Europe Marine Composites Market Size, Share, Trends and Forecast by Composite Type, Fiber Type, Resin Type, Vessel Type, and Country, 2025-2033

Europe Marine Composites Market Size and Share:

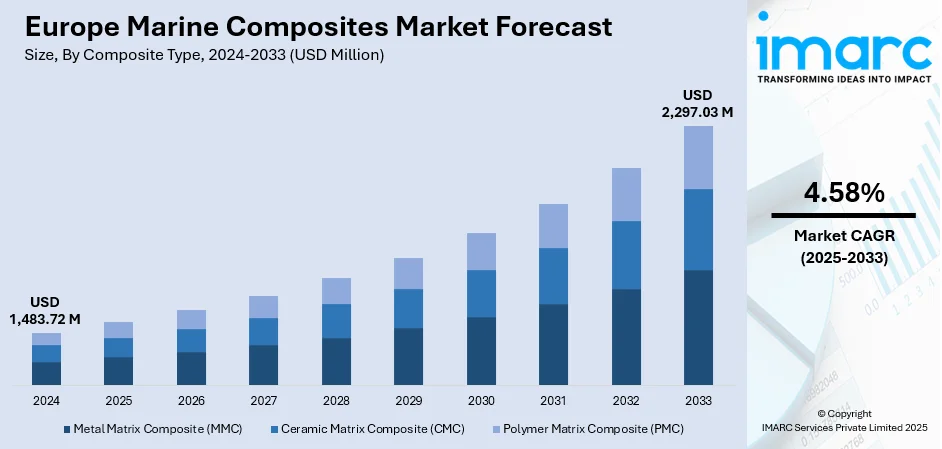

The Europe marine composites market size was valued at USD 1,483.72 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,297.03 Million by 2033, exhibiting a CAGR of 4.58% from 2025-2033.Germany currently dominates the market, driven by growing demand for lightweight, durable, and corrosion-resistant materials that enhance vessel performance and fuel efficiency. Rising focus on reducing carbon emissions, coupled with strict EU environmental regulations, accelerates the adoption of composites in shipbuilding. Increasing investments in leisure boats, luxury yachts, and naval defense projects further fuel market growth. Technological advancements in resin infusion and three-dimensional (3D) printing also boost composite applications, while repair and retrofit activities across Europe’s aging fleet strengthen long-term Europe marine composites market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,483.72 Million |

|

Market Forecast in 2033

|

USD 2,297.03 Million |

| Market Growth Rate 2025-2033 | 4.58% |

One of the key drivers of the Europe marine composites market is the increasing demand for lightweight materials that improve vessel performance and fuel efficiency. Composites, being significantly lighter than traditional metals, allow shipbuilders to reduce overall vessel weight, enabling higher speeds and lower fuel consumption. This directly supports the industry’s push to cut operational costs and meet international decarbonization goals. Moreover, reduced fuel usage helps shipping companies comply with stringent EU emission norms. As passenger ferries, yachts, and commercial vessels seek enhanced efficiency, the demand for marine composites as a sustainable alternative continues to expand rapidly.

To get more information on this market, Request Sample

The flourishing European leisure boating and yacht industry is another major growth driver for marine composites. Europe hosts some of the world’s largest yacht manufacturers, particularly in Italy, France, and Germany, where demand for high-performance, aesthetically appealing, and durable materials is strong. Marine composites offer superior design flexibility, resistance to harsh marine conditions, and reduced maintenance requirements—qualities highly valued in the luxury yacht sector. Additionally, increasing consumer spending on recreational boating and water sports activities further supports Europe marine composites market growth. With rising orders for custom-built yachts and leisure vessels, marine composites are becoming indispensable in Europe’s premium boatbuilding industry.

