Europe Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Country, 2026-2034

Europe Insurtech Market Size and Share:

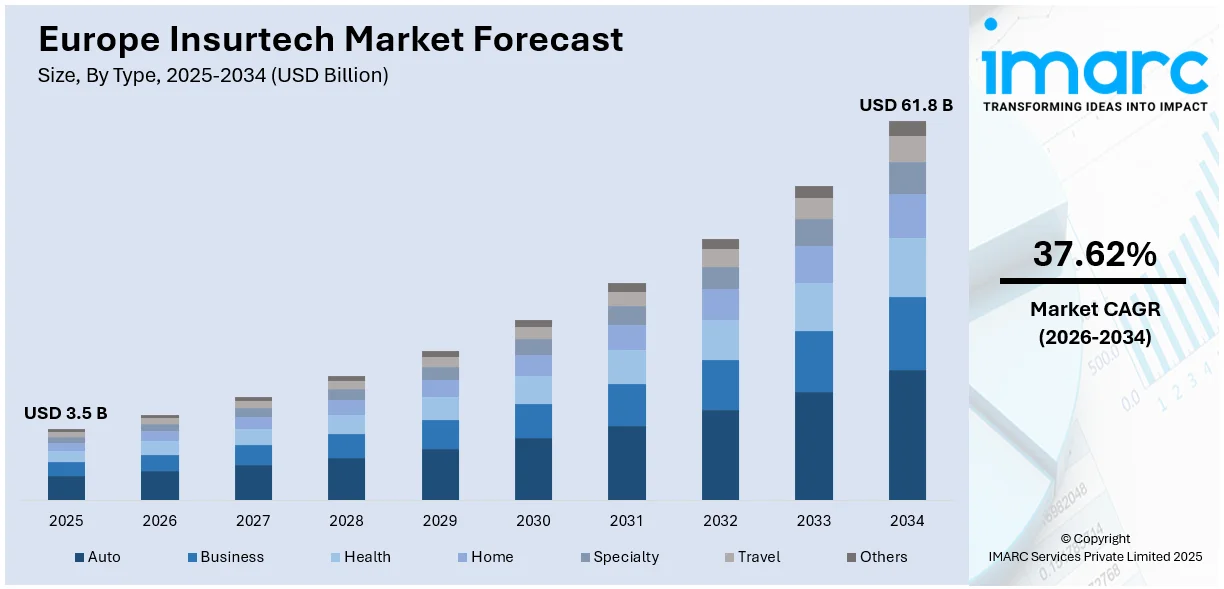

The Europe insurtech market size was valued at USD 3.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 61.8 Billion by 2034, exhibiting a CAGR of 37.62% from 2026-2034. The market is growing significantly, chiefly impacted by leading-edge technologies such as blockchain and artificial intelligence (AI), digital transformation, and amplifying customer need for upgraded, personalized insurance solutions. Additionally, regulatory aid, innovation hubs, and tactical collaborations between conventional insurers and startups are facilitating market expansion, positioning the region as a global leader in insurtech advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.5 Billion |

|

Market Forecast in 2034

|

USD 61.8 Billion |

| Market Growth Rate (2026-2034) | 37.62% |

The Europe insurtech market is primarily being driven by the growing focus on customer-centric solutions as consumers are increasingly preferring personalized insurance products tailored to their unique needs, including flexible coverage options and on-demand policies. As a result, insurtech firms are addressing this demand by adopting advanced data analytics to comprehend customer preferences and behavior. These insights enable insurers to create highly targeted offerings, improving customer satisfaction and retention. Additionally, streamlined digital platforms and real-time support systems are enhancing the overall user experience, establishing trust and loyalty among a tech-savvy clientele. For instance, in October 2024, iLearningEngines, Inc. launched its Insurtech Enterprise AI Knowledge Cloud and hyper apps particularly for the European insurtech sector. This digital solution will aid private insurers to scale and utilize their AI projects, especially where telematics applications development can be bolstered as well as hyper-automated.

