Europe Electric Insulator Market Report Size, Share, Trends and Forecast by Material, Voltage, Category, Installation, Product, Rating, Application, End Use Industry, and Country, 2025-2033

Europe Electric Insulator Market Size and Share:

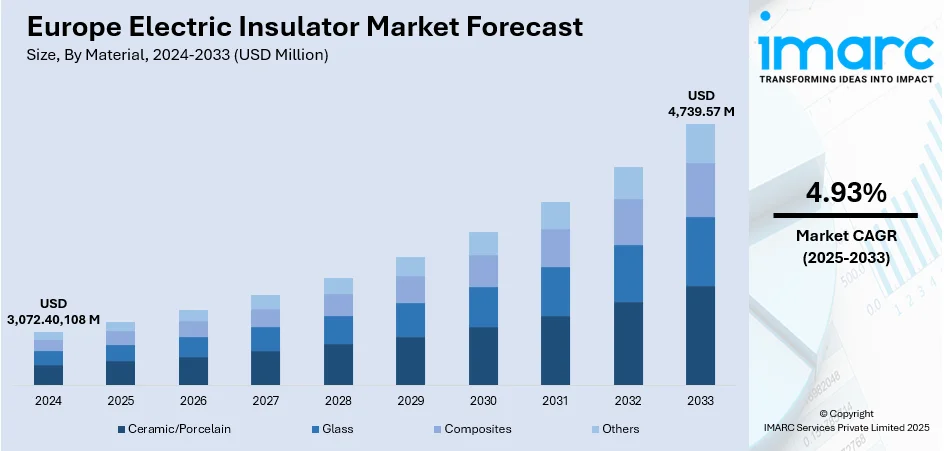

The Europe electric insulator market size was valued at USD 3,072.40,108 Million in 2024. The market is expected to reach USD 4,739.57 Million by 2033, exhibiting a CAGR of 4.93% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is fueled by the increasing demand for electricity and the resulting growth of transmission and distribution systems in Europe. Apart from that, growing investments in renewable energy assets, such as wind and solar power projects, are propelling the demand for efficient and high-performance electric insulators. Besides that, the region's emphasis on replacing aging grid infrastructure to facilitate smart grid deployment and improve energy efficiency further augments the Europe electric insulator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,072.40,108 Million |

| Market Forecast in 2033 | USD 4,739.57 Million |

| Market Growth Rate 2025-2033 | 4.93% |

The market is majorly propelled by the increasing integration of renewable energy sources into national grids, necessitating robust and efficient transmission infrastructure, thereby augmenting demand for high-performance electric insulators. Besides, government-backed initiatives and funding for clean energy transition and infrastructure resilience are catalyzing the replacement of outdated components with advanced insulators. Notably, in 2023, the President of the European Commission introduced the EU-led Global Pledge on Renewables and Energy Efficiency. This international initiative sets forth ambitious targets to significantly accelerate the global energy transition, aiming to increase the total installed capacity of renewable energy to a minimum of 11 terawatts and to enhance the global rate of energy efficiency improvements from approximately 2% to over 4% annually by the year 2030. Moreover, the widespread deployment of high-voltage direct current (HVDC) transmission systems to facilitate long-distance power transfer and cross-border energy trade is generating significant demand for advanced insulator solutions

To get more information on this market, Request Sample

In addition to this, stringent regulations regarding energy efficiency and safety are encouraging utilities to invest in high-quality insulation materials. One of the emerging Europe electric insulator market trends is the shift towards smart grids and automation in electrical infrastructure, which is also creating a strong need for technologically advanced, durable insulators capable of withstanding fluctuating electrical loads and environmental stressors. Additionally, the ongoing electrification of transport and expansion of electric vehicle charging infrastructure are increasing electricity demand, requiring grid enhancements and insulation upgrades. For instance, in July 2025, the UK government announced a EUR 63 Million investment to accelerate the country’s electric vehicle (EV) revolution, with a focus on expanding charging infrastructure and supporting at-home charging for households without driveways. Also, the rising focus on grid decentralization and the adoption of distributed energy systems contribute to the growing requirement for efficient insulation technologies.

