Europe Neoprene Market Size, Share, Trends and Forecast by Manufacturing Route, Grade, Application, End User, and Country, 2025-2033

Europe Neoprene Market Size and Share:

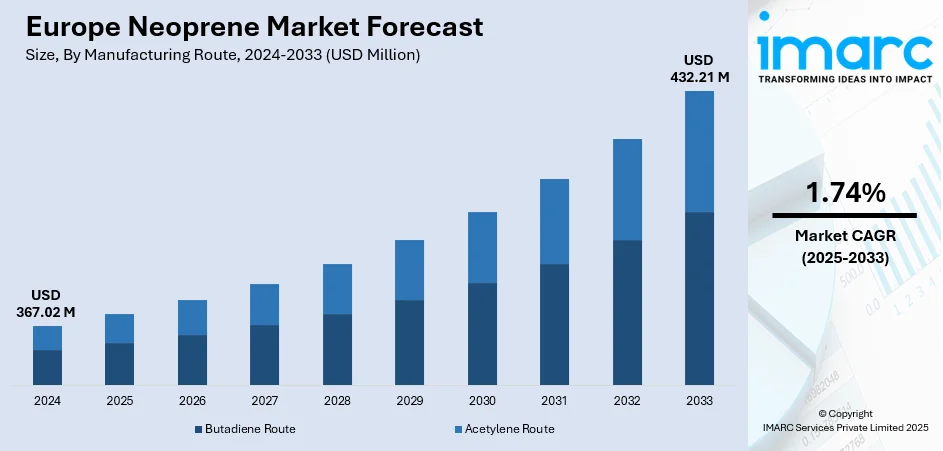

The Europe neoprene market size was valued at USD 367.02 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 432.21 Million by 2033, exhibiting a CAGR of 1.74% from 2025-2033. Germany currently dominates the market, driven by rising demand from automotive, construction, and electrical industries due to neoprene’s durability, flexibility, and resistance to oil, chemicals, and weathering. Increasing use in automotive components, insulation materials, and sealing solutions fuels growth, alongside expanding applications in sportswear and protective gear. Sustainability initiatives and innovation in eco-friendly neoprene production further support adoption. Additionally, Europe’s stringent safety and quality standards in industrial and consumer products encourage higher usage of neoprene across multiple sectors, boosting Europe neoprene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 367.02 Million |

| Market Forecast in 2033 | USD 432.21 Million |

| Market Growth Rate 2025-2033 | 1.74% |

One of the key factors fuelling the Europe neoprene market is its expanding application in the automotive and construction sectors. In the automotive industry, neoprene finds extensive application in the form of hoses, belts, seals, and gaskets owing to its excellent resistance to oil, heat, and abrasion. Likewise, in the construction industry, neoprene's weather, chemical, and fire resistance qualify it as the most desirable material for insulation materials, expansion joints, and sealants. Europe's robust automotive manufacturing base, combined with large infrastructure construction and rehabilitation projects, continues to drive demand for neoprene as a stable and long-lasting material in these markets.

To get more information on this market, Request Sample

Another major driver in the European neoprene market is the rising need for sportswear, wetsuits, and protective gear. With heightened activity levels for water sports, fitness, and outdoor leisure activities, neoprene-based products are greatly in demand for thermal insulation, elasticity, and durability. Moreover, neoprene's protective nature also renders it an ideal choice for industrial safety equipment, medical supports, and orthopedic appliances. Europe's rich sporting culture and increasing consciousness of health, fitness, and on-the-job safety are fueling adoption. Technological advancements in light, environmentally friendly neoprene also increase its consumer market attractiveness, propelling consistent growth in sportswear and protective gear markets.

