Europe Health Insurance Market Size, Share, Trends, and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2026-2034

Europe Health Insurance Market Size and Share:

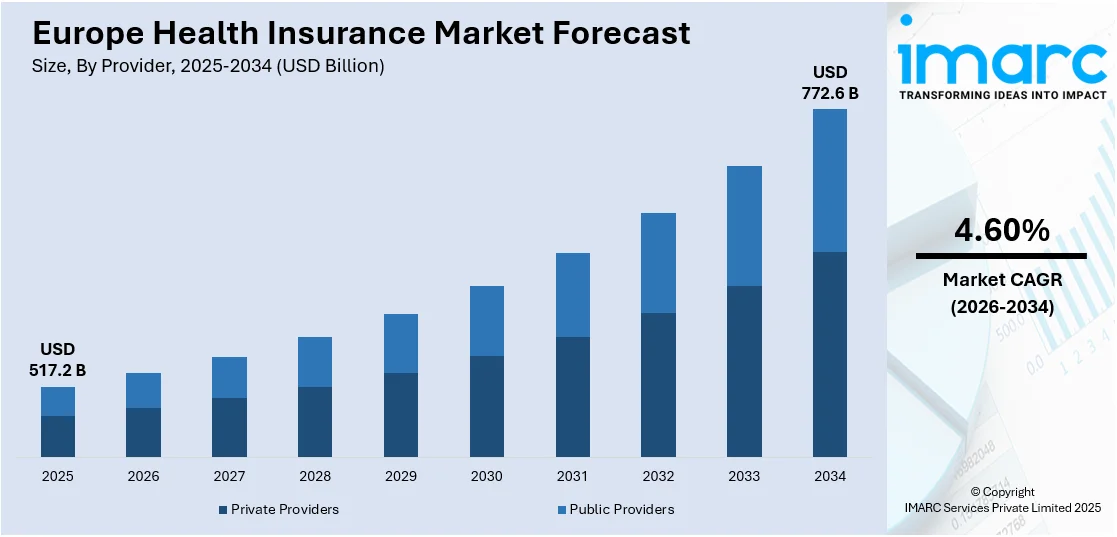

The Europe health insurance market size was valued at USD 517.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 772.6 Billion by 2034, exhibiting a CAGR of 4.60% from 2026-2034. The market is expanding due to rising healthcare costs, increasing awareness of preventive care, and supportive government policies. Aging population, growing prevalence of chronic diseases and technological advancements in claim processing are also contributing to the growing demand across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 517.2 Billion |

| Market Forecast in 2034 | USD 772.6 Billion |

| Market Growth Rate (2026-2034) | 4.60% |

The Europe health insurance market is significantly driven by the aging population and the increasing prevalence of chronic diseases. According to the report published by the World Health Organization (WHO), the population aged 60 and older in the European Region is growing rapidly and is expected to reach over 300 million by 2050 necessitating age friendly adaptations in healthcare, housing, and urban planning. As the median age rises, there is a heightened demand for comprehensive health insurance plans that cater to age related health issues. Governments and private sectors are also investing in healthcare infrastructure to meet these growing demands, thus further propelling market growth.

To get more information on this market Request Sample

Another key driver is the advancement of digital technologies and telemedicine services. The integration of innovative technologies like artificial intelligence and big data analytics enhances the efficiency and personalization of health insurance offerings. Consumers are increasingly seeking digital first solutions for ease of access and management of their health plans. For instance, in January 2024, the Innovative Health Initiative (IHI) launched two new funding calls addressing key health challenges in Europe. With substantial funding from Horizon Europe the calls focus on heart disease management, biomarker validation, support for healthcare workers, medication adherence and utilizing real-world data for improved healthcare outcomes. Furthermore, regulatory support and favorable policies across European countries encourage the expansion of health insurance providers fostering competition and improving service quality. These factors collectively contribute to the dynamic growth of the health insurance market in Europe.