To get more information on this market Request Sample

Supportive regulatory frameworks are acting as a key growth-inducing factor for the European insurtech market. Policymakers are increasingly encouraging digital transformation within the insurance sector through the implementation of guidelines that promote transparency, data protection, and innovation. For instance, in August 2024, the European Union introduced the European AI Act, a groundbreaking regulatory framework imposing stringent standards for high-risk applications like loan assessments. This legislation emphasizes transparency, robust data protection, and risk management, ensuring ethical AI practices. By mandating compliance in critical sectors, the Act enhances accountability and user rights. A key global benchmark, it addresses challenges in AI deployment while fostering innovation within a regulated environment. Moreover, services like regulatory sandboxes are allowing insurtech startups to test innovative solutions in a controlled environment. Furthermore, several digital financial initiatives aim to create a harmonized digital ecosystem across member states, ensuring fair competition and scalability. These measures are enabling both startups and established insurers to adopt cutting-edge technologies while maintaining compliance, boosting market expansion.

Europe Insurtech Market Trends:

Integration of Advanced Technologies

The market is expanding due to the adoption of cutting-edge technologies like big data analytics, blockchain, the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). Such improvements help Insurtech firms and traditional insurers to innovate and improve several components of the insurance value chain, thereby favoring market expansion. Large datasets are easily analyzed by AI and ML algorithms to enhance risk assessment and underwriting procedures. AI has the ability to detect fraud, evaluate the veracity of claims, automate repetitive activities with speed and accuracy. Furthermore, blockchain maintains the transparency and immutability of transactions, fostering confidence between insurers and clients. It provides a secure and unchangeable record of insurance contracts, claims, and transactions. Moreover, leading players are utilizing these technologies to deliver precise outcomes. For instance, in April 2024, Hellas Direct, the rapidly expanding digital insurer operating in the CEE region, selected FRISS to enhance its focus on innovation within the insurance technology market in Europe. By using FRISS, Hellas Direct will maximize fraud detection and risk mitigation for their subsidiaries in Greece and Romania. FRISS's proven AI-powered solutions will provide Hellas Direct with real time results by enabling automated claims processing.

Increasing Frequency and Severity of Natural Disasters

There is a rise in the need for insurance plans that consider environmental risks because of high frequency and intensity of natural disasters such as earthquakes, wildfires, and floods. For instance, according to the European Environment Agency, over 370,000 hectares of forest were destroyed by wildfires in the first nine months of 2024, while severe flooding in September impacted approximately 2 million individuals across Central Europe. As a result, insurtech companies are concentrating on creating innovative solutions that make use of cutting-edge technologies and data analytics in order to more accurately identify, reduce, and manage these environmental hazards. In addition, people are becoming conscious about the financial effects of natural disasters, which is prompting both individuals and companies to look for insurance solutions that provide strong protection and quick recovery alternatives.

Rapid Expansion of Embedded Insurance Solutions

Embedded insurance is rapidly gaining momentum in Europe, offering policies seamlessly integrated into consumer transactions. This model allows customers to purchase coverage during routine activities, such as booking travel or making online purchases. Moreover, this approach is reshaping how insurance is marketed, emphasizing convenience and accessibility. Furthermore, companies are leveraging partnerships with digital platforms to embed insurance products into everyday experiences. Additionally, this trend aligns with the evolving expectations of tech-savvy consumers, who seek simplified and instant solutions, and it is expected to drive significant growth in the insurtech sector. For instance, in December 2024, Watches of Switzerland Group announced a partnership with Zillion, a prominent embedded insurance provider, to provide a lucrative customer benefit at point of sale. Through this partnership, consumers can attain instant coverage for their jewellery and watch procurements via mobile, with the need for app downloads.

Europe Insurtech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe insurtech market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, service, and technology.