Europe Marine Composites Market Trends:

Expanding Leisure and Luxury Yacht Industry

Increased demand for leisure boats and luxury yachts in Europe is another prime driver of demand for marine composites. Europe is one of the world's leading center for yacht production, with top-ranking countries including Italy, France, and Germany in terms of production as well as exports. Buyers in this market are looking for not just performance and endurance but also creative design and attractiveness. Marine composites provide unparalleled flexibility, enabling yacht manufacturers to produce sleek, tailored designs and still provide excellent resistance to severe marine environments. Their lightness provides higher speed and fuel economy, very much in demand for premium recreational vessels. Rising disposable income, along with growing participation in marine recreation and water sport, have further increased sales of recreational boats in the region. As demand for luxury yachts and leisure boats continues to grow, the dependence on marine composites within Europe's luxury boatbuilding industry will increase.

Stringent Environmental Regulations and Sustainability Goals

Another key Europe marine composites market trends is the stringent environmental policies set by the European Union and the International Maritime Organization (IMO) to cut carbon emissions and enhance sustainability in shipping. The IMO’s 2023 GHG Strategy aims to reduce carbon intensity by at least 40% by 2030, achieve net-zero emissions around 2050, and promote 5–10% adoption of near or zero-emission fuels by 2030. Traditional shipbuilding materials like steel and aluminum, while strong, increase vessel weight and fuel consumption, leading to higher emissions. In contrast, marine composites offer a lighter yet highly durable alternative that improves fuel efficiency and reduces environmental impact. Their resistance to corrosion also extends vessel lifespan and lowers maintenance needs. As Europe pursues its decarbonization agenda, demand for composites is rising, further supported by government incentives and industry investments in sustainable shipbuilding.

Technological Advancements in Composite Manufacturing

Technological innovation in composite manufacturing techniques is a crucial driver propelling the Europe marine composites market demand. Advanced methods such as resin transfer molding, vacuum infusion, and 3D printing have significantly improved the cost-efficiency, strength, and scalability of marine composites. These techniques not only reduce production time but also allow greater design flexibility, enabling shipbuilders to manufacture complex structures with precision. Furthermore, advancements in hybrid composites and bio-based resins are addressing sustainability concerns while enhancing performance characteristics. European research institutions and shipyards are increasingly collaborating to develop next-generation marine composites optimized for strength, durability, and recyclability. Such innovations lower the total lifecycle cost of vessels, making composites more attractive compared to traditional materials. As adoption of advanced manufacturing spreads across both commercial and defense shipbuilding, technological progress will remain a core driver of market expansion in Europe.

Europe Marine Composites Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe marine composites market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on composite type, fiber type, resin type, and vessel type.

Analysis by Composite Type:

- Metal Matrix Composite (MMC)

- Ceramic Matrix Composite (CMC)

- Polymer Matrix Composite (PMC)

According to the Europe marine composites market forecast, the polymer matrix composites (PMC) account for the majority share in the Europe marine composites market, driven by their excellent mechanical properties, versatility, and cost efficiency. PMCs, typically reinforced with glass or carbon fibers, provide a superior strength-to-weight ratio, corrosion resistance, and durability, making them highly suitable for marine environments. They are widely adopted in hulls, decks, masts, and interior structures across cruise ships, yachts, and naval vessels. The ease of manufacturing, repair, and customization offered by PMCs further supports their dominance. Moreover, their compatibility with advanced processing techniques like resin infusion and 3D printing enhances design flexibility. Combined with growing demand for lightweight and fuel-efficient vessels, PMCs continue to lead composite adoption in Europe’s shipbuilding industry.

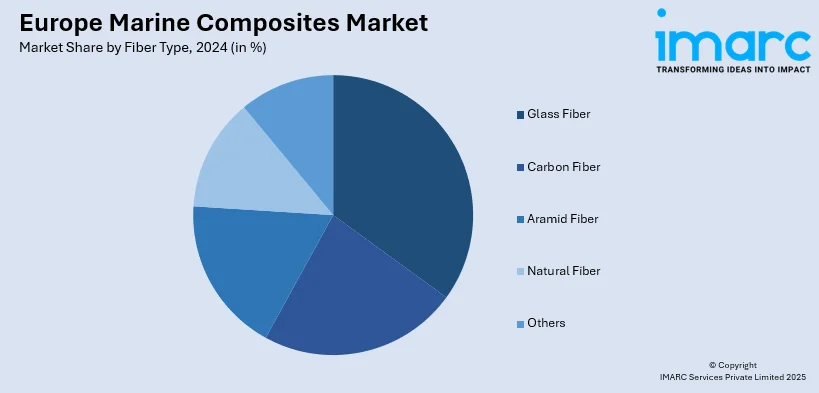

Analysis by Fiber Type:

