Europe LED Lighting Market Size, Share, Trends and Forecast by Product Type, Installation, Application, and Country, 2026-2034

Europe LED Lighting Market Summary:

The Europe LED lighting market size was valued at USD 26.83 Billion in 2025 and is projected to reach USD 55.99 Billion by 2034, growing at a compound annual growth rate of 8.52% from 2026-2034.

The huge transformation in the Europe LED lighting market is underpinned by rapid industrialization, which is embracing energy-efficient technologies and considering sustainability as a focus point within infrastructure. Replacing the traditional lighting solutions through stricter legislation and increasing awareness among consumers about energy conservation have seen the emergence of different dynamics in the design, deployment, and maintenance of lighting solutions. This transformation has been felt across residential, commercial, and industrial areas, as businesses and homes increasingly take on environmentally friendly, cost-effective, and long-lifetime lighting solutions with an aim to meet environmental goals and regulatory policies.

Key Takeaways and Insights:

- By Product Type: LED lamps and modules dominate the market with a share of 57% in 2025, driven by widespread adoption across residential and commercial spaces due to superior energy efficiency and long operational lifespan compared to conventional alternatives, making them the preferred lighting solution in the region.

- By Installation: New installation leads the market with a share of 60% in 2025, driven by large-scale infrastructure development and government-backed smart city initiatives encouraging the deployment of advanced LED systems in newly constructed buildings and public spaces across Europe.

- By Application: Residential represents the largest segment with a market share of 25% in 2025, driven by growing homeowner demand for cost-effective, energy-saving lighting options and supportive policy frameworks incentivizing the replacement of legacy systems with modern LED solutions.

- Key Players: The Europe LED lighting market is dominated by multinational corporations and innovative regional players, featuring intense competition, advanced technological developments, and a focus on energy efficiency, smart solutions, and sustainable lighting innovations. Some of the key players operating in the market include Cree Inc., Dialight PLC, Eaton Corporation Inc. (Cooper Industries LLC), Osram Licht AG, Panasonic Corporation, Seoul Semiconductor Co., Ltd., Signify N.V. (Philips Inc.), TRILUX GmbH & Co. KG, and Zumtobel Group AG.

The Europe LED lighting market is growing significantly. The countries in the Europe region are placing greater emphasis on reducing carbon emissions. In 2025, Signify introduced Europe’s first LED tube made with 40 % post‑consumer recycled plastic as part of its sustainability portfolio, reinforcing energy‑efficient lighting adoption across the region. In addition, the cost of electricity is continuously increasing in the region. LEDs promise significantly lower operational costs over the course of the light's lifecycle. In the commercial and industrial sectors, intelligent systems are increasingly being used to integrate LEDs with sensors and connectivity solutions. In the residential market segment, the cost of LED lighting is continuously declining. Therefore, the market for LED lighting in the region is growing rapidly. Moreover, smart solutions are also growing in the region.

Europe LED lighting Market Trends:

Accelerated Adoption of Smart and Connected Lighting Systems

The European lighting industry is witnessing a rapid shift towards smart and connected LED technology. Signify announced that it will showcase its latest connected lighting systems and innovations at Light + Building 2026 in Frankfurt, underlining the company’s push to advance IoT‑enabled and data‑driven LED solutions across Europe. Facility managers and individuals are increasingly using lighting systems that are enabled with IoT technology, wireless connectivity, and cloud technology, thereby helping them achieve dynamic changes through automated controls based on the number of people occupying these spaces. Commercial offices, retail spaces, and public infrastructure are witnessing high uptake, driven primarily by their need for operational efficiency, cost-effectiveness, and occupant comfort, thereby defining smart lighting.

Human-Centric Lighting Gaining Prominence

Human-centric lighting, which synchronizes light intensity and color with natural biological rhythms, is becoming a key trend in European healthcare, education, and workplaces. According to reports, Norwegian lighting manufacturer Glamox secured a major contract to install human‑centric LED systems in two newly built schools in central Sweden, designed to help pupils concentrate better during the day and support healthier sleep patterns, highlighting real‑world adoption of circadian‑focused lighting in European education facilities. Advanced LED systems can fine-tune spectral output to promote circadian health, productivity, and well-being. Design standards and wellness-focused building certifications are encouraging architects to integrate these solutions. This is increasing demand for premium LED products that move beyond basic illumination to actively enhance occupant performance, comfort, and overall experience.

