Europe Electric Bus Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Length, Range, Battery Capacity, and Country, 2025-2033

Europe Electric Bus Market Size and Share:

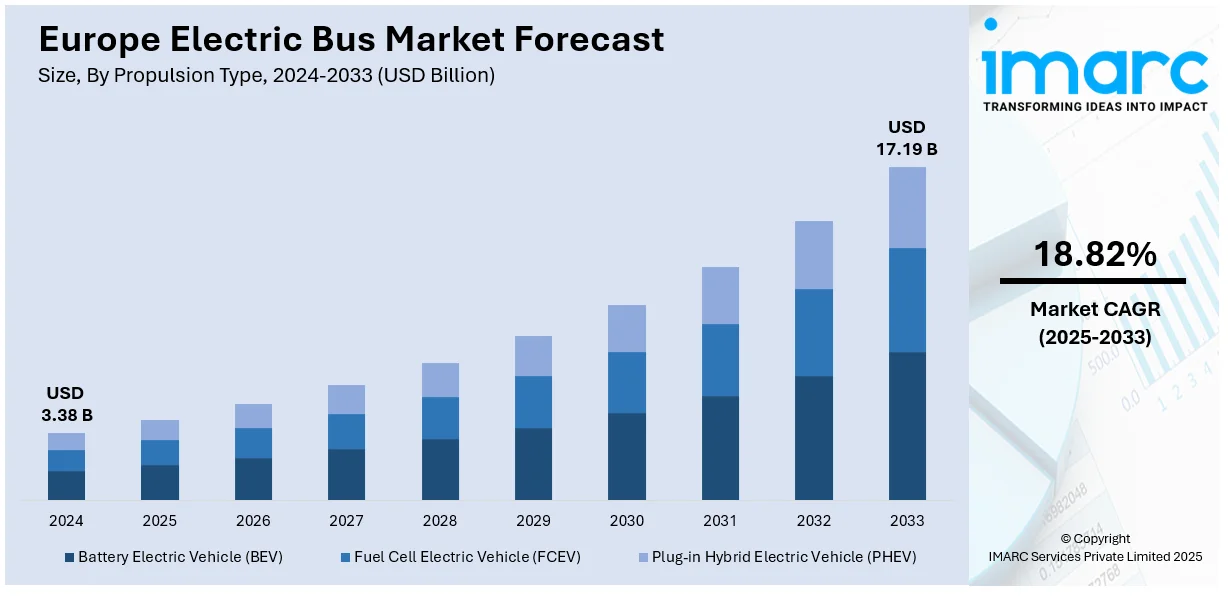

The Europe electric bus market size was valued at USD 3.38 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.19 Billion by 2033, exhibiting a CAGR of 18.82% during 2025-2033. Germany currently dominates the market, holding a significant market share of over 28.7% in 2024. The enactment of supportive government regulations in the country, a few advancements in the technology of batteries to ensure efficiency and better performance, and environmental pollution awareness among people are a few of the key factors that are driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.38 Billion |

|

Market Forecast in 2033

|

USD 17.19 Billion |

| Market Growth Rate 2025-2033 | 18.82% |

The European market is heavily influenced by growing government assistance and strict environmental laws. As European nations strive to lower their carbon footprints and enhance air quality, governments are encouraging massive use of electric vehicles, including electric buses. Programs like the European Green Deal and national initiatives for cleaner travel have fostered a good climate for the uptake of electric buses. Such policies usually involve offering financial incentives, subsidies, and tax credits to municipalities and operators to shift to electric buses from conventional diesel-run buses. Also, cities are implementing low-emission zones, which also create demand for zero-emission buses to meet air quality regulations.

In addition, the integration of smart technologies in electric buses, including fleet management software, real-time tracking, and predictive maintenance systems, has enhanced operational efficiency and lowered maintenance costs. These developments are especially significant for fleet operators who wish to maximize their services and reduce operating costs. The expansion of charging infrastructure also complements this trend, with increasing cities deploying fast-charging stations to support electric buses. In 2024, some of the cities in France, the UK, and the Netherlands experienced a fast uptake of these technologies, further cementing the transition towards electric mobility. With continuous innovation, the future of electric buses in Europe seems more promising as they become a central component of the region's sustainable transport policy.

Europe Electric Bus Market Trends:

Implementation of Favorable Government Policies

The implementation of favorable policies to restrict urban air pollution, reduce greenhouse gas (GHG) emissions, and promote sustainable transportation modes are predominantly fueling the market growth. Furthermore, the European city bus fleets are anticipated to shift predominantly to electric power by 2030 with the assistance of public transport operators and municipal governments. Over the past five years, Europe has experienced its number of electric buses increase from approximately 200 to more than 2,500 buses. Further, several countries on the European continent have set out to transition their public transport fleet to hydrogen fuel-based vehicles as a way of realizing their emissions targets. In June of 2020, for instance, Germany passed the National Hydrogen Strategy. The policy contributed a cumulative investment of EUR 7 Billion to hasten the fleet of public transport to hydrogen technologies in the future. These initiatives are likely to propel the European electric bus market demand in the coming year.