- Glass Fiber

- Carbon Fiber

- Aramid Fiber

- Natural Fiber

- Others

Glass fiber represents the majority share in the Europe marine composites market owing to its superior strength-to-weight ratio, affordability, and excellent corrosion resistance. It is widely used in shipbuilding for hulls, decks, bulkheads, and structural components, offering durability and safety in harsh marine environments. Compared to other fibers, glass fiber provides an optimal balance of performance and cost, making it suitable for both large-scale commercial vessels and leisure boats. Its ease of processing and compatibility with resins like polyester and epoxy further enhance its adoption. Additionally, glass fiber’s recyclability and adaptability to advanced manufacturing techniques support sustainability goals. These advantages make it the most preferred reinforcement material, driving its dominance in Europe’s marine composites market.

Analysis by Resin Type:

- Polyester

- Vinyl Ester

- Epoxy

- Thermoplastic

- Phenolic

- Acrylic

- Others

Based on the Europe marine composites market analysis, the polyester dominates the market demand in the Europe marine composites sector owing to its cost-effectiveness, versatility, and widespread availability. As one of the most commonly used resins, polyester offers an excellent balance between performance and affordability, making it the preferred choice for shipbuilders across both commercial and recreational applications. It provides good mechanical strength, durability, and resistance to water and corrosion, ensuring long service life in harsh marine environments. Moreover, polyester resins are compatible with various reinforcement fibers, such as glass fiber, which further enhances their utility in hulls, decks, and interior components. Ease of processing, faster curing times, and suitability for mass production strengthen its adoption, solidifying polyester’s position as the leading material in Europe marine composites market outlook.

Analysis by Vessel Type:

- Power Boats

- Sailboats

- Cruise Ships

- Others

Cruise ships hold the majority share in the Europe marine composites market due to their extensive use of lightweight and durable materials that enhance performance, fuel efficiency, and passenger comfort. With the rising demand for luxury cruising in Europe, shipbuilders prioritize composites for decks, hulls, interior structures, and fittings because they reduce overall vessel weight while maintaining strength and safety. This directly supports compliance with stringent EU emission standards and lowers operational costs. Additionally, composites offer excellent resistance to corrosion, reducing long-term maintenance expenses, which is crucial for large vessels operating continuously. The growing focus on sustainable and innovative ship design, combined with Europe’s strong cruise tourism industry, positions cruise ships as the dominant segment driving composite adoption.

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the leading region in the Europe marine composites market, driven by its strong shipbuilding industry, advanced manufacturing capabilities, and emphasis on sustainability. The country has a well-established reputation in producing high-performance vessels, including luxury yachts, naval ships, and commercial boats, which increasingly rely on composites for weight reduction, fuel efficiency, and durability. Germany’s technological leadership in resin infusion, automation, and hybrid materials further accelerates adoption. Moreover, stringent environmental regulations and the national push toward reducing carbon emissions encourage the use of eco-friendly composites. A strong network of research institutions and innovation-driven collaborations also support advancements. Rising demand for leisure and recreational boating strengthens Germany’s position as a key growth hub in the European marine composites market.

Competitive Landscape:

The competitive landscape of the Europe marine composites market is characterized by intense rivalry among global and regional players, focusing on innovation, sustainability, and cost efficiency. Companies compete by developing advanced materials that meet stringent environmental regulations while offering durability, lightweight properties, and enhanced performance. Strategic partnerships with shipbuilders, technological advancements in resin systems and manufacturing techniques, and increased investments in research are shaping competition. Market participants are also targeting growth opportunities in leisure boats, yachts, and naval applications. Furthermore, expanding repair and retrofit activities across Europe’s aging fleet present additional opportunities. Overall, competition is centered on delivering high-performance, eco-friendly solutions while maintaining strong customer relationships in a highly regulated market.

