Europe Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Country, 2026-2034

Europe Online Grocery Market Summary:

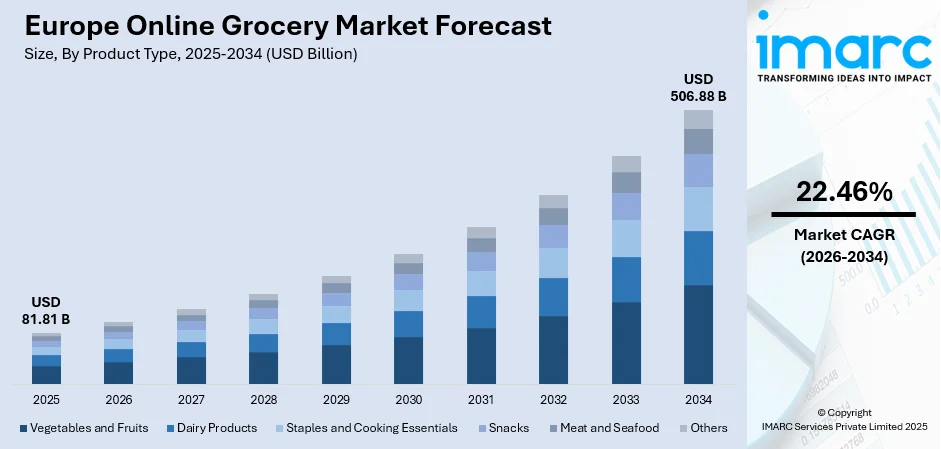

The Europe online grocery market size was valued at USD 81.81 Billion in 2025 and is projected to reach USD 506.88 Billion by 2034, growing at a compound annual growth rate of 22.46% from 2026-2034.

The Europe online grocery market is experiencing substantial momentum as consumers increasingly embrace digital platforms for their everyday shopping needs. Growing smartphone penetration, enhanced digital payment systems, and improved last-mile delivery infrastructure are collectively transforming the regional grocery landscape. Rising health consciousness is driving demand for organic and specialty products through online channels, while busy urban lifestyles reinforce preferences for convenient home delivery services. Major retailers are investing heavily in omnichannel strategies, integrating physical stores with robust e-commerce operations to capture growing Europe online grocery market share.

Key Takeaways and Insights:

-

By Product Type: Vegetables and fruits dominate the market with a share of 32% in 2025, owing to rising consumer awareness regarding nutritional benefits and increasing preference for fresh, chemical-free produce purchased through convenient digital channels. Health-conscious shoppers are driving sustained demand for organic options.

-

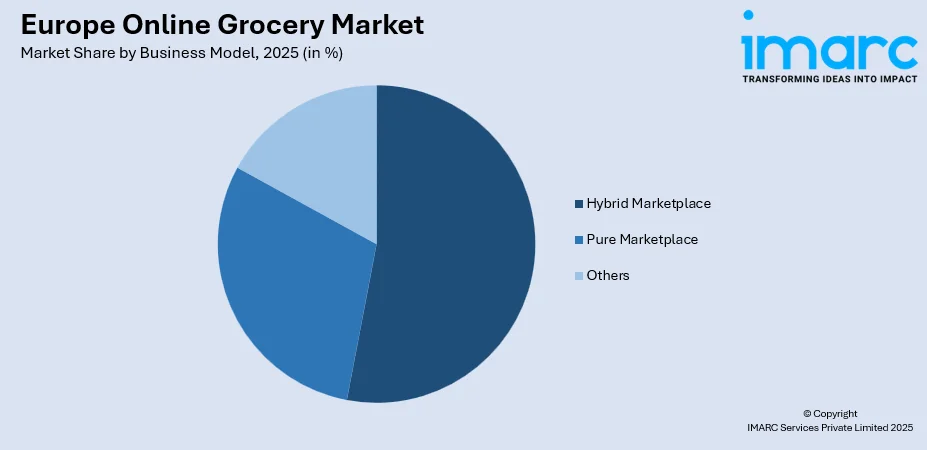

By Business Model: Hybrid marketplace leads the market with a share of 53% in 2025, reflecting consumer preference for platforms that combine extensive product variety with reliable fulfillment capabilities. These models leverage both proprietary inventory and third-party partnerships to ensure comprehensive coverage.