Europe Neoprene Market Trends:

Expansion in Automotive and Construction Applications

The automotive and building industries are two of the primary growth drivers in the Europe neoprene market trends. Neoprene finds extensive application in auto manufacturing for safety-critical parts like hoses, belts, gaskets, and seals owing to its superior oil, heat, and mechanical stress resistance. Europe has a robust automotive base in Germany, France, and Italy, and therefore the demand for high-tolerance products is huge. Neoprene in construction is appreciated for its resistance to weather, flexibility, and flame retardancy and thus finds applications in insulation, expansion joints, adhesives, and sealant systems. The urbanization of the region, redevelopment of aging infrastructure, and increased focus on energy-efficient construction are providing increased prospects for the use of neoprene. With automobile and building sectors increasingly emphasizing protection, longevity, and performance, the position of neoprene as a trusted substance is set to solidify further, paving the way for steady market development in Europe.

Rising Demand in Sportswear, Wetsuits, and Protective Gear

A key driver of neoprene demand in Europe is its expanding use in sportswear, wetsuits, and protective equipment, supported by strong trade dynamics. According to Eurostat, in 2023, sports footwear represented 29.8% of extra-EU sporting goods imports, while gymnastic, athletic, and swimming equipment accounted for 21.4%, categories that often include neoprene-based products. With Europe’s rich culture of outdoor and water sports such as surfing, diving, and sailing, neoprene is indispensable for wetsuits and related gear due to its insulation, buoyancy, and flexibility. Beyond recreation, it is also used in orthopedic braces, industrial gloves, and safety apparel, benefiting from its durability and comfort. Rising fitness participation, heightened workplace safety standards, and the shift toward lightweight, eco-friendly neoprene align with Europe’s sustainability goals, reinforcing neoprene’s importance across consumer and industrial applications while ensuring sustained market growth.

Technological Advancements and Sustainability Initiatives

Sustainability trends and technological innovation are increasingly powerful drivers of the Europe neoprene industry. Conventional neoprene manufacturing is based on petrochemical processes, but with increasing environmental concerns and regulatory pressures within Europe, industry players are working to create greener alternatives. Bio-based neoprene and green manufacturing processes are gaining traction, especially in consumer-oriented sectors like sportswear and automobiles. In addition, advances in material science have enhanced the thermal stability, chemical resistance, and recyclability of neoprene, expanding its scope of application. Such European regulations focusing on carbon reduction and circular economy practices are inducing firms to implement more sustainable materials such as eco-neoprene. These are not only satisfying customer demands for sustainability but also congruent with the region's rigorous regulatory system. As businesses look for high-performance but eco-friendly solutions, technological innovation and eco-friendly initiatives will also have a profound impact on spurring neoprene adoption in various sectors across Europe.

Europe Neoprene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe neoprene market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on manufacturing route, grade, application and end user.

Analysis by Manufacturing Route:

- Butadiene Route

- Acetylene Route

The butadiene route dominates the Europe neoprene market demand owing to its cost-effectiveness, scalability, and ability to deliver consistent material performance across applications. Butadiene-based neoprene offers excellent resistance to oil, heat, chemicals, and weathering, making it highly suitable for automotive parts, construction materials, adhesives, and protective gear. Its widespread availability and mature production technology ensure a stable supply chain, supporting large-scale industrial demand. Additionally, the route provides manufacturers with flexibility in tailoring neoprene grades to meet diverse end-user requirements. Despite the emergence of eco-friendly alternatives, the butadiene process continues to hold a strong position due to its established infrastructure, efficiency, and proven reliability, thereby driving its dominance in the European neoprene market.

Analysis by Grade:

- General-Purpose Grade Neoprene

- Pre-Crosslinked Grade Neoprene

- Sulfer-Modified Grade Neoprene

- Slow Crystallizing Grade Neoprene

Based on the Europe neoprene market analysis, the general-purpose grade neoprene represents the majority of shares in the Europe neoprene market due to its wide adaptability, cost efficiency, and balanced properties. This grade combines durability, flexibility, and resistance to heat, oil, chemicals, and weathering, making it highly suitable for diverse applications in automotive, construction, electrical, and consumer products. Industries prefer general-purpose neoprene because it meets essential performance requirements without the higher costs associated with specialized grades. Its versatility in producing gaskets, hoses, belts, adhesives, and sealing solutions drives large-scale demand. Additionally, its proven reliability and availability support continuous adoption across both industrial and consumer sectors. These advantages collectively reinforce its leading market position and ensure dominance over other neoprene grades in Europe.

