Europe Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Country, 2026-2034

Europe Meat Market Size and Share:

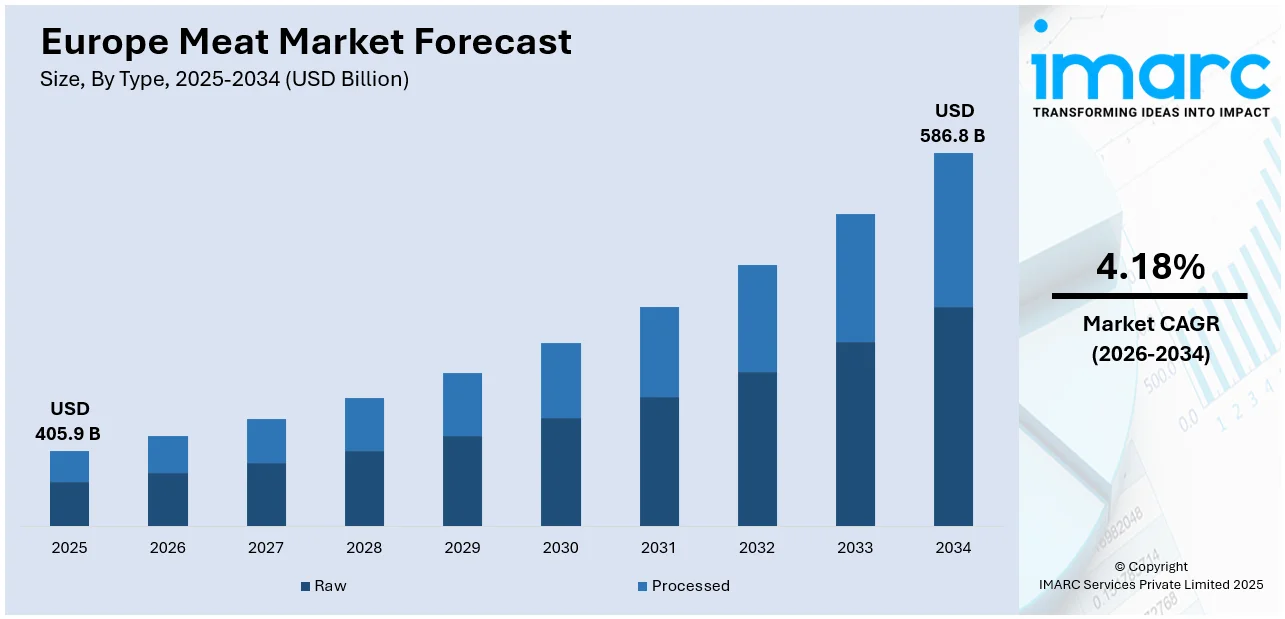

The Europe meat market size was valued at USD 405.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 586.8 Billion by 2034, exhibiting a CAGR of 4.18% from 2026-2034. The Europe meat market is driven by rising demand for protein-rich diets, evolving consumer preferences, and expanding food service sectors. Among various products, chicken leads the market due to its affordability, versatility, and health perception. Its dominance continues amid increasing adoption of convenient, ready-to-cook poultry products across European households.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 405.9 Billion |

|

Market Forecast in 2034

|

USD 586.8 Billion |

| Market Growth Rate (2026-2034) | 4.18% |

The rising consumer demand for protein-rich diets is a primary driver of the market, with meat being a staple source of protein in European households. The growing trend of health-conscious eating has also led to increased consumption of leaner meat options, such as poultry, as consumers seek to balance nutrition and taste. Regional preferences play a role, with specific countries favoring particular types of meat or preparation methods. For example, Germany’s strong affinity for sausages and Spain’s demand for cured meats like chorizo highlight cultural influences. For instance, in September 2024, Nosh.bio, a B2B foodtech startup specializing in fermented fungi-based ingredients, announced a partnership with the zur Mühlen Group (ZMG), which is a part of the Tönnies Group, a leader in the European meat production sector. This collaboration allows the partners to launch Koji Chunks, a new category of clean-label products.

