Europe Energy Drinks Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

Europe Energy Drinks Market Size and Share:

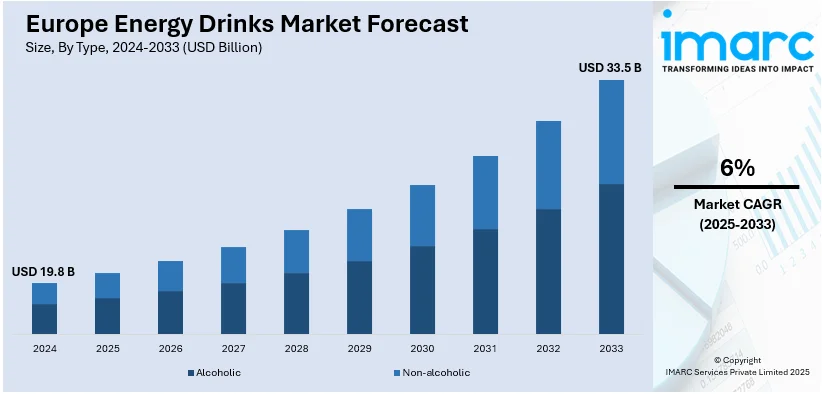

The Europe energy drinks market size was valued at USD 19.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 33.5 Billion by 2033, exhibiting a CAGR of 6% from 2025-2033. The market is experiencing robust growth, driven by the increasing health-consciousness among consumers, introduction of innovative product variations, expanding distribution channels, thriving sports and fitness culture, and rapid urbanization, all contributing to rising revenue.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 19.8 Billion |

|

Market Forecast in 2033

|

USD 33.5 Billion |

| Market Growth Rate 2025-2033 | 6% |

The growing need for health and wellness products among European consumers is the key factor behind the high demand for energy drinks. Apart from this, the increase in lifestyle changes that include working for long hours and paying attention on maintaining the level of physical fitness, by people making a quest for easy energy solutions is accelerating the Europe energy drinks market share. This leads to the increased consumption of energy drinks, as they offer improved alertness and stamina. As per a report by the European Food Safety Authority, 70% of Europeans are known to consume energy drinks regularly, indicating their integration into daily routines. Furthermore, the ongoing shift toward natural and organic ingredients in energy drinks that attract health-conscious consumers is enhancing the market growth.

The rising innovation in flavors, formulations, and packaging is another major factor driving the energy drinks market in Europe. The increasing focus of manufacturers on introducing unique flavors and functional benefits to cater to diverse consumer preferences is catalyzing the Europe energy drinks market growth. In line with this, the development of sugar-free and vegan-friendly variations that address the dietary preferences of specific consumer segments is stimulating the market growth. For instance, Fresh Del Monte UK collaborated with Scotland-based beverage manufacturer the Old Tom Gin's (OTG) company to introduce an exclusive range of energy drinks. It features a minimum of 20% real fruit juice with no added sugar and is available in innovative and tasty flavors, including pineapple, mango, passion fruit, and lime.

Europe Energy Drinks Market Trends:

Expanding Distribution Channels

The burgeoning expansion of distribution channels in Europe, including online and e-commerce platforms, is catalyzing the growth of the market. In 2023, the business-to-consumer (B2C) European e-commerce market saw a modest growth of 3%, thus increasing from €864 billion to €887 billion. This leads to the rising availability of energy drinks through various retail formats and online platforms that widen consumer access. Apart from this, the rise of quick-commerce platforms, which deliver products within hours, is also contributing to the increased consumption of energy drinks in Europe. Moreover, the growing popularity of supermarkets, convenience stores, and vending machines as critical channels that offer the advantage of immediate availability is fueling the expansion of the European energy drink market.

Rising Sports and Fitness Culture Promotion

The rising prominence of sports and fitness culture in Europe is a major factor driving the energy drinks market. As per industry reports, in 2023, the fitness industry in Europe witnessed a significant uptick, with a 12.3% increase in membership, culminating in 63.1 million active members. Moreover, fitness facilities burgeoned to 63,830, underlining Europe’s position as the largest fitness facility market globally. Along with this, the increasing participation in gym activities, outdoor sports, and fitness programs that create a robust demand for beverages that offer energy replenishment and performance enhancement is catalyzing the expansion of the industry. Apart from this, the rising focus on sponsorships of major sporting events, partnerships with fitness influencers, and endorsements by athletes that amplify the popularity of energy drinks as a go-to option for fitness enthusiasts is propelling the market growth.