Circular Economy Principles Influencing Product Design

European LED lighting design is increasingly guided by sustainability and circular economy principles. In January 2026, the European Commission highlighted efforts to “close the loop” on electronic waste by funding projects such as PLAST2bCLEANED, which develops processes to transform hazardous plastic waste from electrical and electronic equipment into high‑value recyclable materials, an initiative that supports more circular lifecycle management for products like LED lighting. EU regulations on electronic waste are prompting manufacturers to create modular, repairable, and recyclable products, while brands adopt take-back and refurbishment programs to extend lifecycles. Institutional buyers and municipalities are factoring total lifecycle impact into procurement decisions. This shift prioritizes long-term environmental performance alongside cost, influencing large-scale lighting projects and encouraging circular practices across the industry.

Market Outlook 2026-2034:

The European LED lighting market is set for steady growth through 2033, driven by the region’s strong decarbonization goals, ongoing construction activity, and the gradual phase-out of outdated lighting systems. Integration of advanced LED technologies with digital controls and energy management solutions is creating enhanced value across commercial, residential, and public applications. Rising investments in smart city projects, energy-efficient building retrofits, and sustainable infrastructure initiatives are expected to generate significant opportunities for manufacturers, suppliers, and service providers across the European lighting ecosystem. The market generated a revenue of USD 26.83 Billion in 2025 and is projected to reach a revenue of USD 55.99 Billion by 2034, growing at a compound annual growth rate of 8.52% from 2026-2034.

Europe LED lighting Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

LED Lamps and Modules |

57% |

|

Installation |

New Installation |

60% |

|

Application |

Residential |

25% |

Product Type Insights:

To get detailed segment analysis of this market, Request Sample

- LED Lamps and Modules

- LED Fixtures

The LED lamps and modules dominates with a market share of 57% of the total Europe LED lighting market in 2025.

LED lamps and modules remain the leaders in the European LED landscape, thanks to the varied ways they can be placed in standard sockets and their ease of installation. Thus, they remain very viable retrofit solutions for both homes and businesses. This category includes replacement bulbs, specialty modules, and linear tubes, all of which boast significant energy efficiency and light quality advantages compared to their traditional halogen and fluorescent counterparts. Their adaptability and performance improvements make them the preferred choice for both residential and commercial applications.

Steady price reductions further strengthened their position, making quality lighting accessible to a greater number of consumers. Innovations that manufacturers focus on relate to improvements in brightness, color accuracy, and lifespan, creating obvious advantages over traditional forms of lighting. Strong distribution through retail and e-commerce, combined with institutional procurement from developers and facilities managers, ensures wide market penetration and stable demand, thus maintaining this segment as the leading one in the LED lighting market of Europe.

Installation Insights:

- New Installation

- Replacement

The new installation leads with a share of 60% of the total Europe LED lighting market in 2025.

The new installation segment in Europe reflects the continuation of construction activities in various sectors such as residential, commercial, and public infrastructure. Today, buildings are designed with LED systems from the very beginning, indicating a new perspective and approach towards the use of the technology, as architects, engineers, and constructors of buildings now consider the use of LEDs for lighting to be the norm. This strengthens the idea of focusing on the new installation segment.

Government initiatives to upgrade urban infrastructure and increase the number of smart city networks are also driving demand for new installations of LEDs. Many cities are investing in intelligent street lighting technologies, while transportation centers, hospitals, and educational institutions are completing purpose-built installations of LEDs to meet specific needs. For instance, these are being installed during initial construction, minimizing costs and enhancing benefits, thereby driving adoption of LEDs for new constructions over other options.

Application Insights:

- Residential

- Outdoor

- Retail and Hospitality

- Offices

- Industrial

- Architectural

- Others

The residential dominates with a market share of 25% of the total Europe LED lighting market in 2025.

The residential sectors of European countries are rapidly switching to LEDs due to the move against incandescent and halogen lamps, which are being phased out under EU Ecodesign and RoHS regulations that, since 1 September 2023, have prohibited placing many types of halogen lamps (including common G9, G4, and GY6.35 caps) and fluorescent tubes on the market, a regulation that has accelerated the transition to LEDs in homes. LEDs promise energy savings, longer lifespans, and a wide range of models, from different color temperatures to different types and smart home capabilities. All this makes LEDs the first choice in new homes and renovations due to improved aesthetics, efficiency, and convenience, while meeting the overall goals for sustainability and energy savings in residential properties.