Europe Electric Insulator Market Trends:

Integration of Advanced Power Technologies in Transmission Infrastructure

The market is primarily driven by the introduction of advanced power technologies in the European transmission system to develop the infrastructure. For instance, Flexible Alternating Current Transmission System (FACTS) and High Voltage Direct Current (HVDC) transmission will increase transmission network capacity and improve the reliability of the networks with limited environmental impact. Supporting this, as per industry reports, the EU’s electricity transmission infrastructure comprises 390,000 km of high-voltage transmission lines, with an average age of 30 years, while 40–55% of distribution grid assets will be more than 40 years old by 2030. As Europe transitions toward a more resilient and decarbonized power grid, High Voltage Direct Current (HVDC) systems, smart grids, and digital substations are gaining prominence. These advanced technologies require reliable, high-performance insulation systems that can withstand elevated voltages, fluctuating loads, and complex grid interactions. Countries such as Germany, the Netherlands, and the UK are accelerating grid modernization programs to integrate large-scale renewable energy sources into national transmission networks, which in turn drives the demand for technologically advanced insulators.

Refurbishment and Upgradation of Aging Grid Infrastructure

A significant trend propelling the Europe electric insulator market growth is the ongoing refurbishment and upgradation of aging grid infrastructure. Much of the electrical transmission and distribution infrastructure in Western and Central Europe was established several decades ago and is now reaching or exceeding its designed operational lifespan. As reported, the European grids are aging, with nearly 40% of them being over 40 years old, just ten years shy of their typical lifespan. An aging grid not only results in transmission losses but also restricts the connection of new renewable energy sources, leading to a bottleneck in green electricity generation in several EU member states. This aging infrastructure poses challenges in terms of efficiency, safety, and reliability, prompting utilities and transmission system operators to undertake extensive maintenance and retrofitting initiatives. Replacing outdated insulators with modern alternatives is a critical component of these programs. Modern insulators offer improved mechanical performance, weather resistance, and reduced leakage current, making them suitable for current and future energy transmission demands. These efforts are further incentivized by national policies supporting energy resilience and EU-wide goals.

Rising Focus on Renewable Energy Integration and Grid Stability

The growing share of renewable energy in Europe’s energy mix is catalyzing the transformation of grid infrastructure and, by extension, it is positively impacting the Europe electric insulator market outlook. With increasing capacity additions in wind, solar, and hydroelectric power, the European grid faces the challenge of accommodating intermittent and decentralized energy inputs. This necessitates robust transmission and distribution systems that can efficiently transfer power across vast and variable geographies. Electric insulators play a crucial role in maintaining system reliability under fluctuating loads and dynamic voltage conditions associated with renewables. Additionally, many renewable projects are located in remote or offshore locations, where environmental stress is severe, driving demand for high-performance composite insulators with superior hydrophobicity and UV resistance. Furthermore, the EU’s commitment to carbon neutrality by 2050 is pushing member states to accelerate grid decarbonization through renewable integration, prompting a parallel surge in demand for insulators engineered for high-voltage applications and smart grid compatibility to support long-term grid stability.

Europe Electric Insulator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe electric insulator market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on material, voltage, category, installation, product, rating, application, and end use industry.

Analysis by Material:

- Ceramic/Porcelain

- Glass

- Composites

- Others

Ceramic/porcelain leads the market in 2024. The ceramic and porcelain materials are known for their superior electrical insulating properties, high endurance, and stability against high temperatures. The materials are best suited for resisting the electrical stresses in power transmission and distribution systems. The mechanical strength and resistance against environmental conditions like moisture and UV radiation make porcelain a very popular material used in the manufacture of high-voltage insulators. With the non-conductive nature of ceramic, they guarantee safe operation in all sorts of weather since electrical faults are less likely to occur. Moreover, the chemical degradation and corrosion ensure that the components have good longevity and are reliable in harsh environments. With the increasing demand for efficient and sustainable transmission of energy in Europe, the position of ceramic and porcelain in preserving system integrity and safety becomes more important, cementing their position in the market.