Growing Urbanization and Lifestyle Changes

The rising urbanization and fast-paced lifestyles of European individuals fueling the demand for energy-boosting products is positively impacting the market growth. As per industry reports, the urban population in the region 340,311,203 in 2023, which is a 0.8% increase from 2022. It is also expected that Europe's level of urbanization will increase to approximately 83.7% in 2050. As more individuals move to urban areas, they face increasing time constraints, leading to a preference for on-the-go solutions. Consequently, the market is expanding due to the increasing popularity of energy drinks, which are available in handy packaging. Aside from this, the rise in dual-income homes has led to greater dependence on these items, which help people stay active and productive throughout the day and overcome drowsiness, bolstering market growth.

Europe Energy Drinks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe energy drinks market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, end user, and distribution channel.

Analysis by Type:

- Alcoholic

- Non-alcoholic

The alcoholic energy drinks segment is experiencing amplified market penetration in Europe as consumers are seeking exclusive beverages that they can enjoy socially. Along with this, market is growing is due to rising concern over combining energizing substances with alcohol in order to target nightlife and party culture.

Energy drinks without alcohol are popular as they provide practical advantages like boosting stamina, improving attention, and enhancing athletic performance. Additionally, the market is expanding due to their broad appeal among professionals, students, and fitness enthusiasts. Moreover, the market is expanding due to consumers' growing desire for healthier lifestyles, which promotes the development of sugar-free and organic alternatives.

Analysis by End User:

.webp)

- Kids

- Adults

- Teenagers

The energy drinks market for kids is a niche segment largely driven by the increasing availability of sugar-free and caffeine-free versions targeted at younger consumers. Moreover, the amplifying demand for functional beverages from parents for their kids that provide hydration and mild energy without harmful additives is accelerating the growth of the market.

Adults hold the most significant share of the Europe energy drinks market due to extensive consumption and wider applications in different use scenarios. Further, professionals consume energy drinks for long periods of working hours, thereby bolstering the growth in this market. Another factor which boosts the market growth is healthier, natural, and low-calorie choices which are available in this market.

Teenagers contribute to a significant percentage of the European energy drink market, which is fueled by their desire for drinks that boost their alertness and stamina while participating in extracurricular or academic activities. Furthermore, the introduction of unique flavors and packaging that cater to the tastes of youngsters is also supporting the growth.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets make a brand product and various products readily available at one's doorstep. This attracts the customer with a significant discount in bulk purchase, several offers, and displays to capture more eyeballs through their store. Additionally, their wide distribution throughout cities and suburbs ensures that energy drinks are accessible to a wide range of consumers, making them an attractive option for many customers to shop.

Specialty stores serve niche audiences that demand premium, organic, or health-oriented energy drinks. Such stores appeal to fitness enthusiasts, athletes, and health-conscious consumers by offering curated selections that emphasize quality and functionality. Additionally, the introduction of personalized customer service and tailored product recommendations at specialty stores that enhance the shopping experience is impelling the market growth.

Convenience stores are important in the energy drinks market because they fulfill the needs of the on-the-go consumer, who demands the quick and easy access of a product. They are sited in high-traffic areas like gas stations and urban centers. They depend on impulse buying and single-service packaging. Round-the-clock availability and strategic placement ensure that demand will be steady and amplify market expansion.

The growing popularity of e-commerce is the leading driver for online stores. These platforms provide convenience and competitive pricing with a better range of products than at home. In addition to this, they offer services, including subscription services, recommendation services, and digital promotion which appeal to tech-savvy and time-constrained buyers.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is one of the leading markets for energy drinks in Europe, which has been primarily driven by a high fitness culture and increasing demand for functional beverages. The heightening demand among German consumers for sugar-free and natural ingredients is contributing to the market growth. Furthermore, innovative product launches well-established distribution networks, such as supermarkets, convenience stores, and online platforms which are enhancing market growth.