Europe Health Insurance Market Trends:

Integration of AI and Big Data Analytics

The utilization of artificial intelligence (AI) and big data analytics revolutionizes the Europe health insurance market by enhancing various operational aspects. AI algorithms analyze vast datasets to improve risk assessment, accurately predicting individual health risks and enabling insurers to price premiums more precisely. For instance, in November 2024, Groupe Mutuel integrated Ada Health's AI-powered care navigation into its app enhancing member access to personalized healthcare across Switzerland. This partnership provides 24/7 symptom assessments and care recommendations based on users' insurance plans aiming to improve treatment timelines and reduce unnecessary doctor visits. Big data facilitates the detection of fraudulent activities by identifying unusual patterns and anomalies, thereby reducing financial losses. Additionally, AI-driven customer service tools, such as chatbots and virtual assistants provide personalized and efficient support enhancing the overall user experience. This integration not only streamlines processes but also fosters trust and satisfaction among policyholders, thus driving market growth and innovation.

Expansion of Private Health Insurance

The growth of private health insurance in Europe is fueled by the increasing strain on public healthcare systems caused by aging populations and escalating healthcare costs. Private insurers are stepping in to offer supplementary and alternative coverage addressing gaps in public provisions such as shorter wait times access to specialized treatments and enhanced care options. These plans often include benefits like advanced diagnostics, mental health services and international coverage catering to diverse consumer needs. For instance, in October 2024, Allianz Partners launched Elevate a new healthcare top-up plan for EU/EEA employees expanding on the former EU Top-Up Plan from Germany. The flexible plans enhance statutory healthcare covering treatments like dental and physiotherapy with budgets ranging from €300 to €1500 annually. Additionally, rising disposable incomes and awareness of comprehensive healthcare have boosted demand. Employers also contribute by providing private health insurance as an employee benefit further driving expansion.

Rise in Mental Health Coverage

Mental health coverage is becoming a priority in the health insurance sector reflecting the growing acknowledgment of its critical role in overall well-being. Insurers are broadening plans to include services like therapy, counseling, psychiatric consultations, and medication management. For instance, in November 2024, AXA launched the Mind Health Self-check a free confidential tool aimed at enhancing mental health awareness and prevention. Responding to alarming global statistics on mental health’s economic impact the initiative encourages self-assessment and aims to de-stigmatize mental health issues while promoting proactive management of well-being across 13 countries. This shift addresses the rising prevalence of mental health issues, fueled by modern lifestyle pressures and global events. Governments and advocacy groups are driving policies mandating equitable mental and physical health coverage ensuring accessibility for all. Employers are also offering enhanced mental health benefits to support employee wellness. These developments signify a paradigm shift in health care emphasizing comprehensive support for mental health.

Europe Health Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe health insurance market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on provider, type, plan type, demographics, and provider type.

Analysis by Provider:

- Private Providers

- Public Providers

Private health insurance providers play a significant role in the Europe health insurance market by offering tailored and supplementary coverage options. These plans often cover services excluded from public systems such as dental, optical and expedited treatments. Private insurers cater to a wide range of customer needs including expatriates and high-income individuals seeking premium healthcare services. The growing demand for personalized and comprehensive plans coupled with shorter wait times and enhanced customer service drives the prominence of private providers in the market.

Public health insurance providers dominate the Europe health insurance market through government-funded programs that offer universal or subsidized coverage. These systems prioritize accessibility and equity ensuring that essential medical services are available to all citizens. Public providers focus on preventive care and managing chronic conditions reducing the overall healthcare burden. Despite financial pressures from aging populations and rising costs public systems remain a cornerstone of healthcare delivery in Europe supported by taxation and mandatory contributions to maintain widespread access.