To get more information on this market Request Sample

Technological advancements in meat processing and packaging have increased product shelf life, quality, and safety, thereby making meat products more appealing to consumers. Innovations in cold chain logistics have also improved the distribution of fresh and frozen meat across Europe, ensuring consistent availability. The emergence of plant-based meat alternatives and hybrid products has expanded market opportunities, catering to flexitarians and those reducing meat consumption for health or environmental reasons. For instance, in July 2024, Redefine Meat, the leader of ‘new-meat’, an emerging category of premium-quality plant-based meat made from plants, announced the launch of its award-winning Redefine Flank Steak in European retail.

Europe Meat Market Trends:

Technological Advancements in Meat Processing

Innovations in meat processing, packaging, and cold-chain logistics have significantly enhanced product quality, safety, and shelf life. These advancements ensure consistent supply, reduce waste, and allow for convenient meat formats like ready-to-eat and processed products. As technology evolves, producers can better meet the growing demand while adhering to food safety regulations and maintaining competitive pricing. For instance, in March 2024, Planted, the Swiss FoodTech trailblazer for clean label plant-based meats, introduced the planted.steak, a fermented steak from plants, now widely available across numerous foodservice outlets in Europe. The launch of planted.steak as the first product from Planted’s ‘whole-muscle platform’; this also marks the announcement of the company’s strategic expansion of its production capabilities with an advanced fermentation facility in Kemptthal, Switzerland. The European meat industry, including products like EU Meat and Euro Meat Market offerings, is evolving to match consumer demand for higher-quality standards.

Rising Popularity of Sustainable and Ethical Meat Products

European consumers increasingly prioritize sustainability and ethical considerations in their purchasing decisions. The demand for organic, free-range, and sustainably sourced meat continues to grow, driven by concerns about environmental impact and animal welfare. These preferences have spurred the rise of cultivated and plant-based meat alternatives, expanding the industry's offerings to meet diverse consumer values. For instance, in September 2024, Barcelona’s Novameat, a B2B company specializing in different cuts of plant-based chicken, beef, and turkey, announced that it had raised €17.4 million in an oversubscribed Series A round led by Sofinnova Partners and Forbion via its BioEconomy Fund. The already existing investors, including Unovis Asset Management, Praesidium, and Rubio Impact Ventures, also reinvested, leveraging on the company’s practical alternatives to meat. This shift also supports the growing demand for European smoked meat options, aligning with more ethical production standards.

Regional Preferences and Culinary Traditions

Europe's diverse culinary heritage plays a significant role in meat market dynamics. Each region showcases distinct preferences for specific meats and preparation styles, from German sausages to Spanish cured ham. These cultural influences sustain demand for traditional and premium meat products, contributing to the market's robustness and resilience. For instance, in November 2024, Danish Crown announced the launch of its new premium brand, Masterpiece 1887, which represents the premium variation of Danish livestock farming products. This growth in demand for high-quality regional meats is reflected in the popularity of products like European sausage, which continues to hold a strong position in both local and global markets.

Expansion of Lab-Grown Meat Technologies

Lab-grown meat, also referred to as cultured or cell-based meat, is emerging as a transformative trend in the European meat market. Driven by environmental sustainability and ethical concerns surrounding conventional livestock farming, this technology utilizes animal cells to cultivate meat in bioreactors, eliminating the need for slaughter. Regulatory bodies in Europe are gradually evaluating the safety and approval pathways for commercial sale, encouraging startups and food tech companies to innovate in this space. As awareness grows regarding the ecological impact of traditional meat production—including greenhouse gas emissions and land usage—lab-grown alternatives are gaining support from environmentally conscious consumers and investors. Technological advancements and decreasing production costs are expected to accelerate commercialization over the coming years.