The market for energy drinks in France is driven by the raised urbanization and consumption of energy-enhancing drinks that can produce a stimulating effect. The growing tendency among French consumers toward healthy lifestyles is in favor of the market growth. Moreover, stringent advertisement laws are motivating companies to develop innovative marketing practices in order to target youth and boost market growth.

The United Kingdom is a leading country in Europe's energy drinks market, with high consumption among teenagers and young adults. Additionally, the sports culture and on-the-go lifestyle of the country that is creating a high demand for functional and convenient beverages are driving the market growth. Besides this, the accelerating sales of sugar-free and low-calorie energy drinks are also fostering the market growth in the country.

The market for energy drinks in Italy is growing due to the hiked demand for functional beverages that can meet active and social lifestyle. Apart from this, the amplified demand for products that improve focus and stamina is giving a positive outlook to the market. Moreover, the strong café culture offering energy drinks as alternatives to traditional beverages like coffee is also propelling the market growth.

Energy drinks are becoming steadily popular in Spain among students and working professionals who need instant energy boosts amid hectic schedules. Additionally, the nation's robust tourist industry is fueling the market expansion by encouraging travelers to consume more energy drinks. Furthermore, manufacturers are launching new products that cater to consumers' growing demands for healthier formulas and unique flavors, is encouraging the market's expansion.

Competitive Landscape:

- The market's leading companies are constantly searching for strategies to improve their visibility and satisfy evolving demands from customers. To reach a wider audience, they are making investments in product innovation by launching new tastes and formulations. For instance, the development of sugar-free and organic variants aligns with the growing health consciousness among consumers. Additionally, these companies are expanding their distribution networks, leveraging traditional retail channels and e-commerce platforms to increase accessibility. Moreover, to raise brand awareness and loyalty, various companies are concentrating on strategic alliances and sponsorships, particularly in the entertainment and sports industries. Additionally, to fulfill regulatory requirements and environmental demands, they are implementing sustainability measures like eco-friendly packaging and responsible sourcing. The report provides a comprehensive analysis of the competitive landscape in the Europe energy drinks market with detailed profiles of all major companies.

Latest News and Developments:

- In August 2024, ACTI+ launched its new line of clean energy drinks in the UK, offering three fresh flavors: Strawberry & Dragon Fruit, Peach & Apricot, and Pineapple & Yuzu. These zero-sugar drinks are packed with nootropics, essential vitamins, and minerals, designed to boost natural energy, cognitive performance, and immunity. ACTI+ provides a healthy alternative to traditional energy drinks, promoting positive energy with no artificial ingredients. Available in major UK retailers like Tesco, WHSmith, and Amazon.

- In April 2024, Celsius Holdings, Inc., announced its plans to expand the sales and distribution of its CELSIUS energy drinks to France starting from the fourth quarter of 2024. The brand selected Suntory Beverage & Food France as its exclusive sales and distribution partner in the country.

- In February 2024, Spadel announced that they are expanding their product range and entering the energy drinks market in Europe. They are collaboration with Zyla to introduce natural and less sweetened energy drinks. The drinks will be available in three types of energy, such as boost, vitality, and focus.

- In January 2024, C4 Energy Europe announced a collaboration with Millions to launch a new energy drink infused with Millions' iconic Bubblegum and Strawberry flavors. This partnership blends performance with nostalgia, appealing to fitness enthusiasts and sweet lovers alike. The innovative product aims to enhance active lifestyles while delivering a unique and enjoyable energy experience. The launch marks a significant step in redefining energy drinks with a distinctive, nostalgic taste.

Europe Energy Drinks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcoholic, Non-Alcoholic |

| End Users Covered | Kids, Adults, Teenagers |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe energy drinks market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe energy drinks market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe energy drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Energy drinks refer to functional beverages that are designed to boost energy, improve alertness, and enhance physical and cognitive performance. These drinks contain ingredients like caffeine, taurine, vitamins, and sugar or sugar-free alternatives. They are popular among teenagers, young adults, professionals, and fitness enthusiasts, and cater to various lifestyles.

The Europe energy drinks market was valued at USD 19.8 Billion in 2024.

IMARC estimates the Europe energy drinks market to exhibit a CAGR of 6% during 2025-2033.

Key factors driving the Europe energy drinks market include the rising health consciousness among consumers, increasing demand for functional beverages, expanding fitness and sports culture, innovative product launches, and the growth of online and retail distribution channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)