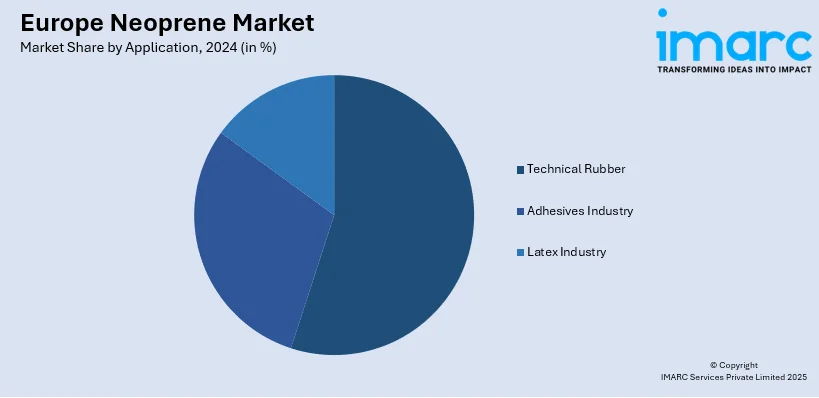

Analysis by Application:

- Technical Rubber

- Adhesives Industry

- Latex Industry

Technical rubber holds the leading position in the Europe neoprene market owing to its extensive use in high-performance industrial applications that demand strength, durability, and resistance to extreme conditions. Neoprene-based technical rubber is widely utilized in automotive parts, industrial machinery, sealing systems, hoses, gaskets, and conveyor belts, where resilience to oil, heat, and chemicals is critical. Its ability to maintain flexibility and performance under harsh environments makes it a preferred choice for manufacturers. Additionally, Europe’s robust automotive and industrial base drives consistent demand for technical rubber products. The material’s balance of reliability, cost-effectiveness, and adaptability across sectors ensures its dominance, reinforcing its position as a key segment in the regional neoprene market.

Analysis by End User:

- Automotive

- Manufacturing

- Consumer Goods

- Medical

According to the Europe neoprene market forecast, the automotive sector accounts for the largest market share in the Europe neoprene market due to its extensive reliance on neoprene for critical components requiring durability and resistance. Neoprene is widely used in automotive hoses, belts, gaskets, seals, and vibration mounts, where resistance to heat, oil, abrasion, and chemicals is essential for long-term performance. With Europe being home to a strong automotive manufacturing base and leading vehicle exporters, the demand for high-quality materials remains strong. Additionally, the growing focus on vehicle safety, efficiency, and sustainability supports the use of reliable materials like neoprene. Its versatility, cost-effectiveness, and proven performance make neoprene indispensable in automotive applications, ensuring this sector maintains the dominant market share.

Breakup by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the leading region supporting neoprene market demand, driven by its strong industrial base, advanced automotive sector, and robust construction activities. As Europe’s largest automobile producer, Germany generates significant demand for neoprene in hoses, belts, seals, and gaskets, where resistance to oil, heat, and wear is essential. The country’s well-developed infrastructure and ongoing investment in construction projects further boost neoprene usage in insulation, adhesives, and sealing materials. Additionally, Germany’s focus on innovation and sustainability encourages the adoption of high-performance and eco-friendly neoprene solutions across industries. With its technological expertise, strong export capabilities, and industrial growth, Germany continues to play a central role in driving Europe neoprene market demand.

Competitive Landscape:

The competitive landscape is characterized by the presence of both global producers and regional manufacturers competing through product innovation, quality, and pricing strategies. Companies focus on enhancing performance characteristics such as durability, flexibility, and environmental sustainability to cater to diverse industries including automotive, construction, sportswear, and protective gear. Growing emphasis on eco-friendly and bio-based neoprene solutions is intensifying competition, with firms investing in research and development to align with Europe’s stringent environmental regulations. Strategic partnerships, capacity expansions, and technological advancements further define the competitive environment. Overall, competition remains strong, driven by the need to balance cost efficiency with innovation and sustainability across industrial and consumer applications.