Emerging Technological Advancements

The ongoing advancements in battery technology are increasing the range and performance levels of electric buses. Also, lithium-ion batteries with greater energy density and rapid charging capacity are allowing buses to travel longer distances on a single charge and minimizing charging time, thereby supporting the market growth. Further, different major players in the market are investing more and more in expanding and refining the technology to provide more advanced and efficient forms of electric buses. For example, in June 2022, Van Hool unveiled a new line of zero-emission public buses A-Series at the European Mobility Expo in Paris. Van Hool's A-series of zero-emission buses included versions of a battery-electric and fuel cell (hydrogen) powertrain. Likewise, in April 2022, Switch Mobility unveiled its new Metrocity electric bus at BUS2BUS in Berlin. Subsequently, in June 2022, the company unveiled its new 12-meter bus at the European Mobility Expo in Paris. In addition, the continuous innovation in wireless charging technology is expected to increase charging infrastructure projects, where charging facilities will be available on the go, and charging stations need not be stopped frequently, thereby boosting the Europe electric bus market revenue during the forecast period.

Public Awareness and Demand

Increased public consciousness regarding environmental concerns and need for cleaner modes of transport are driving demand for electric buses among passengers, compelling transit authorities to shift towards cleaner fleets. With this, many bus operators are now turning to electric buses from IC engine-driven buses, which is having a positive effect on the Europe electric bus market outlook. For example, in July 2021, MZK in Konin announced that it would be the first public transport company in Poland to introduce a hydrogen bus to its fleet. Financed by Solaris Bus & Coach, the agreement involved the four-year lease of an Urbino 12 hydrogen bus powered by energy from hydrogen. The bus was handed over in Konin in 2022. In a similar way, VDL Bus&Coach initiated the construction of a new climate-neutral factory at Roeselare in Belgium, where production of the first bus began early in 2022. Industrial buildings have been constructed in a manner so that only electric-powered buses can be produced in an efficient and climate-neutral way.

Europe Electric Bus Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe electric bus market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on propulsion type, battery type, length, range, and battery capacity.

Analysis by Propulsion Type:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

In 2024, battery-electric buses led the electric bus market, accounting for 90.1% of the total market share, driven by the increasing demand for sustainable and zero-emission transport solutions, fueled by stringent environmental regulations and government incentives. The transition from diesel buses to electric alternatives is part of broader efforts to reduce carbon emissions, especially in urban areas. Additionally, advancements in battery technology, longer driving ranges, and lower operational costs made battery-electric buses the preferred choice for public transportation fleets. This trend is expected to continue as cities aim to achieve ambitious sustainability goals.

Analysis by Battery Type:

.webp)

- Lithium-ion Battery

- Nickel-Metal Hydride Battery (NiMH)

- Others

In 2024, lithium-ion battery led the electric bus market, accounting for 94.3% of the total market share. The widespread adoption of lithium-ion batteries is primarily due to their superior energy density, longer lifespan, and cost-effectiveness compared to other battery types. With advancements in battery technology, lithium-ion batteries have become the preferred choice for electric bus operators, offering efficient energy storage and faster charging capabilities. Furthermore, ongoing research and improvements in lithium-ion battery performance are enhancing their reliability and reducing overall lifecycle costs, driving further adoption across Europe. Moreover, the decline in lithium-ion battery prices is also catalyzing the growth of this segment. In 2023, the lithium-ion battery price was noted to be around USD 139 per kWh in the global market, a decrease of around 82.17% from 2013. This, in turn, is offering lucrative growth opportunities to the overall market.

Analysis by Length:

- Less than 9 Meters

- 9-14 Meters

- Above 14 Meters

In 2024, 9-14 Meters led the electric bus market, accounting for 69.7% of the total market share. This growth was driven by the high demand for mid-sized buses in urban and suburban areas. These buses offer an ideal capacity for city routes, balancing passenger demand and operational efficiency. Their versatility allows them to operate in both densely populated city centers and regional routes with moderate passenger volumes. Additionally, the larger bus sizes provide more opportunities for energy efficiency, making them a popular choice for public transport operators looking to optimize both cost and capacity. Also, the demand for 9-14 meters bus is rising. In response to this, numerous manufacturers are introducing electric buses with improved features in this size. For instance, in April 2022, Switch Mobility showed its new Metrocity electric bus at BUS2BUS in Berlin. Later in June 2022, the company launched its new 12-meter bus at the European Mobility Expo in Paris.