Analysis by Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The auto insurance segment represents a significant market share in the European insurtech market, driven by advancements in telematics and connected car technologies. Insurtech firms are leveraging AI and data analytics to provide usage-based insurance, personalized premiums, and real-time claim processing. As electric vehicles gain popularity, insurers are adapting to cover new risks and opportunities. Moreover, these innovations enhance customer engagement and operational efficiency while addressing evolving mobility trends. The incorporation of telematics and the Internet of Things (IoT) devices in vehicles further positions auto insurance as a dominant segment in the market.

Business insurance is a growing segment in the European insurtech market, fueled by the increasing adoption of digital tools to streamline coverage for enterprises. Insurtech solutions offer tailored policies for small and medium-sized enterprises (SMEs), covering risks such as cyber threats, liability, and property damage. These platforms use AI-driven risk assessments and blockchain to improve policy management and claims processing. Furthermore, as businesses prioritize operational resilience, demand for customizable and efficient digital insurance solutions continues to grow, solidifying business insurance as a key market segment.

Health insurance occupies a notable share of the European insurtech market, as digital solutions transform how policies are managed and delivered. Companies are employing AI, wearables, and mobile apps to enhance health monitoring, policy customization, and claims automation. Furthermore, the rising focus on preventative healthcare and telemedicine is driving innovation in this sector. Insurtech firms are also improving customer experiences by integrating wellness programs and digital consultations, making health insurance more accessible and efficient. This modernization addresses growing consumer demands for convenience and personalized healthcare coverage.

The home insurance segment in the European Insurtech market is expanding due to the adoption of smart home technologies. Insurtech companies are using IoT devices to monitor risks such as fire, theft, or water damage, providing real-time insights and proactive solutions. Moreover, AI-driven risk assessments enable personalized premiums, enhancing customer trust and satisfaction. Additionally, the integration of digital claims processing and automated underwriting simplifies policyholder interactions. As homeowners seek comprehensive and hassle-free coverage, insurtech solutions are reshaping the traditional home insurance landscape.

Specialty insurance is emerging as a vital segment in the European insurtech market, catering to unique risks such as marine, aviation, and professional liability. Insurtech firms are innovating in this niche by offering highly tailored policies and leveraging advanced data analytics for precise risk evaluation. Moreover, blockchain and AI tools streamline policy management and enhance transparency in underwriting. Furthermore, the rise in global trade and niche industries has increased demand for specialty insurance, making it a lucrative area for insurtech growth and innovation.

Travel insurance holds a significant market share in the European insurtech landscape, driven by rising consumer demand for flexible and comprehensive coverage. Insurtech companies are introducing parametric insurance solutions, such as real-time payouts for flight delays and cancellations. Moreover, digital platforms simplify policy selection and claims processes, enhancing convenience for travelers. In addition to this, integration with mobile apps and AI enables personalization, catering to individual travel needs. As international travel grows significantly, the adoption of innovative insurtech solutions in travel insurance continues to grow, enhancing customer experience and operational efficiency.