Analysis by Voltage:

- Low

- Medium

- High

High leads the market in 2024. High voltage insulators are capable of withstanding the unusually high electrical stresses contained within power transmission systems. These insulators play a critical role in ensuring the integrity and safety of high-voltage networks that deliver electricity across extended distances. Their fundamental function is to avoid electrical leakage or short circuits by creating an insulating barrier between conductors and ground structures. The need for high-voltage insulators arises from the need for more efficient energy distribution, especially in regions where power grids are extensive or work under demanding conditions. High-voltage insulators also have to withstand extreme environmental conditions, including temperature fluctuations and pollution, which makes their material durability and strength essential. With Europe striving to upgrade and extend its energy infrastructure, the relevance of high-voltage insulators in maintaining reliable and safe electrical transmission remains central to enabling energy growth as well as grid stability.

Analysis by Category:

- Bushings

- Other Insulators

Bushings leads the market in 2024. The segment offers a secure and efficient way of transferring electrical current between conductive and non-conductive electrical equipment parts. Bushings are commonly employed in transformers, switchgear, and other high-voltage equipment to insulate the conductors but let them pass through metal enclosures. Bushings play a crucial role in avoiding electrical faults and enabling the proper operation of power transmission networks. Constructed from materials such as porcelain and composite, they possess superior dielectric strength and can handle high mechanical stresses and harsh environmental conditions. With the growing demand for efficient and dependable power systems in Europe, the function of bushings becomes even more critical to ensure the safety, stability, and durability of electrical infrastructure. Their consistent performance ensures an uninterrupted flow of energy, keeping pace with the increasing trend towards sustainable and robust power grids.

Analysis by Installation:

- Distribution Networks

- Transmission Lines

- Substations

- Railways

- Others

Transmission lines lead the market in 2024. The installation of insulators in transmission lines has a direct impact on the reliability and efficiency of the power supply. Transmission lines carrying high-voltage electricity over long distances need strong and reliable insulators to avoid electrical faults and maintain a perpetual flow of power. Quality installation enables insulators to resist mechanical stresses, environmental conditions, and electrical pressure without affecting safety or performance. The increasing need for secure and stable energy transmission systems in Europe makes it imperative to use quality insulators for transmission line installation. With a focus on green energy and grid development, the fitting of insulators for such lines is critical for avoiding system breakdowns, lowering upkeep costs, and maintaining the stability of electrical networks. Proper installation avoids downtime, extends the lifespan of infrastructure, and ensures that the whole power distribution system runs smoothly.

Analysis by Product:

- Pin Insulator

- Suspension Insulator

- Shackle Insulator

- Others

Pin insulator leads the market in 2024. Pin insulators are an important especially in low to medium voltage power transmission systems. The pin or cross-arm mounted insulators suspend the electrical conductors and offer a safe and sound barrier between the live conductors and the grounded structure. Easy installation and maintenance design make them popular for overhead lines. Pin insulators play an important role in avoiding electrical leakage so that the electricity goes through safely and efficiently. Composed of materials such as porcelain and composite, they are durable and resistant to environmental conditions like moisture, wind, and pollution. With the ongoing development of Europe's energy system, pin insulators continue to play a significant role in ensuring the stability and safety of the electrical system. Their function in assisting power transmission with a low possibility of failure reflects their continued relevance in the electrical grid of the region.