In addition to this, higher interest in residential home automation and energy management is again increasing the market for residential LEDs. The increase in smart bulbs and home automation devices that can be controlled using voice assistants is attracting the new generation of urban residents to these devices, who value ease and saving on energy costs. The construction of more residential complexes to meet urbanization needs and renovations to existing ones to be within modern energy standards will drive the market for LEDs in Europe’s residential sector.

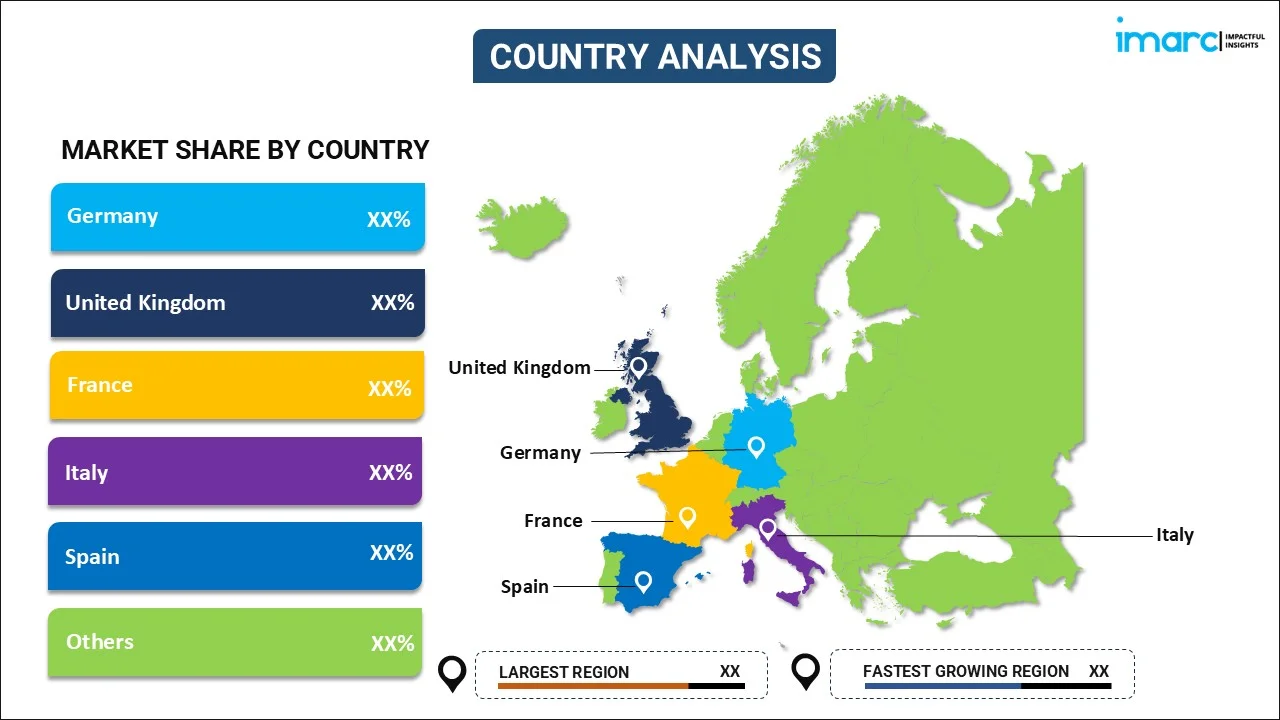

Country Insights:

To get detailed regional analysis of this market, Request Sample

- Germany

- United Kingdom

- France

- Italy

- Spain

- Others

Germany represents one of the most advanced LED lighting markets in Europe, underpinned by the country's strong industrial base, high energy prices, and a deeply entrenched culture of engineering excellence and sustainability. Demand is consistently driven by large-scale commercial and industrial users seeking to optimize operational efficiency, alongside an increasingly sustainability-conscious residential consumer base actively replacing legacy systems with modern, energy-efficient LED alternatives.

The United Kingdom exhibits robust demand for LED lighting solutions across both the public and private sectors, shaped by ambitious national energy efficiency targets and a well-developed commercial real estate market undergoing significant modernization. Growing adoption of smart building technologies and integrated lighting management systems is accelerating transition across office, retail, and healthcare environments, while government-backed incentive programs and stringent building regulations continue to provide consistent impetus for LED uptake throughout the country.