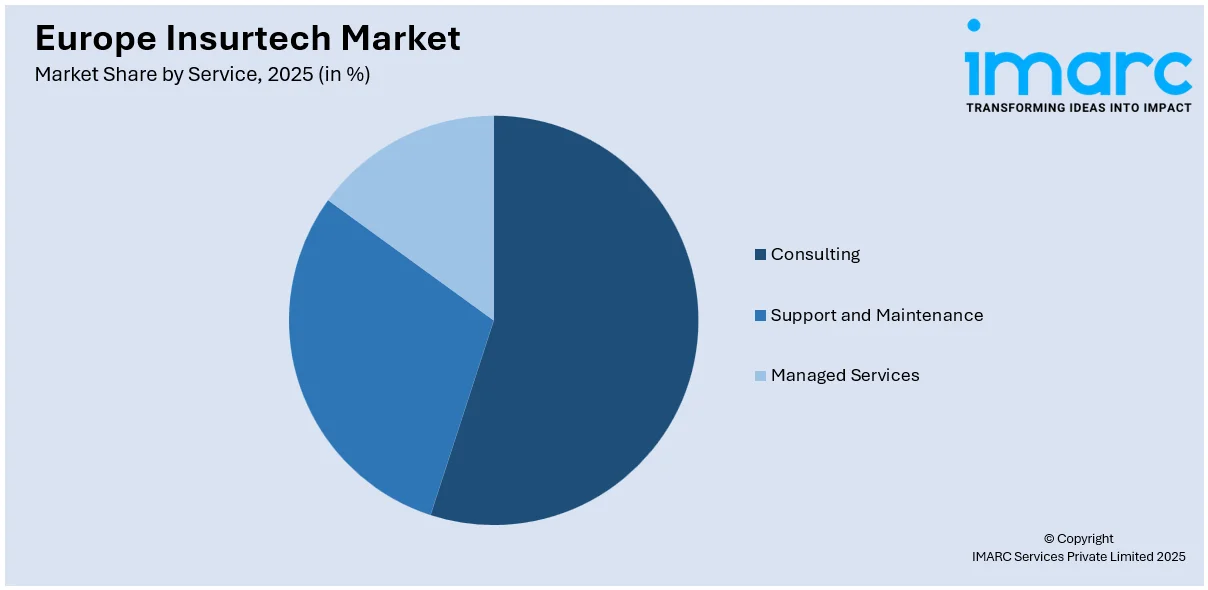

Analysis by Service:

Access the comprehensive market breakdown Request Sample

- Consulting

- Support and Maintenance

- Managed Services

The consulting segment holds a significant share of the Europe insurtech market as insurers increasingly seek expertise to navigate digital transformation. Consulting firms provide strategic guidance on adopting advanced technologies like AI, blockchain, and IoT while ensuring regulatory compliance. They also help insurers streamline operations, optimize underwriting processes, and enhance customer experience. Additionally, as the demand for innovative solutions rises, consulting services are becoming critical for devising tailored strategies that align with market dynamics and customer expectations, further driving their growth in the insurtech ecosystem.

Support and maintenance services are vital for the sustained growth of insurtech solutions in Europe, ensuring the reliability and efficiency of deployed systems. These services include regular updates, system performance optimization, and troubleshooting to minimize downtime and enhance user satisfaction. Moreover, with the rapid adoption of AI-driven tools and cloud-based platforms, insurers rely on specialized support teams to maintain operational continuity. The increasing complexity of digital insurance platforms further underscores the importance of robust maintenance frameworks, proving the dominance of the segment in the market.

Managed services represent a growing segment in the European insurtech market, offering end-to-end solutions that reduce operational burdens for insurers. These services encompass IT infrastructure management, data security, and automated claims processing, allowing insurers to focus on core business activities. Furthermore, by outsourcing critical processes to managed service providers, insurers benefit from enhanced scalability, cost efficiency, and access to specialized expertise. Moreover, this trend is driven by the need to optimize resources while staying competitive in a technology-driven market landscape.

Analysis by Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Blockchain is emerging as a transformative technology in the European insurtech market, driving transparency and efficiency. Its decentralized ledger system ensures secure, immutable records of insurance contracts, claims, and transactions. This reduces fraud, accelerates claims processing, and builds trust between insurers and policyholders. Blockchain also facilitates seamless collaboration among stakeholders, particularly in reinsurance and cross-border transactions. Furthermore, the adoption of smart contracts enables automated policy enforcement, minimizing administrative overheads. In addition, as demand for secure, efficient systems grows, blockchain's share in the European insurtech market continues to expand.

Cloud computing plays a pivotal role in modernizing the European insurtech sector by enabling scalable, cost-effective solutions. It supports real-time data processing, seamless integration of digital platforms, and enhanced operational flexibility. Moreover, cloud-based infrastructures empower insurers to deploy advanced analytics and personalized services while ensuring robust data security and compliance with regulations like GDPR. Additionally, insurtech firms are increasingly adopting cloud solutions for streamlined collaboration, disaster recovery, and scalable storage. Furthermore, this technology's ability to drive agility and innovation has solidified its position as a critical segment in the insurtech market.