Surge in Demand for Plant-Based Meat Alternatives

Plant-based meat is experiencing significant growth in the European market due to rising consumer demand for sustainable, cruelty-free food options. Derived primarily from soy, pea protein, and other legumes, these products are designed to replicate the taste, texture, and nutritional profile of animal-based meat. Retail availability has expanded across supermarkets and foodservice channels, with many restaurants integrating plant-based offerings into their menus. Health-conscious consumers seeking to reduce red meat consumption without sacrificing dietary satisfaction are increasingly embracing these alternatives. The trend is further supported by EU-level sustainability goals and carbon reduction initiatives. Major food companies and startups alike are investing heavily in research and marketing to capture a growing segment of flexitarian and vegan consumers across Europe.

Growing Preference for Organic Meat Products

Organic meat is gaining traction in Europe as consumers become more concerned with animal welfare, antibiotic-free farming, and food traceability. Certified organic meat must meet stringent regulations that emphasize natural feed, humane animal treatment, and environmentally responsible farming practices. This aligns closely with European Union directives promoting sustainable agriculture and food safety. The organic segment appeals strongly to families, health-conscious individuals, and ethically minded shoppers who prioritize transparency and premium quality in their food purchases. As disposable incomes rise and public awareness of industrial farming impacts deepens, organic meat sales are growing across both urban and rural markets. Retailers are expanding shelf space for organic offerings, and online grocery platforms are enhancing accessibility through targeted delivery and product range expansions.

Europe Meat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe meat market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, product, and distribution channel.

Analysis by Type:

- Raw

- Processed

Raw meat holds a significant market share due to its traditional consumption in European households and its versatility in diverse culinary applications. Fresh raw meat is preferred by consumers due to its perceived quality and versatility in creating personalized meals. Raw meat is popular because of strong regional and cultural eating traditions as well as the increased need for fresh protein sources. Its market domination is further supported by developments in cold chain logistics and packaging, which guarantee the availability of fresh raw meat throughout retail channels.

Processed meat leads the market due to its convenience, longer shelf life, and widespread use in ready-to-eat and fast-food segments. Products like deli goods, cured meats, and sausages are essential to European snack culture and cuisines. There is a greater need for quick, simple-to-prepare choices due to growing urbanization and hectic lifestyles. Processing technology advancements along with premium and organic product choices increase processed meat's appeal to a wider range of customer groups.

Analysis by Product:

- Chicken

- Beef

- Pork

- Mutton

- Others

Chicken dominates the Europe meat market due to its affordability, versatility, and health appeal as a lean protein source. Many different cuisines use it extensively, and it works well in both classic and contemporary recipes. The demand for low-fat foods like chicken has surged due to growing health consciousness. It is also affordable and easily accessible due to its shorter production cycle. Its market share across retail and food service channels is also greatly influenced by the popularity of processed chicken products like nuggets and ready-to-eat dishes.

Beef holds a substantial market share in Europe due to its association with premium quality, rich taste, and cultural significance in traditional dishes like steaks, roasts, and stews. Beef is valued by European customers due to its high protein content and use in fine dining and gourmet meals. Beef is central to the culinary traditions of nations like France, Italy, and Germany. The availability of grass-fed and organic beef options increases demand among consumers who are concerned about sustainability and health.

Pork remains a cornerstone of the European meat market, deeply embedded in regional diets and culinary traditions. It is a mainstay in a variety of recipes, from sausages to cured goods like ham and bacon, because of its cost and adaptability. Specialties made from pig, including bratwurst and prosciutto, are highly sought after in nations like Germany, Spain, and Italy. Furthermore, a consistent supply is guaranteed by its extensive availability and effective production methods, enhancing pork's standing as a top option in the market.