France presents a dynamic and expanding LED lighting market, driven by the government's active pursuit of energy transition objectives embedded within national climate frameworks. Widespread renovation activity across the country's substantial existing building stock, combined with new construction projects incorporating energy performance mandates from the outset, supports steady LED adoption. The hospitality and retail sectors are particularly prominent consumers, prioritizing LED solutions that deliver both operational savings and superior ambiance for discerning customers.

Italy's LED lighting market benefits from a combination of regulatory alignment with EU energy directives and a strong tradition of design-led innovation that distinguishes local manufacturers. Demand is especially pronounced in the architectural, hospitality, and residential renovation segments, where aesthetic quality and light customization are paramount purchasing criteria. Municipal authorities across major Italian cities are progressively deploying LED street and public lighting as part of broader urban sustainability programs, further broadening the overall market base.

There is significant growth in the adoption of LED lighting technologies in Spain, as reflected by national and regional strategies to decrease energy poverty and upgrade urban infrastructures. There is also a significant opportunity arising from Spain’s growing tourism and hospitality sector. These sectors require sophisticated hospitality and entertainment environments, which can benefit from the adoption of LED lighting systems to optimize business and entertainment experiences. Also, growing awareness of the long-term benefits of LED adoption in Spain is solving the cost constraint for businesses and households across all application segments.

The rest of the European markets, covering nations located in Central, Eastern, and Northern Europe, represent an emerging contributor for the overall regional LED lighting market. Nations within this group possess high growth prospects for LED adoption due to EU cohesion funds, increasing costs of energy, and enhancing regulatory environments. Upgrading infrastructures and investments from the private sector in efficient energy solutions provide an emerging market opportunity.

Market Dynamics:

Growth Drivers:

Why is the Europe LED lighting Market Growing?

Stringent EU Energy Efficiency Regulations and Phase-Out of Conventional Lighting

In a related case, the European Union has developed legislation that requires a gradual phase-out of inefficient lighting solutions such as halogen or fluorescent light bulbs. In July 2023, LightingEurope issued a press release highlighting that the phase-out of most conventional general lighting lamps across the EU would take effect within one month, urging retailers and consumers to transition to energy-efficient LED alternatives. This, therefore, changes the market dynamics since there is a set incentive, as well as legislation, driving individuals towards using alternative light bulbs. Moreover, there is an increase in EU building regulations, which only allow for a certain level of energy efficiency provided by LED-based solutions. There is also an EU Energy Label, which guides individuals in making purchasing decisions, thus encouraging the adoption of efficient solutions.

Rising Electricity Costs Driving Demand for Energy-Efficient Solutions

The highly consistent and fluctuating nature of electrical costs in Europe presents a significant economic incentive for businesses and individuals alike. In February 2026, major European industry leaders, including CEOs from BASF, ArcelorMittal, and other large corporations, publicly urged the European Union to take urgent action to cut high energy prices, reporting that industrial electricity costs in Europe remain more than twice those in the United States and China, placing substantial pressure on operating budgets. It is undeniable and quite visible that LED lighting systems substantially reduce electrical consumption and costs, given that the same light is produced while only requiring a fraction of conventional electrical power. For businesses, in particular, this is substantial, considering that many such businesses tend to operate 24/7 and would thus be able to benefit substantially from this. Indeed, it has been noted that property managers and logistics providers recognize the smart business sense behind investing in LED solutions, as they have long payback periods, thus necessitating immediate implementation, regardless of government subsidy.

Expanding Smart City and Infrastructure Modernization Programs

National and municipal authorities across Europe are actively modernizing public infrastructure through smart city initiatives, where LED street lighting is central. For example, in July 2025 the EU’s Smart Cities Marketplace is providing technical assistance to municipalities such as Pezinok in Slovakia to replace outdated public lighting with smart LED systems that include remote monitoring, dimming, and scheduling functionality that expected to cut energy use by up to 80 %. Advanced LED systems with remote monitoring, dimming, and fault detection can significantly lower energy use while improving reliability and operational flexibility. Budget-conscious city administrations benefit from these technologies, supported by EU cohesion funds and national infrastructure allocations dedicated to urban LED retrofits. This public sector adoption complements private investments, creating a continuous demand channel that drives long-term growth in the European LED market.