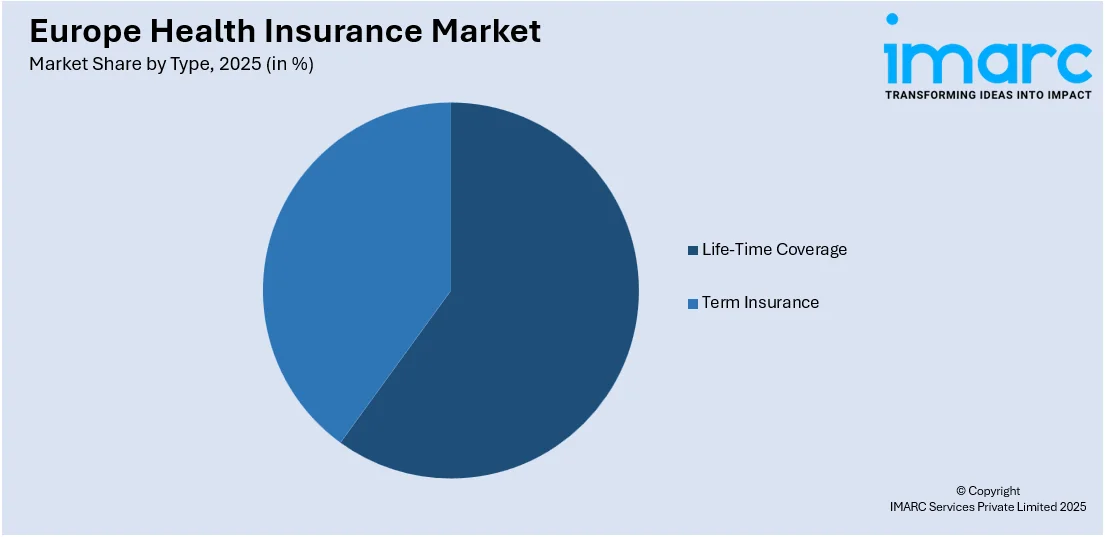

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Life-Time Coverage

- Term Insurance

Lifetime coverage health insurance provides comprehensive protection throughout an individual’s life making it a preferred option for long-term financial security. This type of insurance is ideal for those seeking consistent healthcare access especially for chronic conditions or age-related illnesses. It typically includes a wide range of services from hospitalization to preventive care ensuring continuity of care without the need for frequent policy renewals. Lifetime coverage is popular among families and individuals aiming for stability in healthcare expenses.

Term health insurance offers coverage for a specified period providing flexibility for short-term needs. This type of policy is suitable for individuals seeking temporary healthcare protection such as during international travel, job transitions or specific life phases. Term plans are generally more affordable making them accessible to younger demographics or those with limited financial resources. These policies focus on immediate healthcare requirements often excluding extended benefits which makes them a practical choice for short-term risk management.

Analysis by Plan Type:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Medical insurance is a fundamental component of the Europe health insurance market providing coverage for hospitalization, outpatient care and routine check-ups. This plan type is popular due to its focus on medical expenses for individuals or groups ensuring financial security during illnesses or emergencies. The growing prevalence of lifestyle diseases and increasing healthcare costs are driving demand. Many providers offer tailored packages including cashless hospitalization and network hospital benefits making medical insurance a reliable option for residents.

Critical illness insurance addresses the financial burden of severe medical conditions like cancer, heart disease or organ transplants. This plan provides a lump sum payout upon diagnosis enabling policyholders to cover treatment expenses, rehabilitation or loss of income. With rising incidences of critical illnesses across Europe this insurance type is gaining traction. It caters to individuals seeking financial stability during health crises offering peace of mind through flexible terms and disease-specific coverage options.

Family floater health insurance offers a single policy to cover an entire family under a shared sum insured. This plan is highly valued in Europe for its cost effectiveness and comprehensive coverage of medical expenses including hospitalization and pre and post hospitalization care. It caters to diverse healthcare needs within a household providing flexibility and convenience. With the growing emphasis on family health and wellness this plan type continues to be a preferred choice for European families.

Analysis by Demographics:

- Minor

- Adults

- Senior Citizen

Health insurance for minors in Europe focuses on providing coverage for children’s medical needs including vaccinations, routine check-ups and treatment for illnesses or injuries. Policies often include pediatric care and specialized services like dental and vision coverage. Parents opt for these plans to ensure their children’s health and financial protection against unexpected healthcare expenses. The demand is rising due to increasing awareness about preventive healthcare for children making this demographic a significant segment in the Europe health insurance market.

Health insurance for adults is the largest demographic segment in the Europe health insurance market driven by the working age population. Plans cater to individual health needs including coverage for lifestyle diseases, maternity benefits, and mental health support. With rising healthcare costs and the emphasis on preventive care adults are increasingly opting for comprehensive policies. Employers also contribute by offering group insurance plans making this segment critical for the growth of the health insurance industry in the region.

Health insurance for senior citizens addresses the unique healthcare needs of Europe’s aging population, covering chronic illnesses, long-term care and pre-existing conditions. Policies often include benefits like cashless hospitalization, home care services and wellness programs tailored for older individuals. As the senior demographic grows due to increasing life expectancy demand for such plans is rising. This segment is vital for the health insurance market with insurers designing policies that offer extensive coverage and financial security for retirees.