The Internet of Things (IoT) is reshaping the European insurtech market by enabling data-driven insights and dynamic risk assessment. IoT devices, which includes telematics in vehicles and smart home sensors, provide real-time data that insurers use to tailor premiums and improve claims accuracy. These technologies enhance preventive measures by identifying potential risks early, benefiting both insurers and policyholders. Moreover, IoT's growing integration into health, auto, and property insurance underscores its increasing contribution to the insurtech landscape, offering new avenues for personalized and proactive coverage.

Machine learning is revolutionizing the European insurtech market by automating complex processes and improving decision-making accuracy. Algorithms analyze vast datasets to optimize risk assessment, pricing models, and claims management. Furthermore, fraud detection is significantly enhanced through predictive analytics and anomaly detection, reducing losses for insurers. Machine learning also drives customer-centric innovations, such as chatbots for instant support and personalized policy recommendations. In addition, by continuously learning from new data, this technology remains a cornerstone for enhancing operational efficiency and customer satisfaction in the insurtech market.

Robo advisory is gaining traction in the European insurtech market as a tool for providing automated, personalized financial advice. These AI-driven platforms assess individual needs and risk profiles to recommend suitable insurance products. Robo advisors enhance customer experience by simplifying complex decisions and offering 24/7 accessibility. Furthermore, insurers benefit from cost efficiency and scalability, enabling them to serve broader demographics. As digital-first consumers demand seamless interactions and tailored solutions, robo advisory’s role in shaping the European insurtech market is becoming increasingly significant.

Country Analysis:

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Poland

- Others

Germany's insurtech market is driven by its well-established insurance industry and strong technological infrastructure. Local startups and established insurers are adopting AI, blockchain, and IoT to enhance underwriting, claims processing, and customer interaction. Moreover, regulatory frameworks, such as BaFin's initiatives, support innovation while ensuring compliance. Additionally, the demand for digital insurance products, especially in health and property insurance, is increasing, fueled by tech-savvy consumers and the country's push towards digital transformation. Furthermore, Germany’s robust economy and focus on automation provide a fertile ground for insurtech growth.

The United Kingdom remains a hub for insurtech innovation, supported by its dynamic financial services sector and regulatory support through initiatives like the FCA’s regulatory sandbox. Startups in London and other cities are leveraging AI and big data to deliver personalized insurance solutions. The UK's focus on embedded insurance and partnerships between traditional insurers and tech firms further drives market growth. Despite Brexit challenges, the UK continues to attract significant investment, strengthening its position as a leader in the European insurtech market.

France’s insurtech market is gaining momentum, propelled by government-backed digital transformation initiatives and a consumer shift towards personalized and flexible insurance solutions. Startups are focusing on AI-driven risk assessment and blockchain for claims transparency. Additionally, the French regulatory environment, supported by Autorité de Contrôle Prudentiel et de Résolution (ACPR), promotes innovation while ensuring consumer protection. Furthermore, with a growing demand for digital-first insurance products, particularly in auto and health segments, France is becoming a key player in Europe’s insurtech landscape.

Italy’s insurtech market is expanding as insurers adopt digital platforms to address growing demand for simplified and accessible insurance solutions. The market is propelled by an escalating use of telematics in motor insurance and AI-driven underwriting processes. Consumer preferences for mobile-first platforms are reshaping the industry, while partnerships between startups and traditional insurers are accelerating innovation. Italy’s focus on digitization, supported by regulatory bodies, positions the country as a promising growth area in the European insurtech sector.

Russia’s insurtech market is evolving, driven by an increasing focus on digital insurance solutions and government-backed initiatives to modernize the financial sector. Local startups and insurers are utilizing AI and machine learning to improve risk assessment and fraud detection. In addition to this, the adoption of mobile-first platforms for policy management and claims is gaining traction. Despite challenges in regulatory harmonization, Russia’s large population and growing digital literacy create significant opportunities for insurtech advancements, particularly in health and property insurance.