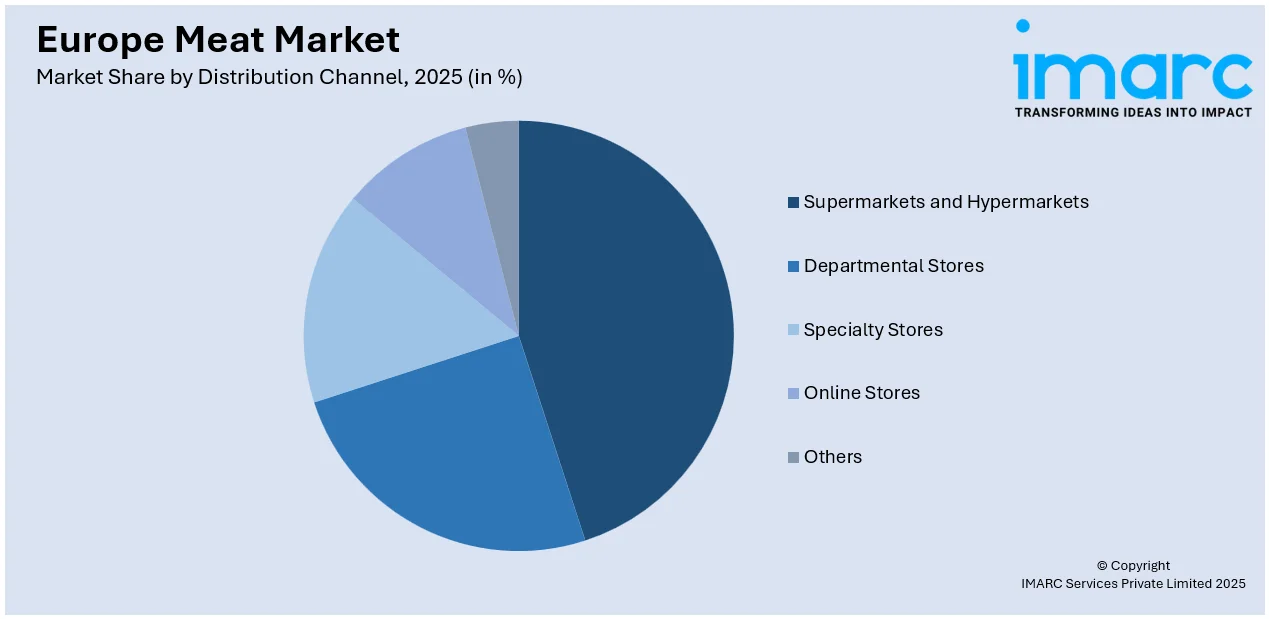

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the Europe meat market due to their extensive reach, diverse product offerings, and competitive pricing. These stores accommodate a variety of consumer tastes by offering a large assortment of fresh, processed, organic, and plant-based meat products. Their emphasis on loyalty programs, incentives, and convenience draws in a wide range of clients. The availability of premium meat products is also guaranteed by the incorporation of cutting-edge refrigeration and packaging technology, which makes these stores a popular option for household shopping.

Departmental stores hold a significant market share as they cater to urban consumers seeking convenience and variety. These stores frequently have special areas for both processed and fresh meat items, which appeals to customers with limited time. Their attractiveness is increased by their prime positions in residential and urban areas, as well as by seasonal specials and attentive customer support. Department stores also frequently carry high-quality and locally produced specialty meat products, satisfying a wide range of palates and attracting consistent customer traffic.

Specialty stores are favored for their focus on premium, organic, and artisanal meat products, appealing to quality-conscious and niche consumers. These outlets offer curated selections, including locally sourced, sustainably raised, or rare meat varieties, attracting customers with specific dietary or ethical preferences. Their emphasis on expert advice and personalized shopping experiences enhances customer loyalty. Specialty stores also capitalize on rising trends in organic and ethical meat consumption, reinforcing their position in the European meat market.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany's meat market thrives on strong cultural traditions, with high demand for sausages, pork, and processed meat. Convenience products like ready-to-eat meals are popular, driven by urbanization and busy lifestyles. Sustainability-conscious consumers increasingly prefer organic and free-range options, while the rise of plant-based and hybrid products reflects evolving dietary trends. Technological advancements in processing and packaging ensure consistent quality, meeting high food safety standards. Germany's robust foodservice sector further bolsters the demand for diverse meat products.