Analysis by Provider Type:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Preferred Provider Organizations (PPOs) are a popular type of health insurance in Europe offering policyholders flexibility to choose healthcare providers within or outside the insurer’s network. PPO plans provide partial reimbursement for out-of-network care making them attractive for individuals seeking broad access to medical services. These plans often cover preventive care, specialist visits and hospitalization. PPOs are particularly suited for those who prioritize flexibility over cost as premiums and co-payments are typically higher. The rising demand for personalized healthcare options contributes to the growth of PPOs in the European health insurance market.

Point of Service (POS) plans combine features of PPOs and Health Maintenance Organizations (HMOs) providing policyholders with the flexibility to access in-network and out-of-network healthcare services. While primary care physicians coordinate treatment referrals are often required for specialist visits. POS plans are popular in Europe due to their balanced approach to cost and provider choice. They appeal to individuals seeking affordable premiums without compromising access to quality care. The growing preference for hybrid models of healthcare coverage supports the expansion of POS plans in the European health insurance market.

Health Maintenance Organizations (HMOs) emphasize cost effective healthcare by requiring policyholders to use in network providers and select a primary care physician for referrals. These plans are widely adopted in Europe for their affordability and comprehensive coverage including preventive care, specialist consultations and emergency services. HMOs suit individuals who prioritize cost savings and are comfortable with a coordinated care model. The focus on integrated healthcare delivery systems and increasing demand for managed care solutions are driving the adoption of HMO plans in the European health insurance market.

Exclusive Provider Organizations (EPOs) offer coverage restricted to a network of healthcare providers with no reimbursement for out-of-network care except in emergencies. EPOs are cost-effective providing access to high-quality medical services within the insurer’s approved network. These plans are gaining traction in Europe due to their lower premiums and focus on streamlined care. They appeal to individuals who prefer affordable insurance without requiring out-of-network flexibility. The increasing focus on cost containment in healthcare is bolstering the growth of EPO plans in the European health insurance market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany’s health insurance market is one of the most advanced in Europe driven by a dual public and private system. Statutory health insurance (SHI) covers the majority of residents ensuring comprehensive access to healthcare services. The private health insurance (PHI) sector caters to high income individuals and specific groups offering tailored benefits. Germany’s aging population and focus on preventive care are key drivers of market growth. Additionally, digital healthcare initiatives and telemedicine are enhancing service delivery.

France’s health insurance market is defined by its universal coverage system with public health insurance (Sécurité Sociale) covering most citizens. Complementary private insurance (mutuelles) supplements public plans providing additional benefits like dental and optical care. France’s robust healthcare infrastructure and high healthcare spending contribute to market growth. Rising demand for personalized health plans and digital health innovations are transforming the sector. The country’s emphasis on equitable healthcare access coupled with a growing aging population ensures continued expansion of its health insurance market.

The United Kingdom’s health insurance market operates alongside the National Health Service (NHS) which provides free public healthcare. Private health insurance is a growing segment offering faster access to specialists, reduced waiting times and enhanced care options. Demand is rising due to increasing healthcare pressure on the NHS and the growing preference for private treatment. The UK market is also witnessing growth in employer sponsored health plans and wellness programs. Innovations in telemedicine and digital health are reshaping the private insurance landscape making the UK a dynamic player in Europe’s health insurance market.

Italy’s health insurance market supports its universal public healthcare system Servizio Sanitario Nazionale (SSN). Private health insurance complements public coverage by offering faster access to specialists and additional services such as dental and optical care. Growing healthcare demands coupled with an aging population are driving market expansion. Italy is also witnessing an increase in health awareness and demand for tailored insurance plans. Innovations in digital health and telemedicine are further enhancing service delivery making private health insurance a critical component of the country’s healthcare ecosystem.

Spain’s health insurance market complements its universal public healthcare system Sistema Nacional de Salud (SNS). Private health insurance is growing as individuals seek quicker access to specialists and comprehensive care options. Spain’s aging population and increased focus on preventive care are key growth drivers. Many insurers are incorporating digital health tools and telemedicine to improve customer experience and service efficiency. Employer sponsored health plans are also gaining popularity. The combination of public and private healthcare systems ensures Spain remains a significant player in Europe’s health insurance market.