-

By Platform: App-based exhibits a clear dominance in the market with 68.08% share in 2025, driven by superior user experience, personalized recommendations powered by artificial intelligence, and seamless integration with digital payment solutions. Mobile-first shopping habits among younger demographics reinforce this trend.

-

By Purchase Type: One-time represents the leading segment with a market share of 83% in 2025, reflecting flexible consumer preferences and the popularity of spontaneous purchasing enabled by quick commerce platforms offering rapid delivery across urban centers.

-

By Country: Germany comprises the largest country with 26% share in 2025, driven by advanced digital infrastructure, high consumer purchasing power, and substantial investments in refrigerated logistics networks by leading retailers expanding their e-commerce capabilities.

-

Key Players: Key players drive the Europe online grocery market by expanding digital platforms, enhancing delivery networks, investing in dark store infrastructure, and forming strategic partnerships with technology providers to strengthen market positioning and accelerate customer acquisition across diverse European markets. Some of the key players operating in the market include Flink, Just Eat, Delivery Hero, Uber Eats, Doordash, Amazon Inc., Rewe, Rakuten Group, Inc, Tesco and Carrefour.

To get more information on this market Request Sample

The Europe online grocery market is advancing rapidly as digital transformation reshapes traditional retail structures across the continent. Rising urbanization rates and increasingly hectic lifestyles are compelling consumers toward time-saving digital shopping alternatives that eliminate commuting and queuing inconveniences. According to GSMA Intelligence, by the end of 2024, approximately 520 Million people in Europe representing 88% of the population subscribed to mobile services. This expanding digital connectivity provides essential infrastructure supporting e-commerce growth. Platform innovations including artificial intelligence-driven recommendations, real-time inventory tracking, and flexible delivery scheduling are enhancing customer experiences significantly. Quick commerce models promising delivery within minutes have transformed consumer expectations regarding service speed, compelling traditional retailers to accelerate their digital transformation initiatives and invest substantially in fulfillment capabilities throughout their operational networks.

Europe Online Grocery Market Trends:

Expansion of Quick Commerce and Dark Store Networks

Quick commerce platforms promising ultra-fast delivery within minutes are revolutionizing consumer expectations across European urban centers. Retailers are establishing extensive dark store networks strategically positioned within densely populated neighborhoods to enable rapid order fulfillment. These dedicated fulfillment facilities optimize picking efficiency and reduce last-mile delivery times substantially. Delivery Hero, a German based online food ordering company, operated approximately 800 dark stores across nearly 50 markets worldwide, with most orders picked and packed within four minutes. This infrastructure investment supports the growing Europe online grocery market growth trajectory.

Rising Demand for Sustainable and Health-Conscious Products

European consumers increasingly prioritize organic, locally sourced, and sustainably packaged grocery products purchased through digital channels. Health consciousness is driving demand for chemical-free produce, plant-based alternatives, and clean-label items across all product categories. Retailers are responding by expanding organic assortments and implementing transparent supply chain practices that build consumer trust. Sustainability commitments including green packaging initiatives and carbon-neutral delivery options are becoming competitive differentiators as environmentally conscious shoppers favor brands aligning with their values throughout their purchasing journeys.

Integration of Artificial Intelligence and Personalization Technologies

Advanced artificial intelligence capabilities are transforming online grocery experiences through personalized recommendations, predictive ordering, and chatbot-assisted shopping interfaces. Major European grocers have implemented generative AI-powered solutions for customer service enhancement and individualized product suggestions based on purchasing history. These technologies improve customer engagement while optimizing inventory management and reducing food waste through demand forecasting accuracy. Personalized loyalty programs leveraging AI-driven insights are replacing traditional reward structures, creating deeper customer relationships and increasing retention rates across competitive markets.

Market Outlook 2026-2034:

The Europe online grocery market demonstrates promising growth prospects driven by continuous digital infrastructure improvements, evolving consumer preferences, and substantial industry investments in fulfillment capabilities. The market generated a revenue of USD 81.81 Billion in 2025 and is projected to reach a revenue of USD 506.88 Billion by 2034, growing at a compound annual growth rate of 22.46% from 2026-2034. Omnichannel strategies integrating physical retail with digital platforms will dominate competitive positioning as retailers seek comprehensive market coverage. Quick commerce expansion and subscription model adoption will drive incremental growth while technological innovations enhance operational efficiency throughout the value chain.