The report provides a comprehensive analysis of the competitive landscape in the Europe neoprene market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: The DYNAMICNORD SE series of neoprene wetsuits, launched on June 24, 2025, offered divers a stylish camouflage blue design crafted from abrasion-resistant limestone neoprene. These neoprene devices ensured warmth, durability, and freedom of movement for a memorable underwater experience.

- May 2025: Rodolfo Comerio inaugurated the Comerio Calendering Technology Center in Italy as a global hub for industrial calendering innovation, where advanced processes involving neoprene devices were tested across sectors like automotive and aerospace to enhance efficiency, sustainability, and performance in high-tech material applications.

- April 2025: Lomo Watersport launched the Lomotec Neo neoprene device, crafted from organic natural rubber, offering eco-conscious surfers high-performance flexibility and comfort at a lower cost. The device redefined sustainable surfing by combining environmental responsibility with premium stretch and second-skin feel.

- April 2025: VIKING Lifesaving Equipment launched the first CTV immersion suit tailored for women in offshore wind, featuring durable neoprene cuffs and neck seal, with design input from Ørsted, Siemens, and Vestas to enhance female-specific PPE standards. The YouSafe Cyclone suit supported equity goals with its high-vis GORE-TEX build and inclusive sizing.

- February 2025: Viviana launched the Viviana Bag 8NP, crafted from high-quality neoprene to protect and organize lavalier microphones, and paired it with new Lav Mic Patches, enabling optimal storage with Velcro surfaces for visibility and order.

Europe Neoprene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Manufacturing Routes Covered | Butadiene Route, Acetylene Route |

| Grades Covered | General-Purpose Grade Neoprene, Pre-Crosslinked Grade Neoprene, Sulfer-Modified Grade Neoprene, Slow Crystallizing Grade Neoprene |

| Applications Covered | Technical Rubber, Adhesives Industry, Latex Industry |

| End Users Covered | Automotive, Manufacturing, Consumer Goods, Medical |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe Neoprene market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe neoprene market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe Neoprene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Europe neoprene market was valued at USD 367.02 Million in 2024.

The Europe neoprene market is projected to exhibit a CAGR of 1.74% during 2025-2033, reaching a value of USD 432.21 Million by 2033.

The Europe neoprene market is driven by rising demand in automotive and construction industries for durable, heat- and chemical-resistant materials, expanding applications in sportswear, wetsuits, and protective gear, and growing innovation in eco-friendly neoprene. Additionally, EU sustainability policies and strict safety standards further accelerate adoption across industrial and consumer markets.

The butadiene route dominates Europe’s neoprene market due to its cost-effectiveness, large-scale production efficiency, and reliable material quality. It enables consistent performance in automotive, construction, and industrial applications, making it the preferred manufacturing method. Its scalability and economic advantages further reinforce its leading position in meeting regional neoprene demand.

General-purpose grade neoprene dominates the Europe market as it offers balanced properties of flexibility, durability, and resistance to heat, oil, and weathering at cost-effective rates. Its wide adaptability across automotive, construction, sportswear, and industrial applications makes it the most preferred grade, driving its majority market share.

Technical rubber leads the Europe neoprene market due to its critical role in high-performance applications across automotive, construction, and machinery industries. Its superior strength, durability, and resistance to heat, chemicals, and weathering make it essential for seals, gaskets, and insulation, ensuring reliable performance in demanding industrial environments.

The automotive sector dominates Europe’s neoprene market as the material is essential for components like hoses, belts, seals, and gaskets. Its durability, flexibility, and resistance to heat, oil, and abrasion make it indispensable for vehicle performance, supporting the sector’s leading share in regional neoprene demand.

Germany leads neoprene market demand in Europe due to its strong industrial foundation, advanced automotive manufacturing, and large-scale construction activities. The country’s focus on innovation, high-quality production, and sustainable practices further drives neoprene adoption in automotive components, insulation, and sealing applications, reinforcing Germany’s dominant position in the regional market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)