Competitive Landscape:

The Europe health insurance market is witnessing significant growth driven by increasing healthcare expenditure and the rising need for accessible medical services. The aging population and a growing incidence of chronic illnesses are amplifying demand for comprehensive coverage. Advancements in digital technologies, such as telemedicine and streamlined claims management, are enhancing user experiences and boosting adoption rates. Additionally, evolving government regulations focused on universal healthcare access are fostering market expansion. The preference for customized health plans, coupled with an emphasis on preventive care, is shaping product offerings, positioning the market for sustained growth in the coming years. For instance, in August 2024, PassportCard, the leading international private medical insurance provider, announced its plans to expand into the French iPMI market, opening a dedicated office in Paris with tailored products. Aiming to serve France's significant expatriate population, the move aligns with PassportCard's strategy to enhance its presence in Europe and improve customer satisfaction.

The report provides a comprehensive analysis of the competitive landscape in the Europe health insurance market with detailed profiles of all major companies, including:

- Aetna Inc.

- UNITEDHEALTH GROUP

- AXA

- Bupa

- ASSICURAZIONI GENERALI S.P.A.

- Allianz Care

- Cigna

- Aviva

- VHI Group

- Vitality

- Oracle

- MAPFRE

- Saga

Latest News and Developments:

- April 2025: European B2B payment firm Pliant acquired Austrian InsurTech company hi.health to combine its payment expertise with hi.health’s insurance-specific solutions. Hi.health will continue operating independently but will leverage Pliant’s infrastructure to enhance its digital platform, which allows insured individuals to submit healthcare invoices and prescriptions for reimbursement via a mobile app—eliminating the need for upfront payments.

- January 2025: Vienna Insurance Group (VIG) strengthened its presence in Southeast Europe by establishing a new life insurance company, Vienna Life. The new company focuses on life and health insurance, complementing VIG’s existing non-life insurance businesses in Albania operated by SIGMA and Intersig. Vienna Life will offer risk products like credit protection and term insurance, as well as savings products including traditional life insurance and pension solutions. Health insurance will also be a significant part of Vienna Life’s portfolio. This move allows VIG to cover the full spectrum of insurance services in Albania, targeting both retail and corporate customers.

- January 2025: DUAL Europe launched a new pan-European Accident & Health (A&H) business. The division aims to provide tailored A&H insurance covering risks from accidents and illnesses, targeting groups like schools, sports teams, and travelers. Starting early 2025, DUAL will offer innovative features including a digital travel app, easy online claims, and parametric services for travel disruptions. Supported by global insurers AXIS and Hamilton, this expansion enhances broker options and meets growing healthcare demands across Europe.

- October 2024: Alan, a European health insurance startup announced its expansion to Canada. The startup has also added additional services to improve consumer satisfaction, as Alan members can use the company’s mobile app, for example, to chat with doctors, order prescription glasses, and consume preventive care content on mental health or back pain.

- September 2024: Altea Insurance launched a new office in Ireland, expanding its operations across the European Economic Area. The firm will provide tailored insurance and risk management solutions for healthcare entities, supported by its AlteaPlus platform. This strategic move aims to meet the rising demand for integrated risk mitigation services in Europe.

- March 2024: RSA Insurance launched a new Accident and Health (A&H) product, offering comprehensive Group Personal Accident and Business Travel cover. Designed for mid-market to large businesses, it includes 24/7 virtual GP access, emotional well-being support, and crisis management, enhancing employee protection globally.

Europe Health Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life – Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Companies Covered | Aetna Inc., UNITEDHEALTH GROUP, AXA, Bupa, ASSICURAZIONI GENERALI S.P.A., Allianz Care, Cigna, Aviva, VHI Group, Vitality, Oracle, MAPFRE, Saga, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe health insurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe health insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe health insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health insurance market in Europe was valued at USD 517.2 Billion in 2025.

The market in Europe is majorly driven by rising healthcare costs, an aging population, increasing prevalence of chronic diseases, ongoing technological advancements such as telemedicine, and favorable government policies promoting accessible and comprehensive healthcare coverage.

IMARC estimates the health insurance market in Europe to exhibit a CAGR of 4.60% during 2026-2034, reaching a value of USD 772.6 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)