Europe Online Grocery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Vegetables and Fruits |

32% |

|

Business Model |

Hybrid Marketplace |

53% |

|

Platform |

App-Based |

68.08% |

|

Purchase Type |

One-Time |

83% |

|

Country |

Germany |

26% |

Product Type Insights:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Vegetables and fruits dominate with a market share of 32% of the total Europe online grocery market in 2025.

The vegetables and fruits segment maintains commanding market leadership driven by increasing consumer health consciousness and growing preference for fresh, nutrient-rich produce purchased through convenient digital platforms. European shoppers increasingly prioritize organic and locally sourced options, recognizing the nutritional advantages of chemical-free cultivation methods that preserve nutritional integrity while minimizing environmental impact. Government campaigns promoting balanced diets and healthier eating habits have reinforced this preference across the continent, encouraging consumers to incorporate more fresh produce into their daily consumption patterns.

Online platforms are enabling consumers to access wider product varieties including exotic and specialty items unavailable through traditional retail channels, thereby expanding culinary possibilities beyond regional limitations. Digital grocery services have simplified the process of sourcing premium quality fruits and vegetables by offering detailed product descriptions, origin information, and freshness guarantees that build consumer confidence. The convenience of doorstep delivery combined with curated selections tailored to seasonal availability continues attracting health-focused households seeking reliable access to nutritious food options.

Business Model Insights:

Access the comprehensive market breakdown Request Sample

- Pure Marketplace

- Hybrid Marketplace

- Others

Hybrid marketplace leads with a share of 53% of the total Europe online grocery market in 2025.

The hybrid marketplace model demonstrates clear market dominance by combining proprietary inventory management with third-party seller partnerships, offering consumers comprehensive product selection alongside reliable fulfillment services. This approach enables platforms to maintain quality control over core product categories while expanding assortment breadth through strategic vendor relationships. In November 2024, online supermarket Knuspr partnered with Amazon to deliver groceries to Amazon Prime members under the initiative called Knuspr on Amazon, marking a significant milestone in German digital grocery collaboration and expanding hybrid fulfillment capabilities.

Hybrid models provide operational flexibility enabling platforms to scale efficiently while maintaining consistent service quality across diverse product categories. These platforms leverage sophisticated logistics infrastructure combining centralized warehousing with distributed fulfillment networks to optimize delivery speed and cost efficiency. Consumer trust in hybrid marketplaces stems from established brand reputations combined with extensive product availability meeting diverse household needs. The model supports seamless integration of fresh produce, packaged goods, and specialty items within unified shopping experiences that enhance customer satisfaction and drive repeat purchasing behavior.

Platform Insights:

- Web-Based

- App-Based

App-based exhibits a clear dominance with a 68.08% share of the total Europe online grocery market in 2025.

Mobile application platforms have achieved commanding market leadership driven by superior user experience, personalized shopping features, and seamless integration with smartphone ecosystems. App-based platforms leverage device capabilities including location services, push notifications, and biometric authentication to enhance convenience and security throughout the purchasing journey. Widespread mobile internet adoption across European populations provides essential infrastructure supporting mobile commerce expansion and enabling ubiquitous access to grocery shopping services regardless of time or location constraints.

Applications enable sophisticated personalization through artificial intelligence algorithms analyzing purchasing patterns to deliver tailored recommendations and promotional offers that resonate with individual consumer preferences. Real-time order tracking, flexible delivery scheduling, and instant customer support features create compelling value propositions driving user preference toward mobile platforms over traditional web-based alternatives. Younger demographics particularly favor app-based shopping experiences aligned with their digital-native lifestyles and expectations for immediate gratification and seamless transactional experiences. Retailers continue investing heavily in application development and optimization recognizing mobile channels as primary growth drivers for online grocery engagement and long-term customer retention strategies.

Purchase Type Insights:

- One-Time

- Subscription

One-time represents the leading segment with an 83% share of the total Europe online grocery market in 2025.