Analysis by Rating:

- <11 kV

- 11 kV

- 22 kV

- 33 kV

- 72.5 kV

- 145 kV

- Others

11kV leads the market in 2024 as it is the level of voltage that most medium-voltage distribution systems have. Insulators intended for use in 11 kV systems serve an important function of safely supporting and insulating electrical conductors in power systems to provide efficient and reliable distribution of electricity. Insulators are constructed to withstand the electrical stresses of medium-voltage power transmission while possessing mechanical strength as well as environmental resistance to factors such as moisture, temperature, and pollution. With the growing demand for reliable and safe delivery of energy to urban and rural areas, the 11 kV rating guarantees that the electricity infrastructure continues to function, reducing the instances of faults and outages. With further development and expansion of energy networks across Europe, 11 kV-rated insulators continue to play a critical role in upholding the security, reliability, and longevity of the electricity grid, catering to domestic as well as industrial power demands.

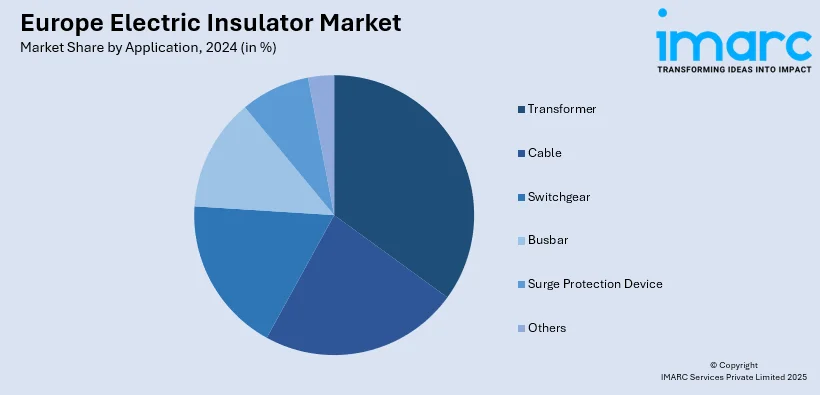

Analysis by Application:

- Transformer

- Cable

- Switchgear

- Busbar

- Surge Protection Device

- Others

Transformer leads the market in 2024. Transformers are essential in regulating and distributing electrical power across various voltage levels. Insulators used in transformers must withstand high electrical stresses while providing mechanical support to the live components, ensuring that the transformer operates safely and efficiently. These insulators avoid electrical leaks and reduce the danger of short circuits, which may lead to system malfunctions or safety risks. Transformers also usually sit in difficult environments, so it is crucial for the insulators to be weather-resistant, chemical-resistant, and heat-resistant. With the need for energy transmission that is secure and dependable rising throughout Europe, the place of insulators in transformers becomes increasingly significant in maintaining the constant supply of electricity. Their performance and durability directly reflect on the lifespan of transformers, making them an important component of the infrastructure for distributing power within the region.

Analysis by End Use Industry:

- Utilities

- Industries

- Others

Utilities lead the market in 2024. The segment has high dependency on insulators for efficient and safe transmission and distribution of electricity. Insulators are critical components in power generation equipment, substations, and electrical grids, as they protect high-voltage electrical conductors by supporting and insulating them against faults and interruptions. In the utilities sector, it is important to preserve the integrity of the power grid in order to provide unbroken service to domestic and industrial customers. With Europe placing greater emphasis on increased renewable energy sources and upgrading its infrastructure, there is increasing demand for superior-quality insulators. Insulators employed in the utilities sector must be long-lasting, resistant to adverse weather, and able to withstand mechanical and electrical loads of advanced power systems. The dependability of these insulators is paramount to guaranteeing the efficiency, safety, and sustainability of Europe's energy supply chain, thus underscoring their role in the utilities industry.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