Spain’s insurtech market is witnessing growth, spurred by increasing consumer demand for personalized insurance solutions and digital convenience. New and upcoming enterprises based in the region are applying technology such as AI and big data on risk analysis, claims management. In addition, the UK government’s attitude toward fintech and digitalization is positive for insurtech developments. Key areas of growth include health, motor, and travel insurance, as tech-savvy consumers seek faster and more efficient insurance products, positioning Spain as an emerging player in Europe’s insurtech market.

The Netherlands has established itself as a leading insurtech hub, driven by its advanced digital infrastructure and a strong focus on innovation. To improve customer experience, local startups and insurers integrate the use of AI, blockchain, and IoT solutions to develop suitable solutions. Furthermore, regulatory support from the Dutch Authority for the Financial Markets (AFM) ensures a balance between innovation and compliance. Additionally, the growing demand for embedded insurance and tailored products positions the Netherlands as a key player in the European insurtech landscape.

Switzerland’s insurtech market benefits from its strong financial sector and focus on precision-driven innovation. The country’s regulatory environment fosters digital transformation while ensuring robust consumer protection. Moreover, Swiss startups and insurers are pioneering AI and blockchain applications for policy management and claims automation. Additionally, the rising use of telematics in motor insurance and IoT in health insurance highlights Switzerland’s role as a leader in high-value, technologically advanced insurtech solutions within Europe.

Poland’s insurtech market is growing rapidly, supported by increasing digital adoption and a young, tech-savvy population. Startups and insurers are focusing on mobile-first platforms, leveraging AI for personalized risk assessment and claims management. Government initiatives to enhance digital transformation across industries provide a favorable environment for innovation. Additionally, Poland’s market is particularly strong in microinsurance and embedded insurance, meeting the needs of underserved consumer segments and positioning the country as a rising market in the European insurtech sector.

Competitive Landscape:

The European insurtech market is characterized by intense competition, with established insurers collaborating with innovative startups to leverage advanced technologies. Key players are focusing on partnerships, acquisitions, and the development of AI-driven solutions to streamline operations, enhance customer experience, and reduce costs. For instance, in November 2024, BrokerTech Ventures (BTV) announced a partnership with Instech.IE, an Ireland-based insurance innovation firm, to support insurtech companies entering new markets. The collaboration enables Irish startups to access the US market via BTV’s network, while US firms benefit from Instech.IE’s expertise in Europe. This initiative offers a strategic soft landing for startups in both regions. Moreover, major companies are driving innovation through offerings like fraud detection, telematics-based insurance, and personalized digital platforms. In addition, regulatory support further shapes the competitive environment, encouraging firms to comply with transparency and data protection standards while fostering innovation in the regional market.

The report provides a comprehensive analysis of the competitive landscape in the Europe insurtech market with detailed profiles of all major companies.

Latest News and Developments:

- In June 2024, Collinson collaborated with World Nomads to introduce an Annual Multi-Trip (AMT) product tailored for customers in the UK and Ireland. The offering includes enhanced coverage limits, benefits for both annual and single-trip policies, and the innovative parametric service, SmartDelay. Collinson will underwrite the AMT product and provide World Nomads customers with SmartDelay, ensuring comprehensive protection for travel disruptions.

Europe Insurtech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Poland, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe insurtech market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe insurtech market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insurtech market in Europe was valued at USD 3.5 Billion in 2025.

The key factors driving the market include increasing digital adoption, demand for personalized insurance solutions, regulatory support for innovation, and advancements in AI and blockchain technologies. Rising consumer preference for seamless online experiences and cost-efficiency further accelerates the growth of insurtech across the region.

The Insurtech market in Europe is projected to exhibit a CAGR of 37.62% during 2026-2034, reaching a value of USD 61.8 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)