One-time purchasing dominates the market reflecting consumer preference for flexibility and spontaneous shopping behavior enabled by quick commerce platforms offering rapid delivery options. This model accommodates varying household needs and consumption patterns without requiring long-term commitments that may not suit all consumer lifestyles. The emergence of ultra-fast delivery services promising groceries within minutes has transformed spontaneous purchasing into mainstream behavior, with consumers increasingly comfortable placing frequent smaller orders rather than periodic bulk purchases that require advance planning and storage considerations.

One-time purchases allow consumers to respond immediately to changing needs, take advantage of promotional offers, and explore new products without subscription constraints limiting their purchasing flexibility. Quick commerce models have particularly reinforced this purchasing pattern by reducing friction associated with ordering and delivery timing while ensuring product availability across diverse categories. Retailers benefit from one-time transactions through increased visit frequency and opportunities for impulse purchases that expand basket sizes and drive incremental revenue growth. The segment maintains dominance despite subscription model growth as consumers value autonomy in managing household grocery procurement according to individual circumstances and evolving personal preferences.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany is the largest country with 26% share of the total Europe online grocery market in 2025.

Germany maintains clear leadership supported by advanced digital infrastructure, robust logistics networks, and substantial retailer investments in e-commerce capabilities. The German market benefits from high consumer purchasing power and technology-savvy demographics embracing digital shopping solutions across diverse product categories. Major players continue optimizing delivery networks reaching both urban centers and suburban communities while expanding fulfillment capabilities to meet growing consumer expectations. Click-and-collect grocery services have experienced accelerating adoption as consumers increasingly embrace convenient fulfillment options that combine online ordering flexibility with immediate product availability.

German retailers have invested heavily in refrigerated logistics and temperature-controlled supply chains ensuring fresh product quality throughout delivery processes from warehouse to doorstep. The market demonstrates strong quick commerce penetration with multiple platforms competing for urban consumer attention through ultra-fast delivery promises and competitive pricing strategies. Environmental consciousness among German consumers drives demand for sustainable packaging and locally sourced products available through specialized online channels catering to eco-minded shoppers. Regulatory support for digital commerce innovation combined with established payment infrastructure creates favorable conditions for continued market expansion and competitive development across the country.

Market Dynamics:

Growth Drivers:

Why is the Europe Online Grocery Market Growing?

Rising Consumer Demand for Convenience and Time-Saving Solutions

Modern European lifestyles characterized by busy schedules, long working hours, and urban commuting demands are compelling consumers toward time-efficient grocery shopping alternatives. Online platforms eliminate traditional shopping inconveniences including travel time, parking challenges, checkout queues, and physical store navigation burdens. The average commute time in Europe approaches one hour daily, leaving limited time for conventional grocery shopping activities. Digital platforms enable shopping flexibility allowing consumers to place orders at any time regardless of store operating hours. Quick commerce models promising delivery within minutes have further elevated convenience expectations, transforming grocery shopping into seamless experiences integrated within daily routines. The Belgian retailer Colruyt Group launched its Collect&Go platform utilizing refrigerated lockers to offer same-day pick-up and delivery services, exemplifying innovation addressing convenience demands.

Expanding Digital Infrastructure and Mobile Connectivity

Widespread smartphone adoption and high-speed internet availability provide essential infrastructure enabling online grocery market expansion across European populations. Enhanced digital connectivity supports seamless application performance, real-time inventory updates, and reliable payment processing critical for e-commerce transactions. Mobile internet penetration improvements particularly in previously underserved areas expand addressable markets for online grocery platforms. High-speed networks enable data-intensive features including video content, augmented reality product visualization, and sophisticated recommendation engines enhancing shopping experiences. Digital payment innovations including contactless transactions, mobile wallets, and buy-now-pay-later options reduce purchasing friction encouraging online shopping adoption. Government initiatives supporting digital transformation and e-commerce development further accelerate infrastructure investments benefiting the online grocery sector across the continent.