Analysis by Range:

- Less than 200 Miles

- More than 200 Miles

In 2024, less than 200 Miles led the electric bus market, accounting for 64.3% of the total market share, driven by the fact that most urban and regional public transport routes do not require long-range buses, making these shorter-range electric buses an optimal choice. These vehicles meet the needs of daily city operations, offering low operating costs and reduced emissions. With improvements in battery technology and faster charging infrastructure, these buses provide sufficient operational time for most routes, making them a practical and cost-effective solution for municipalities and fleet operators.

Analysis by Battery Capacity:

- Up to 400 kWh

- Above 400 kWh

In 2024, upto 400 kWh led the electric bus market, due to their optimal balance of energy capacity, operational range, and cost. These battery capacities are well-suited to meet the requirements of most urban and intercity public transport routes, providing an efficient and reliable range without excessive weight or high costs. With the growing need for electric buses to cover more significant distances between charging points, buses with up to 400 kWh batteries have become increasingly popular due to their ability to support daily operational needs without compromising on performance or requiring frequent recharging.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany led the electric bus market, accounting for 28.7% of the total market share. According to the Europe electric bus market overview, Germany's strong economy allows for huge investments in clean energy technologies, including electric buses. Furthermore, the adoption of supportive government policies, like subsidies and incentives for the adoption of electric vehicles, inspires transit authorities and operators to switch to electric buses, thereby driving market growth. For example, in June 2020, Germany embraced the National Hydrogen Strategy following approval by its federal cabinet. The policy provided an overall investment worth EUR 7 Billion to upsize the fleet of public transportation to hydrogen-based technologies in the future. Other than that, German cities have been implementing strong emission zones, which is rapidly increasing the requirement for zero-emission vehicles that is expected to drive the Europe electric bus market recent price forward.

Competitive Landscape:

The competitive landscape of the European electric bus market is driven by a combination of technological advancements, government regulations, and the shift towards sustainable transportation solutions. Manufacturers are focusing on improving battery efficiency, range, and charging capabilities to meet the growing demand for zero-emission public transport. Strong government incentives and environmental regulations pushing for lower emissions have spurred market growth. Additionally, increasing investments in charging infrastructure and the development of new models with enhanced passenger capacity and operational efficiency are key drivers. Competition is also fueled by the push for integrated solutions, including software for fleet management and predictive maintenance.

Latest News and Developments:

- March 2025: Scania introduced a new electric powertrain for its e-bus platform, offering four power options (240–330 kW) paired with two- or four-speed gearboxes. It included a new 312 kWh battery pack, a rear fast-charging interface (up to 325 kW), and flexible configurations.

- January 2025: Wrightbus launched new electric bus and truck models under its Rightech brand for UK and Europe, including 6m and 9m buses, in addition to its over 1,700 electric vehicles in service.

- October 2024: Volvo Buses unveiled the Volvo 8900 Electric and an upgraded 7900 Electric for city, commuter, and intercity transport in Europe. With capacities up to 540 kWh and 400 kW, production is expected to be supported by a new MCV facility in Egypt for electric bus bodies.

- October 2024: JBM Group announced the launch of its European-homologated electric city bus, starting in Germany. An updated electric coach is also expected to debut at Busworld Europe in October 2025.

- November 2023: Alexander Dennis unveiled its next-generation battery-electric buses, the Enviro100EV and Enviro400EV, designed for the UK and Ireland. The Enviro400EV double decker offers up to 260 miles range for busy routes, while the compact Enviro100EV delivers a class-leading 285 miles per charge.

Europe Electric Bus Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV) |

| Battery Types Covered | Lithium-Ion Battery, Nickel-Metal Hydride Battery (Nimh), Others |

| Lengths Covered | Less Than 9 Meters, 9-14 Meters, Above 14 Meters |

| Ranges Covered | Less Than 200 Miles, More Than 200 Miles |

| Battery Capacities Covered | 400 Kwh, Above 400 Kwh |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe electric bus market from 2019-2033.

- The Europe electric bus market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe electric bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric bus market in Europe was valued at USD 3.38 Billion in 2024.

The electric bus market is projected to exhibit a CAGR of 18.82% during 2025-2033, reaching a value of USD 17.19 Billion by 2033.

The electric bus market is driven by factors such as increasing demand for sustainable transportation, government incentives and regulations promoting eco-friendly solutions, advancements in battery technology, rising fuel costs, and growing urbanization. These factors contribute to the shift towards electric buses for cleaner, more efficient public transit.

In 2024, Germany dominated the electric bus market, accounting for the largest market share of 28.7%, with growth driven by strong government policies supporting green transportation, substantial investments in infrastructure, and increasing public demand for sustainable, energy-efficient public transit solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)