Europe Precious Metals Market Report by Metal Type (Gold, Silver, Platinum, Palladium, and Others), Application (Jewelry, Investment, Electricals, Automotive, Chemicals, and Others), and Country 2026-2034

Market Overview:

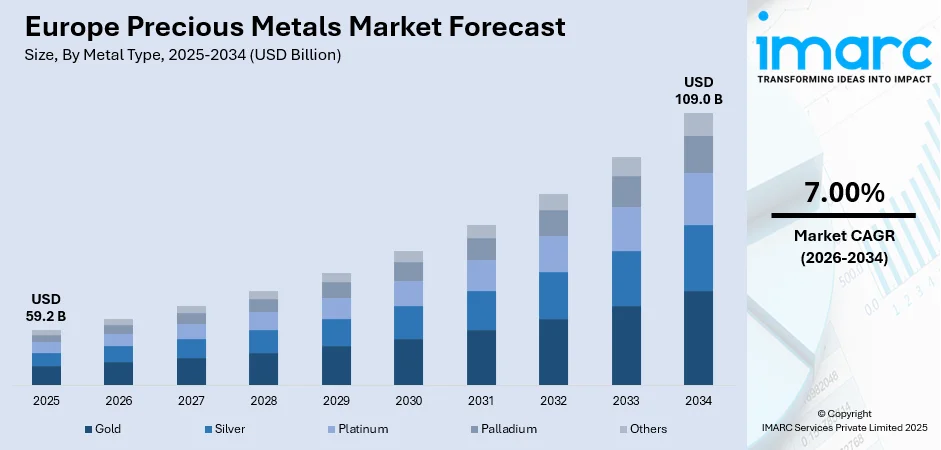

The Europe precious metals market size reached USD 59.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 109.0 Billion by 2034, exhibiting a growth rate (CAGR) of 7.00% during 2026-2034. The escalating investment in precious metals, the growing adoption of precious metals for coin minting, and the demand for these metals in various industries, including jewelry, technology, and automotive are some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 59.2 Billion |

| Market Forecast in 2034 | USD 109.0 Billion |

| Market Growth Rate (2026-2034) | 7.00% |

Precious metals are a group of rare and valuable metallic elements that are highly sought after for their intrinsic properties and various applications. The most widely recognized precious metals are gold, silver, platinum, and palladium. Gold has been treasured for centuries. Its enduring value and beauty make it a popular choice for jewelry and decorative items. It is also highly regarded as a store of wealth and a hedge against economic uncertainties. Additionally, it has industrial applications in electronics, dentistry, and aerospace. Silver, known for its lustrous shine, is used extensively in jewelry, silverware, and coins. It is also a vital component in the production of electrical contacts, mirrors, and solar panels. These precious metals play significant roles in investment portfolios as they serve as a hedge against inflation and currency fluctuations. They are actively traded in global markets, including exchanges in Europe, where there is a strong demand for these metals.

To get more information on this market Request Sample

Europe Precious Metals Market Trends:

The escalating investment in precious metals is driving the market in Europe. Precious metals, such as gold, silver, platinum, and palladium, are often considered safe-haven assets during times of economic uncertainty. Moreover, monetary policy decisions by central banks also play a significant role in driving the precious metals market. When central banks implement loose monetary policies, such as lowering interest rates or engaging in quantitative easing, it can lead to inflationary pressures and depreciation of fiat currencies. In such cases, investors turn to precious metals as a hedge against inflation and currency devaluation. The increased demand for these metals fuels their prices higher. Furthermore, supply and demand fundamentals are also the crucial drivers of the precious metals market. Mining production, exploration activities, and recycling rates also influence the market. Additionally, the demand for these metals in various industries, including jewelry, technology, and automotive, is providing a boost to the market. Furthermore, central banks play a significant role in augmenting the demand for precious metals worldwide. They hold substantial amounts of gold and other precious metals as part of their foreign exchange reserves, aiming to diversify their holdings. This strategy significantly supports the demand for precious metals. The market is also positively influenced by the widespread use of precious metals in various industrial applications, including electronics, and dentistry. Additionally, the growing adoption of precious metals for coin minting, which appeals to collectors and enthusiasts, further impels the demand. Other factors contributing to the market's growth include rapid urbanization and increasing disposable income levels of the masses. These factors create favorable conditions for the expansion of the precious metals market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe precious metals market report, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on metal type and application.

Metal Type Insights:

- Gold

- Silver

- Platinum

- Palladium

- Others

The report has provided a detailed breakup and analysis of the market based on the metal type. This includes gold, silver, platinum, palladium, and others. According to the report, gold represented the largest segment.

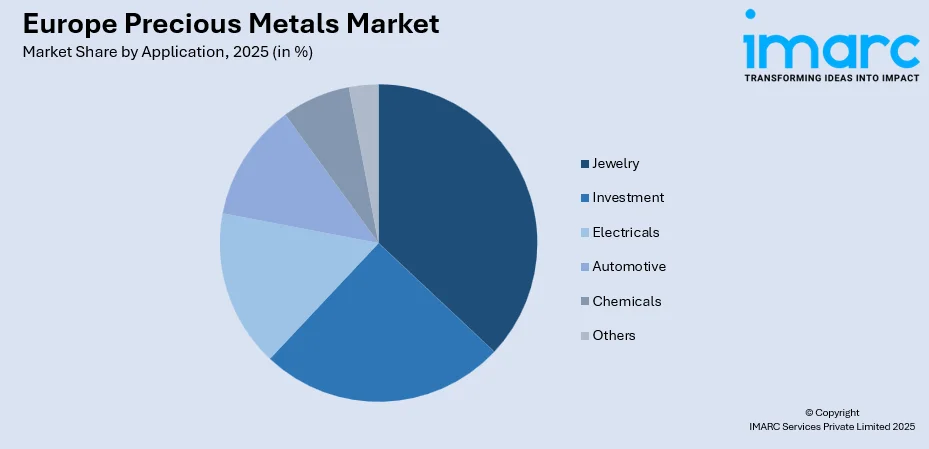

Application Insights:

Access the comprehensive market breakdown Request Sample

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes jewelry, investment, electricals, automotive chemicals, and others. According to the report, investment represented the largest segment.

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Germany, France, the United Kingdom, Italy, Spain, and others. According to the report, Germany was the largest market for precious metals. According to the report, Saudi Arabia was the largest market for precious metal. Some of the factors driving the Europe precious metals market included the economic stability, cultural use of product in jewelry, investment appeal for portfolio diversification, favorable policies, and improved product accessibility through online platforms.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Europe precious metals market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Europe Precious Metals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Metal Types Covered | Gold, Silver, Platinum, Palladium, Others |

| Applications Covered | Jewelry, Investment, Electricals, Automotive Chemicals, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Europe precious metals market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Europe precious metals market?

- What is the breakup of the Europe precious metals market on the basis of metal type?

- What is the breakup of the Europe precious metals market on the basis of application?

- What are the various stages in the value chain of the Europe precious metals market?

- What are the key driving factors and challenges in the Europe precious metals market?

- What is the structure of the Europe precious metals market and who are the key players?

- What is the degree of competition in the Europe precious metals market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe precious metals market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe precious metals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe precious metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)