Advancement in Logistics and Last-Mile Delivery Capabilities

Substantial investments in fulfillment infrastructure including dark stores, micro-fulfillment centers, and optimized delivery networks are transforming online grocery operational capabilities. Advanced logistics technologies enable precise delivery scheduling, real-time tracking, and temperature-controlled transportation ensuring product quality throughout supply chains. Last-mile delivery innovations including electric vehicles, cargo bicycles, and autonomous delivery solutions improve efficiency while reducing environmental impact. Dark stores positioned within urban neighborhoods enable rapid order fulfillment supporting quick commerce promises of delivery within minutes. According to industry sources, micro-hubs positioned within two to three kilometers of dense neighborhoods enable consistent sub-twenty-minute service, significantly boosting repeat orders while lowering last-mile costs. Retailers continue expanding fulfillment networks recognizing logistics capability as competitive differentiation essential for capturing market share.

Market Restraints:

What Challenges the Europe Online Grocery Market is Facing?

High Operational Costs and Profitability Pressures

Operating online grocery businesses requires substantial investments in warehousing, inventory management, cold-chain logistics, and delivery infrastructure that significantly impact profitability margins. Perishable product handling demands specialized facilities and equipment increasing operational complexity and costs. Maintaining competitive pricing while absorbing fulfillment expenses creates challenging unit economics particularly for fresh produce categories requiring careful temperature management throughout supply chains.

Intense Market Competition and Saturation

The European online grocery landscape features fierce competition among established retailers, specialized e-commerce platforms, and innovative quick commerce startups competing aggressively for market share. Customer acquisition costs remain elevated as players invest heavily in promotional activities and discount campaigns to attract shoppers. Differentiation challenges arise as platforms offer increasingly similar product assortments and service features making sustained competitive advantage difficult to establish.

Consumer Trust and Quality Perception Concerns

Some consumers remain hesitant about purchasing fresh produce and perishable items online due to concerns regarding product quality, freshness, and inability to physically inspect items before purchase. Building trust requires consistent delivery of high-quality products and responsive customer service addressing quality complaints promptly. Return and refund processes for unsatisfactory groceries add operational complexity while impacting customer satisfaction and retention rates.

Competitive Landscape:

The Europe online grocery market demonstrates dynamic competitive intensity with established supermarket chains, specialized e-commerce platforms, and technology-driven startups competing across diverse strategic dimensions. Leading players leverage extensive store networks, established supply chain relationships, and brand recognition to strengthen digital presence while investing in fulfillment infrastructure and technology capabilities. Consolidation activity is reshaping the competitive landscape as companies pursue scale advantages through strategic acquisitions and partnerships. Innovation in delivery speed, product assortment, pricing strategies, and customer experience differentiates successful competitors. Players increasingly focus on developing omnichannel capabilities that seamlessly integrate physical retail operations with digital platforms to capture evolving consumer preferences.

Some of the key players include:

- Flink

- Just Eat

- Delivery Hero

- Uber Eats

- Doordash

- Amazon Inc.

- Rewe

- Rakuten Group, Inc

- Tesco

- Carrefour

Recent Developments:

-

In February 2025, Prosus agreed to acquire Just Eat Takeaway.com for approximately EUR 4.1 Billion in an all-cash deal. The acquisition aims to create the fourth largest food delivery group globally and establish a leading European technology platform with enhanced growth prospects across multiple segments including online grocery, food delivery, and fintech services.

Europe Online Grocery Market Report Segmentation:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Model Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platform Covered | Web-Based, App-Based |

| Purchase Covered | One-Time, Subscription |

| Country Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Europe online grocery market size was valued at USD 81.81 Billion in 2025.

The Europe online grocery market is expected to grow at a compound annual growth rate of 22.46% from 2026-2034 to reach USD 506.88 Billion by 2034.

Vegetables and fruits dominated the market with a share of 32%, driven by increasing health consciousness, growing demand for fresh organic produce, and improved cold-chain logistics ensuring quality throughout delivery processes.

Key factors driving the Europe online grocery market include rising consumer demand for convenience, expanding digital infrastructure and mobile connectivity, advancement in logistics and last-mile delivery capabilities, growing health consciousness, and increasing adoption of quick commerce platforms.

Major challenges include high operational costs affecting profitability, intense market competition and saturation, consumer trust concerns regarding fresh product quality, complex logistics requirements for perishable goods, and regulatory compliance demands across diverse European markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)