In 2024, Germany accounted for the largest market share. driven by its developed energy infrastructure and focus on renewable energy transition. As one of Europe's biggest economies, Germany's power generation and transmission systems are widespread, necessitating efficient and high-performance insulators to ensure stability and safety. The nation is a world leader in the advancement and installation of renewable energy resources like solar and wind, fueling the need for creative insulator technologies that can handle the changing grid infrastructure. Moreover, Germany's emphasis on modernizing its electrical grid as well as increasing its renewable energy capacity further strengthens the demand for quality insulators in transmission lines, transformers, and substations. The increasing demand for energy conservation and sustainability in Germany guarantees a constant market for high-technology insulation products, making it a dominant force in the European market for electric insulators.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of several well-established manufacturers, alongside emerging players striving to capture niche segments. The market is moderately consolidated, with key participants focusing on product innovation, material advancements, and compliance with stringent energy efficiency standards to maintain their competitive edge. Companies are also emphasizing research and development to introduce insulators with superior mechanical strength and weather resistance, particularly suitable for renewable energy installations and high-voltage applications. In addition to that, strategic collaborations, joint ventures, and long-term supply contracts with utility providers are common approaches adopted to strengthen market positioning. Furthermore, players are increasingly aligning with sustainability goals, incorporating eco-friendly materials and manufacturing processes into their operations. According to the Europe electric insulator market forecast, the competition is expected to intensify over the coming years as technological advancements and regulatory support for smart grid infrastructure create new growth avenues.

The report provides a comprehensive analysis of the competitive landscape in the Europe electric insulator market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Insulation Technology Group (ITG), a portfolio company of TJC LP, announced its acquisition of Portugal company Cerisol Isoladores Ceramicos SA (Cerisol). This acquisition underscores ITG’s commitment to expanding its capacity to serve customers worldwide and its long-standing focus on porcelain technology and innovation. These factors are crucial in delivering advanced insulation solutions to meet the demands of the growing electrical grid.

- May 2025: CATL unveiled the 9MWh TENER Stack, the world’s first ultra-large capacity ESS, enhancing energy density, seismic safety, and transport flexibility. Designed for high-performance deployment across Europe and beyond, it offered 20% lower construction costs, 40% land-use efficiency, and seamless integration with AC-side infrastructure for grid-scale applications.

- February 2024: ELANTAS announced a substantial investment plan for the Von Roll headquarters in Breitenbach and Büsserach, marking a key development for both the local economy and the global electrical and electronics sector. Between 2024 and 2026, ELANTAS will allocate CHF 12.5 million to centralize its operations in the Büsserach area. This funding will be directed towards modernizing the current facilities to meet cutting-edge technological and sustainability standards. The project aims to set global standards in high-voltage insulation research and testing, with completion scheduled for 2025.

Europe Electric Insulator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Ceramic/Porcelain, Glass, Composites, Others |

| Voltages Covered | Low, Medium, High |

| Categories Covered | Bushing, Other Insulators |

| Installations Covered | Distribution Network, Transmission Line, Substation, Railway, Others |

| Products Covered | Pin Insulator, Suspension Insulator, Shackle Insulator, Others |

| Ratings Covered | <11 kV, 11 kV, 22 kV, 33 kV, 72.5 kV, 145 kV, Others |

| Applications Covered | Transformer, Cable, Switchgear, Busbar, Surge Protection Device, Others |

| End Use Industries Covered | Utilities, Industries, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe electric insulator market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe electric insulator market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric insulator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric insulator market in Europe was valued at USD 3,072.40,108 Million in 2024.

The Europe electric insulator market is projected to exhibit a CAGR of 4.93% during 2025-2033, reaching a value of USD 4,739.57 Million by 2033.

The market is driven by the increasing demand for electricity, the need for grid modernization, and the rise in renewable energy installations. Additionally, the focus on infrastructure upgrades, safety regulations, and the growing trend of electrification in transportation are boosting the demand for reliable electric insulators.

Ceramic/porcelain dominates the material segment in the market in 2024 due to their durability, high insulation properties, and resistance to extreme weather conditions. These materials are widely used in high-voltage applications, offering reliability and cost-effectiveness, which contribute to their strong market presence in Europe.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)