The report provides a comprehensive analysis of the competitive landscape in the Europe marine composites market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Bureau Veritas Solutions Marine & Offshore (BVS) and Bureau Veritas Marine & Offshore (BV) announced that they will be participating in Wind for Shipping (W4S), a European research and development (R&D) project supported by the Interreg North-West Europe initiative. As part of this program, BV will also assist the project's investigation of marine composites production techniques in order to facilitate the large-scale manufacturing of wind propulsion components.

- June 2025: Sweden-based Mangohojden AB successfully completed the acquisition of Slingsby Advanced Composites Ltd., a manufacturer of premier composites for various applications, including marine, headquartered in the United Kingdom. This acquisition aims to increase access to funding, thereby facilitating investments required to fulfill market demands in the upcoming years.

- June 2025: MS Marine Europe, a manufacturer of composite tools for use in decks, hulls, and superstructures, announced the commencement of full-scale plug and mould manufacturing at its cutting-edge facility in Hungary. Constructed to accommodate high-volume production requirements, the facility is expected to develop into an important partner for shipyards and boat manufacturers throughout Europe, as well as internationally.

- March 2025: INEOS Enterprises successfully sold its composites division, INEOS Composites, to KPS Capital Partners, LP. INEOS Composites is a prominent manufacturer of gelcoats and resins for the production of composite plastics for numerous applications, including marine, automotive, and construction.

Europe Marine Composites Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Composite Types Covered | Metal Matrix Composite (MMC), Ceramic Matrix Composite (CMC), Polymer Matrix Composite (PMC) |

| Fiber Types Covered | Glass Fiber, Carbon Fiber, Aramid Fiber, Natural Fiber, Others |

| Resin Types Covered | Polyester, Vinyl Ester, Epoxy, Thermoplastic, Phenolic, Acrylic, Others |

| Vessel Types Covered | Power Boats, Sailboats, Cruise Ships, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe marine composites market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe marine composites market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe marine composites industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The marine composites market in Europe was valued at USD 1,483.72 Million in 2024.

The Europe marine composites market is projected to exhibit a CAGR of 4.58% during 2025-2033, reaching a value of USD 2,297.03 Million by 2033.

The market is driven by rising demand for lightweight, fuel-efficient vessels that comply with stringent EU emission regulations. Growth in leisure boats and luxury yachts further boosts adoption, as composites offer superior durability, corrosion resistance, and design flexibility. Additionally, technological advancements in resin systems and manufacturing techniques enhance performance and cost-efficiency, while repair and retrofit activities across Europe’s aging fleet strengthen long-term demand for composite solutions.

Polymer Matrix Composites (PMC) dominate the Europe marine composites market due to their superior strength-to-weight ratio, corrosion resistance, and versatility. Widely used in hulls, decks, and structural parts, PMCs offer durability, easy processing, and cost efficiency. Their compatibility with advanced manufacturing techniques further boosts adoption across shipbuilding applications.

Glass fiber leads the Europe marine composites market because of its high strength-to-weight ratio, cost-effectiveness, and strong resistance to corrosion. Widely used in hulls, decks, and structural components, it ensures durability and safety. Its compatibility with resins and ease of processing make it the preferred reinforcement material.

Polyester dominates the Europe marine composites market due to its affordability, versatility, and ease of processing. Offering durability, corrosion resistance, and compatibility with reinforcement fibers like glass, it is widely used in hulls, decks, and interiors. Faster curing and suitability for mass production further drive its extensive adoption.

Cruise ships dominate the Europe marine composites market as they extensively use lightweight, durable materials to improve fuel efficiency, structural strength, and passenger comfort. Composites also ensure corrosion resistance and reduced maintenance costs, aligning with stringent environmental standards, making them essential for sustainable and efficient cruise ship construction.

Germany leads the Europe marine composites market due to its robust shipbuilding sector, advanced manufacturing technologies, and strong focus on sustainability. The country excels in producing high-performance vessels, supported by innovations in composite materials and compliance with strict environmental regulations, making it a key hub for market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)