France’s meat market is influenced by its culinary heritage, with high demand for premium beef, poultry, and specialty meats. Artisanal and organic meat products are particularly popular, driven by health-conscious and sustainability-focused consumers. The country’s emphasis on gastronomic traditions supports steady demand for fresh and locally sourced meats. Additionally, the growth of gourmet foodservice outlets and charcuterie culture sustains the market. Innovations in meat processing also contribute to the appeal of convenient, high-quality options.

The UK’s meat market is driven by high demand for poultry and processed meat products like sausages and bacon. Rising health awareness has increased interest in leaner and organic meats, alongside plant-based alternatives. Convenience is a key factor, with busy consumers favoring ready-to-cook and pre-packaged options. Supermarkets dominate the retail sector, ensuring wide accessibility. Additionally, the UK’s multicultural population drives demand for diverse meat varieties, including halal and kosher options, while sustainability concerns shape purchasing choices.

Italy’s meat market is shaped by its rich culinary traditions, emphasizing cured and specialty meats like prosciutto, salami, and beef. Pork is a staple due to its use in various traditional recipes. Organic and locally sourced meat products are gaining popularity, driven by health and sustainability concerns. Italy’s vibrant foodservice industry, including trattorias and fine dining, bolsters demand for premium and artisanal meats. The rising interest in plant-based alternatives complements market growth by offering diverse options.

Spain’s meat market is strongly influenced by its culinary culture, with high demand for pork and cured meats like chorizo and jamón. The popularity of processed meats, such as sausages and deli items, reflects traditional preferences and busy lifestyles. Sustainability and animal welfare concerns are boosting demand for organic and free-range options. Spain’s thriving tourism and foodservice sectors drive consumption of high-quality and specialty meats, while regional variations ensure a diverse and dynamic market landscape.

Competitive Landscape:

The market is highly competitive, featuring established players like Danish Crown, Tönnies, and JBS, alongside emerging innovators in plant-based and cultivated meat such as Beyond Meat, Planted, and Meatly. Traditional meat producers dominate through extensive supply chains, brand loyalty, and premium offerings, while alternative protein companies target sustainability-focused consumers. Key competition areas include product innovation, pricing strategies, and adherence to environmental and ethical standards. The market is also influenced by regional preferences, with producers tailoring products to local tastes. Regulatory advancements and technological progress are enabling new entrants to challenge established brands, reshaping the competitive dynamics. For instance, in November 2024, Tönnies Group, the Germany-based meat producer, announced that it is to operate under the new name of Premium Food Group henceforth. The corporate rebranding aligns with company’s “development” strategies in recent years from being purely a meat processor to a broader food manufacturer.

Latest News and Developments:

- 2025: A new US-UK beef deal grants each country a 13,000 metric ton tariff-free beef quota. This reduces the general quota for other exporters like Brazil, which filled its 2025 limit early and now faces a 36.4% tariff on extra exports.

- In July 2024, Meatly announced it had received regulatory clearance to sell cultivated meat for pet food in the UK, making it the first in the world to get authorization for cultivated pet food. A huge leap forward for the cultivated meat industry, gaining regulatory approval also makes Meatly the first-ever cultivated meat company approved for sale in any European country.

- In November 2024, Dutch startup Meatable, focused on cultivated meat technology, secured strategic investment from Betagro Ventures, the venture capital arm of Thailand’s Betagro food group. Although the funding amount remains undisclosed, the deal marks Betagro’s first venture into the cultivated meat space, highlighting their interest in Meatable’s cell-based technology that mimics traditional pork and beef.

Europe Meat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe meat market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe meat market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe meat market was valued at USD 405.9 Billion in 2025.

The Europe meat market is projected to reach USD 586.8 Billion by 2034, exhibiting a CAGR of 4.18% during 2026-2034.

Market growth is driven by rising consumer demand for high-protein diets, the expansion of food service and retail sectors, technological advancements in meat processing, and growing preference for premium and organic meat products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)