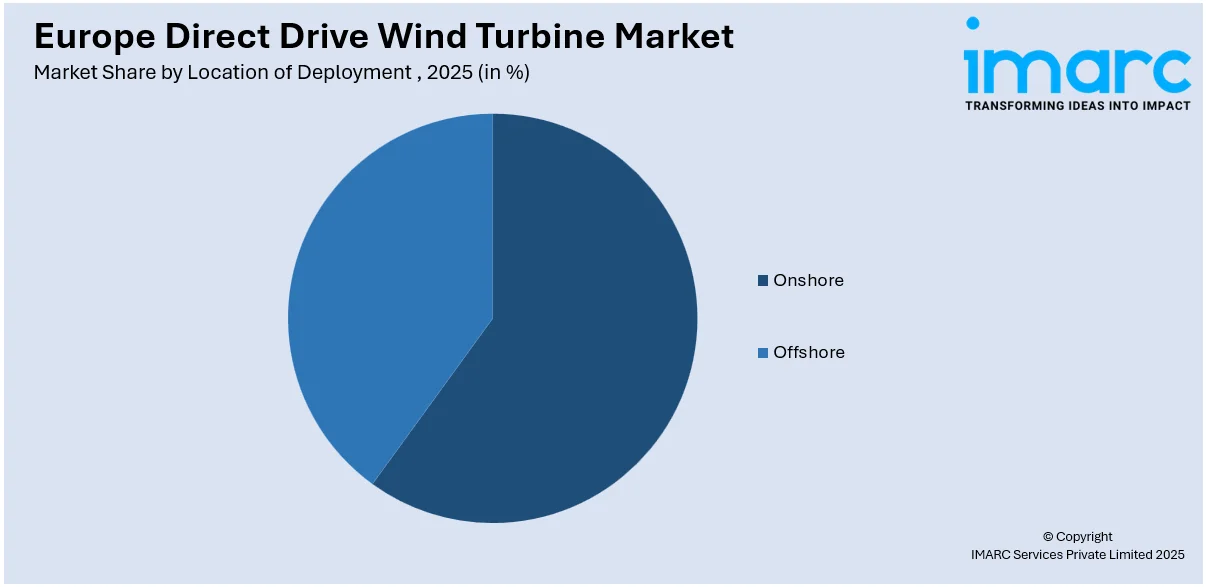

Location of Deployment Insights:

Access the Comprehensive Market Breakdown Request Sample

- Onshore

- Offshore

A detailed breakup and analysis of the market based on the location of deployment have also been provided in the report. This includes onshore and offshore.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, United Kingdom, Italy, Spain, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Direct Drive Wind Turbine Market News:

- August 2024: Bals/SelzEnergie, a German energy holding company, acquired a 330-MW wind turbine contract in Germany. The contract calls for the supply and installation of 50 E-175 EP5 and seven E-138 EP3 wind turbines, as well as the planning and construction of two transformer stations and 20 years of turbine maintenance. The equipment will be utilized in wind farm projects in Rheinhessen and Lower Franconia, with the implementation phase lasting until 2027.

- July 2024: Dutch wind turbine maker EWT officially certified their DW54X-1MW Direct Drive onshore wind turbine, which is ideal for high wind speeds and high wind resource locations. The 54-meter rotor diameter turbine, which has three hub heights, was prototyped and tested in Greece.

Europe Direct Drive Wind Turbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | Less than 1 MW, Between 1 MW and 3 MW, Greater than 3 MW |

| Location of Deployments Covered | Onshore, Offshore |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Europe direct drive wind turbine market performed so far and how will it perform in the coming years?

- What is the breakup of the Europe direct drive wind turbine market on the basis of capacity?

- What is the breakup of the Europe direct drive wind turbine market on the basis of location of deployment?

- What are the various stages in the value chain of the Europe direct drive wind turbine market?

- What are the key driving factors and challenges in the Europe direct drive wind turbine market?

- What is the structure of the Europe direct drive wind turbine market and who are the key players?

- What is the degree of competition in the Europe direct drive wind turbine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe direct drive wind turbine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Europe direct drive wind turbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe direct drive wind turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)