Market Restraints:

What Challenges the Europe LED lighting Market is Facing?

High Initial Investment and Replacement Costs for Advanced Systems

LED systems deliver significant long-term savings, but high upfront costs for high-performance or smart-enabled installations can hinder adoption. Small businesses, budget-conscious households, and local authorities may find premium fixtures with integrated controls, optics, and connectivity financially challenging. Extended payback periods make these investments less attractive for cost-sensitive segments, even though lifecycle economics typically justify the switch to energy-efficient LED solutions.

Complex Regulatory Landscape and Compliance Requirements

Europe’s LED market is governed by extensive regulations covering energy efficiency, electromagnetic compatibility, hazardous substances, and waste management. Navigating these overlapping rules imposes compliance costs and administrative burdens, especially for smaller manufacturers and distributors. Differences in national implementation of EU directives further complicate cross-border operations, potentially slowing product launches and extending time-to-market, challenging companies aiming to scale across multiple European countries.

Market Saturation and Intensifying Price Competition

High LED adoption in residential and commercial segments has led to market saturation and fierce price competition. Low-cost imports, particularly from Asia, put pressure on pricing and margins across the supply chain. European manufacturers face challenges differentiating through quality, innovation, or brand reputation, as purchasing increasingly depends on price. This pressure may limit investment in research and development for advanced or next-generation LED solutions.

Competitive Landscape:

The Europe LED lighting market is characterized by a moderately consolidated competitive structure, featuring a blend of globally dominant corporations and specialized regional players. Multinational corporations with deep R&D capabilities, comprehensive product portfolios, and well-established distribution networks hold significant influence across multiple application segments, leveraging brand recognition and service capabilities to retain institutional and commercial customers. Meanwhile, agile regional and national manufacturers compete effectively in niche segments by offering tailored solutions, faster delivery, and localized technical support. The competitive environment is intensifying as cost pressures from lower-priced imports force differentiation through innovation in smart controls, human-centric lighting, sustainability credentials, and integrated system offerings rather than product specifications alone.

Some of the key players include:

- Cree Inc.

- Dialight PLC

- Eaton Corporation Inc. (Cooper Industries LLC)

- Osram Licht AG

- Panasonic Corporation

- Seoul Semiconductor Co., Ltd.

- Signify N.V. (Philips Inc.)

- TRILUX GmbH & Co. KG

- Zumtobel Group AG

Recent Developments:

- In February 2026, Dreame launches its new Lightstrip P11 LED light across Europe, a smart LED strip featuring RGBICWW multi‑zone control, up to 1,800 lumens brightness, and compatibility with Matter, Alexa, and Google Assistant. Positioned as an affordable alternative to premium strips like Philips Hue, the 5 m strip supports dynamic effects and smart‑home integration.

Europe LED Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | LED Lamps and Modules, LED Fixtures |

| Installations Covered | New Installation, Replacement |

| Applications Covered | Residential, Outdoor, Retail and Hospitality, Offices, Industrial, Architectural, Others |

| Countries Covered | Germany, United Kingdom, France, Italy, Spain, Others |

| Companies Covered | Cree Inc., Dialight PLC, Eaton Corporation Inc. (Cooper Industries LLC), Osram Licht AG, Panasonic Corporation, Seoul Semiconductor Co., Ltd., Signify N.V. (Philips Inc.), TRILUX GmbH & Co. KG, Zumtobel Group AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe LED lighting market size was valued at USD 26.83 Billion in 2025.

The Europe LED lighting market is expected to grow at a compound annual growth rate of 8.52% from 2026-2034 to reach USD 55.99 Billion by 2034.

LED Lamps and Modules held the largest share of 57% in the Europe LED Lighting market, owing to their broad compatibility with existing fixtures, ease of adoption as replacement solutions, and superior energy performance across residential and commercial settings.

Key factors driving the Europe LED lighting market include stringent EU energy efficiency regulations phasing out conventional lighting, rising electricity costs incentivizing energy-saving LED adoption, expanding smart city and infrastructure modernization programs, and increasing consumer and enterprise demand for intelligent, connected lighting systems.

Major challenges include high upfront investment costs for advanced LED and smart lighting systems, a complex multi-layered regulatory compliance environment across EU member states, and intensifying price competition from lower-cost imported products exerting margin pressure on established manufacturers and constraining investment in next-generation product innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)